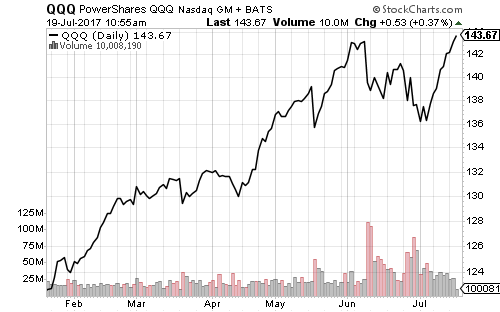

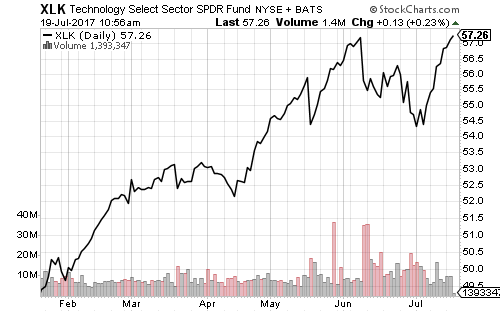

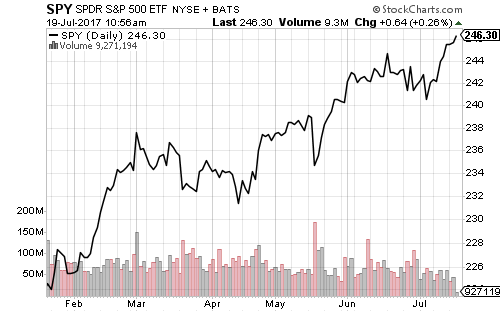

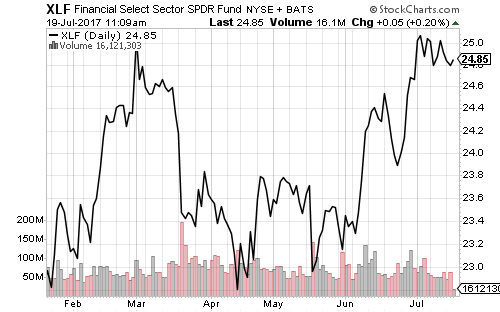

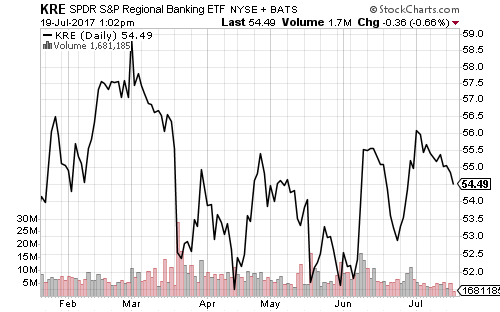

The Nasdaq climbed to another new all-time high on Monday as technology and financials outperformed, while the broader market closed slightly lower.

This will be a big earnings and data week. On Monday, manufacturing and services flash PMIs for July both indicated faster expansion, and existing home sales for June came in slightly lower than expected.

The Conference Board’s consumer confidence survey will be released on Tuesday, followed by new home sales and the Federal Open Market Committee meeting on Wednesday. No policy changes are expected, but the Fed will likely discuss balance sheet reductions. Durable goods and capital expenditures for June, and the University of Michigan’s consumer sentiment survey will be out later in the week. Second-quarter GDP data will be released on Friday. Economists forecast 2.7 percent growth. The Atlanta Federal Reserve’s GDP Now Model predicts 2.5 percent.

