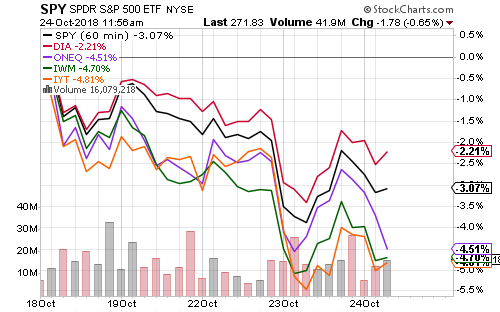

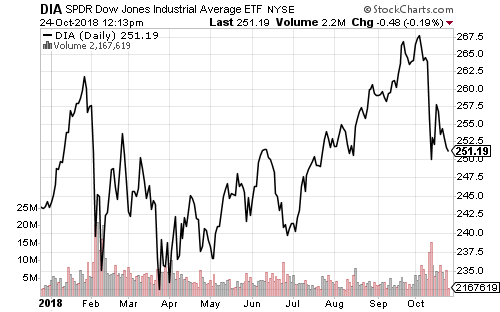

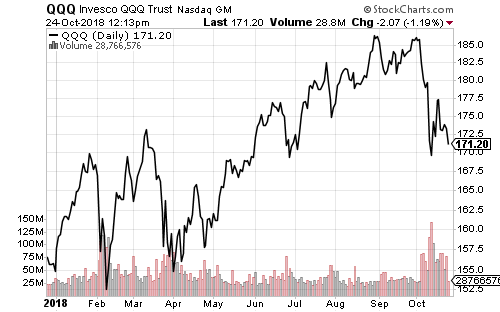

Major indexes declined this week as traders tested lows.

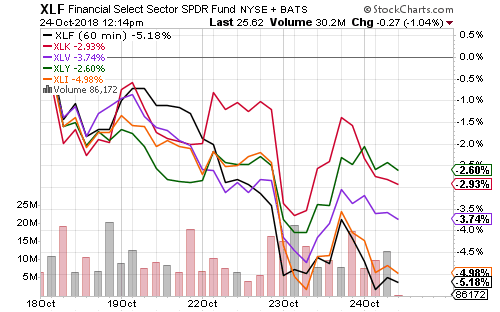

Financials and industrials underperformed on the week. The dip in stocks weighed on interest rates, sending financials lower. Disappointing earnings reports from 3M (MMM) and Caterpillar (CAT) hit the industrial sector.

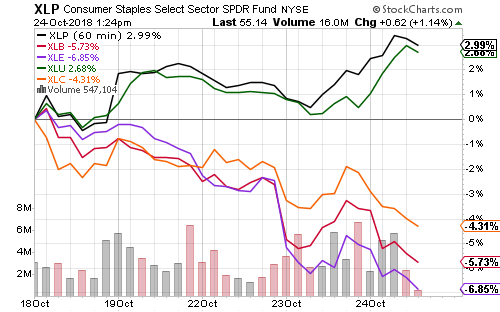

Utilities and consumer staples rallied strongly. A decline in oil prices amid a decline in share prices hit the energy sector particularly hard.

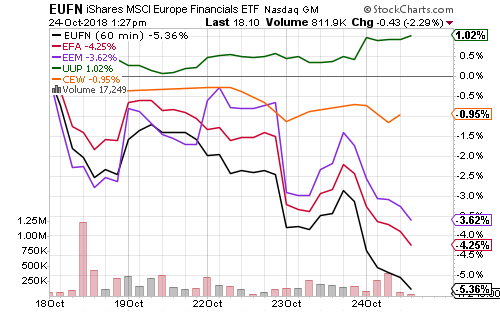

The U.S. Dollar Index climbed more than 1 percent this week. EU officials have threatened to pull support for Italy’s financial system. European financial shares are down more than 5 percent this week and pulled the MSCI EAFE lower than emerging markets.

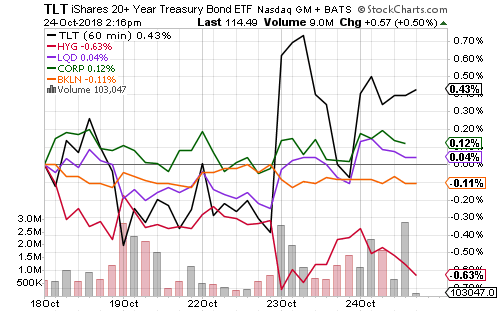

Long-term govt bonds outperformed on the week, but they’ve seen a very small bounce. Investors have been bidding up utilities and real estate on the expectation of lower rates, but the market isn’t delivering yet despite the dip in the stock market. On Friday, the government will announce third-quarter GDP growth.

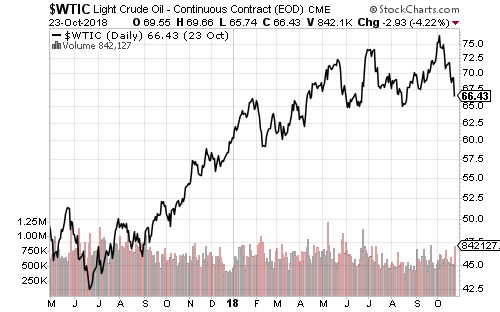

Inflation has been elevated for many months with higher energy prices, but as of Wednesday, crude oil was not far above January 2018 prices. The average price for October will be over $70 a barrel and that should ensure elevated inflation for the month. If crude were to stay closer to $66 a barrel in November, however, crude oil year-on-year gains would collapse from 40 percent in October to 15 percent in November.

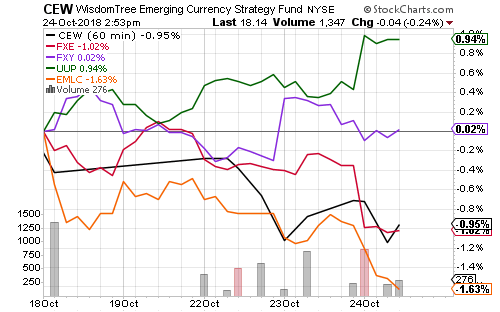

The U.S. dollar was strong this week against the euro and emerging-market currencies. It was steady versus the yen. The euro underperformed many emerging market currencies.

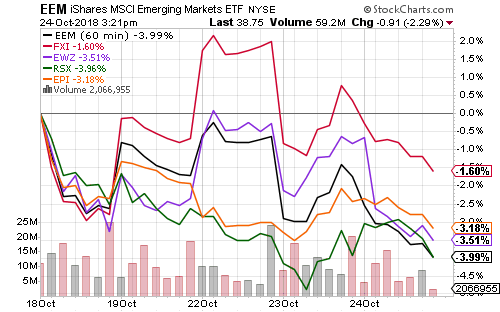

China’s stock market was a relative outperformer this week following a major government rescue effort. Many companies and major shareholders pledged shares as collateral on loans worth trillions of yuan and borrowers are getting the equivalent of margin calls as prices hit multi-year lows. Other major EMs such as Brazil, Russia and India all moved lower on the week.