Click Here to view the January Issue of the Investor Guide to Vanguard Funds Links to January Data Files have been posted below: Market Perspective: 2017 Should Be an […]

Month: January 2017

Global Momentum Guide for January 17, 2017

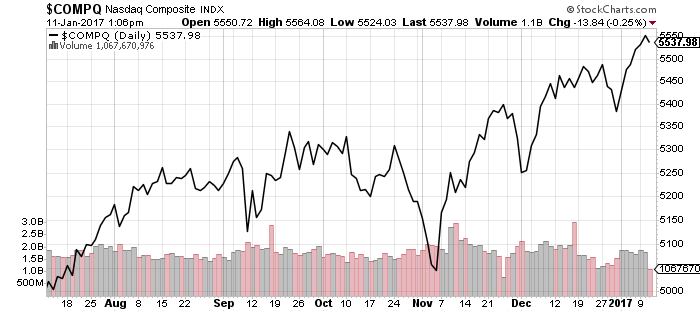

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR PERSPECTIVE The Nasdaq rose 0.96 percent last week, while the MSCI EAFE Index climbed 0.81 percent and the Russell […]

Market Perspective for January 13, 2017

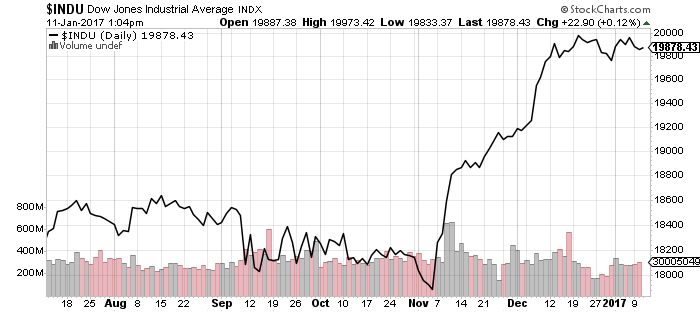

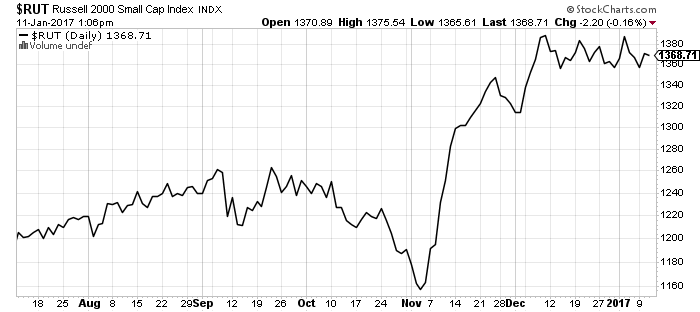

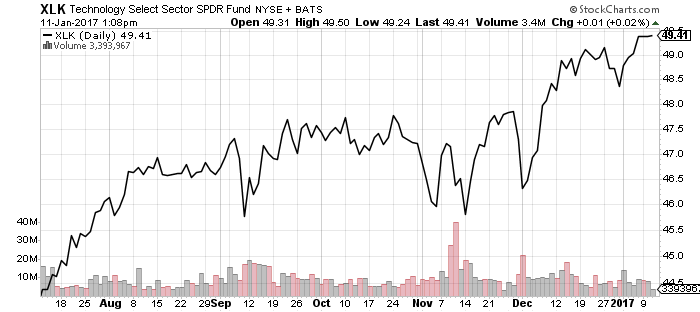

The Nasdaq pushed into record territory this week as technology and consumer discretionary sectors advanced. The other major indexes finished the week relatively unchanged, with the Dow Jones Industrial Average still hovering near the 20,000 mark. Healthcare stocks briefly fell on President-Elect Trump’s comments regarding drug prices before rebounding on Thursday and Friday. Nevertheless, iShares U.S. Healthcare Providers (IHF) is on a 5-day winning streak.

