Economic data will be light this week. U.S. retail sales met expectations of 0.5 percent growth in June, but sales ex-autos beat forecasts at 0.4 percent. The government revised May’s growth from 0.8 to 1.3 percent.

In the wake of strong retail numbers, the Atlanta Federal Reserve hiked its GDP Now model’s GDP growth estimate from 3.9 to 4.5 percent. The Blue Chip Economist consensus has risen throughout July and stands at 3.7 percent. Next Friday, the Bureau of Economic Analysis will release its first estimate of second-quarter GDP.

Later this week, industrial production for June, the homebuilders index for July, housing starts and June building permits will be available later this week.

Crude oil opened sharply lower on Monday and hit $68 a barrel amid reports Saudia Arabia is shipping more oil to the United States. Last month, President Trump asked the Saudis to help stop the rise in oil prices. Last week, he said he might release oil from the strategic petroleum reserve to halt rising gasoline prices.

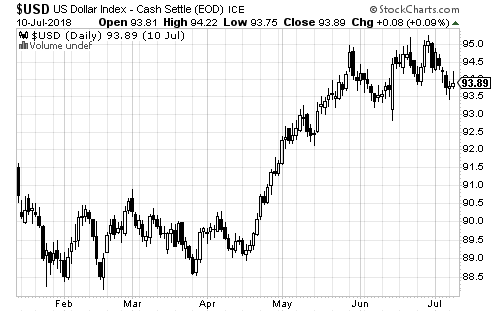

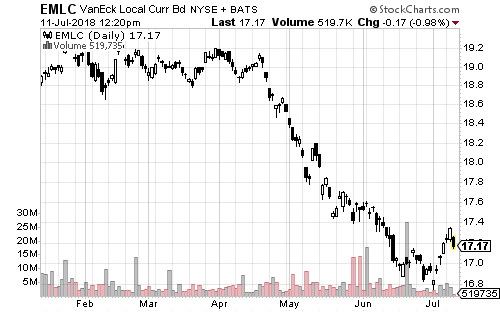

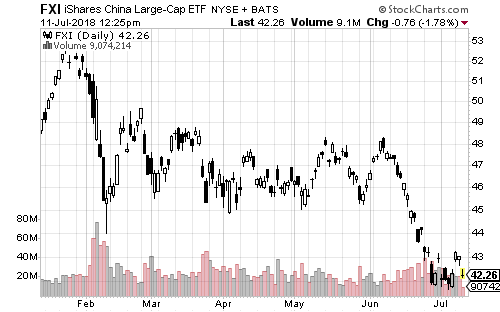

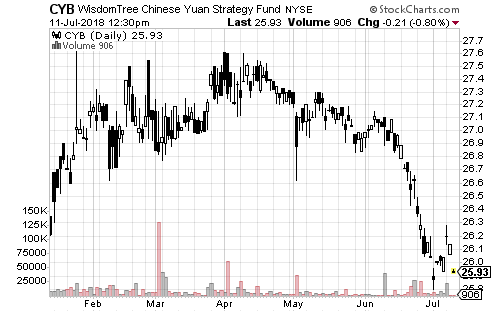

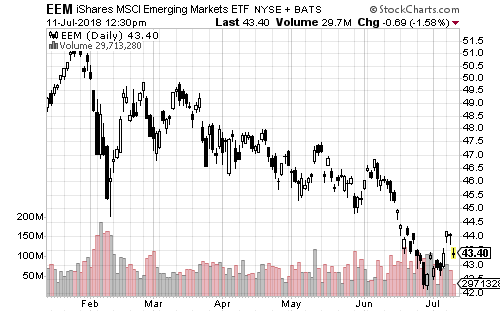

The 10-year Treasury yield rose slightly on Monday, while the U.S. dollar declined slightly versus major developed-market currencies. The greenback gained against emerging-market currencies, including the Chinese yuan.

