The December issue will is NOW AVAILABLE! The Data Files are Posted Below. Market Perspective: Market Surges to New Highs After Election Optimism continues to run high in the wake of […]

Year: 2016

ETF & Mutual Fund Watchlist for December 7, 2016

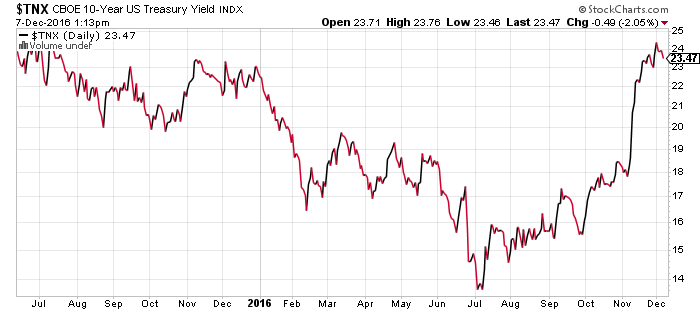

The Federal Open Market Committee meeting is expected to culminate on December 14 in a quarter-point interest rate increase, to a range of 0.50 to 0.75 percent.

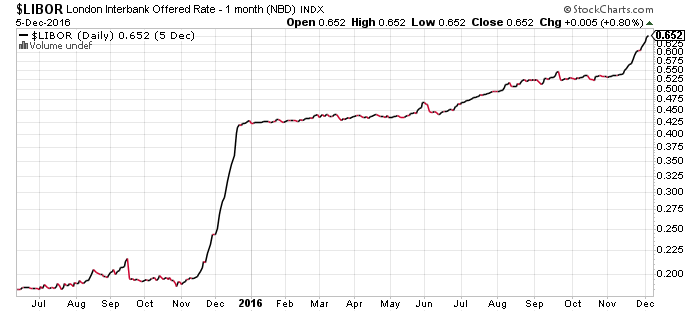

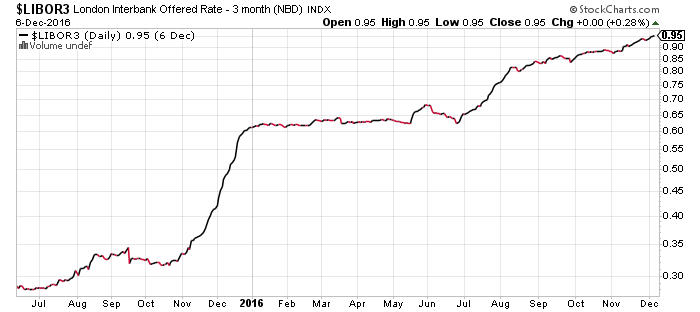

Futures markets have already priced in the rate hike and odds remain at a nearly certain 95 percent or higher. The London Interbank Offered Rates (LIBOR), are already within the Fed’s target range. Three-month LIBOR has even started pricing in 2017 rate hikes, hitting 0.95 percent on Tuesday.

