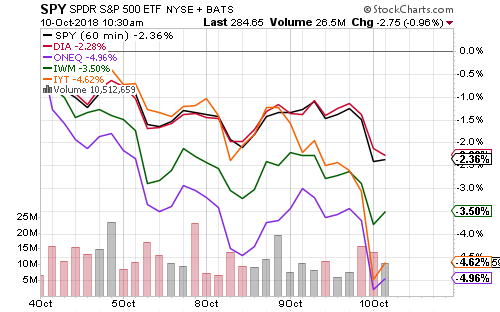

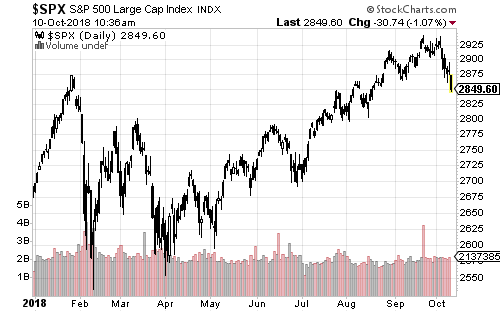

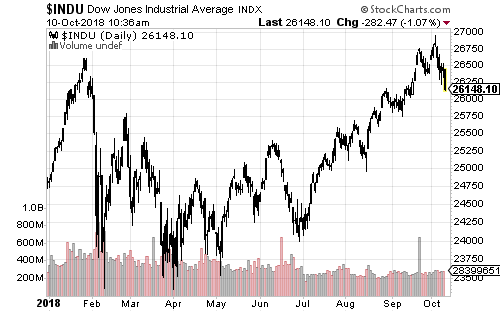

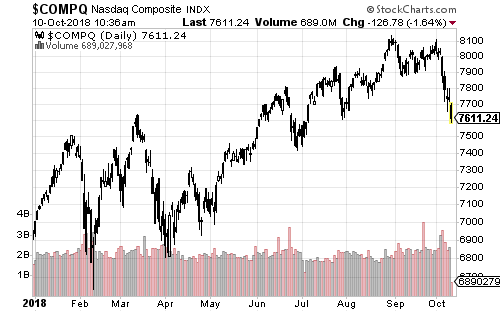

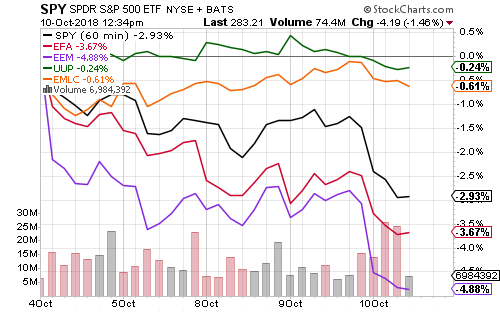

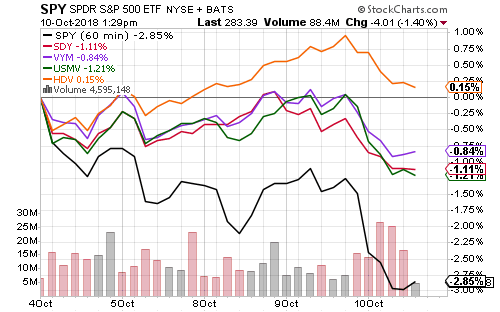

Technology and transportation pulled the markets lower this week. The Dow Jones Industrial Average and S&P 500 Index continued to benefit from exposure to outperforming value sectors.

Short-term selling has been heavy this week.

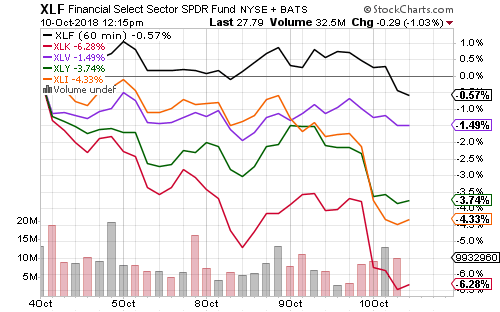

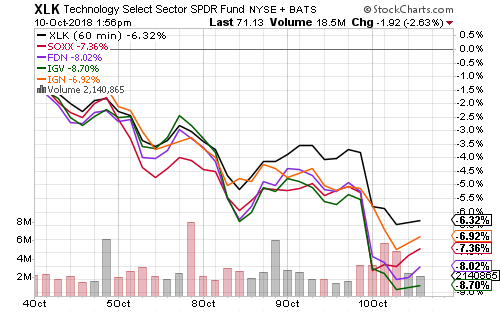

Technology has weakened with semiconductors as trade and cybersecurity threats in China have escalated. Financials and healthcare were strong outperformers.

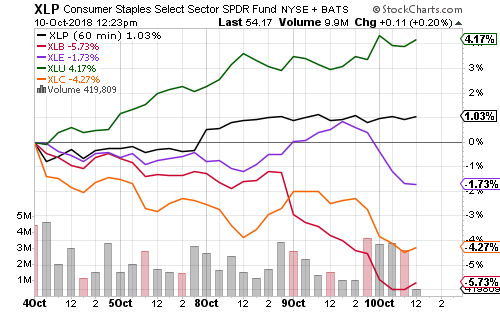

Investors opted for utilities amid the decline in stocks, despite rising interest rates. Consumer staples also benefited, while materials lagged.