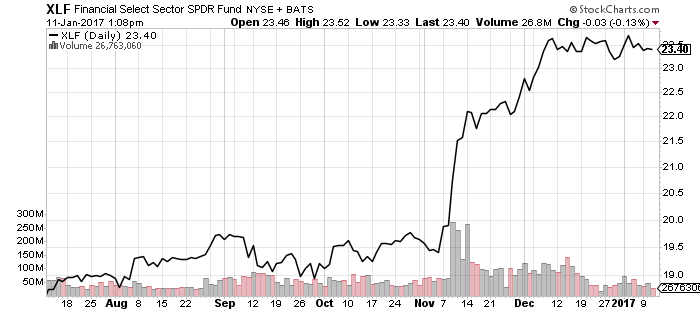

Bank of America, JPMorgan Chase and Wells Fargo all reported before the opening bell Friday. Bank of America (BAC) earned $0.40 per share on revenues of $19.99 billion. This beat analysts’ expectations. JPMorgan Chase (JPM) reported profit of $1.71 per share on revenues of $24.33 billion, well above analysts’ forecasts. A significant increase in its consumer banking operations contributed to the beat. Wells Fargo (WFC) reported earnings per share of $0.96 on revenues of $21.58 billion. All three stocks rallied at the open before giving back their gains.

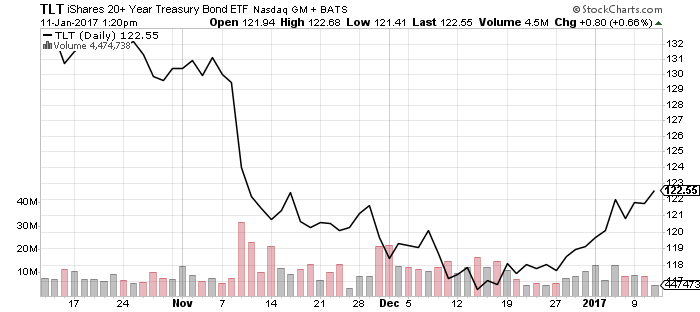

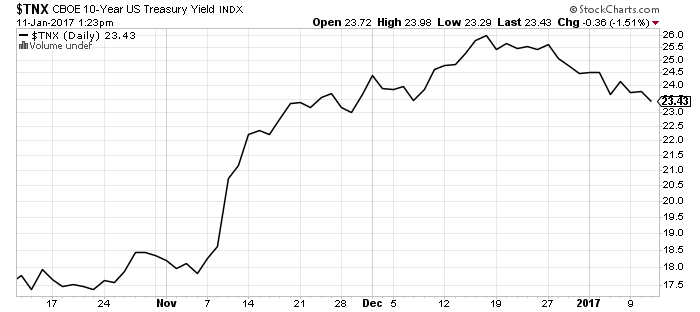

Counter-trend rallies continued in gold and the benchmark 10-year Treasury. Both assets tumbled in late 2016 and rebounded in early 2017. Gold broke above $1,200 an ounce, approximately 70 above its late December low. The yield on the 10-year note slipped to 2.35 percent, down from the peak above 2.6 percent. Friday’s strong bank earnings triggered a rally in the 10-year yield, signaling a potential end to the interest rate pullback.

The Chinese Consumer Price Index (CPI) for December was 2.1 percent, slightly lower than the forecast 2.4 percent year-over-year growth. The 5.5 percent uptick in the country’s Producer Price Index (PPI) was well above expectations, driven by a 1.6 percent increase in December inflation. The U.S. PPI increased 1.6 percent versus last year and only 0.3 percent in December.

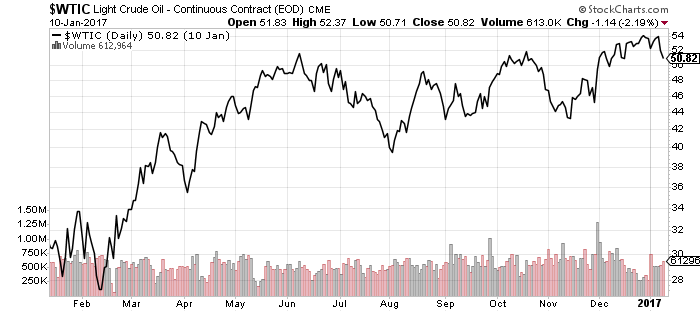

The Job Openings and Labor Turnover Survey (JOLTS) for November showed a slight decline that was in line with analysts’ expectations. The weekly crude oil inventory data Wednesday showed a much larger-than-expected build in stockpiles, weighing on prices. Traders discounted news that OPEC and major non-OPEC countries are abiding by their production cut agreement.

