Earnings season will pick up this week as several blue-chip giants and sector leaders are scheduled to report. Of the 12 percent of S&P 500 firms that have delivered earnings, 61 percent have beaten estimates. Financials lifted the estimated S&P 500 growth rate from 3.0 percent (as of December 31) to 3.4 percent (reported earnings plus current estimates). For the second straight quarter, most companies are on track to report overall earnings growth, and at the current pace we could see a final growth rate closer to 5 percent.

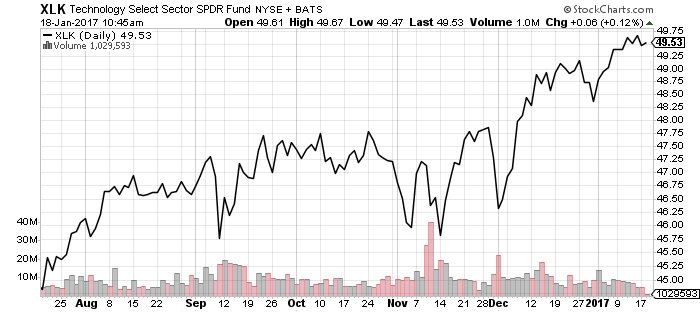

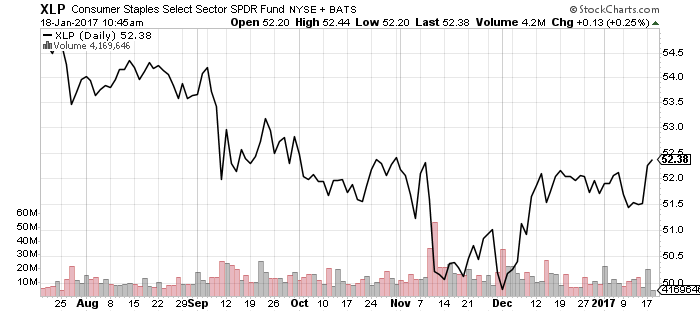

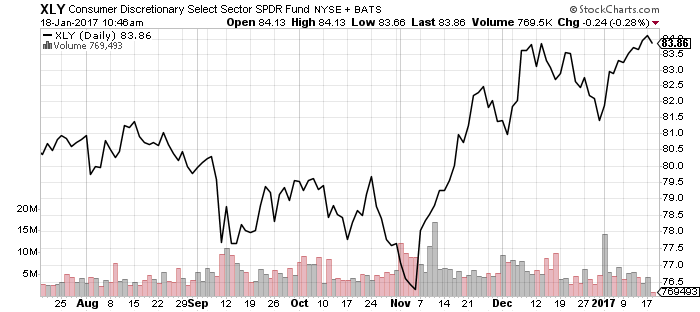

In technology this week, Alphabet (GOOG), Microsoft (MSFT), Yahoo (YHOO), Texas Instruments (TXN), EBay (EBAY) and Intel (INTC) will report. McDonald’s (MCD), Comcast (CMCSA), Diageo (DIA), Unilever (UN), Colgate-Palmolive (CL) will headline the week’s consumer sector reports.

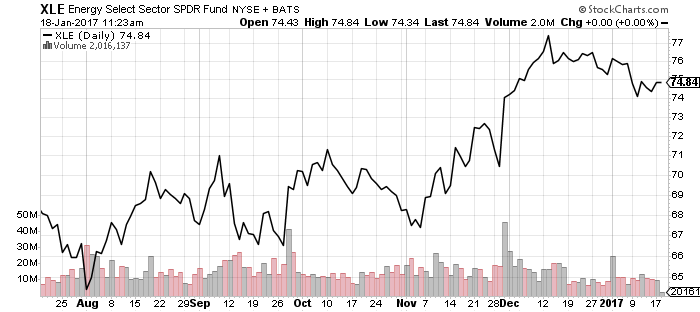

Abbott Labs (ABT), Johnson & Johnson (JNJ), Biogen (BIIB), Bristol Myers (BMY), Celgene (CELG) and Abbvie (ABBV) are among the healthcare firms set to report this week, while energy sector earnings will include Chevron (CVX), Halliburton (HAL), and Baker Hughes (BHI).

