The Dow Transports outperformed over the past week after rail and air transportation stock beat earnings. CSX Corp (CSX) far exceeded earnings estimates. Analysts expected $0.86 per share in earnings, but the company delivered 17 percent more with $1.01 per share. Other rail stocks such as Union Pacific (UNP); which reports tomorrow morning; rallied in sympathy. United Continental (UAL) also beat estimates and raised guidance. Shares gained 13 percent on the week.

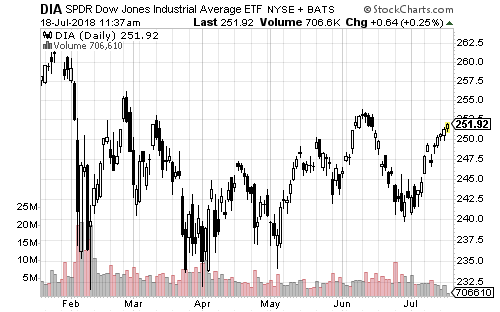

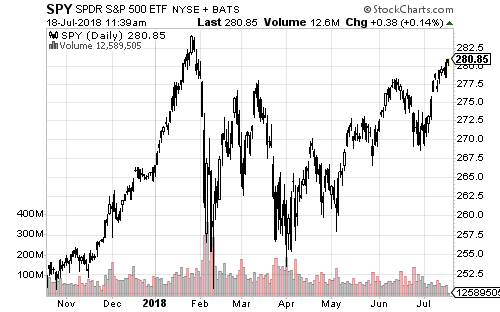

The Nasdaq and Russell 2000 are already at all-time highs and the S&P 500 Index could soon follow them, but the Dow is still caught in a trading range, but should be on track to follow them higher. The first step will be for SPDR DJIA (DIA) to exceed its February high of $255.21, which only requires a gain of 1.4 percent.

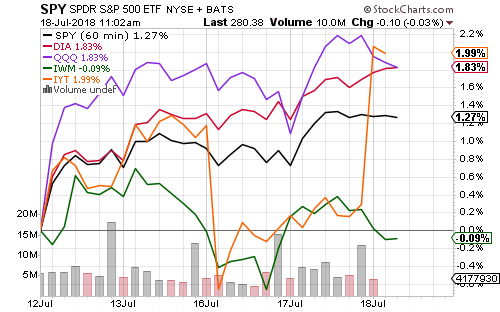

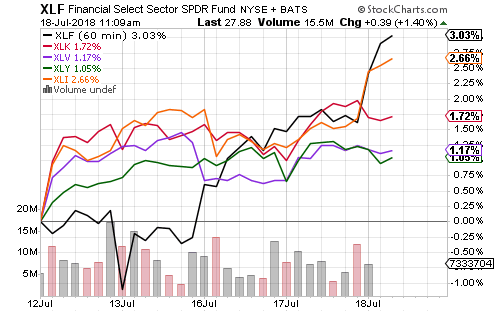

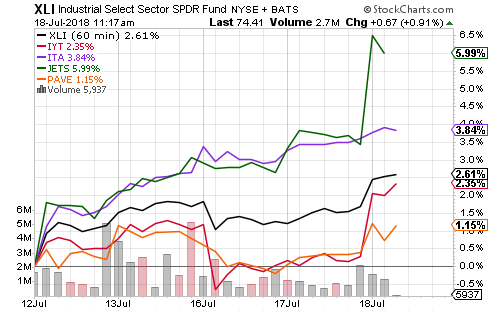

Financials and industrials have had a clear edge in sector performance over the past week. Transportation stocks drove industrials higher on Wednesday. Financials popped following strong earnings results from Morgan Stanley (MS). Berkshire Hathaway (BRK.A), a major component in many financial ETFs, also rose strongly on Wednesday.

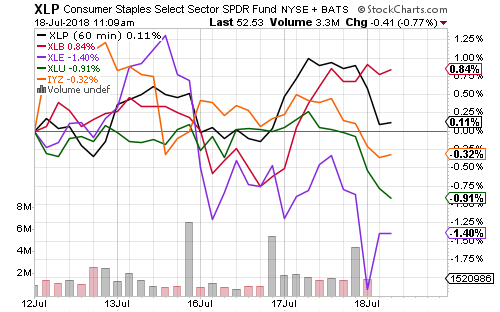

Smaller sectors lagged this week, led to the downside by energy stocks. Crude oil fell more than 5 percent from its Friday high. The smaller decline in energy stocks indicates investors see crude rebounding in days and weeks ahead.

Airlines and chief supplier Boeing (BA) pulled the industrial sector higher over the past week. Also lifting the sector was the defense subsector. Last week, President Trump negotiated an increase in defense spending by NATO allies. Since NATO allies rely on U.S.-manufactured weapons systems, higher defense spending in Europe will boost defense contractors’ bottom lines.

