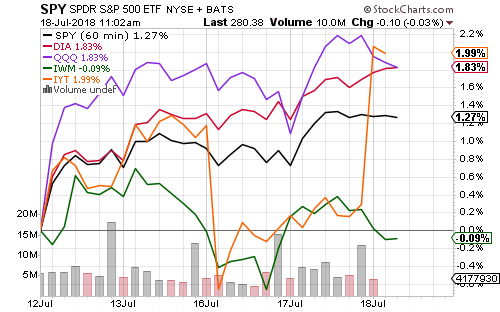

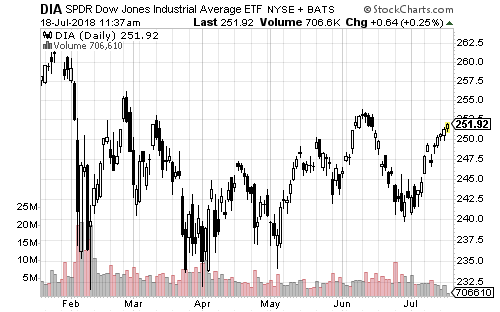

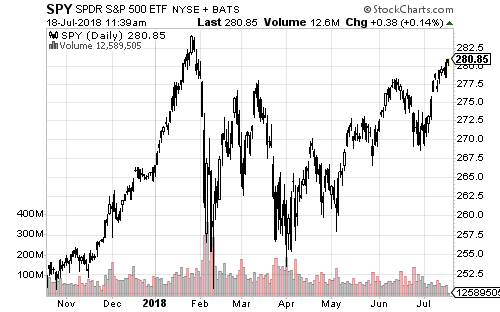

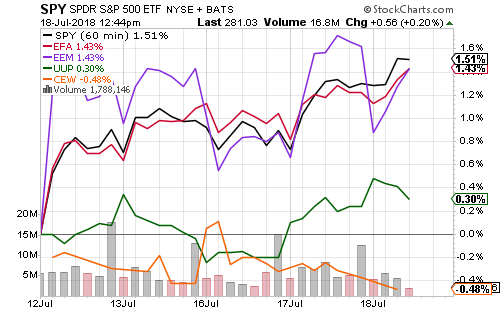

Equities moved higher on Monday with interest rates after Barclays hiked its second-quarter GDP growth estimate to 5.3 percent. The 10-year Treasury yield saw its largest one-day gain since mid-May.

This week will be light on economic data, but not on impact. Friday will bring the first estimate of second-quarter GDP. The Atlanta Federal Reserve will provide and update Thursday. It currently forecasts 4.5 percent growth. The economist consensus is at 4.3 percent. The New York Fed’s Nowcast model lowered its estimate last Friday to 2.69 percent. It’s highest forecast for this quarter was 3.26 percent on June 1.

Long-term bonds fell on Monday as economic forecasts were raised. iShares Barclays 20+ Year Treasury (TLT) declined 1.18 percent on the day.

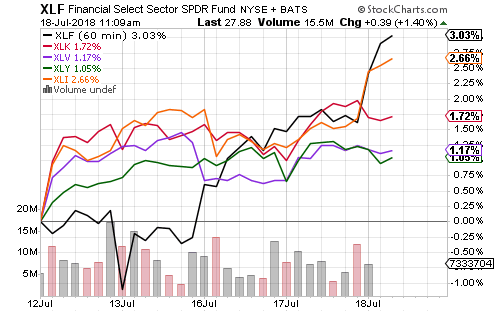

Bank stocks followed interest rates higher. SPDR S&P Regional Banking (KRE) climbed 1.30 percent. SPDR Financial (XLF) rose 1.20 percent, by far the best performer. SPDR Technology (XLF) gained 0.51 percent.

Existing home sales increased at an annualized pace of 5.38 million in June, meeting forecasts. New home sales for June will be out on Wednesday. The flash PMIs for July will be out on Tuesday. Thursday will see durable goods and capital equipment orders for June. The University of Michigan’s consumer sentiment survey will be out on Friday.

