The March Issue of the Investor Guide to Vanguard Funds is NOW AVAILABLE! Links to March Data Files have been posted below. Market Perspective: Improving Employment Figures to Benefit Stocks Equities […]

Month: March 2017

Mutual Fund & ETF Watchlist for March 15, 2017

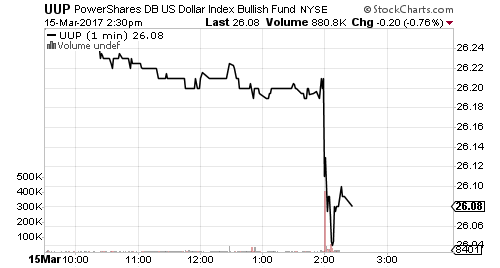

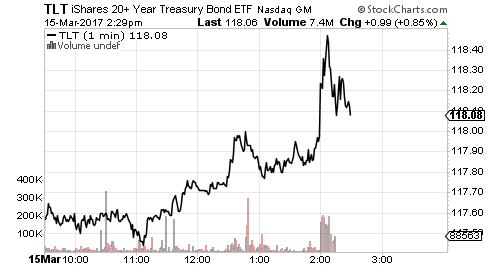

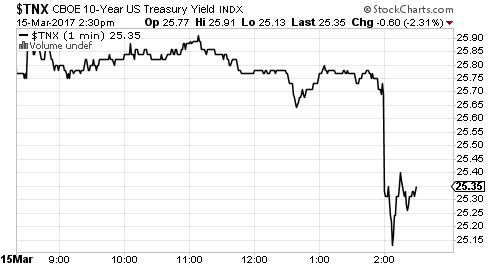

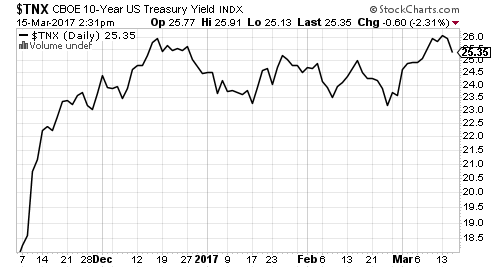

The Federal Reserve raised interest rates by 25-basis points, as expected, and the “dot plot” signals three hikes in 2017. The 10-year Treasury yield fell significantly following the announcement.

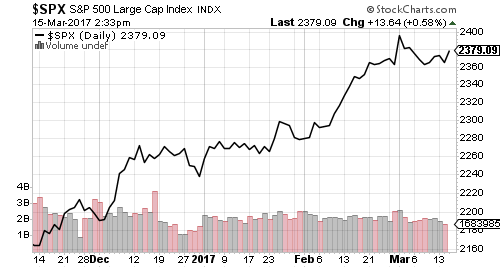

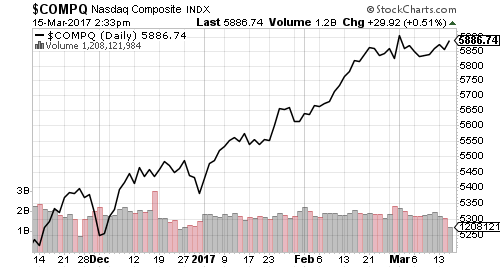

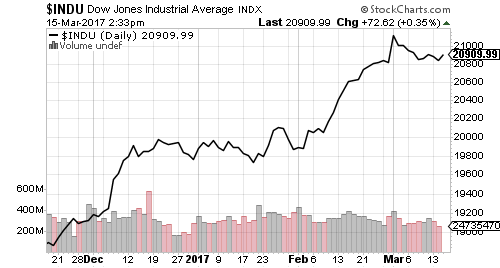

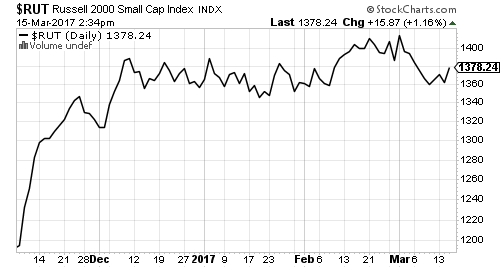

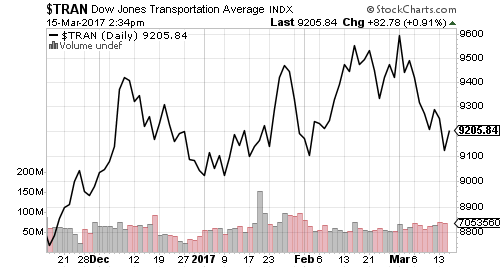

Major indexes consolidated gains over the past week, though the Nasdaq remains the strongest with a relatively shallow consolidation.

