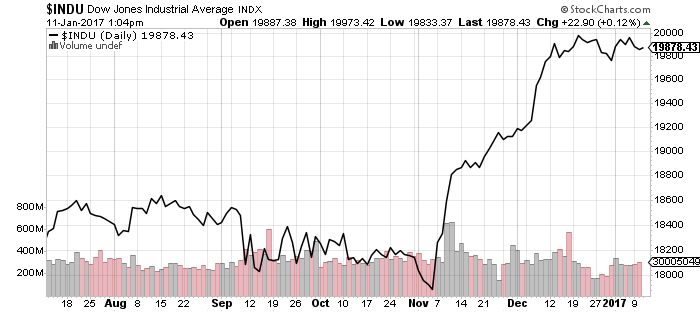

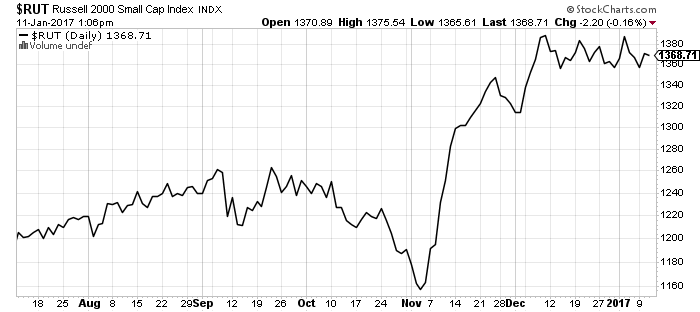

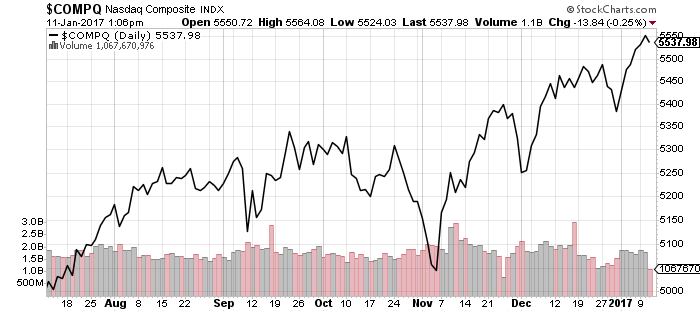

The stock market continues to climb steadily, despite sector consolidation. The Dow moved sideways over the past week, hitting 19999.63 during Friday trading, but retreated without cracking 20,000. The Nasdaq, however, marched on to a new all-time high.