Analysts credit falling interest rates for the better-than-expected 5.8-percent increase in the mortgage purchase application index. Unemployment claims rose less than expected last week, and remain at historic lows. December retail sales climbed 0.6 percent, driven by strong demand for automobiles. The holiday season fizzled for department stores as sales fell 8.4 percent versus a 13.2-percent increase in online sales.

ETF & Mutual Fund Watchlist for January 11, 2017

The stock market continues to climb steadily, despite sector consolidation. The Dow moved sideways over the past week, hitting 19999.63 during Friday trading, but retreated without cracking 20,000. The Nasdaq, however, marched on to a new all-time high.

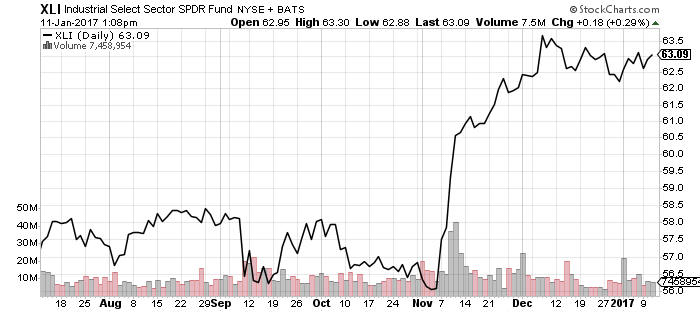

Financials and industrials consolidated their late 2016 gains, while technology has played catch-up.

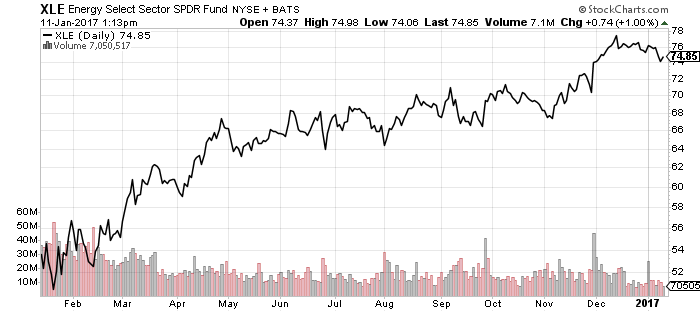

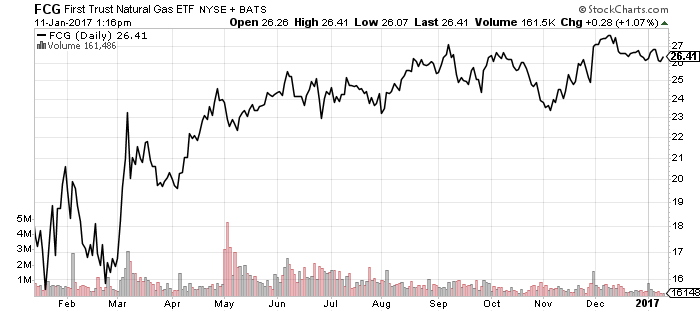

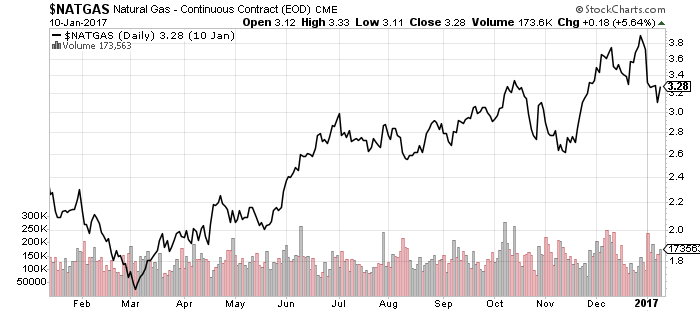

Energy

Energy stocks have been in a short-term downtrend since December, but oil prices didn’t pullback until this week. Natural gas prices and natural gas stocks have both been in a downtrend since December, with the recent spike in natural gas prices quickly fading. The intermediate bull trend in XLE, FCG, oil and natural gas prices remains in effect.

