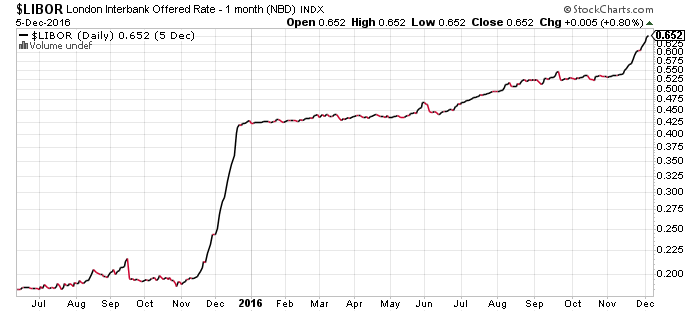

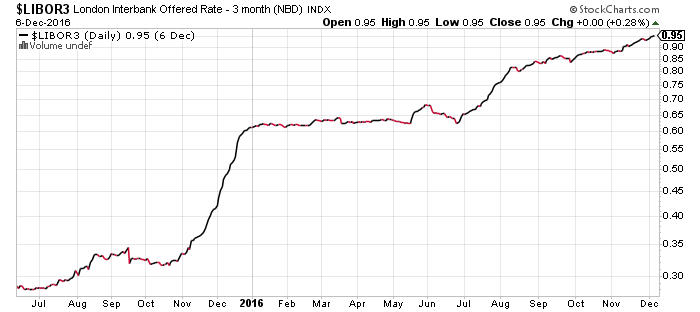

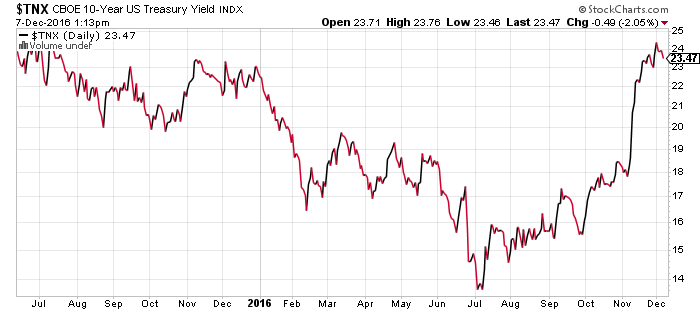

The Federal Open Market Committee meeting is expected to culminate on December 14 in a quarter-point interest rate increase, to a range of 0.50 to 0.75 percent.

Futures markets have already priced in the rate hike and odds remain at a nearly certain 95 percent or higher. The London Interbank Offered Rates (LIBOR), are already within the Fed’s target range. Three-month LIBOR has even started pricing in 2017 rate hikes, hitting 0.95 percent on Tuesday.