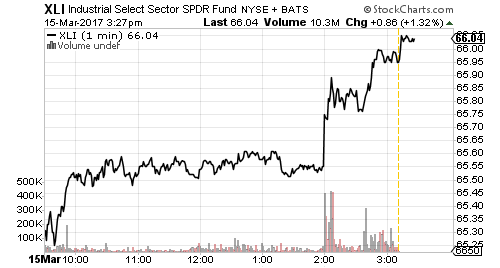

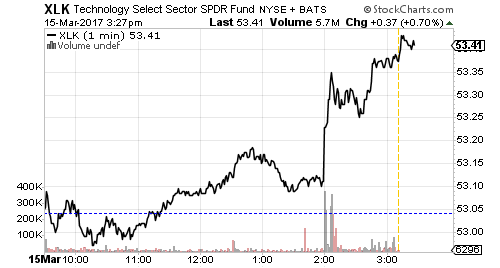

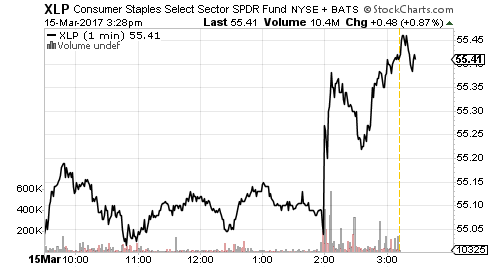

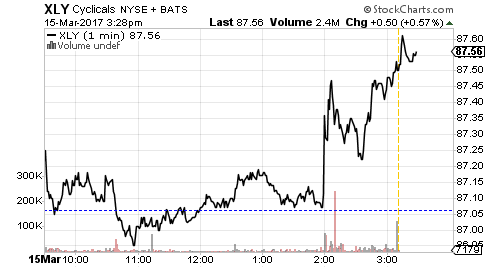

All major indexes jumped in the wake of the Fed’s rate increase.

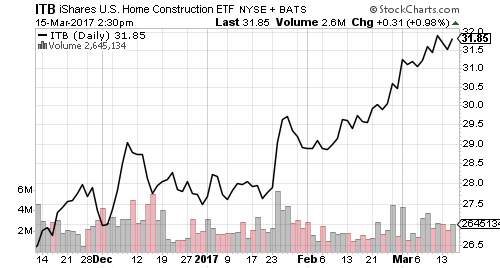

Homebuilders recently hit a new 52-week high. Strong home sales, home price, and construction numbers all point to accelerating growth. Higher employment and wages are also contributing to homebuilder optimism. This week homebuilder confidence hit its highest level since 2005. iShares U.S. Home Construction (ITB) has rallied nearly 25 percent over the past four months.