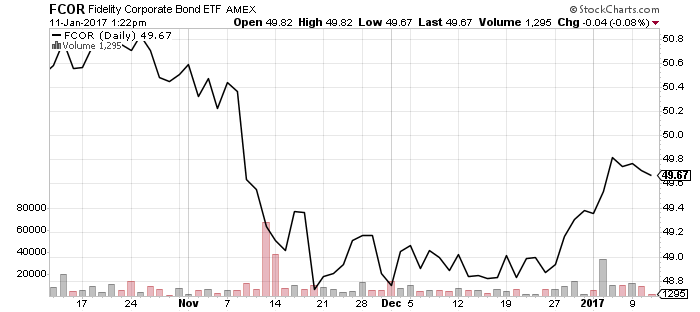

The bond market also consolidated over the past week, continuing a trend started in late December. It’s clearest in long-term government bonds, in funds such as iShares Barclays 20+ Year Treasury (TLT). Corporate and investment-grade bonds that followed government bonds lower have also rebounded.

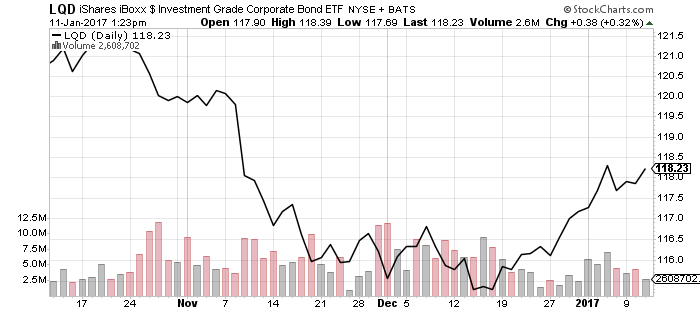

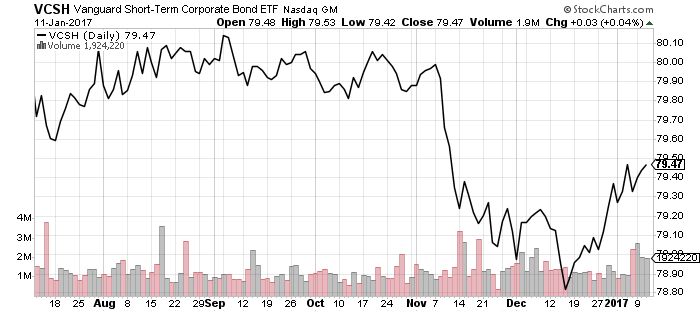

The funds have benefited from higher volatility than interest rates. The 10-year Treasury yield climbed from 1.8 to 2.6 percent after the election, and has since edged back to 2.3 percent, retracing about 40 percent of its move. Fidelity Corporate Bond (FCOR), iShares iBoxx Investment Grade Corporate Bond (LQD) and Vanguard Short-Term Corporate Bond (VCSH) have all retraced about 60 percent.