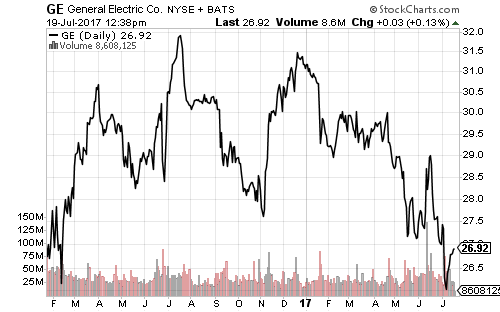

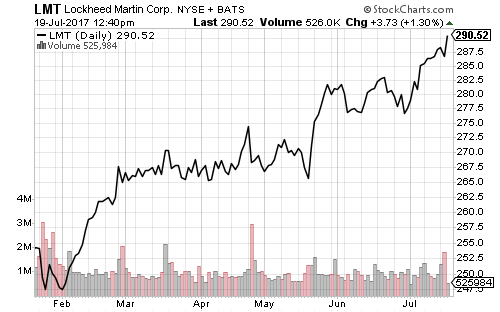

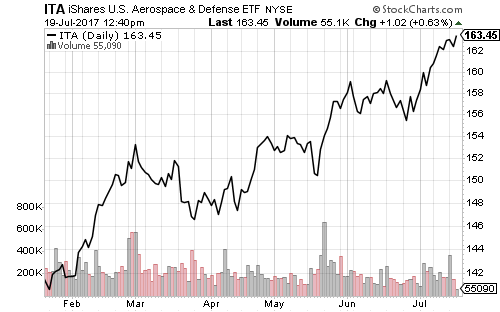

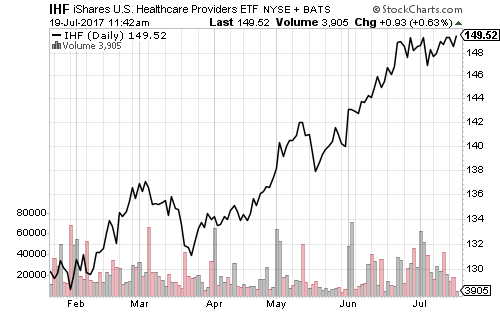

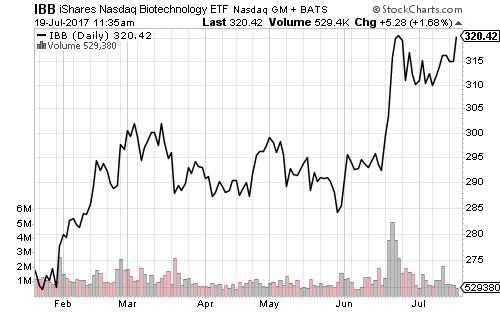

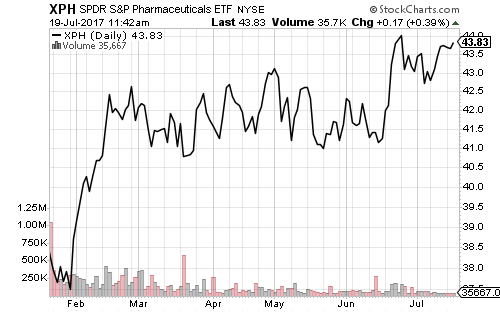

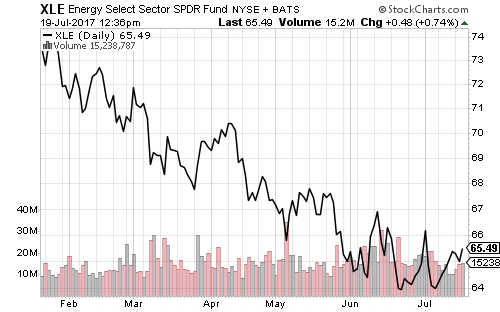

Several Dow Jones Industrial Average components will be reporting this week, as well as some important energy, defense, biotech and telecom sector firms. iShares U.S. Telecommunications (IYZ), iShares U.S. Aerospace & Defense (ITA), iShares Nasdaq Biotechnology (IBB) and SPDR Energy (XLE) will all be impacted.

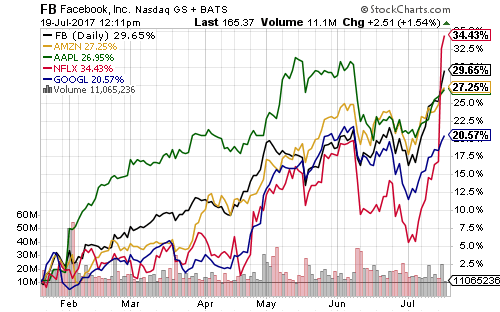

Alphabet (GOOGL) reported earnings on Monday and the firm beat on revenue and profits, but traders initially sent the stock down in after-hours trading. Lower-than-expected ad-click traffic and a severe fine imposed by the EU for search engine practices may have offset earnings beats.

AT&T (T) is expected to report $0.74 per-share in earnings on Tuesday. Analysts forecast $3.09 per share at Amgen (AMGN), a top holding in many biotechnology funds. 3M (MMM), McDonald’s (MCD), United Technologies (UTX), Eli Lilly (LLY), Texas Instruments (TXN), DuPont (DD), Caterpillar (CAT), General Motors (GM) and Biogen (BIIB) will also report on Tuesday.

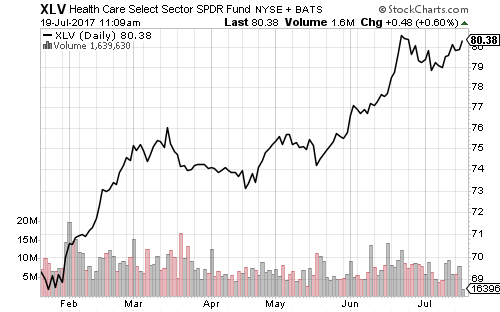

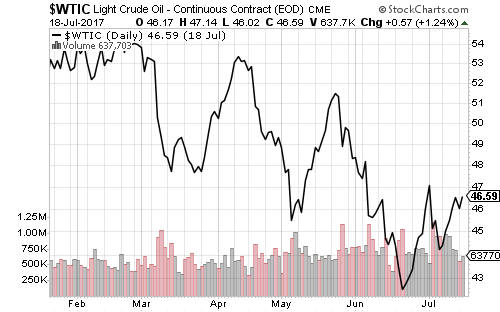

Energy and healthcare will dominate earnings on Wednesday. Exxon Mobil (XOM) and Chevron (CVX) are projected to roughly double their earnings from last year. Merck (MRK), Barclays (BCS), Credit Suisse (CS), American Airlines (AAL) and AbbVie (ABBV) are also scheduled to report on Wednesday.

Thursday will be another vital day for blue chips. Amazon (AMZN), Proctor & Gamble (PG), Comcast (CMCSA), Anheuser-Busch Inbev (BUD), Verizon (VZ), Royal Dutch Shell (RDS.A), Intel (INTC), Mastercard (MA), Altria (MO), British American Tobacco (BAT), Total SA (TOT), Celgene (CELG), Starbucks (SBUX), Dow Chemical (DOW), Baidu (BIDU), Bristol-Myers (BMY), Raytheon (RTN), ConocoPhilips (COP) and UPS (UPS) will all report.

Facebook (FB), Coca-Cola (KO), Boeing (BA), GlaxoSmithKline (GSK), Gilead Sciences (GILD), PayPal (PYPL), Las Vegas Sands (LVS), Northrop Grumman (NOC) and General Dynamics (GD) will report earnings on Friday.