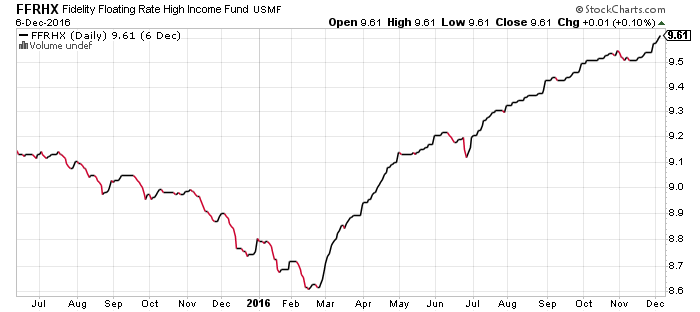

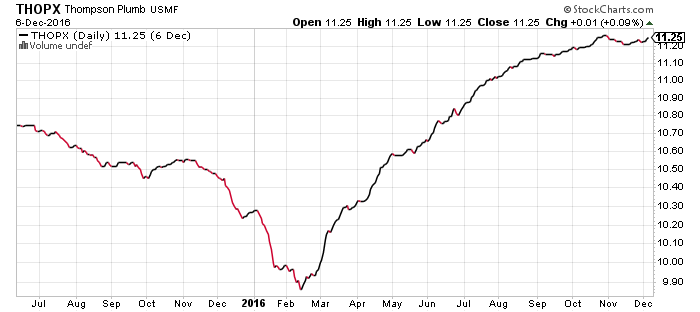

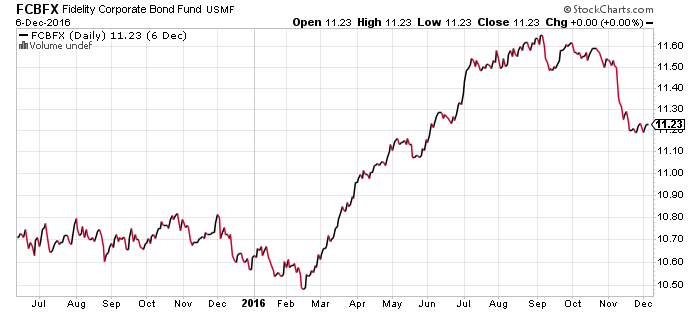

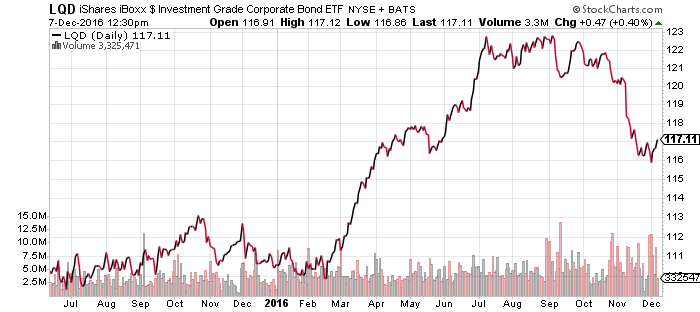

Floating rate funds remain attractive in this climate. Fidelity Floating Rate High Income (FFRHX) has been appreciating with interest rates. High-yield funds, such as Thompson Bond (THOPX), have also done well. Corporate and investment-grade bonds stabilized over the past week and could rally following a rate hike.

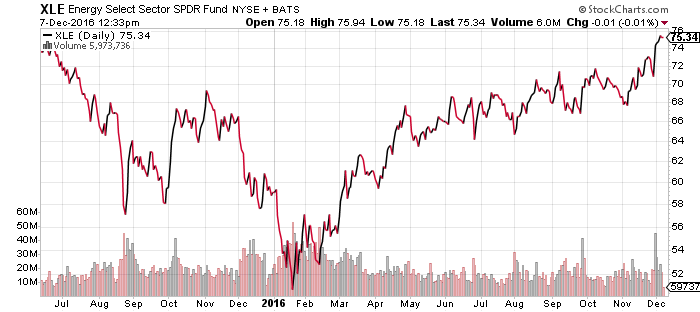

SPDR Energy (XLE)

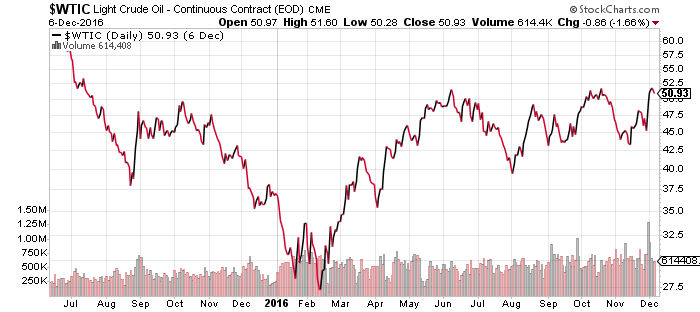

OPEC cut production last week and sent oil higher, but once again it failed to break out of the low $50-range. India’s cash ban is causing some slowdown in demand growth, while inventory at Cushing, OK jumped over the past week. U.S. shale producers rushed to hedge oil above $50 a barrel, indicating prices are unlikely to rise further, but allowing them to pump profitably even if prices fall again. Finally, OPEC production hit another record high over the past week, raising doubts that members will abide by the cuts.