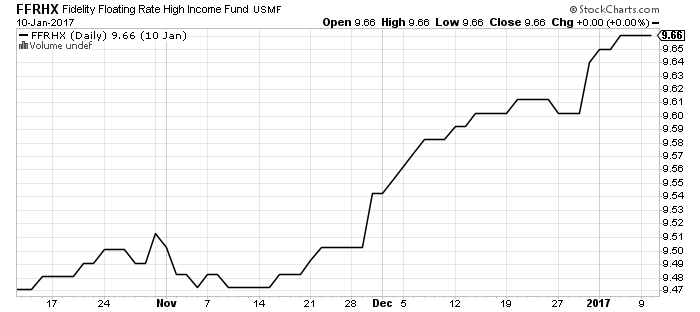

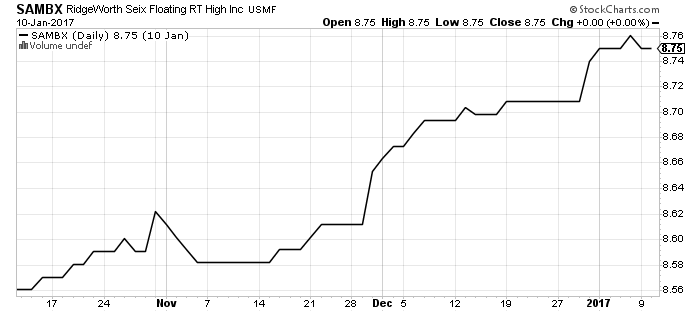

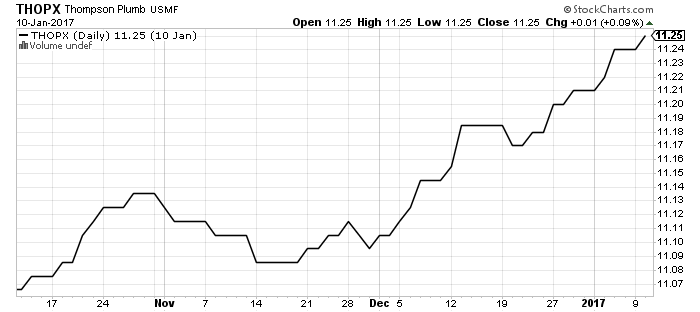

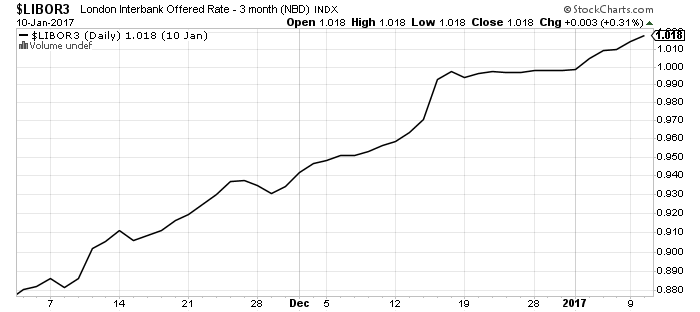

Fidelity Floating Rate High Income (FFRHX) and RidgeWorth Seix Floating Rate High Income (SAMBX) have held up well as the interest rate move consolidates. Three-month LIBOR continues to climb, which signals the market is expecting more short-term rate increases. Thompson Bond (THOPX) gained ground as credit risk declines amid rising economic optimism.

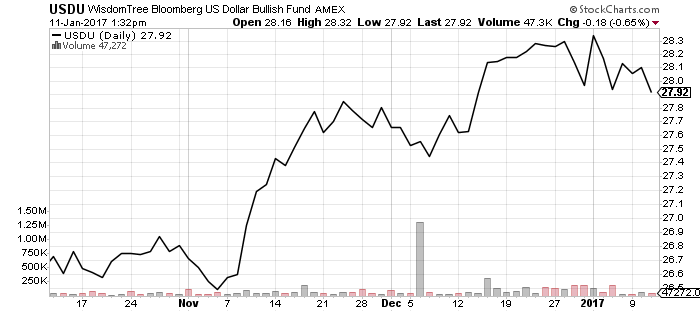

WisdomTree US Dollar Bullish (USDU)

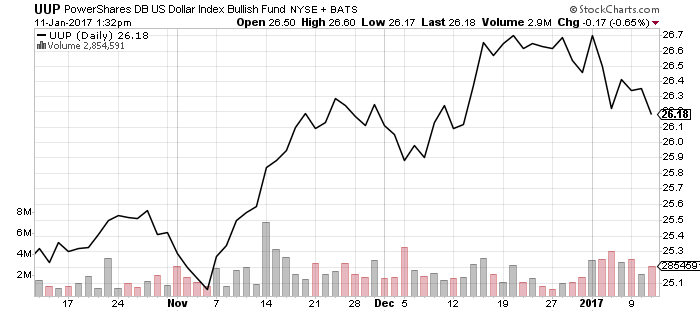

PowerShares DB US Dollar Bullish (UUP)

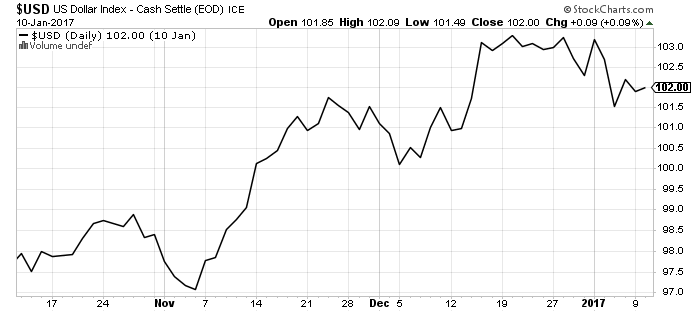

The U.S. dollar also consolidated with interest rates in the new year. The U.S. dollar remains in a short-, intermediate-, and long-term bull market. If the U.S. Dollar Index were to slide below 101, it would threaten the short-term bull market trend, and below 100, it would plunge the index back into the trading range where it spent the bulk of 2015 and 2016.