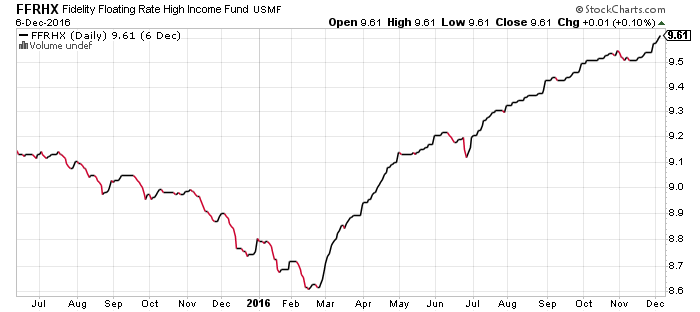

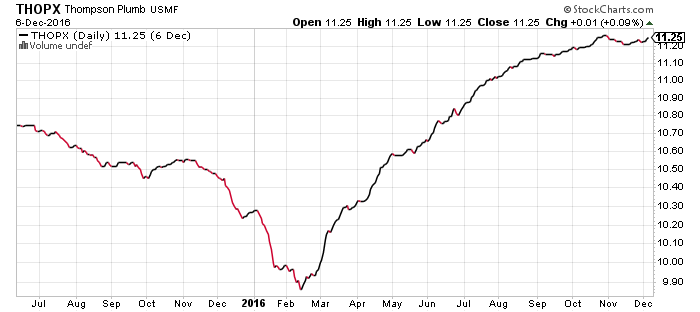

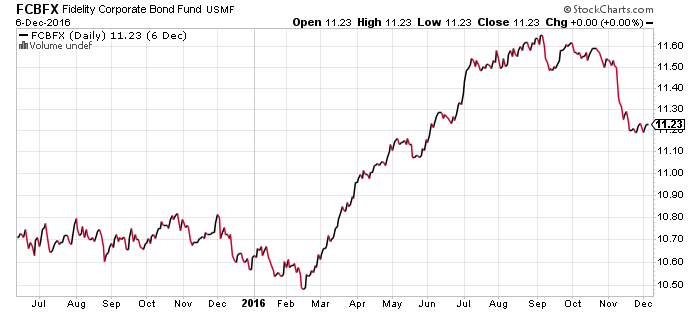

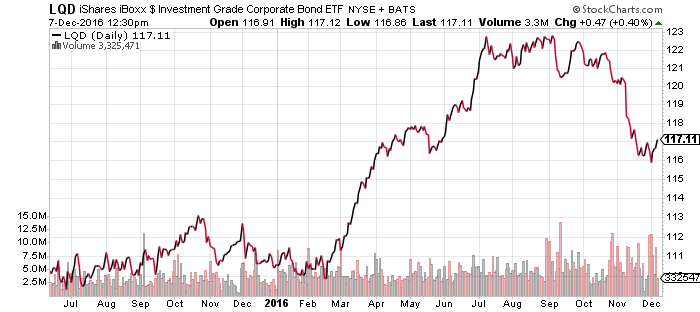

Floating rate funds remain attractive in this climate. Fidelity Floating Rate High Income (FFRHX) has been appreciating with interest rates. High-yield funds, such as Thompson Bond (THOPX), have also done well. Corporate and investment-grade bonds stabilized over the past week and could rally following a rate hike.

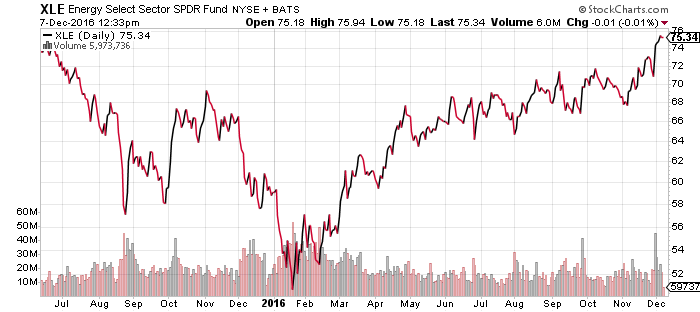

SPDR Energy (XLE)

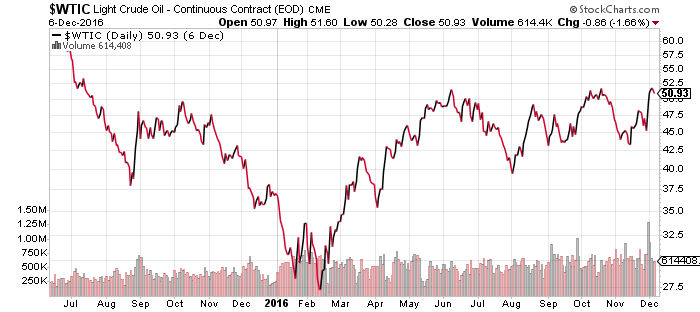

OPEC cut production last week and sent oil higher, but once again it failed to break out of the low $50-range. India’s cash ban is causing some slowdown in demand growth, while inventory at Cushing, OK jumped over the past week. U.S. shale producers rushed to hedge oil above $50 a barrel, indicating prices are unlikely to rise further, but allowing them to pump profitably even if prices fall again. Finally, OPEC production hit another record high over the past week, raising doubts that members will abide by the cuts.

