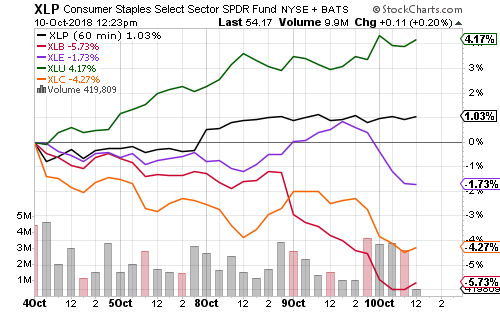

Stocks opened on Monday with strong buying in transportation, defense, industrials, consumer staples and small caps. The Russell 2000 led index performance on the day with a 0.42- percent advance. iShares U.S. Aerospace & Defense (ITA) gained 1.42 percent.

Retail sales increased 0.1 percent in September, missing forecasts, but matching August’s growth rate. Retail sales ex-autos fell 0.1 percent. Bars and restaurants, despite 7.1 percent higher sales, accounted for most of the miss. Online sales rose 1.1 percent.

The October Empire State index shows strong manufacturing activity picked up by the September PMIs carrying over into this month.

Industrial production for September, August job openings and the October homebuilders’ index will be out later this week. Housing starts, building permits and existing home sales, all for September, will also be released. The minutes of the September Federal Reserve meeting will be out on Wednesday.

The U.S. dollar started the week lower, but West Texas Intermediate crude closed below $72 a barrel nonetheless. Natural gas extended its rally, rising another 3 percent. Gold extended gains, but failed to exceed last week’s high.

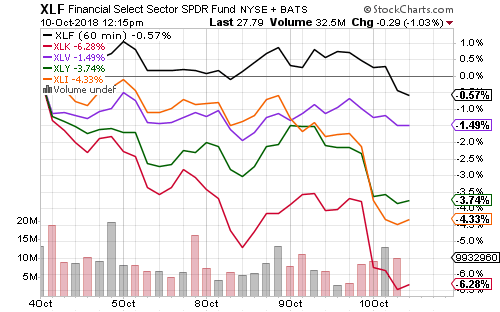

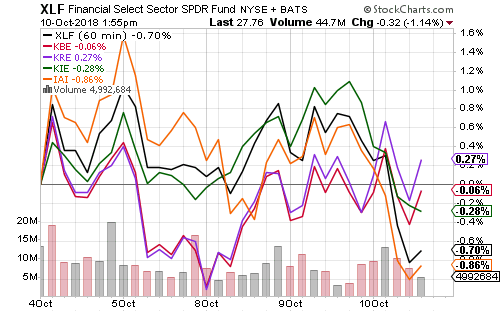

Earnings season will kick into high gear this week. Bank of America (BAC) beat forecasts by 4 cents and delivered strong growth metrics. Charles Schwab (SCHW), Goldman Sachs (GS), Morgan Stanley (MS), American Express (AXP) U.S. Bancorp (USB) and many regional banks will all report earnings this week. SPDR Financial (XLF) and SPDR S&P Regional Bank (KRE) will be most affected by these reports.

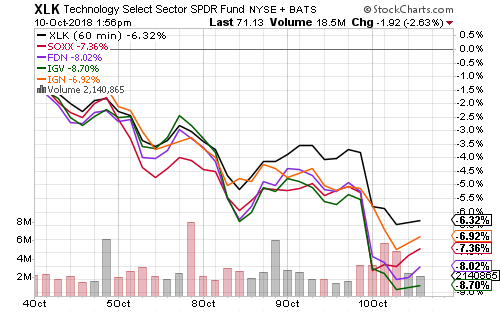

Communication services and Internet funds will also be under the microscope this week with Netflix (NFLX) reporting after the bell on Tuesday. Johnson & Johnson (JNJ) and UnitedHealth Group (UNH) will also report. Other healthcare stocks reporting this week include Abbot Labs (ABT), athenahealth (ATHN) and Intuitive Surgical (ISRG).

Alcoa (AA), PayPal (PYPL), WD-40 (WDFC), Proctor & Gamble (PG), Schlumberger (SLB), Kansas City Southern (KSU) and Honeywell (HON) are also slated to report this week.