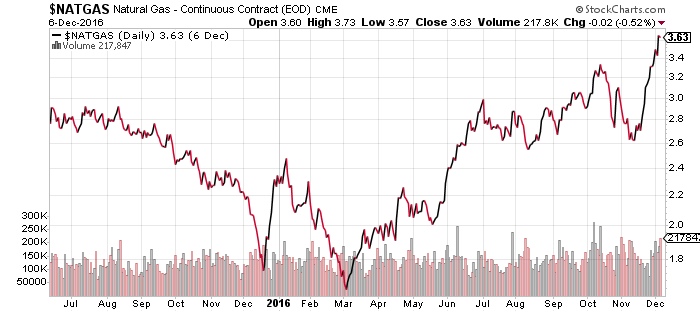

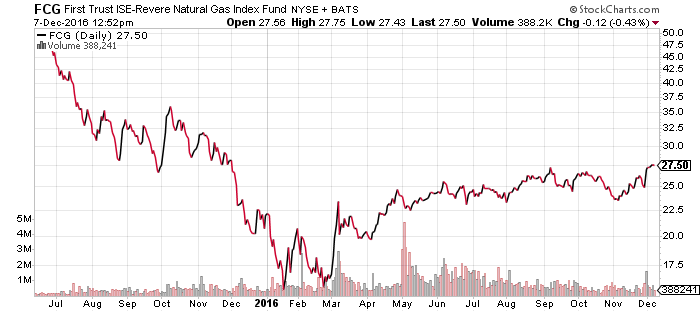

While oil prices corrected last week, natural gas prices spiked to a new 52-week high as an Arctic blast sent temperatures in the Midwest below normal to usher in a possible La Nina pattern.

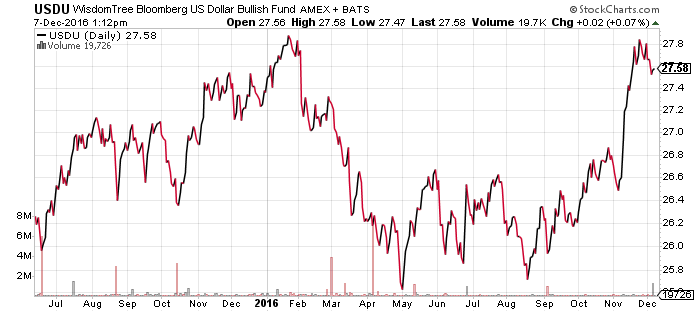

WisdomTree US Dollar Bullish (USDU)

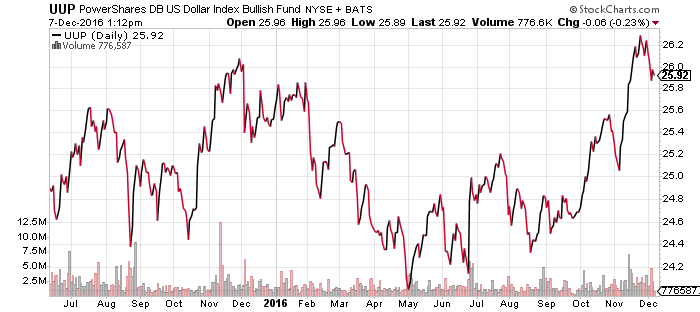

PowerShares DB US Dollar Bullish (UUP)

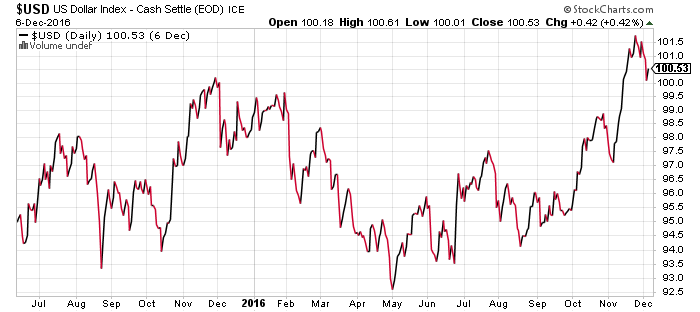

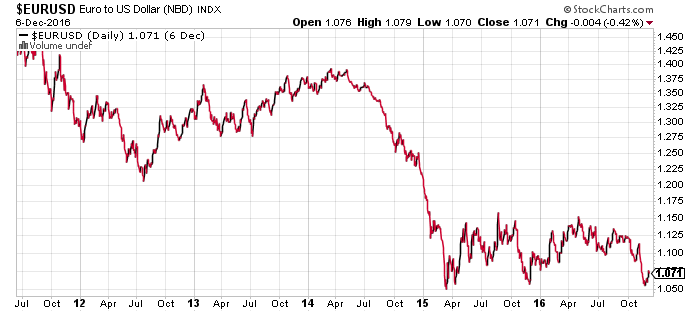

The U.S. dollar pulled back as the euro rallied. The outcome of the Italian referendum was a foregone conclusion and traders responded by selling the news, covering their euro short positions.

