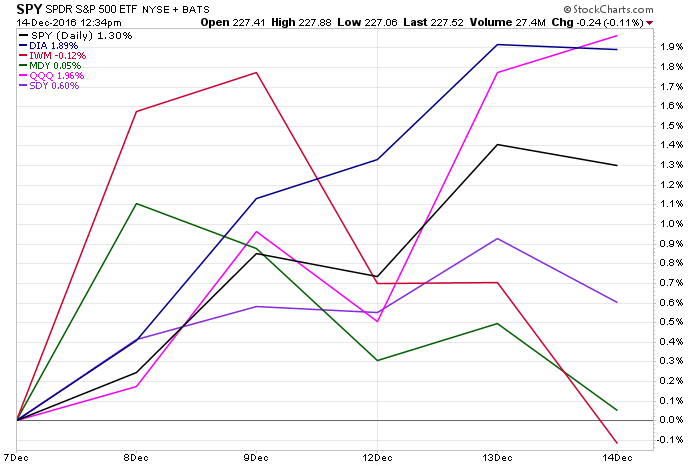

Markets reacted favorably to the Federal Reserve’s latest report. The Dow is approaching 20,000, while the Nasdaq is reaching toward 5,500. Both indexes made new intraday highs this week.

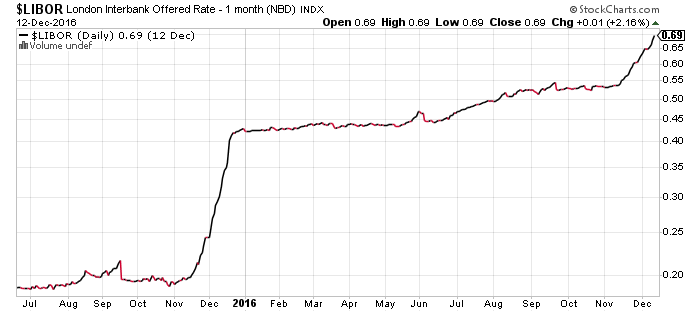

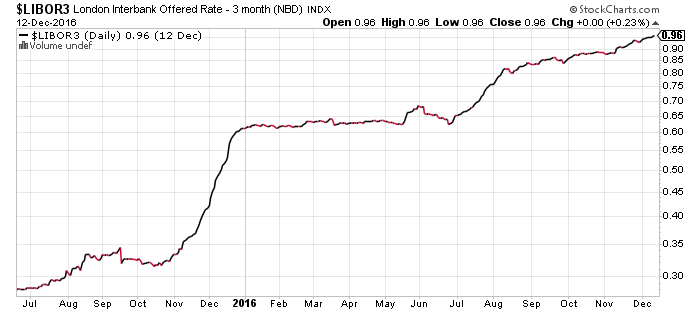

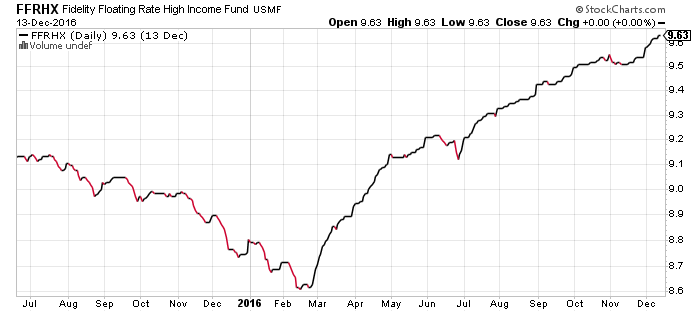

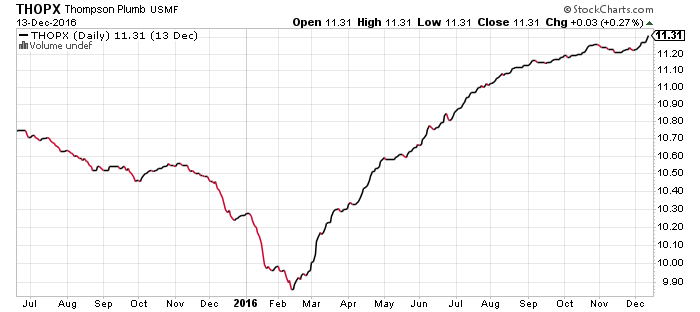