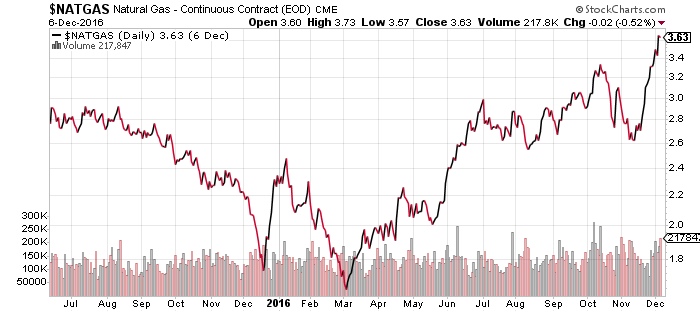

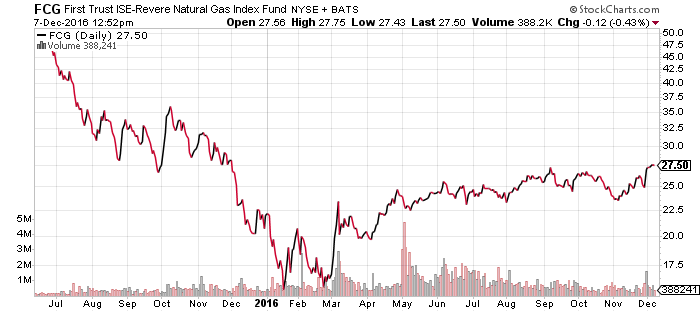

While oil prices corrected last week, natural gas prices spiked to a new 52-week high as an Arctic blast sent temperatures in the Midwest below normal to usher in a possible La Nina pattern.

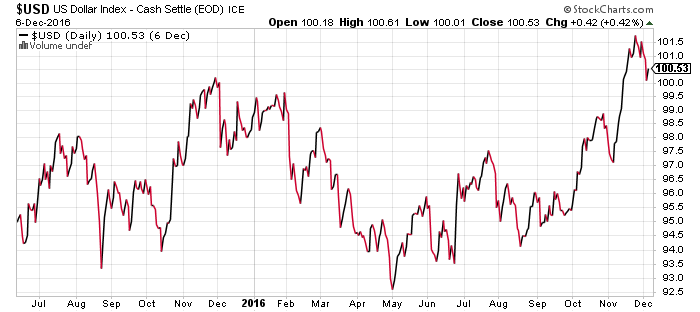

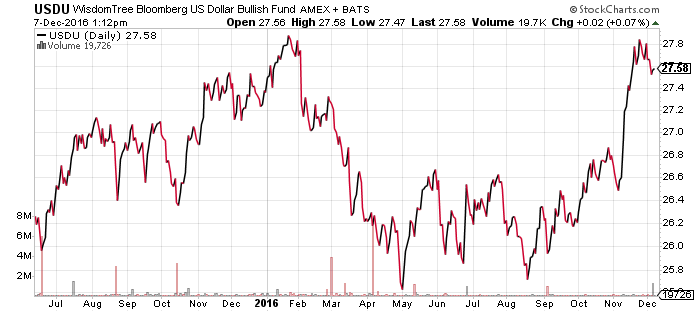

WisdomTree US Dollar Bullish (USDU)

