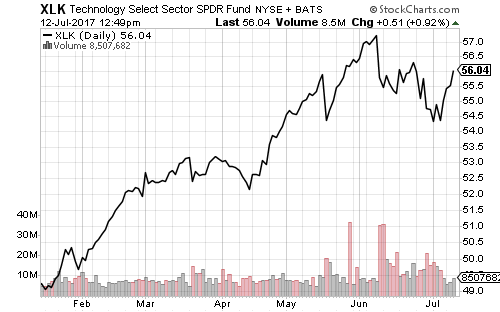

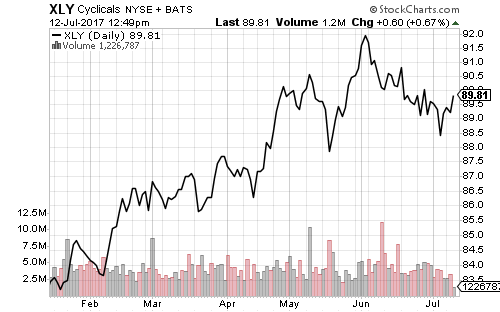

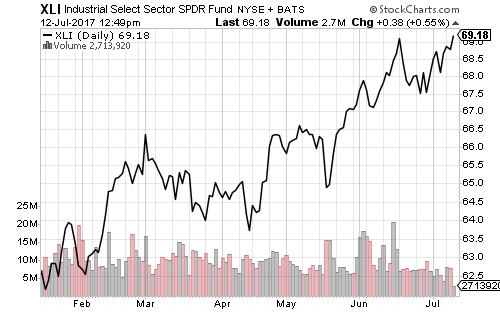

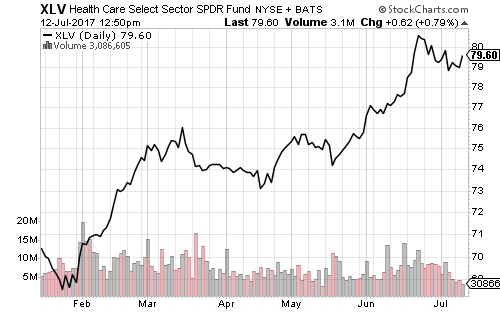

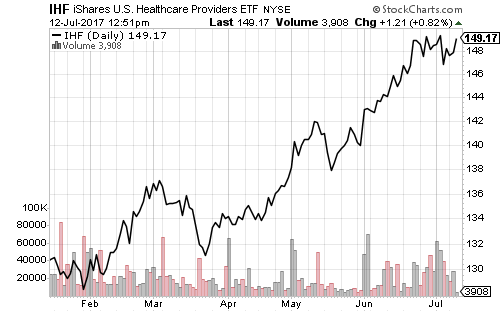

The Dow Jones Industrial Average, S&P 500 and Russell 2000 closed at new all-time highs this week. The Nasdaq led with a gain of 2.59 percent, the S&P 500 climbed 1.41 percent, the Dow 1.04 percent, and the Russell 2000 0.92 percent. Technology led the week’s sector performance, with SPDR Technology (XLK) up 3.36 percent. SPDR Materials (XLB) and SPDR Industrials (XLI) hit new 52-week highs, and SPDR Healthcare (XLV) gained 1.33 percent.

Inflation cooled in June. Headline consumer price inflation was flat, while core inflation eased to 0.1 percent. Both were 0.1 percentage points below estimates. Headline inflation over the past 12-months fell from 1.9 percent in May to 1.6 percent in June as energy related inflation evaporated. The average price for a barrel of crude oil was $49 in June 2016 and $45 in June 2017. Core inflation held steady at 1.7 percent. Producer price inflation rose 0.1 percent, above estimates of 0.0 percent.

Retail sales declined 0.2 percent in June versus estimates of 0.2 percent growth, due in part to falling gasoline prices. Gas station sales fell 1.3 percent. The Atlanta Federal Reserve adjusted its second-quarter GDP estimate to 2.4 percent following the report.

Industrial production rose 0.4 percent in June, exceeding expectations. Business and wholesale inventories increased more than anticipated in May. The University of Michigan consumer sentiment survey eased to 93.1 in July, down from 95.1 in June.

Initial claims for unemployment were 247,000 last week, in line with estimates. The figures remain at four-decade lows. According to the Job Openings and Labor Turnover Survey (JOLTS), job openings fell by 300,000 in May to 5.67 million as hiring jumped to 429,000. Businesses added new workers at the fastest pace since 2004.

