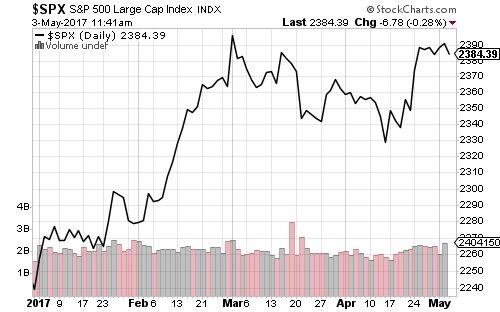

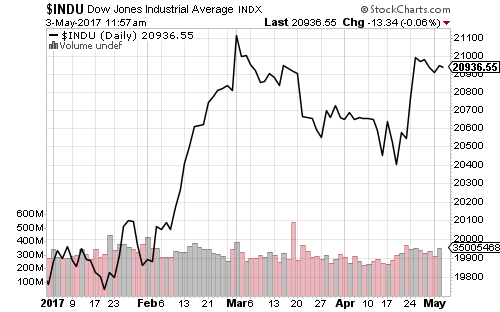

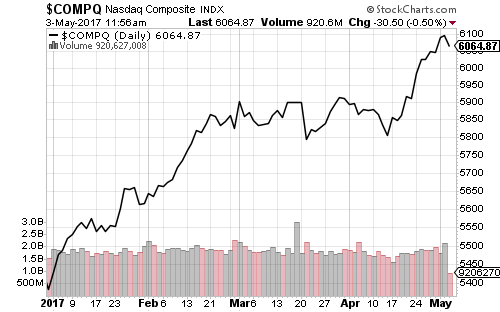

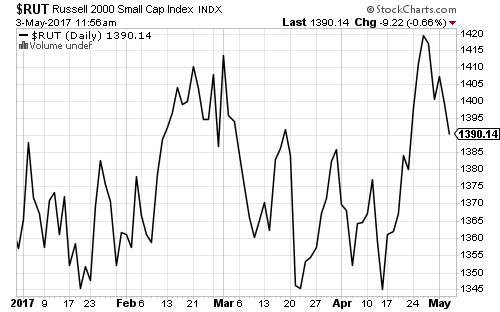

The S&P 500 closed at a new all-time high of 2399.29 last week. The Dow Jones Industrial Average, Nasdaq and Russell 2000 all remain near all-time highs as well. The CBOE Volatility Index (VIX) fell to 9 last week, and continued dropping on Monday to the lowest level since 1993.

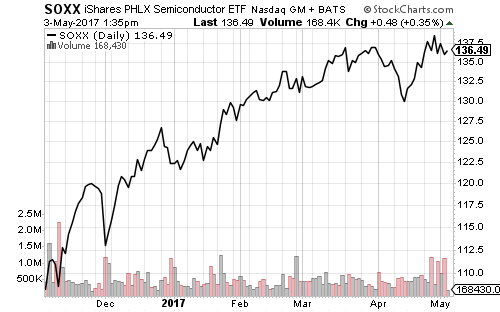

Analysts expect Disney (DIS) report $1.45 per share in earnings on Tuesday. Priceline (PCLN), Allergan (AGN), Duke Energy (DUK) and Nvidia (NVDA) will also report on Tuesday. On Wednesday, Snap (SNAP), maker of Snapchat, will deliver its first earnings report since its March IPO. Troubled pharmaceutical company Mylan (MYL) is also scheduled to report on Wednesday.

Retail season kicks off on Thursday with reports from Macy’s (M), Nordstrom (JWN) and Kohl’s (KSS), followed by. J.C. Penney (JCP) on Friday. Headline retail sales and retail sales ex-autos data is due out on Friday. Both are forecast to rise 0.5 percent.

The April consumer price index will also be out on Friday. Economists expect the headline and core CPI will both reflect 0.2 percent growth. The University of Michigan consumer sentiment for May, also scheduled for release on Friday, is expected to reach 97.3.