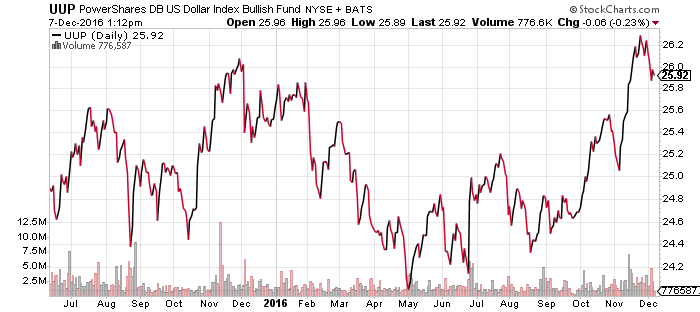

PowerShares DB US Dollar Bullish (UUP)

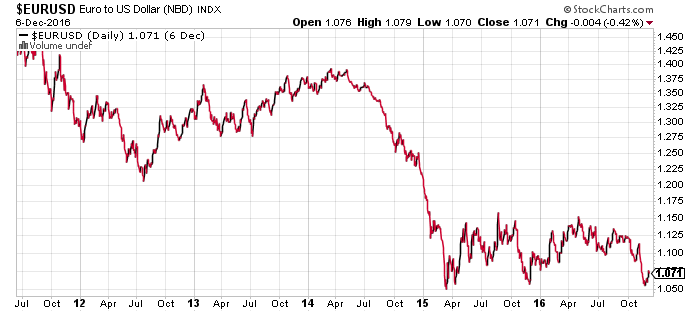

The U.S. dollar pulled back as the euro rallied. The outcome of the Italian referendum was a foregone conclusion and traders responded by selling the news, covering their euro short positions.

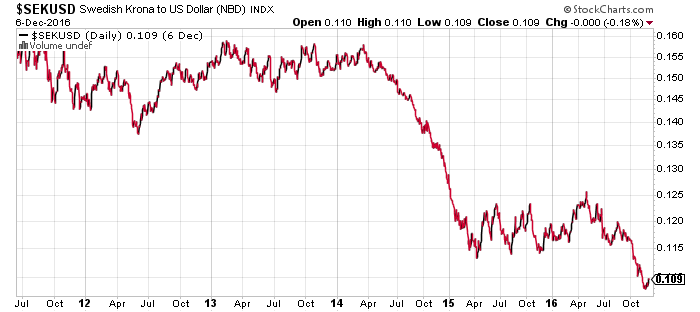

The euro appears to have made a triple bottom, failing to breach 1.05 twice in 2015 and again this month. Then again, the krona had a similar pattern before breaking lower last month.

