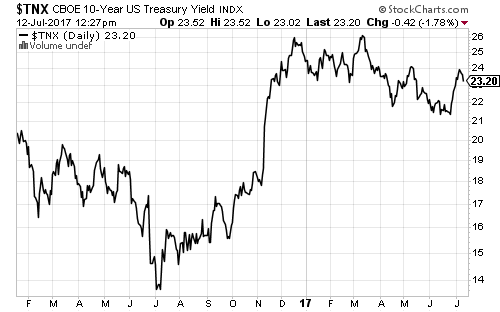

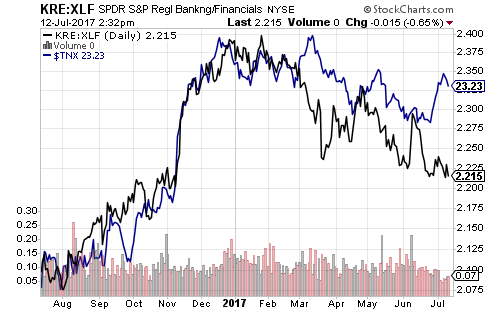

Federal Reserve Chair Janet Yellen testified before Congress on Wednesday, focusing on gradual rate hikes and balance sheet reduction plans. Her comments did little to sway December rate hike odds, which remain near 50 percent, though the U.S. 10-year Treasury yield fell following Yellen’s testimony.

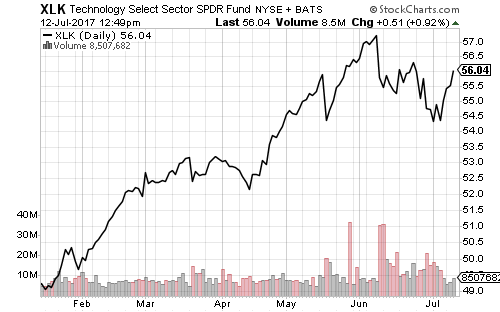

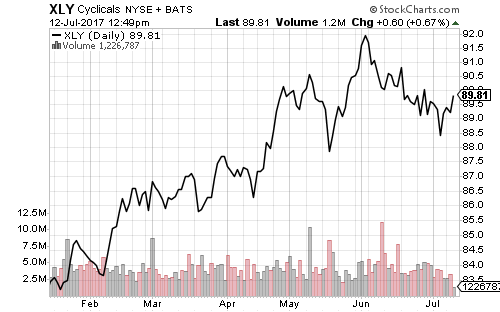

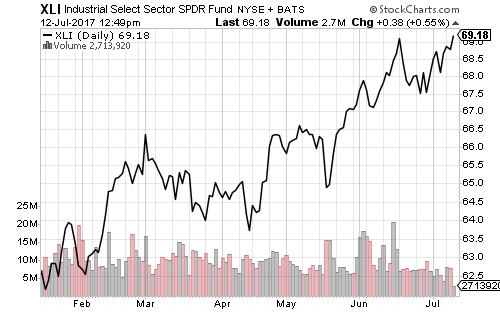

Technology and consumer discretionary shares both rallied. The industrial sector hit a new 52-week high on Wednesday.