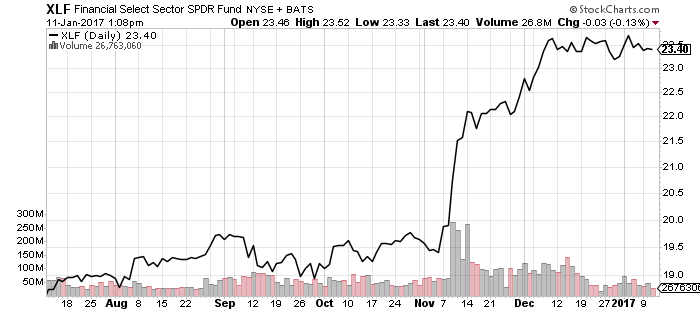

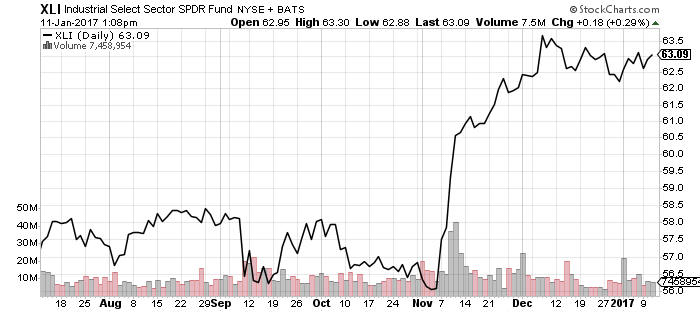

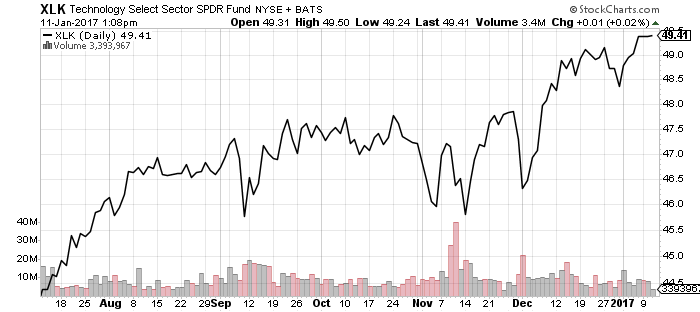

Financials and industrials consolidated their late 2016 gains, while technology has played catch-up.

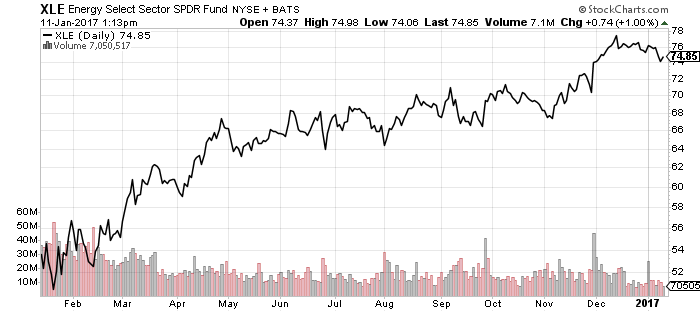

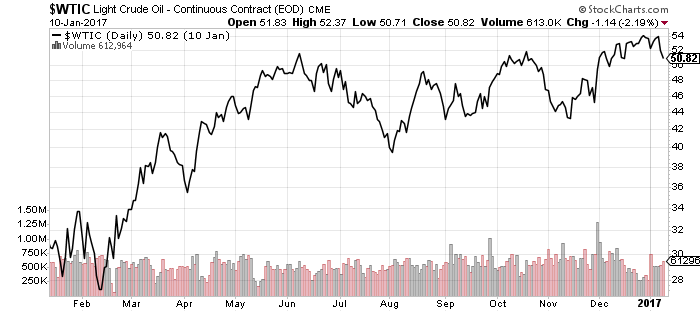

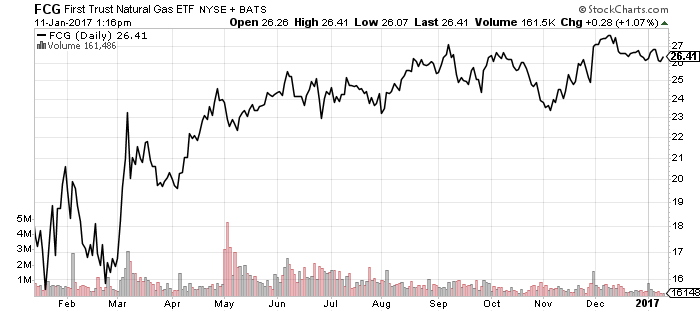

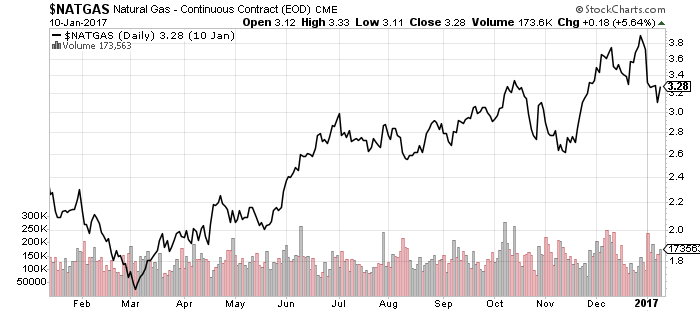

Energy

Energy stocks have been in a short-term downtrend since December, but oil prices didn’t pullback until this week. Natural gas prices and natural gas stocks have both been in a downtrend since December, with the recent spike in natural gas prices quickly fading. The intermediate bull trend in XLE, FCG, oil and natural gas prices remains in effect.