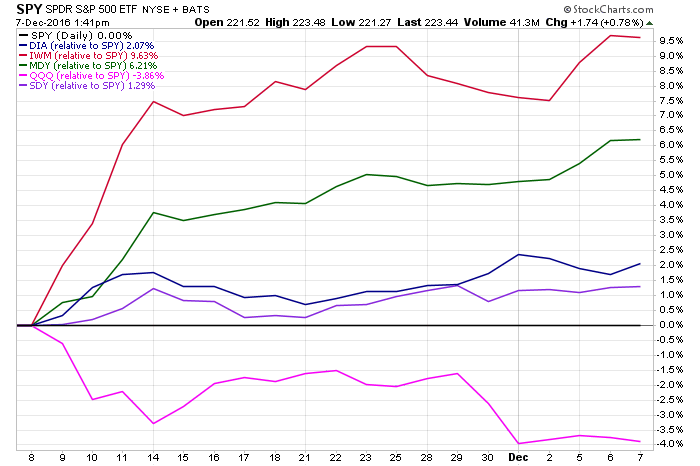

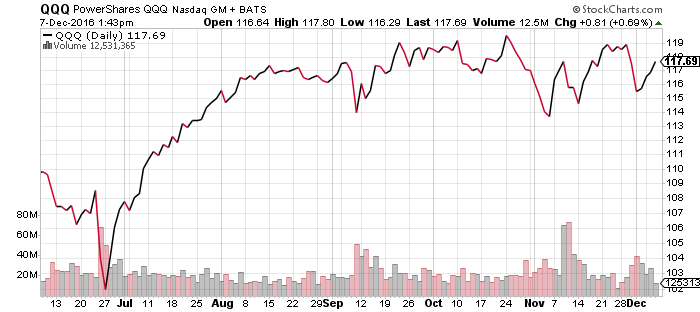

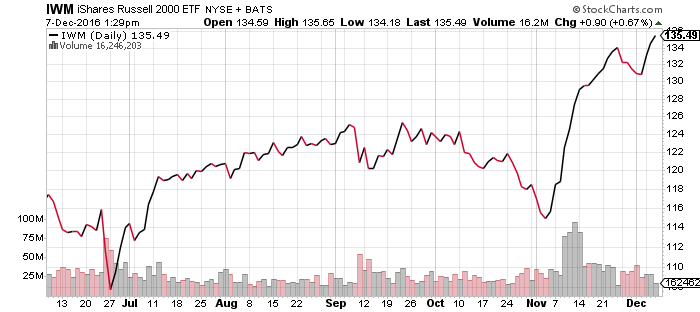

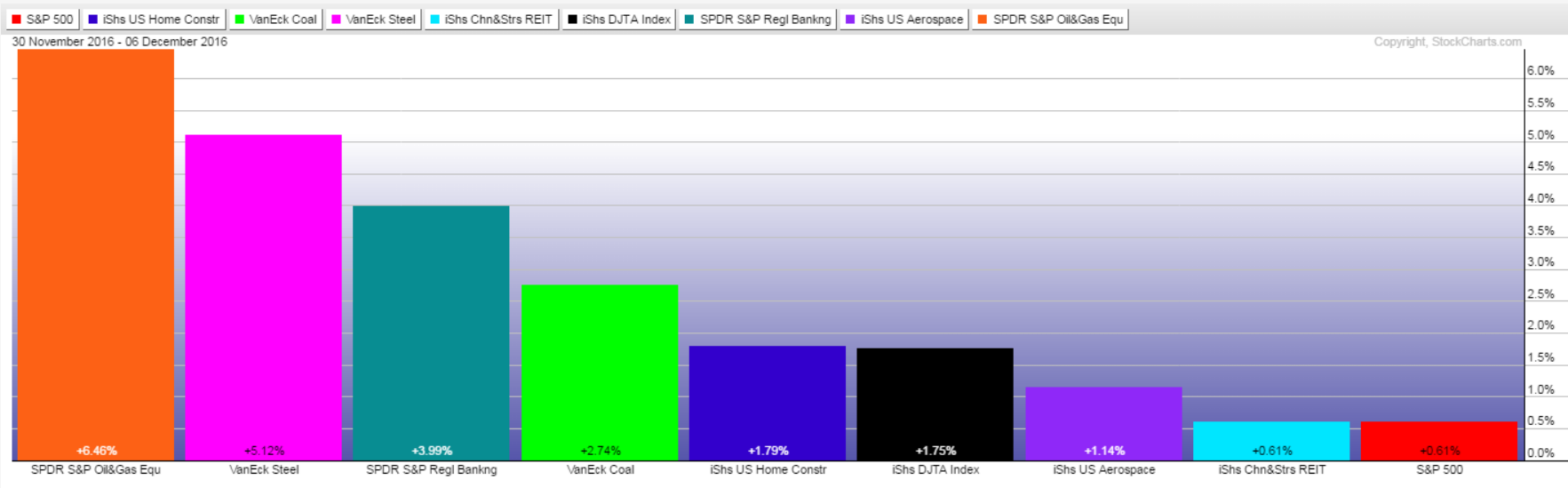

Index Performance

Small-cap and mid-cap stocks continue to lead the market higher, as evidenced in the S&P 500 Index comparison chart below. Even though it has moved higher since the election, the PowerShares QQQ (QQQ) trails the S&P 500 Index by about 4 percent as technology lags the broader market. Small-caps tracked by iShares Russell 2000 (IWM), however, have trounced the S&P 500 Index.

