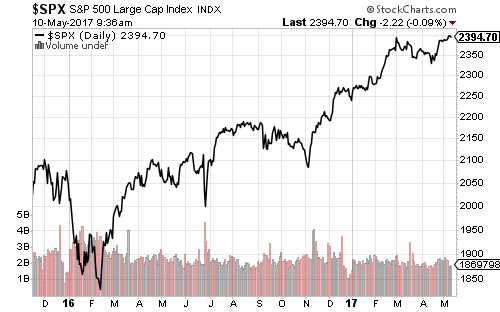

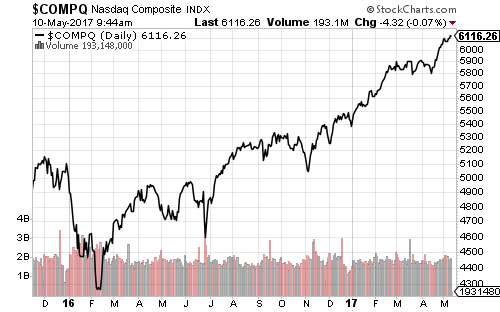

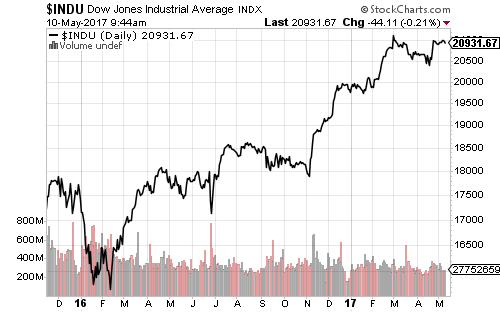

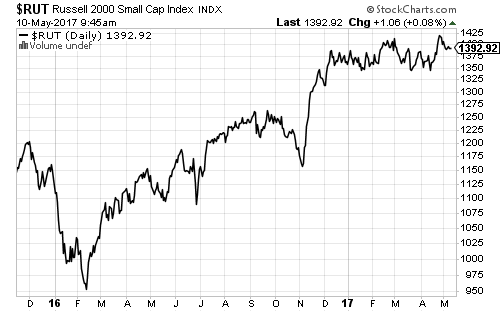

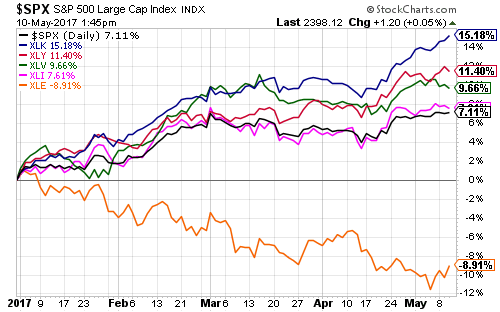

The S&P 500 Index hit a new all-time high on Monday to close at 2402.32. The Nasdaq made a new high on Monday as well, while the Dow Jones Industrial Average gained 0.41 percent and the Russell 2000 climbed 0.81 percent on the day.

Homebuilder confidence hit 70 in May, up from 68 in April. The Empire State Index, a measure of manufacturing activity in the New York region, fell to negative 1 in May. The index made a 12-month high at 18.7 in February. April’s housing starts and building permits, industrial production, and capacity utilization data will be available on Tuesday. Industrial production is expected to reflect a 0.5 percent rise in April, capacity utilization a 0.2 percent increase.

Only 9 percent of S&P 500 companies are left to report earnings. Retailers will dominate this week, with several major firms reporting. Last week, Macy’s (M) and J.C. Penny (JCP) disappointed investors and sent SPDR S&P Retail (XRT) 4.5 percent lower on Thursday and Friday. Home Depot (HD), TJX Companies (TJX), Staples (SPLS), Urban Outfitters (URBN), Target (TGT), L Brands (LB), American Eagle Outfitters (AEO), Gap (GPS), Children’s Place (PLCE) and Foot Locker (FL) are all scheduled to report this week.

Analysts expect 53 cents per share, up from 50 cents a year ago from Cisco (CSCO). Semiconductor equipment supplier Applied Materials (AMAT) will report on Thursday. The consensus calls for profits of 76 cents per share, more than double last year’s 34 cents. Alibaba (BABA) will also report on Thursday. Analysts expect earnings rose to 49 cents per share from last year’s 20 cents.

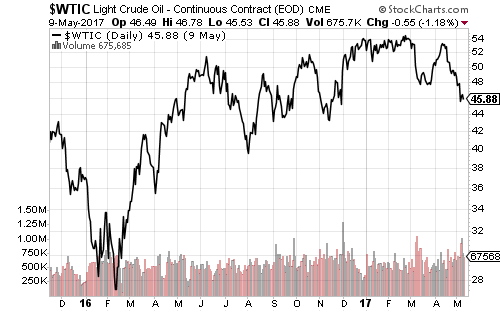

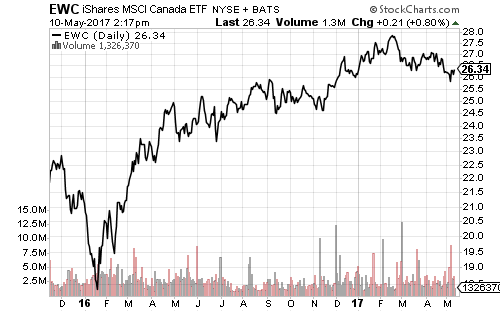

Oil prices climbed above $49 on Monday after Saudi Arabia and Russia agreed to extend production cuts for nine additional months, pending the cooperation of other OPEC nations.

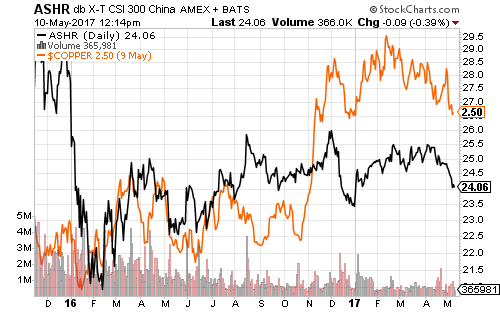

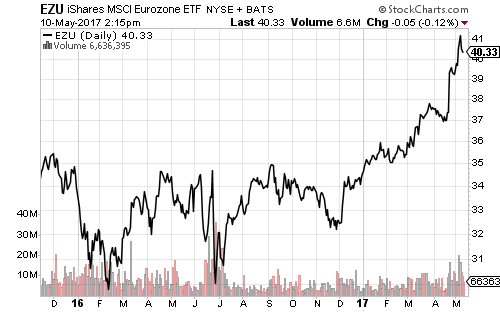

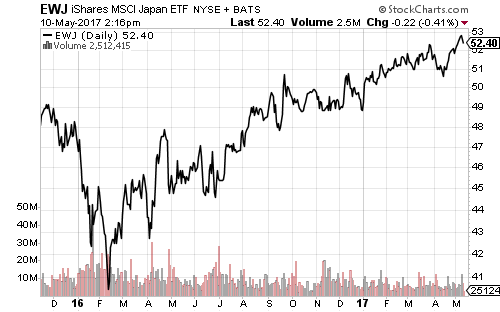

On Sunday night, China reported fixed asset investment and industrial production numbers below expectations. Eurozone consumer price inflation and Japanese first-quarter GDP are due later in the week.