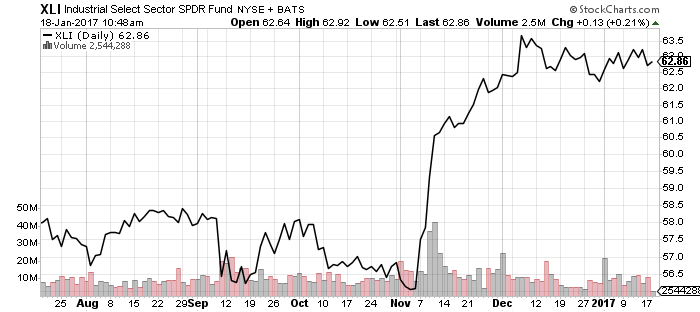

This will be an important week for industrial earnings. Sub-sector funds such as iShares US Aerospace & Defense (ITA) will see almost all of their top-10 holdings report this week. Boeing (BA), Caterpillar (CAT), 3M (MMM), AK Steel (AKS), Alcoa (AA), Steel Dynamics (STLD), Allegheny Technologies (ATI), DuPont (DD), Lockheed Martin (LMT), Illinois Tool Works (ITW), Rockwell Automation (ROK), United Technologies (UTX), Dow Chemical (DOW), Ford (F), Northrup Grumman (NOC), Raytheon (RTN), General Dynamics (GD), and Honeywell (HON) are all scheduled to report.

Verizon (VZ) and AT&T (T) will also report this week. Vanguard Telecom (VOX) has 46 percent of assets in the two firms. iShares US Telecom (IYZ) is more diversified, but still has 20 percent of assets in these two firms.

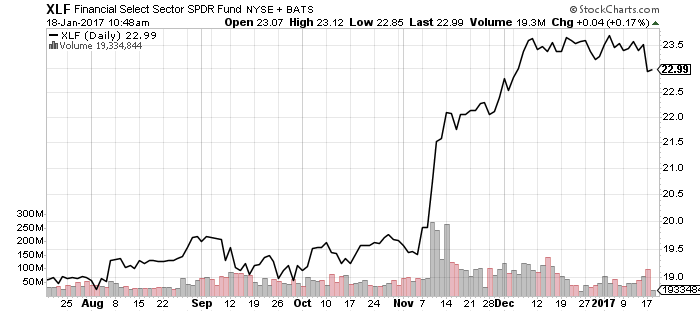

While the bulk of financials have reported, as measured by market capitalization, but dozens of small and regional banks will report this week, important for funds such as SPDR S&P Regional Banking (KRE) as Hennessy Small Cap Financial (HSFNX).