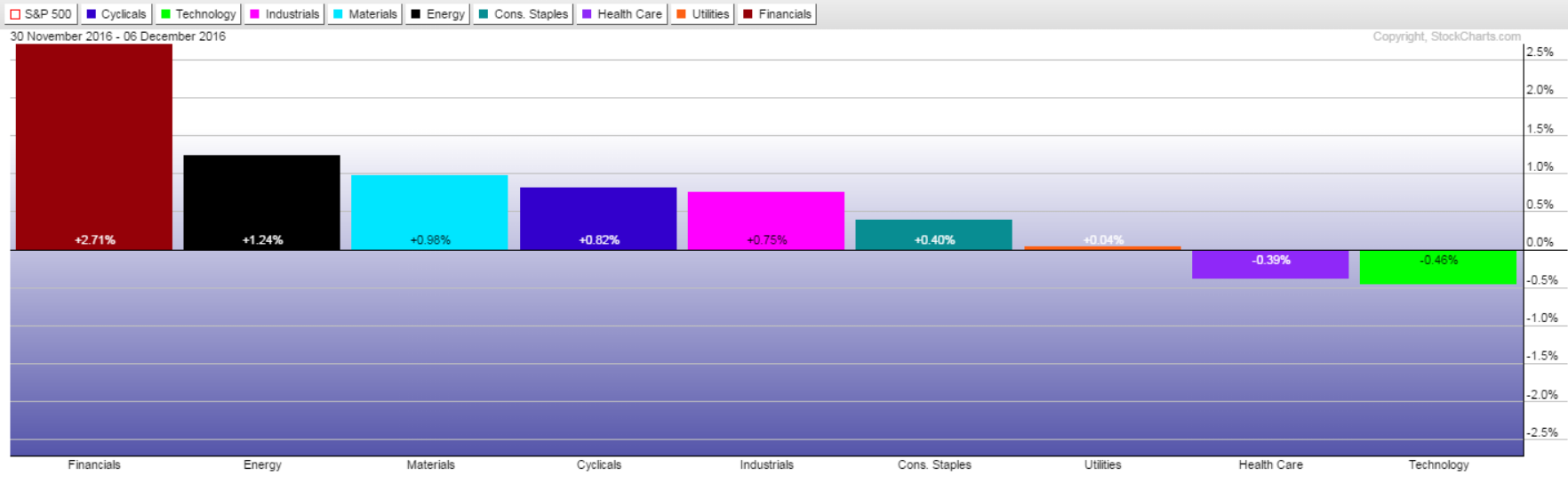

The post-election rally continues to favor industrials and financials, but interest rate-sensitive sectors also performed well over the past week. Consumer staples, utilities, real estate, and telecommunications all pushed higher. Weakness in these sectors appears to be over, at least until rates move higher again.

Homebuilders are an important sector to watch as we enter 2017. Rising interest rates are pushing homebuyers to buy, which is lifting prices in some areas. If homebuilding picks up as well, GDP growth estimates for 2017 will rise.

Market Perspective for December 5, 2016

Markets are poised to rebound after last week’s essentially flat finish. As we enter the first full week of December trading, investors anticipate building on November gains that topped 4 percent. Italy’s referendum will dominate much of this week’s global economic news. Prime Minister Matteo Renzi’s proposed changes to improve the Italian economy were soundly defeated. Investors will now look to the European Central Bank’s (ECB) response and the significant impact on the euro and other major currencies. A significant strengthening in the U.S. dollar may affect the price of Treasuries, oil, gold, and other commodities.

The Royal Bank of Australia (RBA) is scheduled to meet on Tuesday and the ECB’s policy meeting will be held on Thursday. While the RBA is forecast to hold rates at 1.5 percent, the ECB is expected to keep benchmark interest rates at zero percent. During prepared remarks Monday, ECB President Mario Draghi indicated the possibility of tighter monetary policies. Next week’s Federal Reserve meeting and expected interest rate hike is likely to impact markets this week, although most sectors have likely priced in the increase. President-elect Donald Trump’s cabinet picks and fiscal policy statements being made by his transition team may also shape market trends over the next few weeks and lead to increased volatility.