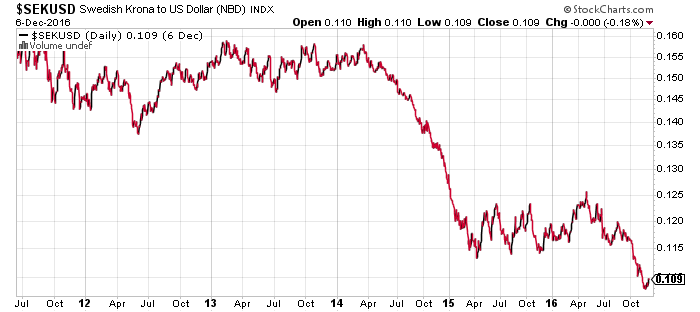

The euro appears to have made a triple bottom, failing to breach 1.05 twice in 2015 and again this month. Then again, the krona had a similar pattern before breaking lower last month.

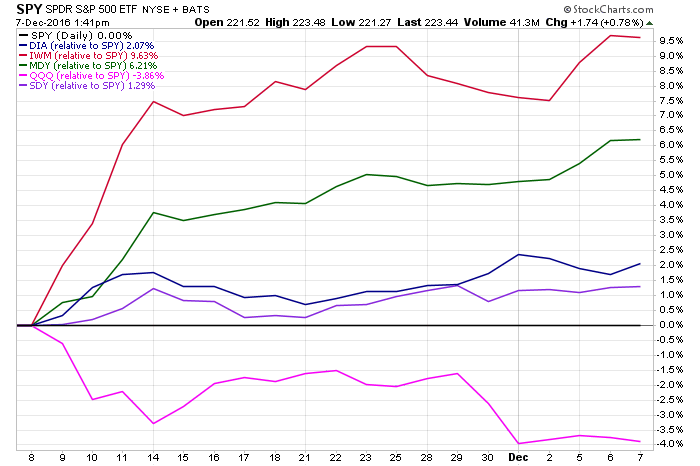

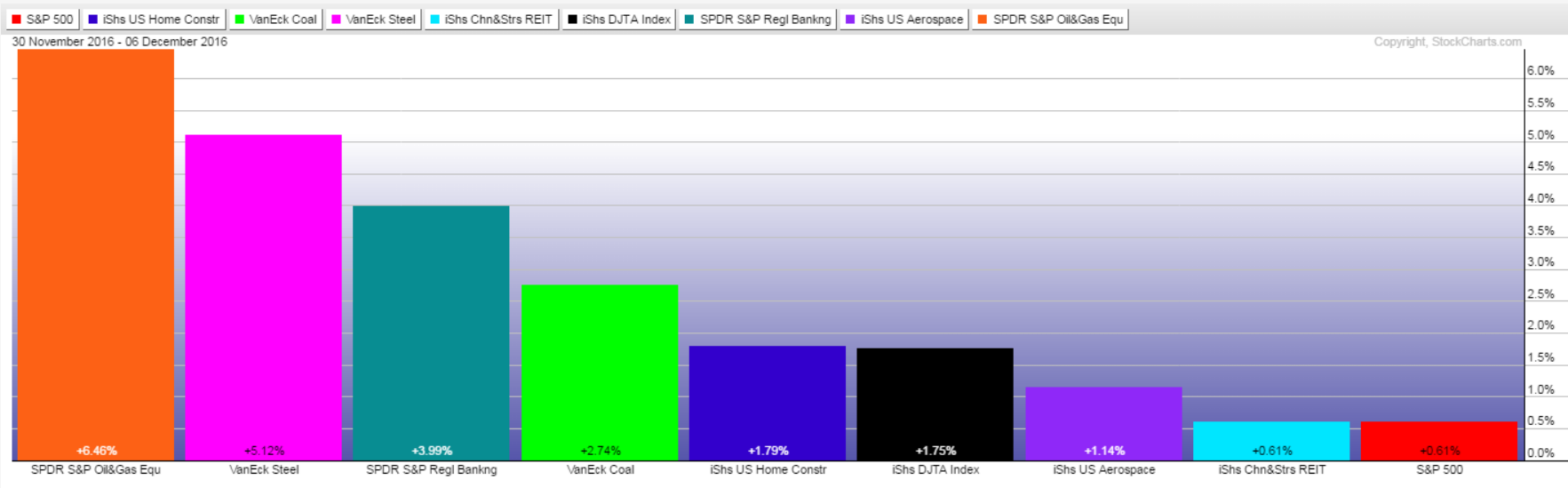

Index Performance

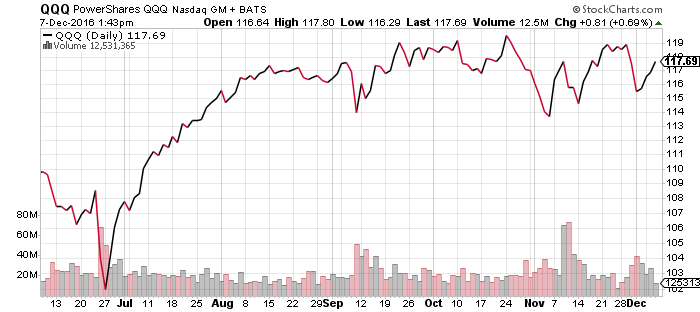

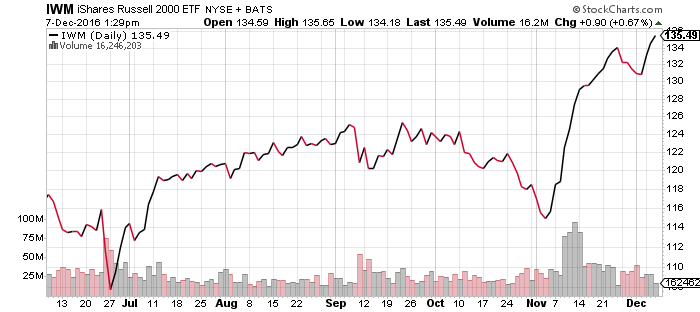

Small-cap and mid-cap stocks continue to lead the market higher, as evidenced in the S&P 500 Index comparison chart below. Even though it has moved higher since the election, the PowerShares QQQ (QQQ) trails the S&P 500 Index by about 4 percent as technology lags the broader market. Small-caps tracked by iShares Russell 2000 (IWM), however, have trounced the S&P 500 Index.