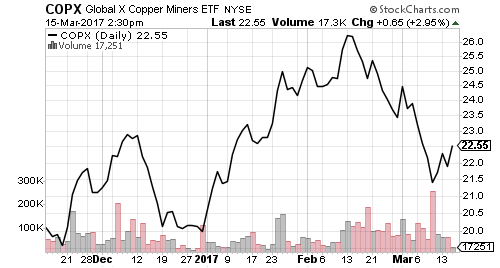

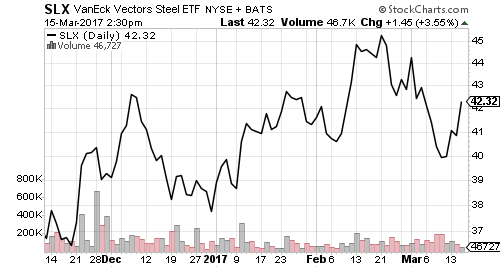

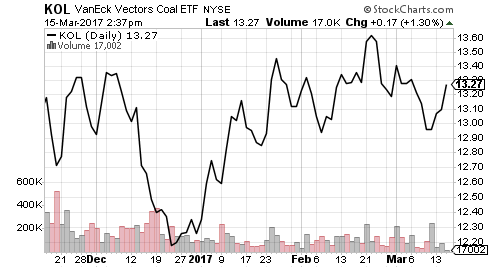

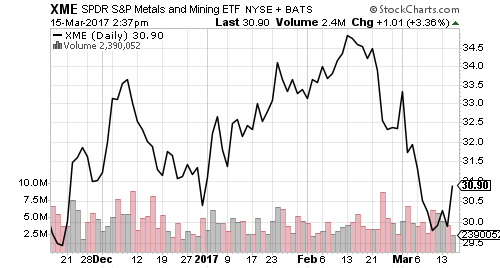

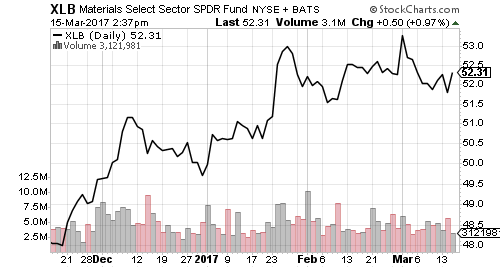

Natural resources sectors started pulling back in February. Heavy volume on March 11 in the chart of COPX reflects capitulation as weak hands dumped shares. Steel and coal bottomed around the same time, while KOL volume increased as bullish investors bought into the rebound.

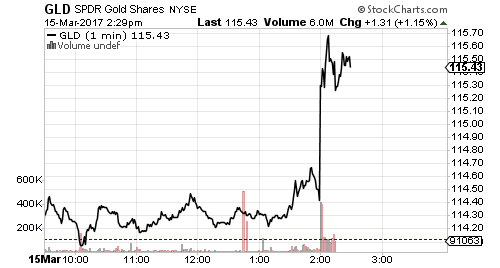

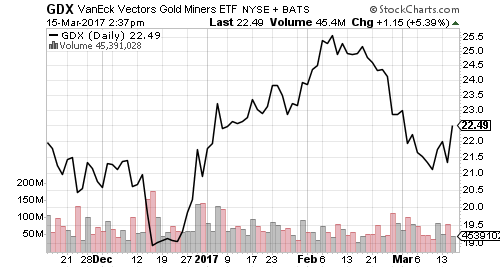

Broader mining funds hadn’t bounced as much as subsector materials funds until Wednesday. Gold miners also saw a weaker bounce over the past week. The commodities complex bounced strongly following the rate hike.