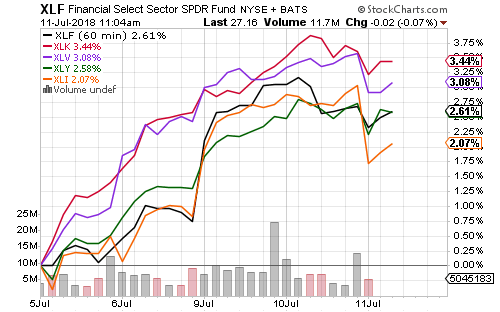

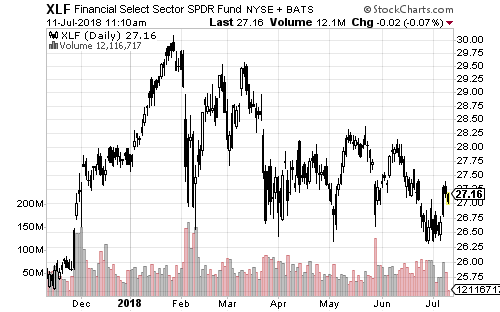

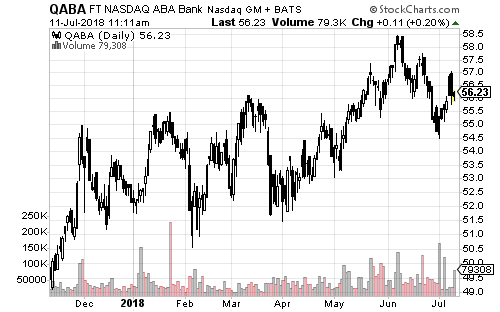

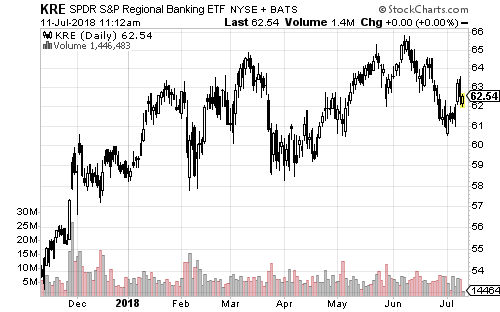

Both Bank of America (BAC) and Blackrock (BLK) beat earnings estimates before the bell on Monday. BofA reported strong growth as well as success with cost cutting efforts.

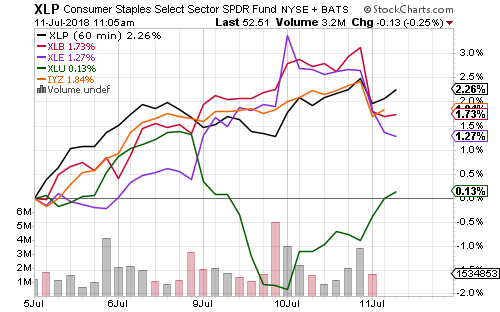

Netflix (NFLX) disappointed investors with underwhelming subscriber growth. The stock lost 13 percent in after hours trading. They also issued weaker guidance for the third quarter. Netflix is a top 10 holding in many Internet and consumer discretionary funds and had gained nearly 150 percent over the past year.

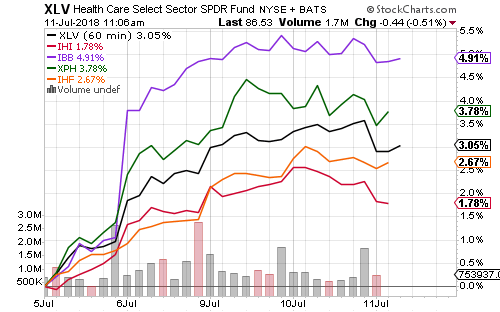

On Tuesday, Johnson & Johnson (JNJ), UnitedHealth Group (UNH) and Goldman Sachs (GS) headline. Charles Schwab (SCHW), CSX Corp (CSX), Interactive Brokers (IBKR) and United Continental (UAL) also report.

Novartis (NVS), International Business Machines (IBM) and Abbott Labs (ABT) are the largest companies scheduled to report on Wednesday. American Express (AXP), Morgan Stanley (MS), U.S. Bancorp (USB), eBay (EBAY) and Alcoa (AA) will also report.

Microsoft (MSFT), Taiwan Semiconductor (TSM), Unilever (UN), SAP (SAP), Philip Morris International (PM), Union Pacific (UNP), Danaher (DHR), Intuitive Surgical (ISRG) and Bank of New York (BK) will report on Thursday.

General Electric (GE), Honeywell (HON) and Stanley, Black & Decker (SWK) will report earnings on Friday. Oil service funds will be in focus as Schlumberger (SLB) and Baker Hughes (BHGE) report. Major regional banks SunTrust Banks (STI), Regions Financials (RF) and Citizens Financial Group (CFG) will also report on Friday.