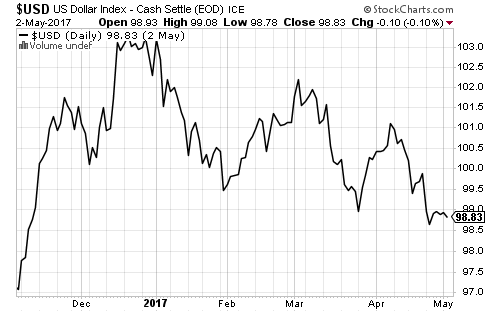

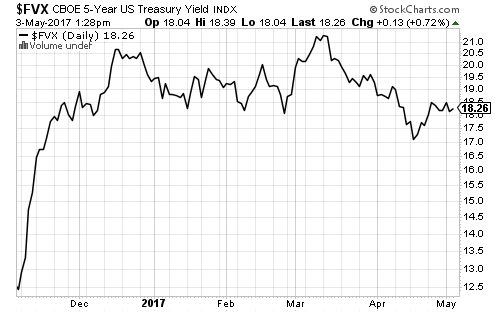

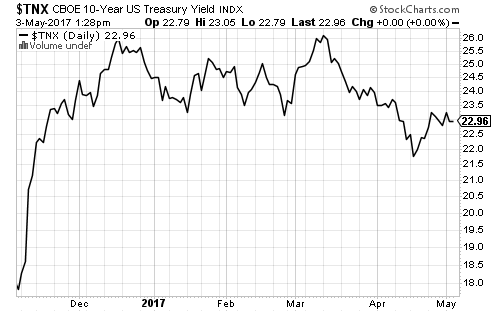

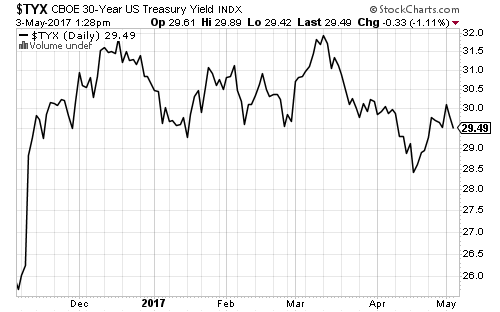

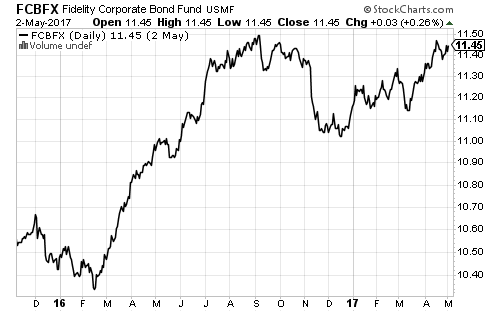

June rate hike expectations are up to 83 percent. Long-term bond yields rallied into Monday with the 10-year Treasury yield at 2.37 percent.

China’s export and import growth showed solid growth year-over-year in April, but missed forecasts, while the trade balance came in above expectations. China’s April CPI, PPI, and new loan growth will be out later in the week. China has targeted shadow banking and the housing market over the past six weeks.

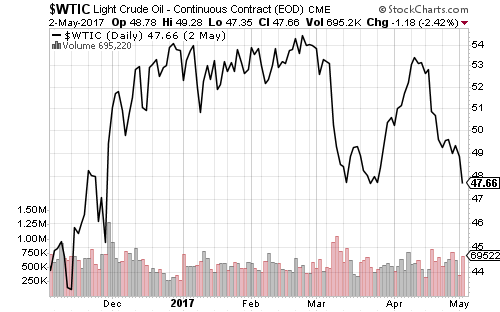

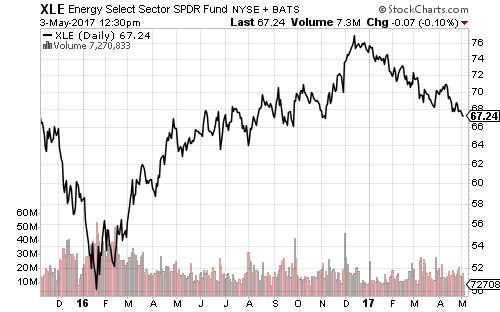

OPEC cuts will expire at the end of June, but OPEC expects slack demand in the first quarter of 2018 and may propose a nine-month extension. The rig count in the U.S. is at its highest since the mid-1980s and production could approach all-time highs this year. West Texas Intermediate crude fell below $45 a barrel last week.

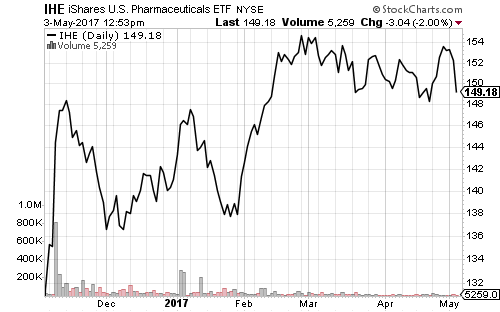

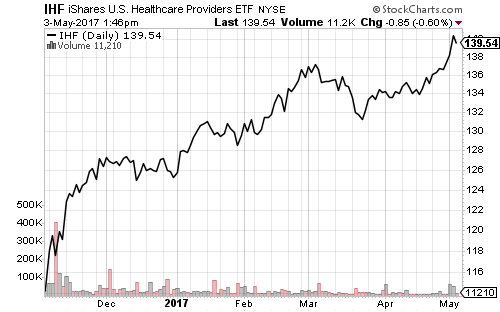

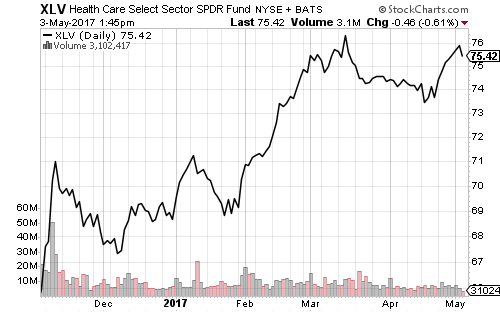

Last week, the House of Representatives passed a partial reform of the Affordable Care Act. The Senate isn’t expected to vote on the bill, but instead offer its own proposal, potentially slowing tax cut legislation.