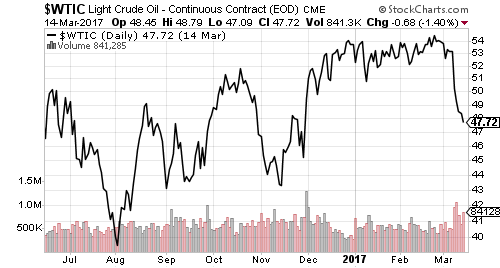

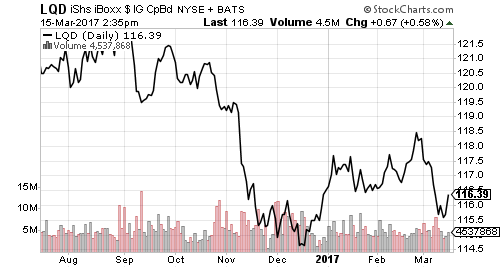

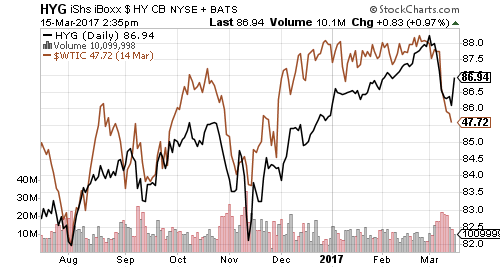

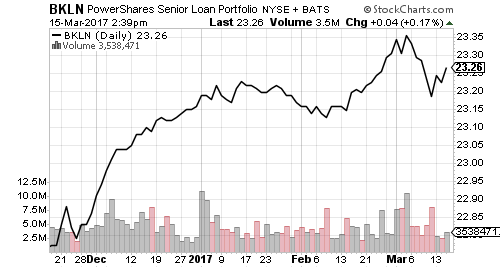

Falling oil prices dinged high-yield credit over the past week. The chart below shows the price of HYG with the price of West Texas Intermediate Crude. A dip in crude oil in August, September and November also caused a small drop in HYG. Investment-grade bonds rallied despite a rise in Treasury bond yields.

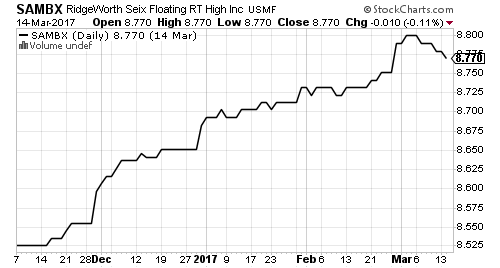

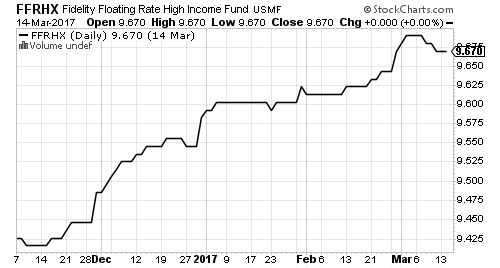

Weakness in high-yield spilled over into short-duration and floating-rate funds, although the declines here were much milder than the small dip in HYG.

The U.S. dollar tumbled, gold and long-term bonds rallied after the Fed’s rate hike.

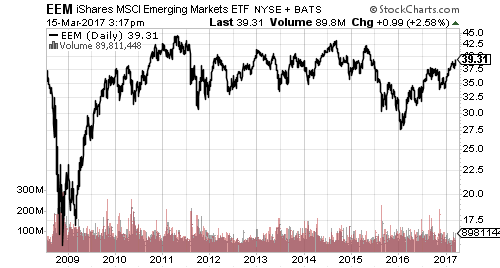

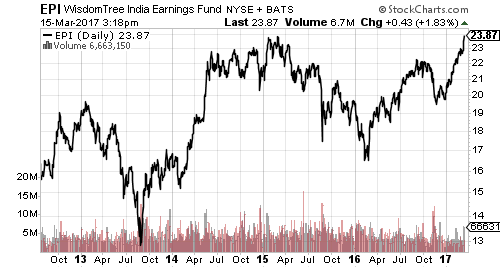

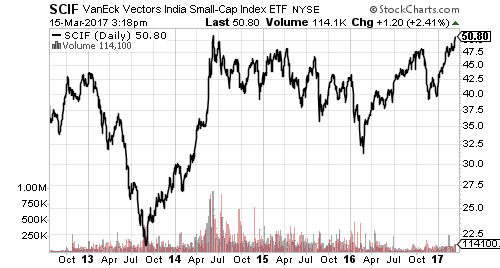

Emerging markets rebounded over the past week and India funds are approaching a multi-year breakout.