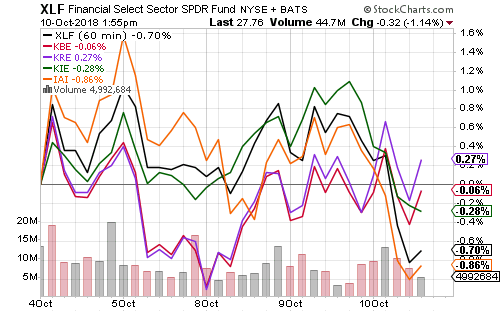

Financial funds were strong nearly across the board this week. Small and regional banks have outperformed with rising rates and widening spreads.

Technology saw broad weakness across its subsectors.

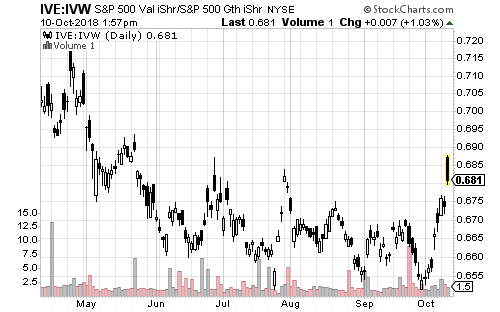

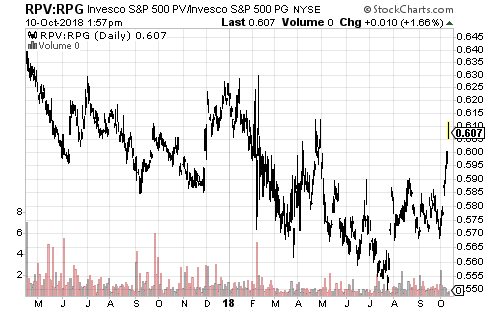

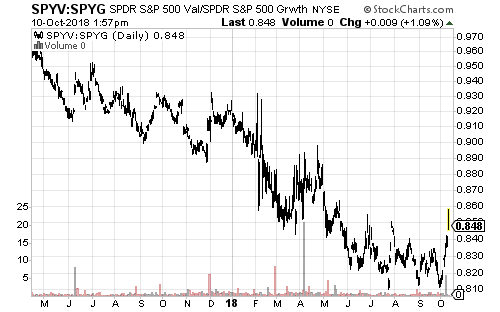

Value stocks have underperformed consistently as technology outperformed.

The U.S. Dollar Index weakened slightly on the week as the euro bounced from lows last week, but the U.S. markets still outperformed foreign shares by a considerable margin.

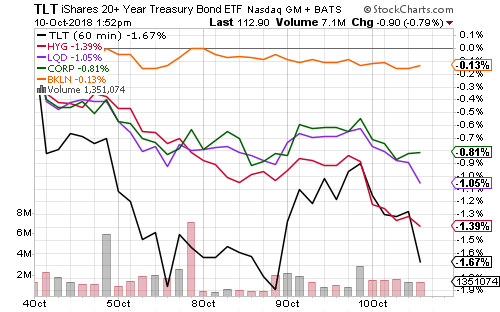

Bond yields pulled back on Monday and Tuesday, but they spiked on Wednesday. Long-term government bonds rebounded strongly mid-week and then faded. However, rising credit risk weighed on markets. Floating-rate funds remain among the strongest performing class of fixed income amid rising rates.

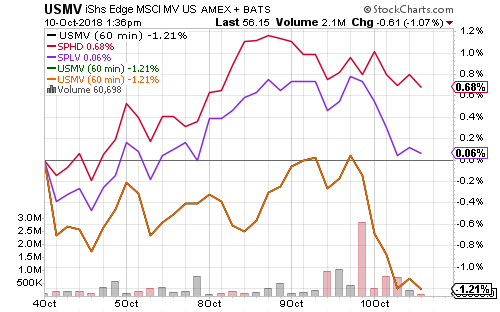

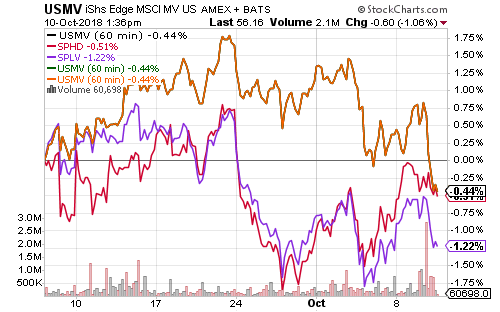

Dividend funds are outperforming the market as investors hold value stocks. iShares Core High Dividend (HDV) gained on the week. Low-volatility and high dividend funds in conservative blue chips are seeing their best relative performance in several months.

Some low-volatility funds are up on the week due to heavy utilities exposure. USMV has bested these funds, at times by a considerable margin, with a more diversified portfolio. It is best to stick with diversified low-volatility funds with rates still in an uptrend.