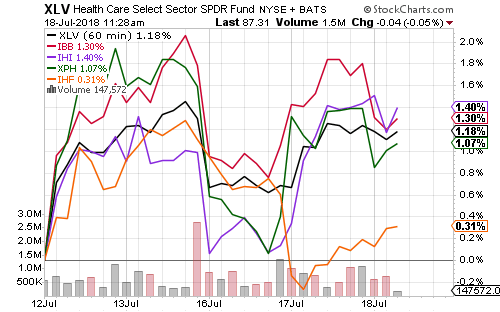

Medical devices and biotechnology pulled the healthcare sector higher this week. The broader sector has also benefited from strong earnings at Johnson & Johnson (JNJ).

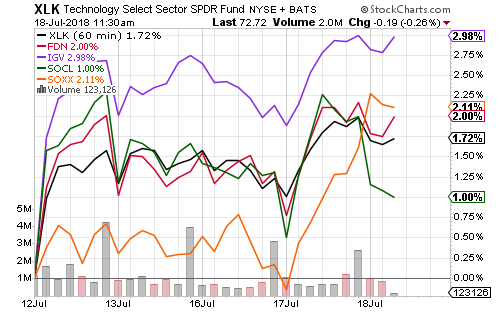

Technology performed well this week. Software and semiconductors drove the sector.

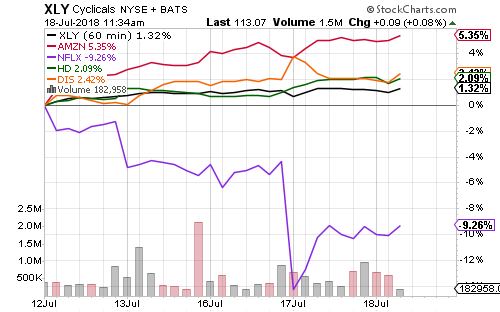

The consumer discretionary sector climbed this week thanks to the ongoing rally in Amazon (AMZN). The gain in Amazon alone accounted for about 93 percent of XLY’s increase, and contributions from the second- and fourth–largest holdings (Home Depot and Disney) pushed that combined contribution over 100 percent. The third-largest holding, Netflix (NFLX), weighed on results. The company missed subscriber growth estimates by a large margin and lowered third-quarter subscriber growth estimates align with the slower growth. Shares fell more than 10 percent before rebounding

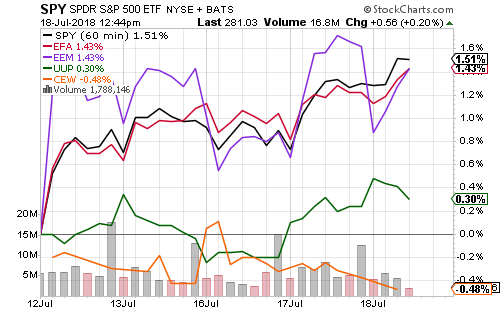

The S&P 500, MSCI EAFE and MSCI Emerging Markets ETFs performed similarly over the past week, even as the U.S. dollar strengthened and emerging market currencies weakened.

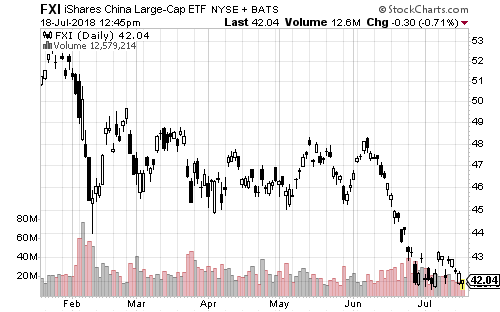

China has greatly influenced emerging market weakness over the past month. Over the past three weeks, it has traded sideways. In Wednesday trading, it failed to make a new low. There’s clearly some support around the $42 for iShares China Large-Cap (FXI). If this holds, an extended rebound in emerging markets is likely. If not, we could see weakness resume.

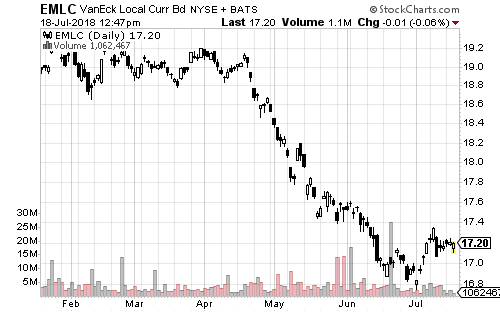

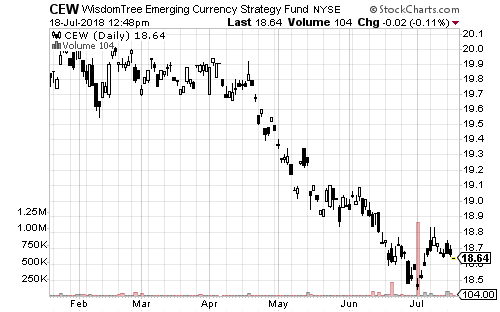

Two other funds to keep an eye on are VanEck Local Currency Bond (EMLC) and WisdomTree Emerging Market Currency (CEW). China is a key driver of EM performance, but the U.S. dollar also plays a major role. As long as CEW and EMLC are rising, odds are iShares MSCI Emerging Markets (EEM) will follow.