Several countries’ Purchasing Managers’ Index (PMI) reports will be available this week. While the Chinese Services PMI is forecast to drop slightly, U.S. and U.K. PMI reports are expected to show a modest increase. Wednesday’s weekly oil inventories are expected to increase marginally. Economists are calling for a decline in mortgage applications due to higher rates. The Job Openings and Labor Turnover Survey (JOLTS) report is also expected to reflect a slight decline in the number of job openings, though Thursday’s unemployment claims are expected to remain at multi-decade lows. Chinese trade balance figures will be released on Thursday and China’s Consumer Price Index reading will be issued Friday.

This week’s earnings reports will include H&R Block, Costco and lululemon athletica. Consensus estimates for H&R Block (HRB) anticipate a net loss of $0.68 per share on revenues of $126.9 billion when it reports on Wednesday. President-elect Trump’s campaign promise to simplify the U.S. tax code could hurt the company’s future earnings. An underperformer this year, Costco (COST) is forecast to show earnings per share (EPS) of $1.20 on revenues of $28.3 billion. lululemon athletica (LULU) is also scheduled to report on Wednesday. Analysts expect EPS of $0.43 and revenues of $540.7 million.

Global Momentum Guide for December 5, 2016

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR PERSPECTIVE Equity markets were broadly lower last week for the first time since the election. The Dow Jones Industrial […]

Market Perspective for December 2, 2016

While the Nasdaq and the S&P 500 came under slight selling pressure this week, the Dow Jones reached another all-time high. Investors rotated out of technology companies that led the markets higher before the election and into financial and energy stocks. This follows an agreement between OPEC and non-OPEC nations to cap production output, collectively reducing output by 1.2 million barrels per day. West Texas Intermediate Crude rallied more than 10 percent on the news. A surprise reduction in crude inventories also bolstered oil prices. For the month of November, the Dow and S&P 500 were up over 5 percent while the Nasdaq gained more than 4 percent.

Shares of the Energy Select Sector SPDR ETF (XLE) gained almost 3 percent, while the SPDR Financial Select Sector ETF (XLF) rose more than 2 percent. The U.S. dollar index and the price of gold were down slightly, and the 30-year Treasury index was down almost 2 percent.

European Central Bank (ECB) President Mario Draghi warned policymakers about the risks of holding rates too low for too long on Monday in advance of a Dec. 8 meeting to discuss the merits of the central bank’s current quantitative easing program versus the process of raising interest rates. The eurozone consumer price index (CPI) increased 0.6 percent, in line with estimates. While the U.K. manufacturing purchasing manager index (PMI) signaled a slight slowdown in November, Chinese PMI numbers beat expectations.

U.S. consumer confidence reached a nine-year high on Tuesday and revised third-quarter GDP rose 3.2 percent, the strongest move upward in over two years. Domestic PMI figures also handily beat expectations. Pending U.S. home sales were relatively flat, while the weekly mortgage purchase applications index dropped close to 10 percent as mortgage rates continue to inch upward. As expected, the Personal Income and Outlays report indicated a slight increase in wages and spending. On Wednesday, the Federal Reserve Beige Book confirmed that the economy continues to grow across most of the country. While analysts anticipated a slight drop, light vehicle sales rose in response to incentives from dealers and automakers. Weekly unemployment claims reached a fresh 43-year low on Thursday. Friday morning’s labor report revealed an increase of 178,000 new jobs and a drop in unemployment to 4.6 percent, reinforcing expectations of a rate hike at the next Fed meeting.

Tiffany’s (TIF) shares rose more than 6 percent when the company easily beat consensus estimates, while Dollar General (DG) shares were off 5 percent after the weaker-than-expected quarterly results. Analysts believe a rise in gas prices hurt the retailer’s consumer base. After selling off ahead of the announcement, shares of supermarket chain Kroger’s (KR) reclaimed break-even territory. Although sales edged up slightly, the company expressed its concerns about the future negative effects of falling food prices and provided cautious future guidance.