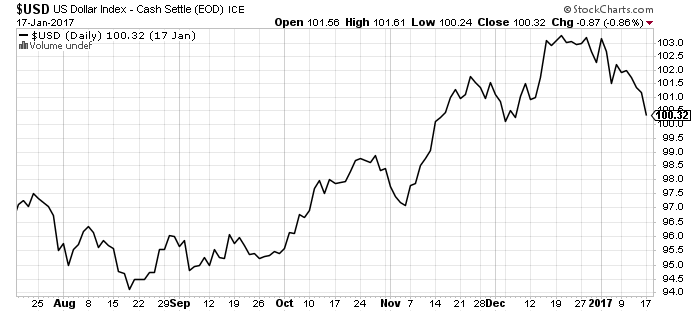

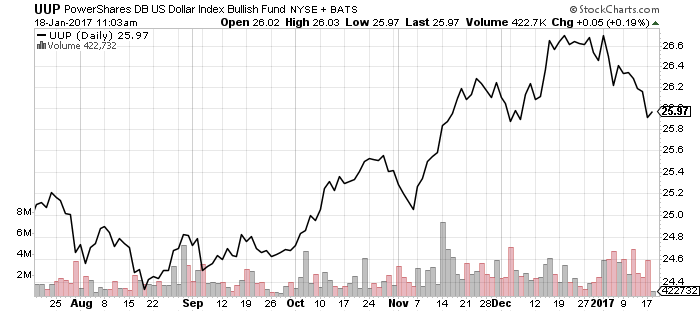

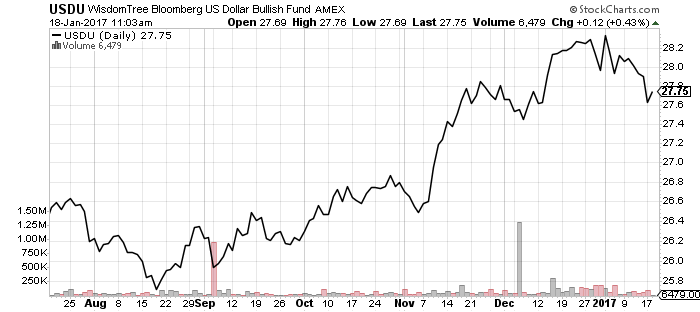

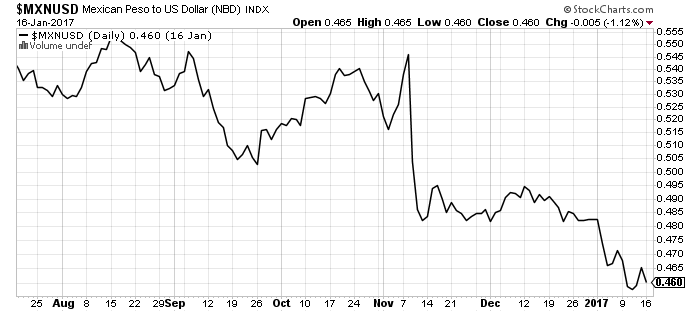

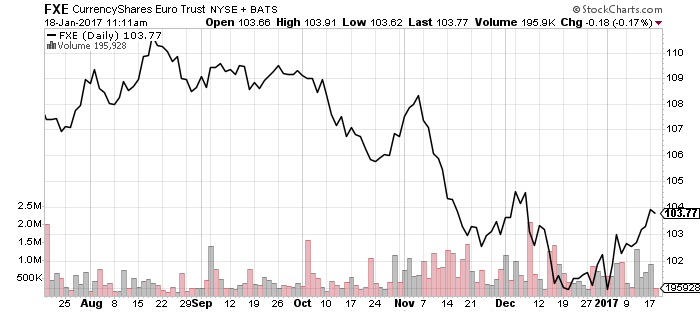

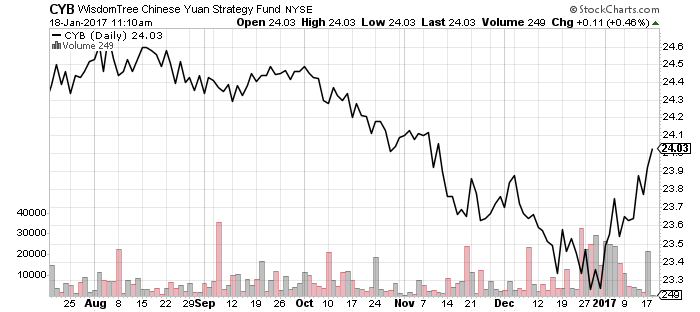

Overseas markets will continue adjusting to currency market moves. President Trump could sign an executive order calling for renegotiation of NAFTA. Last week’s Brexit speech by British Prime Minister May continues to reverberate in Europe. The British High Court will make another ruling on the parliamentary procedure for Brexit later this week. The U.S. Dollar Index could fall below 100 this week.

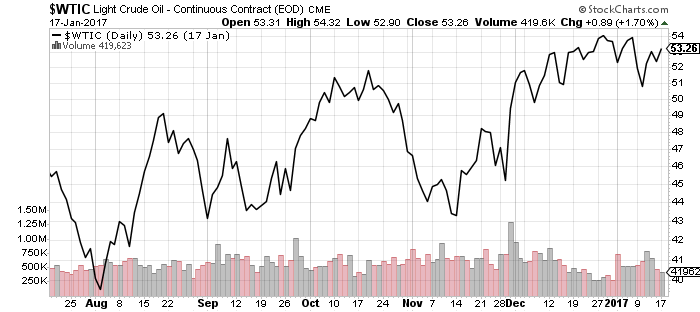

December existing home sales and Markit’s flash manufacturing PMI will be released on Tuesday. Home sales are expected to show a slight uptick month-over-month, while manufacturing is expected to improve. Wednesday’s U.S. crude inventory data is anticipated to reflect a 1.7 million barrel draw on the heels of last week’s 2.3 million barrel increase. Oil market speculators came into the week at bullish extremes, raising the risk of a short-term pullback.

On Thursday, the weekly unemployment claims figure is expected to rise from last week’s 234,000 to a forecasted 247,000, which is still well below levels indicating full employment. Analysts forecast December new home sales rose 0.3 percent from November. The flash services PMI from Markit will be out as well.

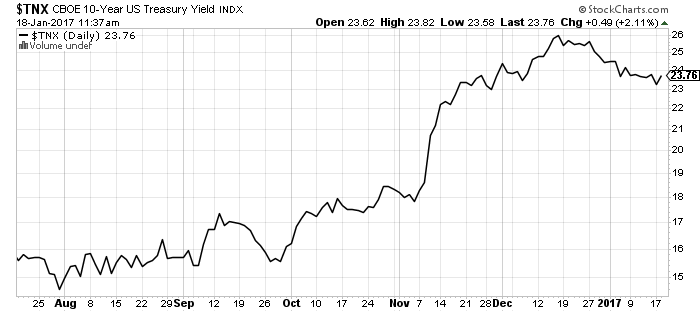

The U.S. Durable Goods Orders report for December, as well as core capital equipment orders will be out on Friday. More importantly, fourth quarter Gross Domestic Product (GDP) will be released. The consensus forecast calls for 2.2 percent growth. The Atlanta Federal Reserve’s GDP Now Model, which has been quite accurate in the past, was calling for 2.8 percent growth in its last update. The final GDP figure should be closer to the Atlanta Fed number, which would be positive for interest rates and the financial sector.