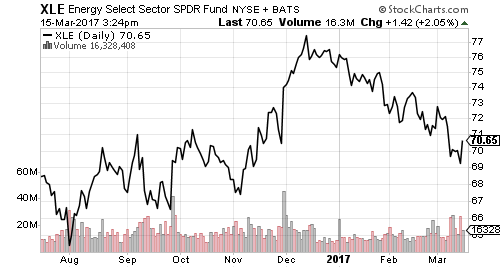

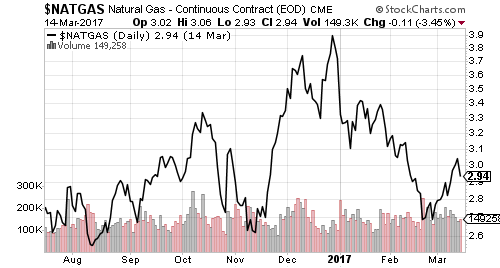

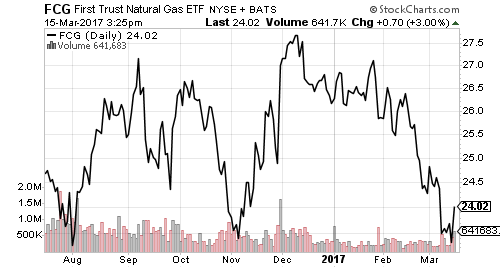

Oil broke out of its three-month trading range last week, resulting in a powerful downside move. Oil stocks and the natural gas sector responded positively, however, to the Fed’s rate announcement.

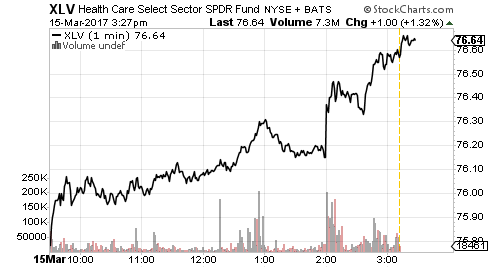

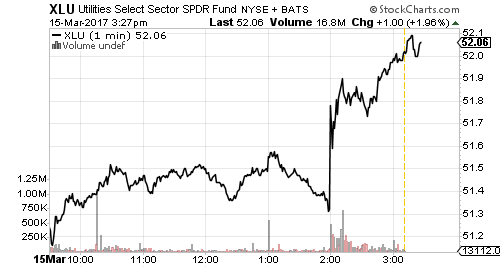

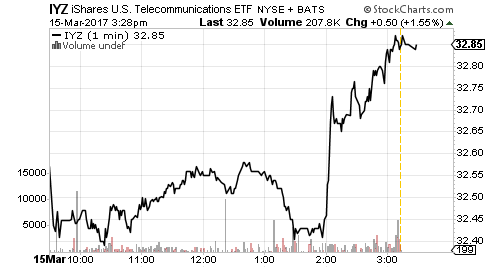

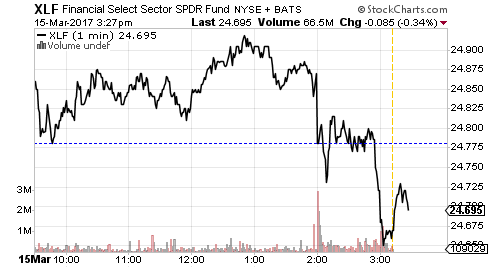

The most rate sensitive sectors, utilities and telecommunications, rallied sharply following the Fed’s announcement. The financial sector fell. This will likely reverse in the days ahead.

Market Perspective for March 13, 2017

The Federal Reserve will most likely raise interest rates 25 basis points on Wednesday to between 0.75 and 1.00 percent. Investors have largely priced in the move. A second hike in June already has better than 50 percent odds.

The consumer price index (CPI) for February will be out on Wednesday. Analysts expect an increase of 0.1 percent. Core CPI is expected to rise 0.2 percent. Economists expect February retail sales increased 0.1 percent. The March Empire State manufacturing index and the March national homebuilders’ surveys are also due. The manufacturing survey is forecast to show a slight drop. Economists expect the homebuilder survey to increase slightly.

Analysts are looking for a jump in housing starts when February data is released on Thursday. Weekly crude oil inventory data will take on renewed importance following last week’s drop in prices. Industry experts predict another significant increase in crude oil inventories. Business inventories for January could impact first quarter GDP estimates if they stray from the expected 0.3 percent increase.

Initial claims for unemployment are forecast to decline slightly from last week. Economists forecast a 0.1 percent increase in the producer price index (PPI) for February. The Philly Fed manufacturing survey is anticipated to show a slight decline. The same day, the Job Openings and Labor Turnover Survey (JOLTS) is expected to remain unchanged from last month. The University of Michigan Consumer Sentiment survey is due out Friday.