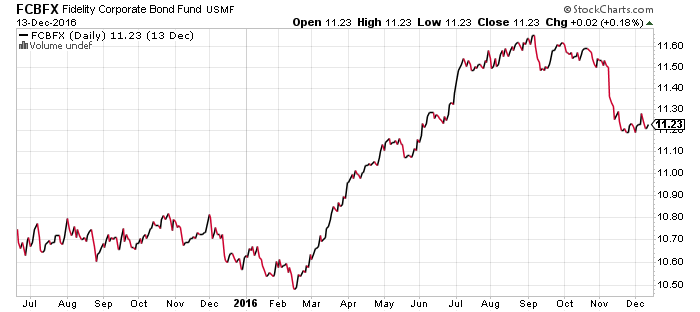

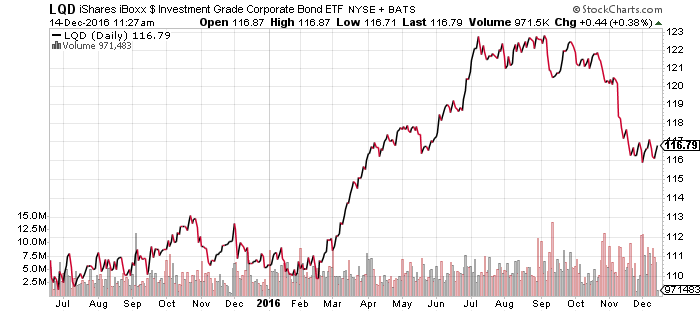

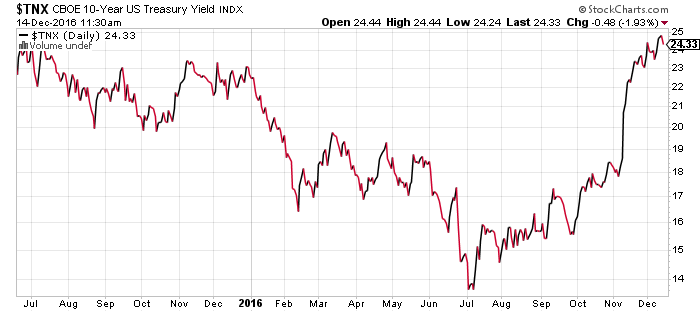

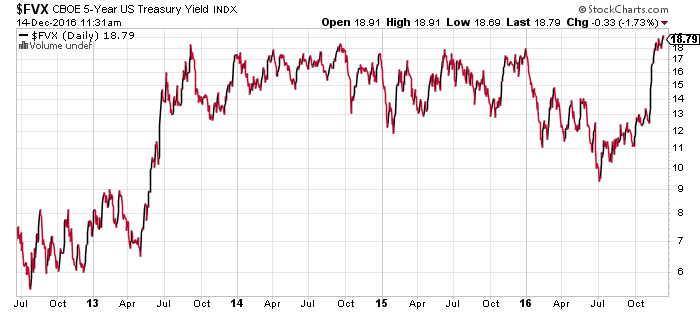

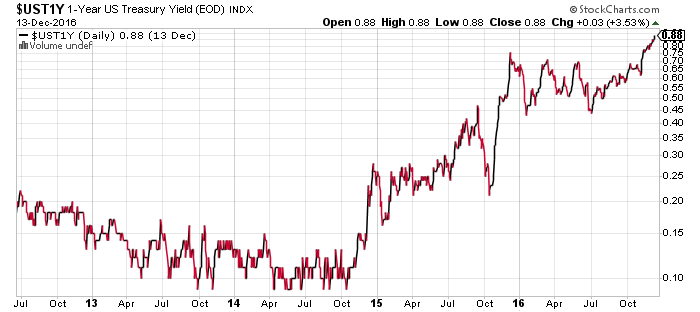

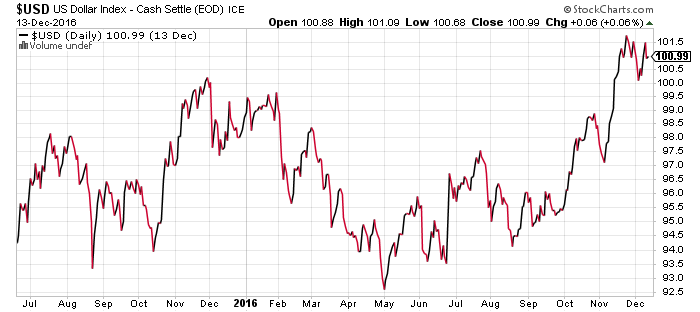

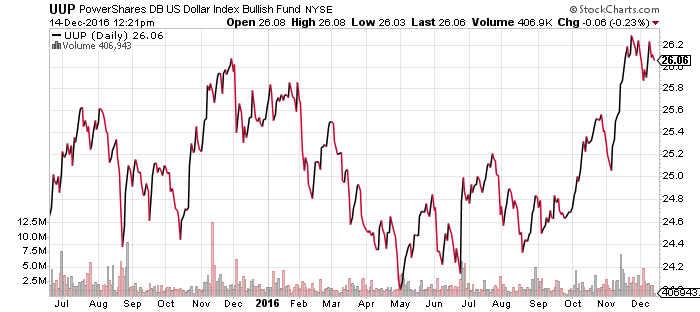

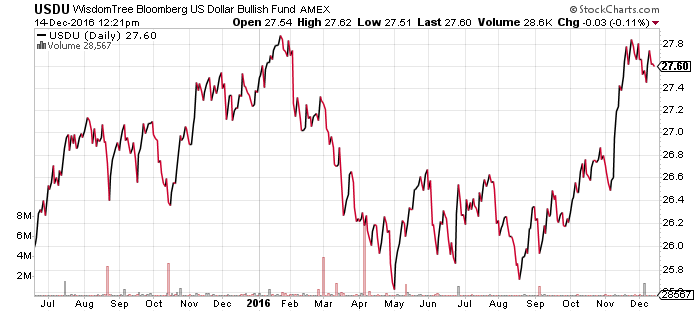

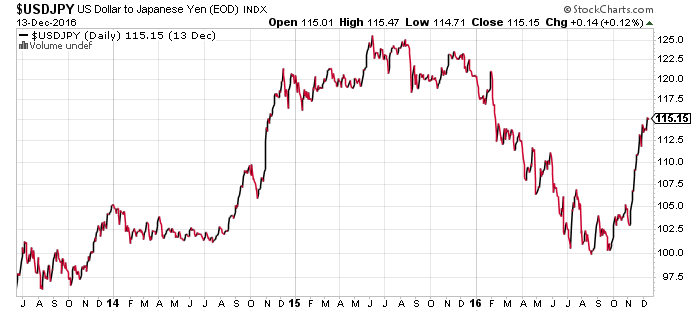

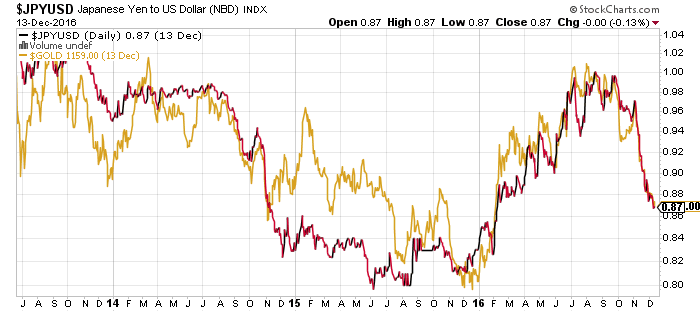

The Federal Reserve raised benchmark interest rates 25-basis points this week, as predicted. The Fed also anticipates three rate hikes in 2017. Markets initially sold off following the meeting, but rapidly rebounded on Thursday. The U.S. dollar hit a 14-year high against a basket of foreign currencies, while gold and government bonds slid.