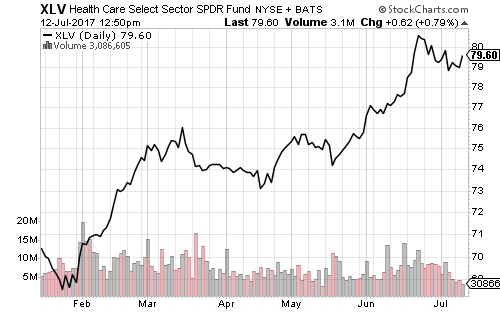

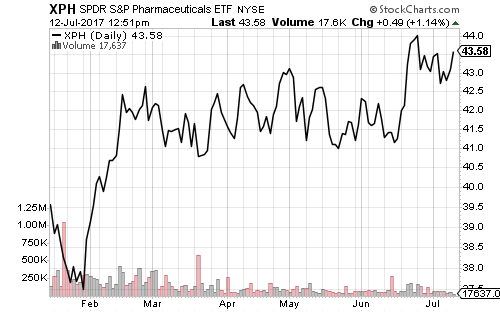

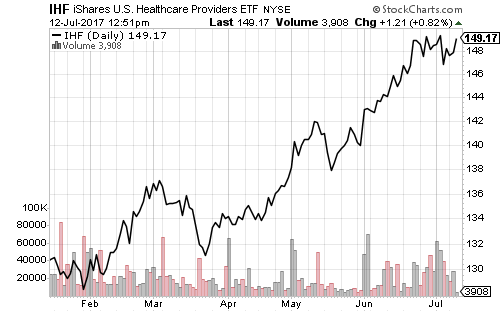

Healthcare could hit a new high in the week ahead. Shares of SPDR S&P Pharmaceuticals (XPH) rallied strongly on Wednesday. Pharma shares are a little more than 1 percent away from a new 2017 high.

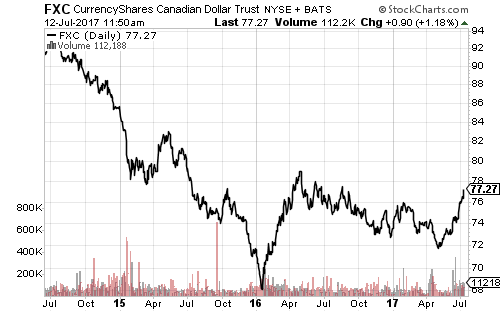

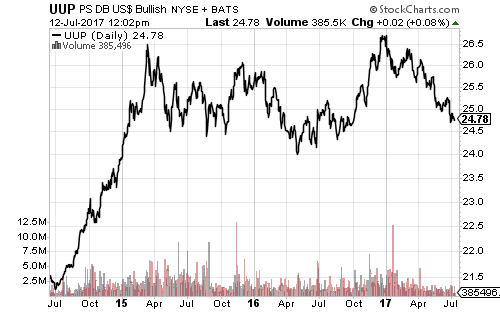

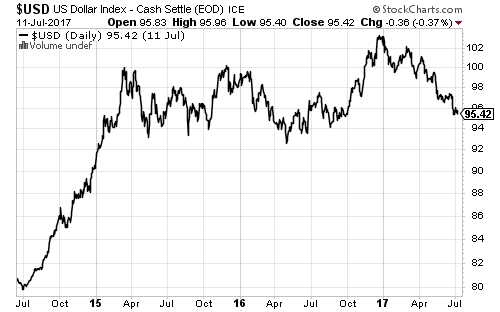

The Canadian dollar rallied more than 1 percent on Wednesday after the Bank of Canada raised interest rates to 0.75 percent, the first increase since 2010. This put downward pressure on the U.S. Dollar Index, but it held above 95.

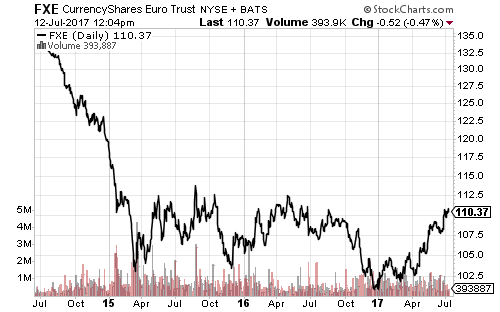

The euro also hit a new 52-week high.