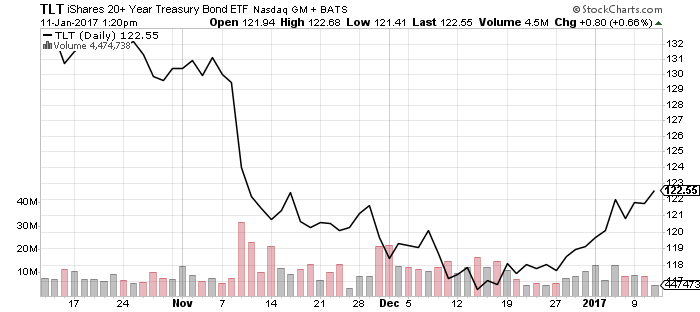

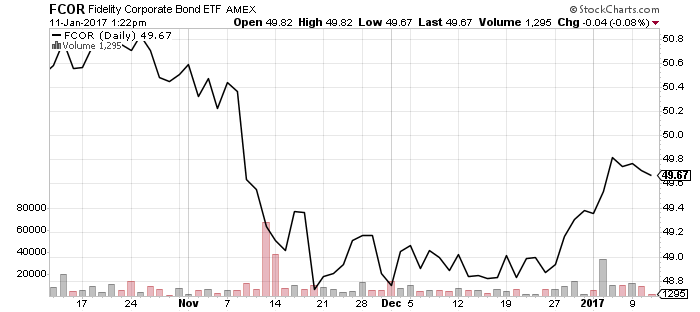

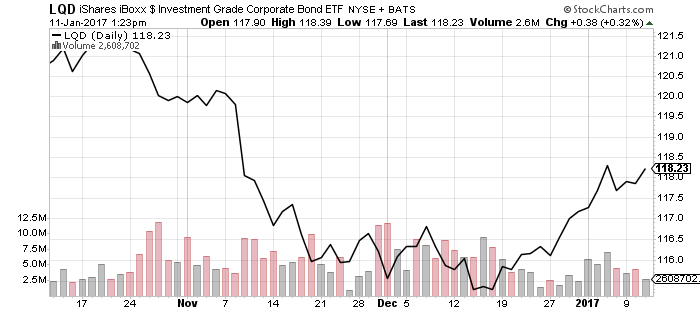

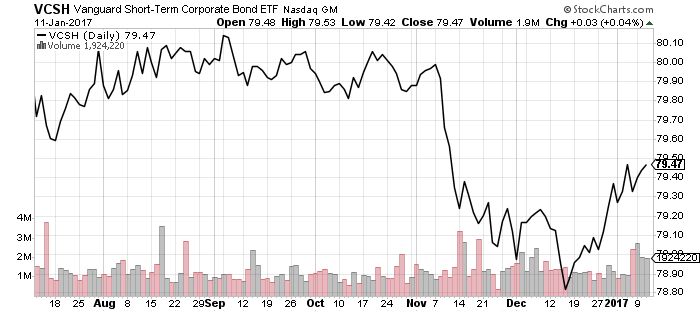

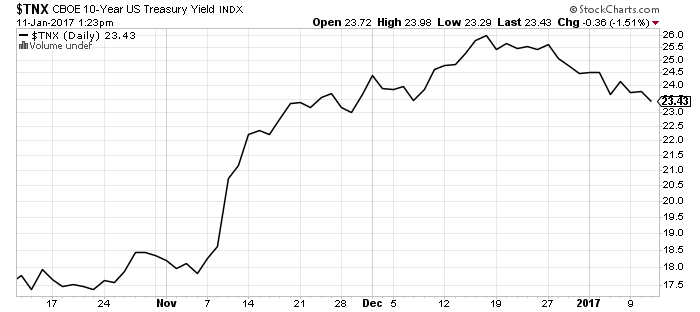

The bond market also consolidated over the past week, continuing a trend started in late December. It’s clearest in long-term government bonds, in funds such as iShares Barclays 20+ Year Treasury (TLT). Corporate and investment-grade bonds that followed government bonds lower have also rebounded.

The funds have benefited from higher volatility than interest rates. The 10-year Treasury yield climbed from 1.8 to 2.6 percent after the election, and has since edged back to 2.3 percent, retracing about 40 percent of its move. Fidelity Corporate Bond (FCOR), iShares iBoxx Investment Grade Corporate Bond (LQD) and Vanguard Short-Term Corporate Bond (VCSH) have all retraced about 60 percent.