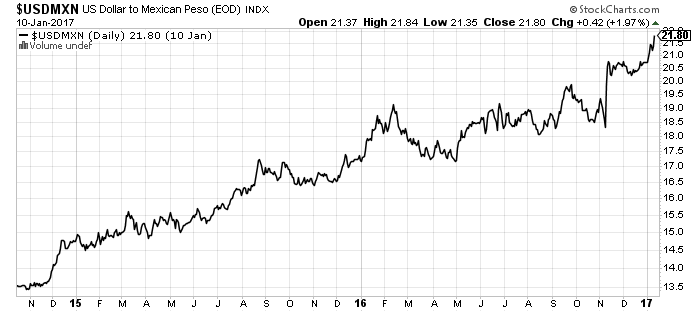

On Wednesday, the Mexican peso fell to new multi-year lows versus the dollar during Trump’s press conference.

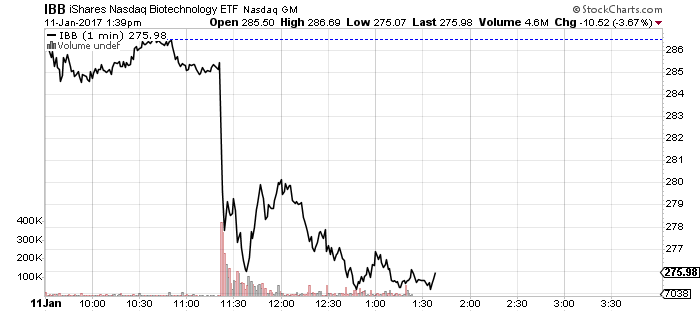

Biotechnology & Pharmaceuticals

President Trump spooked the market when he addressed drug prices today, which sent the pharma and biotech sectors lower. He indicated he would make drug companies bid for access to Medicare and other government programs, though he did not provide any policy details.

We have seen similar reactions to other sectors over the past few months. For example, Boeing (BA) and General Motors (GM) have been singled out by President-elect Trump in tweets. Their stock prices rapidly declined in the minutes and hours following his statements, but rebounded over the following days. Long-term investors should be steady in the face of these headline-generated moves. For more aggressive investors, these events provide a solid buying opportunity.

Market Perspective for January 9, 2017

Markets are poised to resume the post-election rally and should continue higher this week in response to positive earnings, a strong labor market, and general optimism. Alcoa (AA) will kick off 2017 earnings reports tomorrow, and several major financial institutions are scheduled to report on Friday. The current bullish sentiment could cause stocks to break out of the current trading range and again reach new all-time highs.

On Tuesday, the Chinese Consumer Price Index (CPI) is forecast to show 2.4 percent year-over-year growth while the country’s Producer Price Index (PPI) is expected to rise by 4.8 percent. The Job Openings and Labor Turnover Survey (JOLTS) for November is scheduled to reflect a slight decline. The weekly crude oil inventory data and mortgage purchase application index figures are due out on Wednesday. After last week’s unexpected drop, oil stockpiles are forecast to remain steady. Mortgage applications are expected to rise slightly.

Thursday’s weekly unemployment claims figure is projected to increase slightly from the previous report. The U.S. Producer Price Index is expected to rise 0.3 percent and the domestic retail sales figures for December are expected to increase 0.7 percent. Both reports will be available on Friday.

Financial stocks have made solid gains since the year-end rally and interest rate hike. This sector may be poised for significantly higher prices. Financial earnings and revenue numbers could set the overall tone for the rest of the reporting season. Bank of America, JPMorgan Chase and Wells Fargo are all scheduled to report before the opening bell on Friday.

One of the best-positioned large banks, Bank of America (BAC) is forecast to report earnings and revenues well above the same period last year. While analysts anticipate JPMorgan Chase (JPM) to exceed earnings expectations, they are calling for revenues in line with those recorded for the same period a year ago. Recovering from 2016’s fraudulent account scandal, Well Fargo (WFC) is also positioned to benefit from higher interest rates and the proposed changes in banking regulations. The company is expected to report significantly higher year-over-year earnings and revenues.