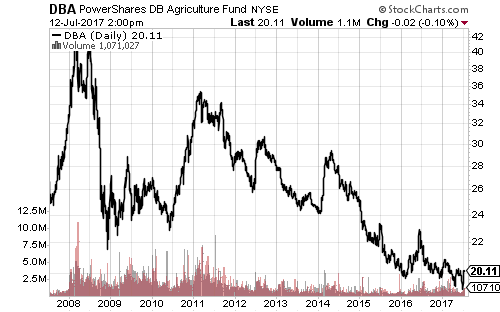

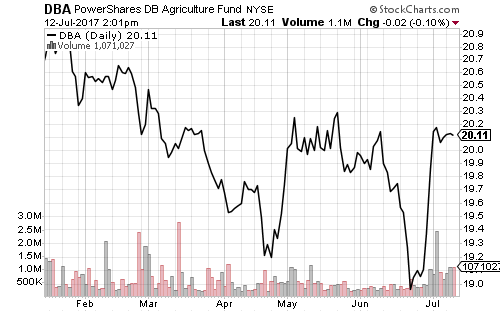

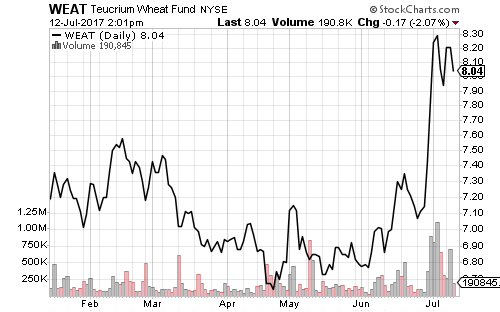

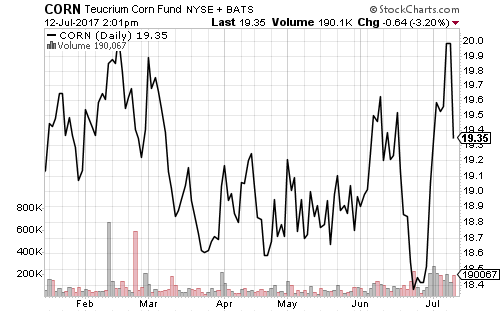

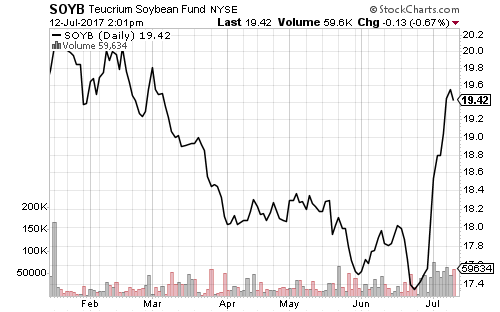

Agricultural commodities rallied in July due to a drought that damaged half of Montana’s wheat crop, sending the Wheat ETF up 17 percent over the past month.

Agricultural prices have been in a long-term decline. In addition to the weaker U.S. dollar, generally crop yields have been strong and inventories high over the past few years.

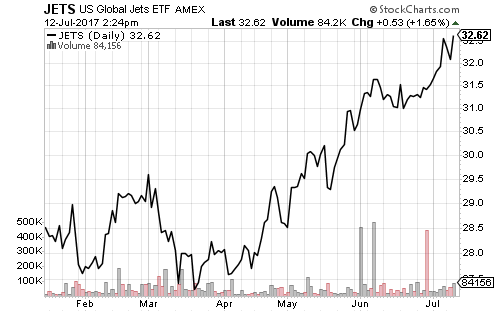

Delta’s (DAL) earnings are expected to come in at $1.65 per-share when the firm reports on Thursday.

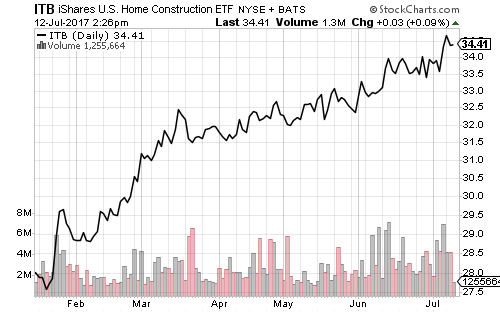

Strong jobs data propelled homebuilders to a new 52-week high.

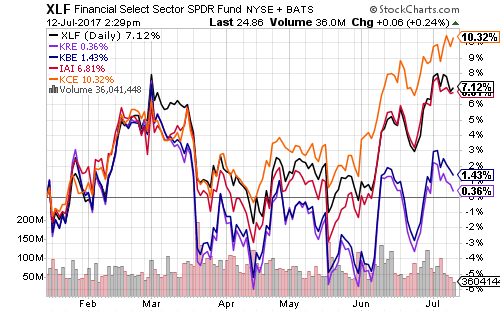

J.P. Morgan (JPM), Citigroup (C) and Wells Fargo (WFC) will officially kick off earnings season on Friday. Recent dividend hikes and rising interest rates have been bullish for bank shares.