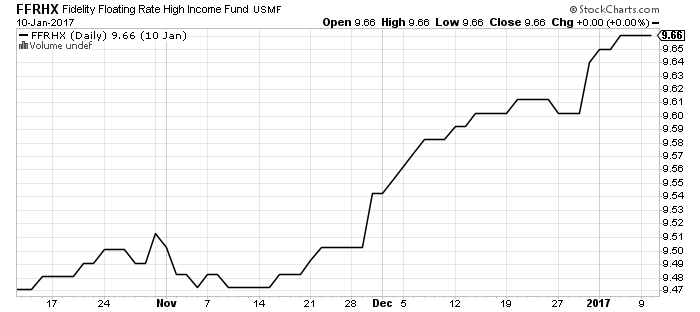

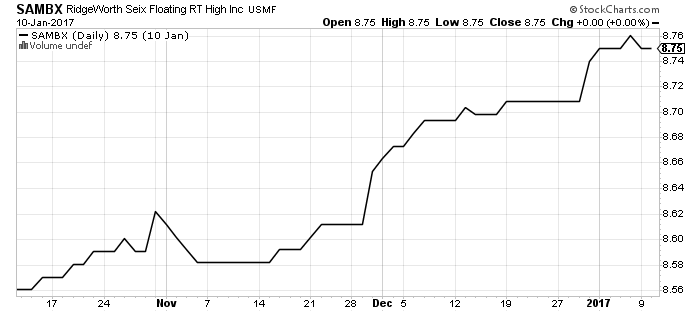

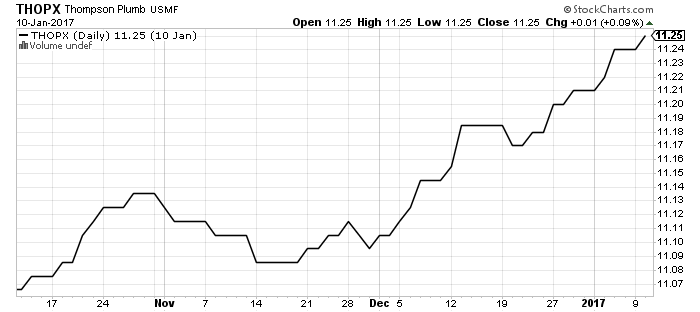

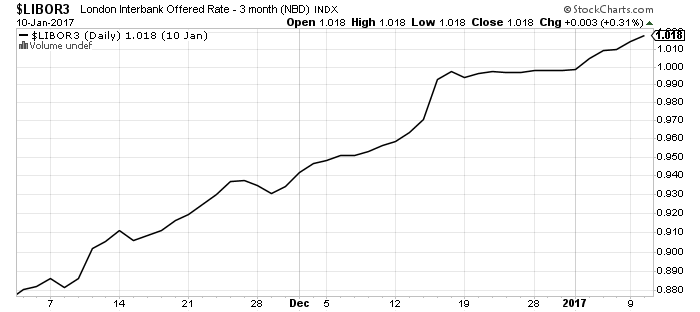

Fidelity Floating Rate High Income (FFRHX) and RidgeWorth Seix Floating Rate High Income (SAMBX) have held up well as the interest rate move consolidates. Three-month LIBOR continues to climb, which signals the market is expecting more short-term rate increases. Thompson Bond (THOPX) gained ground as credit risk declines amid rising economic optimism.

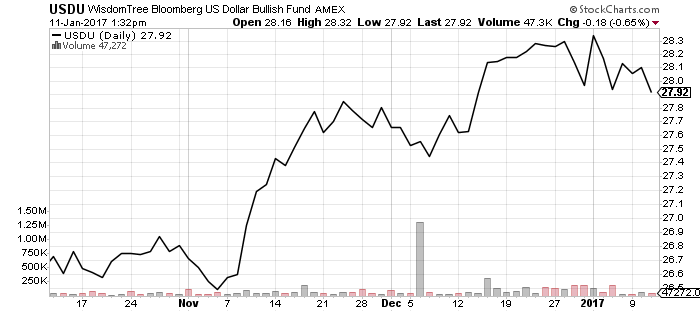

WisdomTree US Dollar Bullish (USDU)