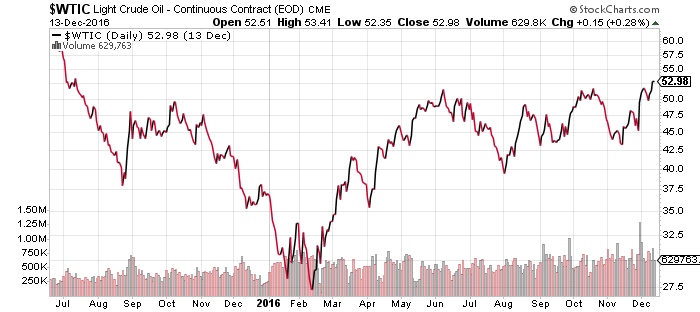

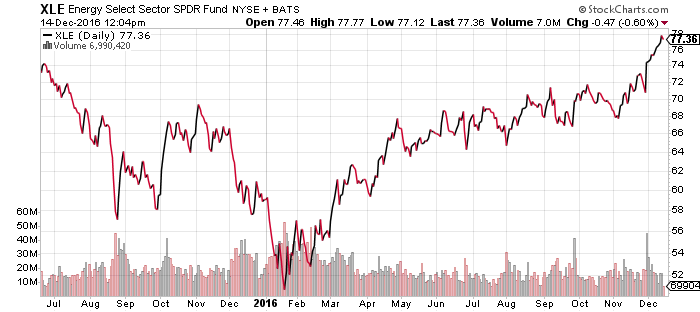

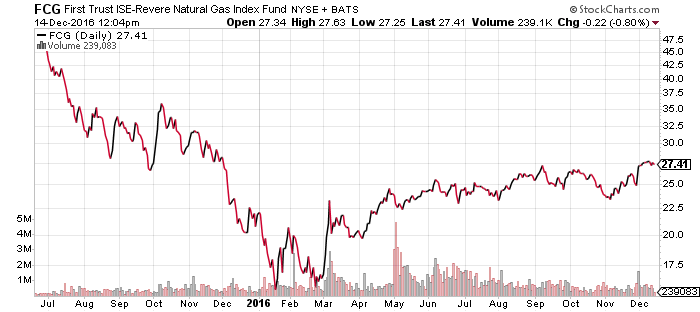

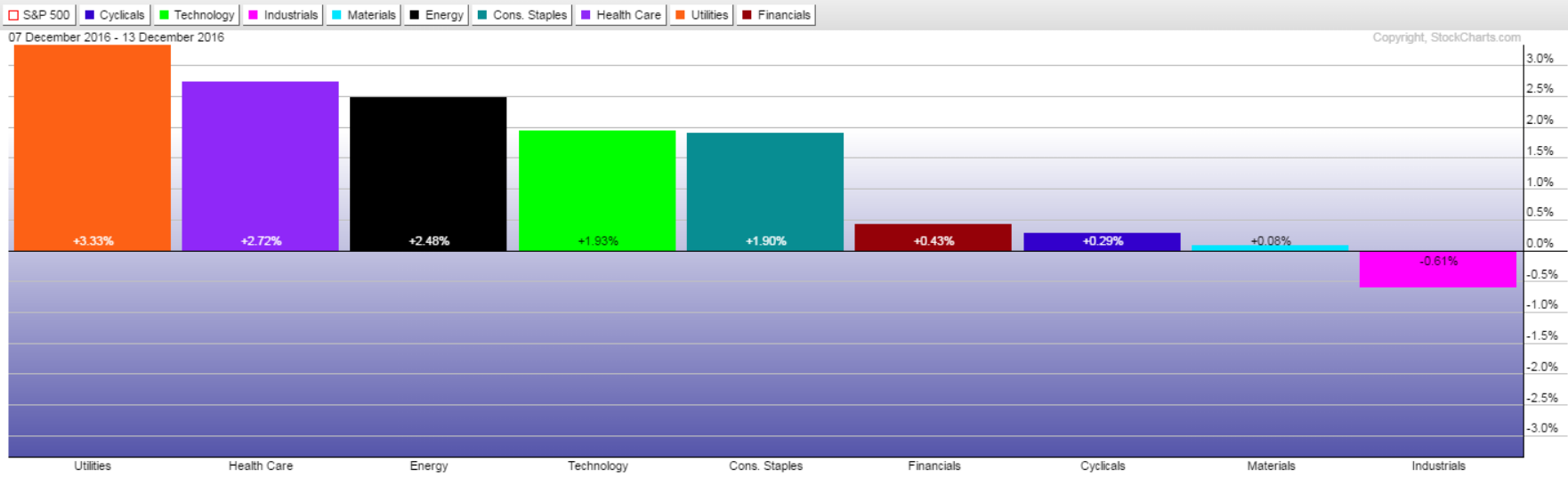

Home loan rates reached their highest levels since 2014, despite a decline in refinancing that pulled this week’s mortgage purchase application down 4 percent, in-line with estimates. Oil and gasoline stockpiles rose more than forecast, depressing crude oil prices. After rallying Monday, West Texas Intermediate Crude faced selling pressure later in the week and closed relatively unchanged. Shares of the Energy Select Sector SPDR ETF (XLE) saw a slight gain on the week.

U.S. retail sales increased 0.1 percent in November, less than the 0.4 percent increase analysts had forecast. Analysts attributed the miss to a drop in auto sales. Domestic industrial production fell 0.4 percent, while capacity utilization dipped to 75 percent from 75.4 percent a month earlier. The latest producer price index (PPI) rose 0.4 percent, doubling expectations with the biggest increase in five months. Consumer prices increased 0.2 percent, matching analysts’ forecast.

Unemployment claims fell for the second consecutive week, per the Bureau of Labor Statistics. The Empire State and Philly Fed manufacturing surveys came in stronger than the consensus estimates, reinforcing overall strength in the economy.

Chinese industrial output rose 6.2 percent, slightly over growth expectations. Chinese producer prices also jumped 1.5 percent in November, a pace that threatens runaway inflation in China. Chinese bond futures tumbled after the Fed hiked rates and the central bank halted bond futures trading on Thursday to stem the decline. The bank also weakened the yuan, dropping it to 6.95 versus the U.S. dollar.

Software developer Adobe Systems (ADBE) reported its sixth straight quarter of 20 percent sales growth, handily beating earnings and revenue estimates. After Thursday’s bell, Oracle (ORCL) reported mixed results, citing the transition from its core database business toward faster-growing sectors like cloud computing for light revenues. Although the company narrowly beat EPS estimates, shares fell more than 5 percent on the news.