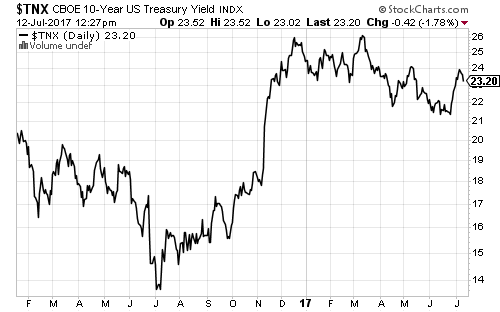

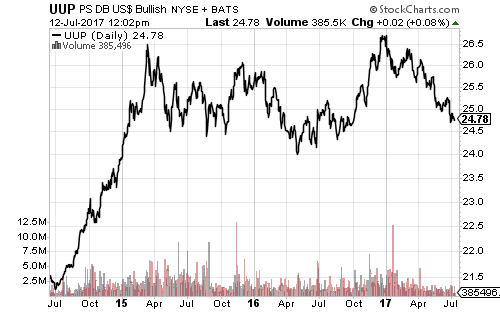

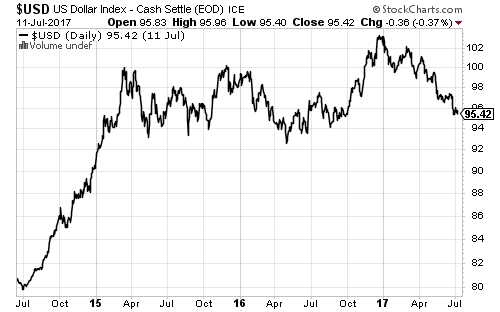

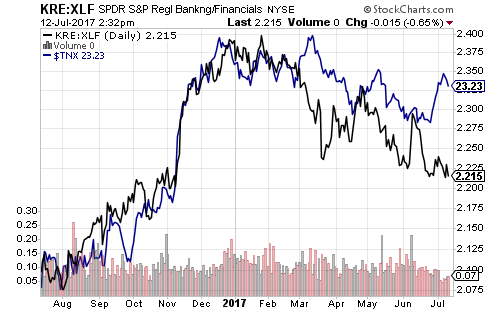

Janet Yellen’s testimony before Congress predictably sent the 10-year Treasury yield lower and the market odds of a December rate hike below 50 percent. The German 10-year government bond yield, which had been moving in tandem with U.S. 10-year, continued rising over the past week.

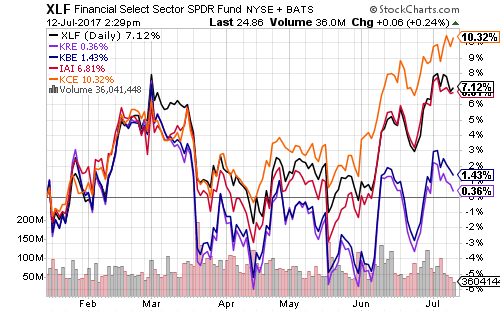

Earnings season kicked off this week with Pepsi (PEP), Delta Air Lines (DAL), J.P Morgan (JPM), Citigroup (C) and Wells Fargo (WFC) reporting.

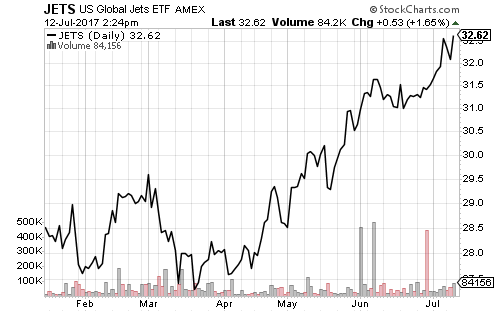

Pepsi beat earnings and sales estimates, but shares fell amid weakness in the consumer staples sector this week. Delta missed recently-inflated estimates, but shares held steady. The airline ETF U.S. Global Jets (JETS) climbed to a new 52-week high.

J.P. Morgan beat earnings estimates by 8 percent, but shares fell on weak guidance. The bank lowered its forecast for net-interest income by 11 percent. Wells Fargo followed in the footsteps of the other mega banks. The bank earned $1.07 per share, 6 cents better than estimates. Citigroup beat estimates as well.

Strong earnings at the mega banks pushed the consensus S&P 500 blended earnings growth rate to 6.8 percent, up from the initial 6.6 percent estimate on June 30.