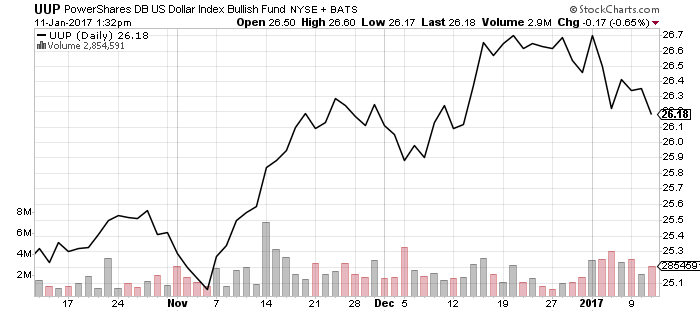

PowerShares DB US Dollar Bullish (UUP)

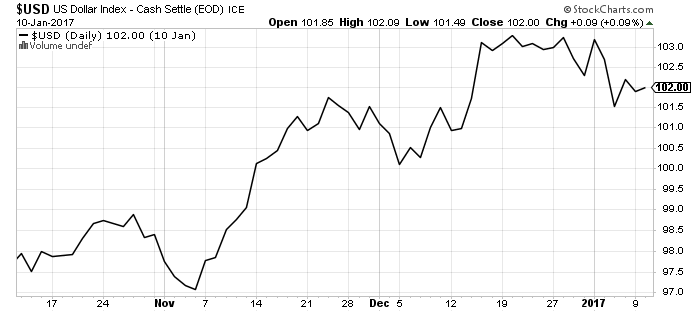

The U.S. dollar also consolidated with interest rates in the new year. The U.S. dollar remains in a short-, intermediate-, and long-term bull market. If the U.S. Dollar Index were to slide below 101, it would threaten the short-term bull market trend, and below 100, it would plunge the index back into the trading range where it spent the bulk of 2015 and 2016.

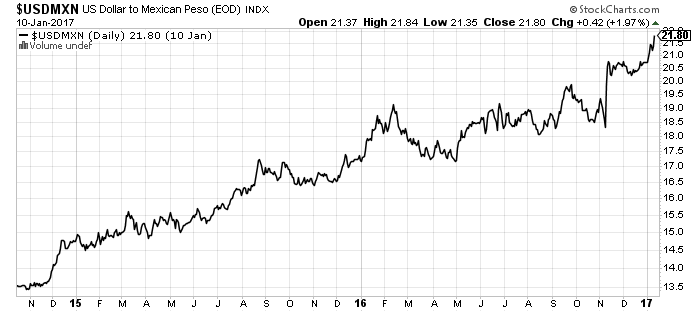

On Wednesday, the Mexican peso fell to new multi-year lows versus the dollar during Trump’s press conference.

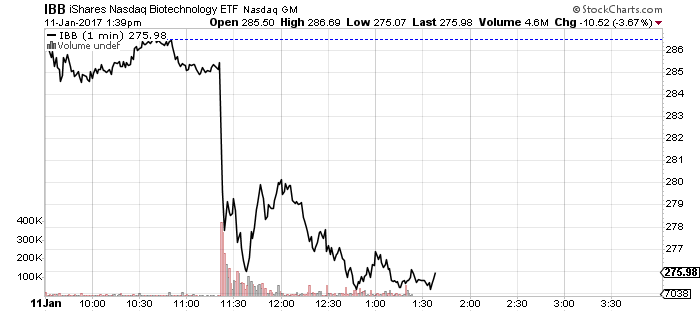

Biotechnology & Pharmaceuticals

President Trump spooked the market when he addressed drug prices today, which sent the pharma and biotech sectors lower. He indicated he would make drug companies bid for access to Medicare and other government programs, though he did not provide any policy details.

We have seen similar reactions to other sectors over the past few months. For example, Boeing (BA) and General Motors (GM) have been singled out by President-elect Trump in tweets. Their stock prices rapidly declined in the minutes and hours following his statements, but rebounded over the following days. Long-term investors should be steady in the face of these headline-generated moves. For more aggressive investors, these events provide a solid buying opportunity.