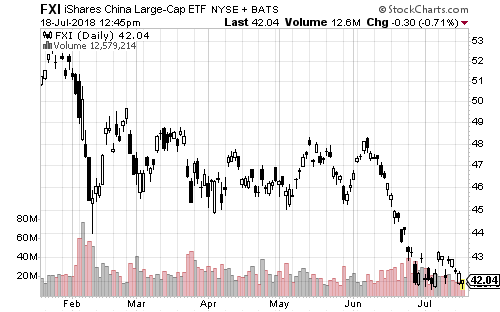

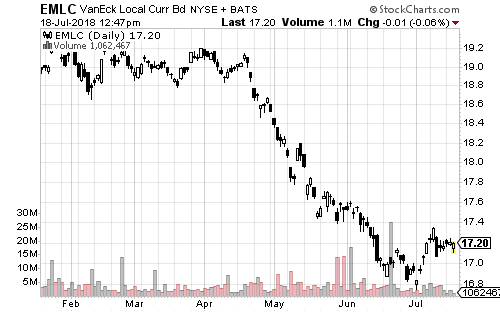

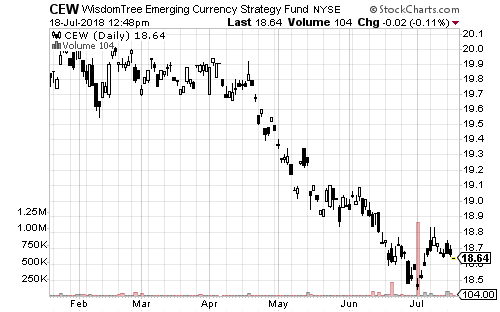

The U.S. Dollar Index rallied on Monday, trading 1 percent below its 52-week high. The index has traded in a tight range of about 1.5 percent over the past two months. The dollar gained versus the euro and some emerging markets on Monday, while it weakened versus the yen.

Earnings season is in full swing this week. Companies that are scheduled to report this week combine for over $1 trillion in market capitalization. Overall, 35 percent of the S&P 500 Index will deliver earnings this week. The current rate of blended growth (reported earnings plus outstanding estimates) is 20.8 percent.

Google (GOOGL), Illinois Tool Works (ITW), Philips (PHG), Haliburton (HAL), TD Ameritrade (AMTD), Ryanair (RYAAY), AT&T (T) Verizon (VZ), 3M (MMM), Texas Instruments (TXN), United Technologies (UTX), Eli Lilly (LLY), Lockheed Martin (LMT), Biogen (BIIB) and Sherwin-Williams (SHW) are among the big names reporting in the first half of the week.

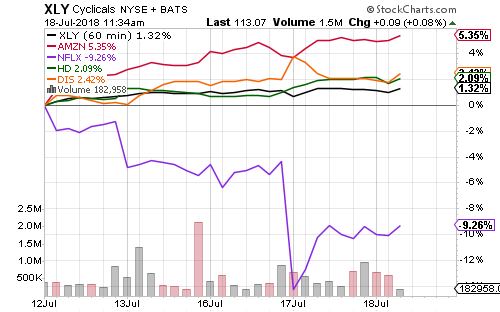

Later in the week we’ll hear from Facebook (FB), Visa (V), Boeing (BA), Coca-Cola (KO), PayPal (PYPL), GlaxoSmithKline (GSK), Gilead Sciences (GILD), United Parcel Service (UPS), Qualcomm (QCOM), Amazon (AMZN), Intel (INTC), Mastercard (MA), Royal Dutch Shell (RDS.A) Anheuser-Busch (BUD), Amgen (AMGN), McDonald’s (MCD), Altria (MO), Exxon Mobil (XOM), Chevron (CVX), Merck (MRK) and Abbvie (ABBV).