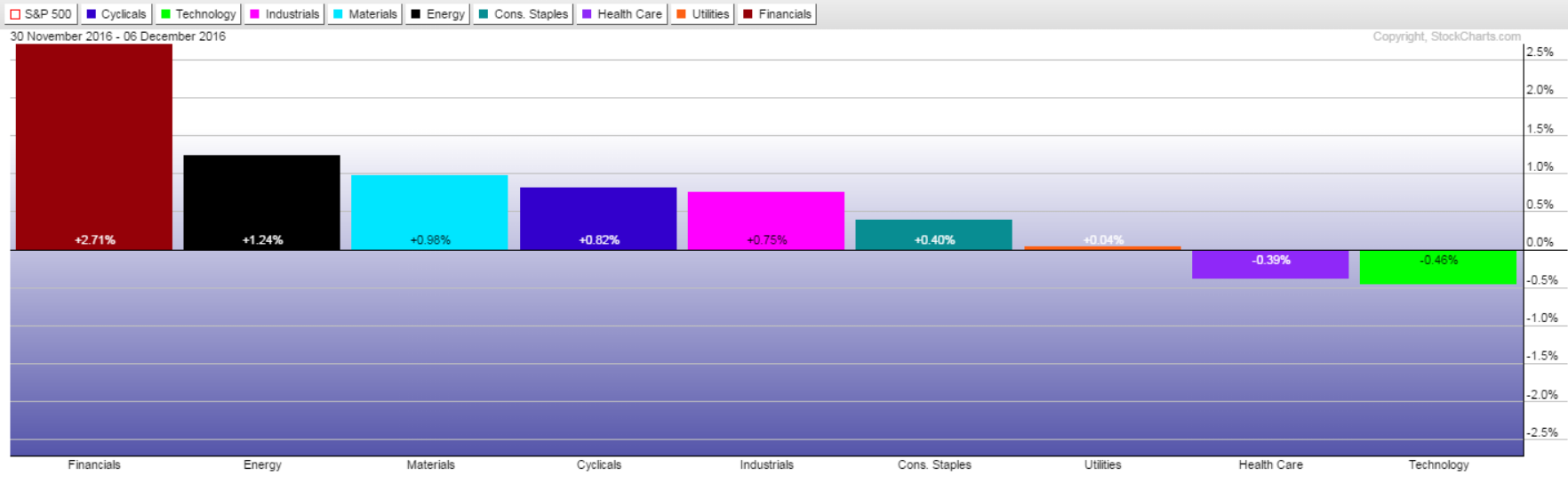

The post-election rally continues to favor industrials and financials, but interest rate-sensitive sectors also performed well over the past week. Consumer staples, utilities, real estate, and telecommunications all pushed higher. Weakness in these sectors appears to be over, at least until rates move higher again.

Homebuilders are an important sector to watch as we enter 2017. Rising interest rates are pushing homebuyers to buy, which is lifting prices in some areas. If homebuilding picks up as well, GDP growth estimates for 2017 will rise.