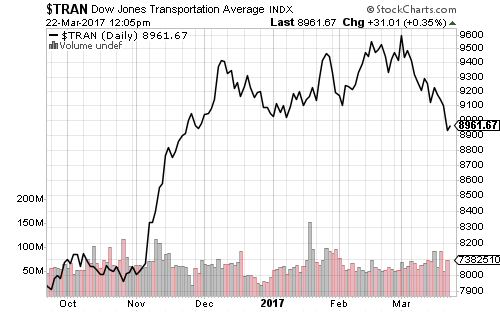

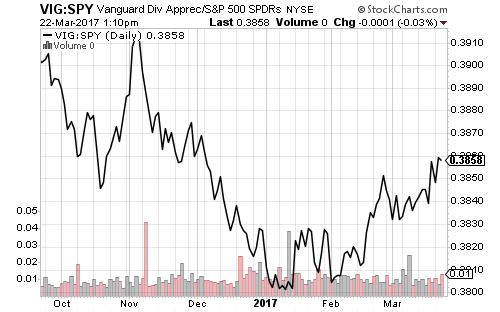

Markets pulled back slightly this week as traders rotated out of interest rate bets following last week’s hike. On Tuesday stocks saw the largest one day sell-off in 2017. The S&P 500 Index fell 1.4 percent for the week, though year-to-date returns are still approaching 4 percent. The Nasdaq and Dow Jones Industrial Average lost 1.2 and 1.5 percent, respectively.

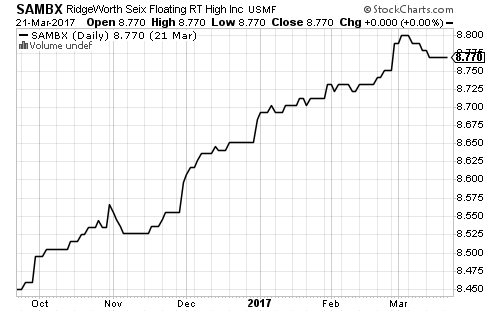

Several officials also discussed shrinking the balance sheet by the end of this year. The Fed’s balance sheet grew from approximately $900 billion ahead of the 2008 financial crisis to $4.5 trillion by the end of quantitative easing. Many bonds held by the Fed are short-term such as $1.4 trillion in U.S. Treasuries with maturities of less than 5 years. Currently, the Federal Reserve reinvests proceeds into new bonds, keeping the balance sheet steady, but it could slowly reduce the balance sheet over time by not repurchasing bonds.

Existing home sales were lower than expected, primarily due to low inventory, but new home sales hit a seven-month high. The Kansas City Fed Manufacturing Survey smashed expectations with a reading of 20 (any number above zero indicates expansion). Initial unemployment claims hit 258,000, slightly higher than economists’ forecasts. The figure is still well below the 300,000 level that signals full employment and a strong labor market.

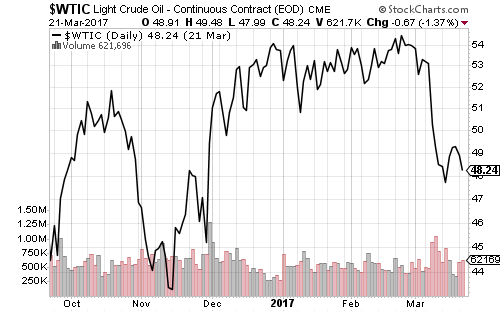

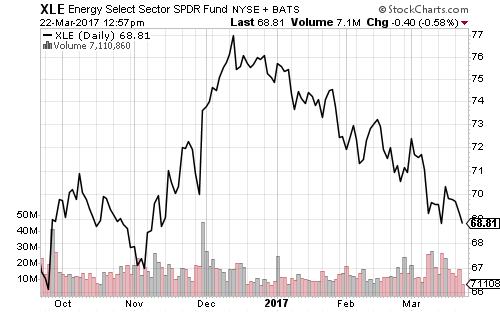

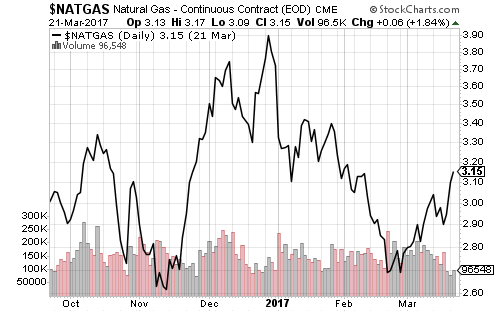

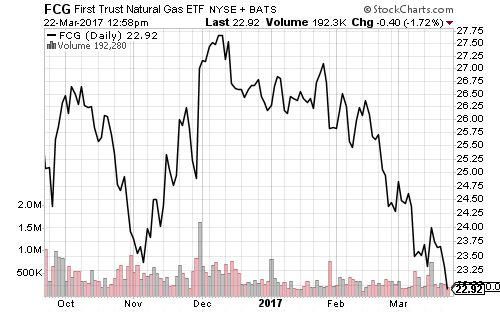

Weekly oil inventory increased by nearly 5 million barrels last week, significantly higher than forecast estimates. Domestic shale oil production also continues to offset OPEC cuts. West Texas Intermediate Crude fell below $48 a barrel.

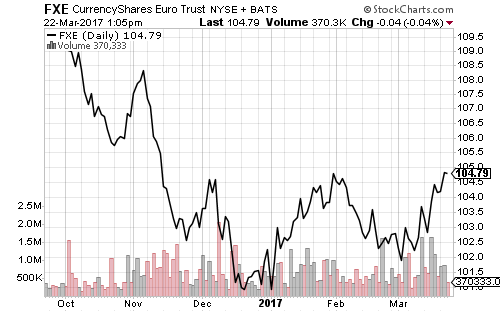

Durable goods orders increased 1.7 percent in February, slightly higher than expectations. Core capital equipment orders fell 0.1 percent. Flash PMIs for Japan and the U.S. showed a slight decline, while Europe’s saw a surprise uptick. All three are above 50, signaling expansion in manufacturing. In the United Kingdom, the Brexit process will formally begin on March 29.

General Mills (GIS) reported its seventh straight month of declining sales, sending shares down slightly more than 2.5 percent. FedEx (FDX) also missed forecast earnings estimates, citing higher fuel costs last quarter. Management maintained full-year guidance, but shares dipped on the week.

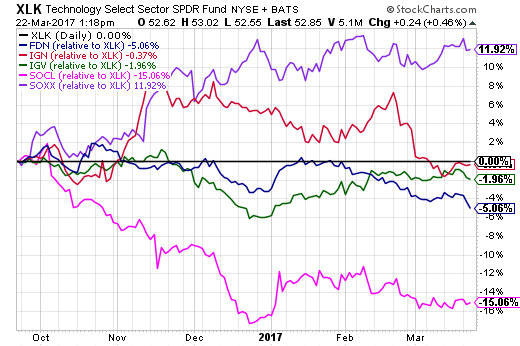

Nike (NKE) fell 6 percent after missing sales expectations and lowered future guidance. Shares of Micron Technology (MU) popped 11 percent on Friday following better-than-expected results. The cyclical semiconductor sector is currently in an uptrend, with strong demand pulling chip prices higher.