On Thursday, the Bank of Japan (BoJ) and the Bank of England (BoE) will meet. Both are expected to keep their rates unchanged, but the BoJ could announce a reduction in quantitative easing. Some analysts believe the BoJ has already begun a stealth taper.

In political news, the U.S. debt ceiling will expire on Thursday. While a temporary reset will begin Friday, Congress will need to approve a new ceiling or an extension. President Trump’s first budget proposal is also expected on Thursday. The United Kingdom may officially begin the road to independence by invoking Article 50 on Tuesday, setting in motion its exit from the European Union. The Netherlands goes to the polls on Wednesday. The Party for Freedom (PVV) wants to pull Holland out of the EU as well.

As earnings season winds down, only a few well-known names have yet to report. This week, Oracle (ORCL), Adobe Systems (ADBE), Dollar General (DG) and Tiffany & Co. (TIF) are scheduled to report. Oracle is forecast to show 3 percent year-over-year growth as the enterprise database giant captures more cloud computing business. Consensus estimates call for earnings per share (EPS) of $0.62 on revenues of $9.25 billion. Oracle missed its forecasts last quarter.

On Thursday, analysts expect Dollar General to report $1.41 per share in earnings. Aside from earnings, investors will focus on same-store sales figures and rising costs. After the bell, Adobe is expected to post earnings of $0.87 per share and revenues of $1.65 billion. On Friday, analysts anticipate Tiffany & Co. will announce $1.37 per share in earnings as high-end merchants evade the overall downward trend in brick-and-mortar retail.

Global Momentum Guide for March 13, 2017

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR PERSPECTIVE The MSCI EAFE Index was the best performer last week, rising 0.38 percent. The Nasdaq fell 0.15 percent, […]

Market Perspective for March 10, 2017

The major indexes were flat on the week following Friday’s strong jobs report. 235,000 new jobs were created in February, compared to the 190,000 forecast. The unemployment rate stayed at 4.7 percent despite more workers entering the labor force. The underemployment rate fell from 9.4 percent to 9.2 percent. Average hourly wages increased 0.2 percent.

On Wednesday, West Texas Intermediate Crude fell 5 percent and eventually hit $48 later in the week. Energy stocks lost about 3 percent on the week. In 2017, weekly inventory has consistently been well above 2016 levels.

The Federal Reserve will almost certainly hike interest rates next week. The 10-year Treasury yield briefly climbed above 2.6 percent. Overseas, the Royal Bank of Australia and the European Central Bank (ECB) held interest rates steady this week. Additionally, the ECB will continue its quantitative easing program even though Eurozone inflation has reached the 2 percent target.

Japanese fourth-quarter gross domestic product (GDP) figures came in above expectations at 1.2 percent. The latest Chinese Consumer Price Index (CPI) along with the Producer Price Index (PPI) readings showed a reduction in consumer inflation while factory prices rose 7.8 percent year-on-year.

With 99 percent of S&P 500 companies reporting, the earnings growth rate for Q4 2016 is 4.9 percent. Brick-and-mortar retailers still face stiff competition from online retailers as well as changes in consumer buying habit. Urban Outfitters (URBN) fell 3 percent on Wednesday after disappointing sales and revenues. Express, Inc. (EXPR) also reported numbers below analysts’ expectations. Shares of the company fell nearly 12 percent on the news. The selling pressure in retail spread to Dick’s Sporting Goods (DKS) despite the company’s solid quarterly results. DKS sales and earnings surpassed expectations, but shares fell 7 percent. SPDR S&P Retail (XRT) fell to a new 2017 low on Thursday.

Higher mortgage rates and slow sales hampered the performance of Hovnanian (HOV). Shares were down 8 percent on the week. Despite the lower results this week, analysts raised their overall bottom-up earnings per share estimates for the current quarter. It’s also an outlier report for the industry, which generally beat sales and earnings estimates this reporting season. Housing industry data remains strong as well. This week’s employment report showed solid job gains in residential construction. iShares U.S. Home Construction (ITB) hit a new 52-week high on Friday.