Markets have rallied consistently since the election, though the next week may initially bring corrections in response to the Federal Reserve’s 25-basis point interest rate hike. Some traders may take profits, while investors may rotate into sectors that have lagged since July.

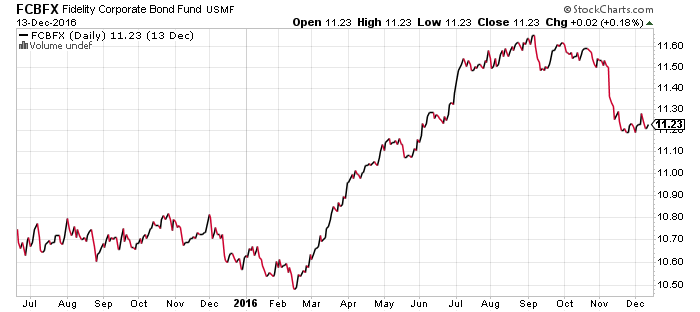

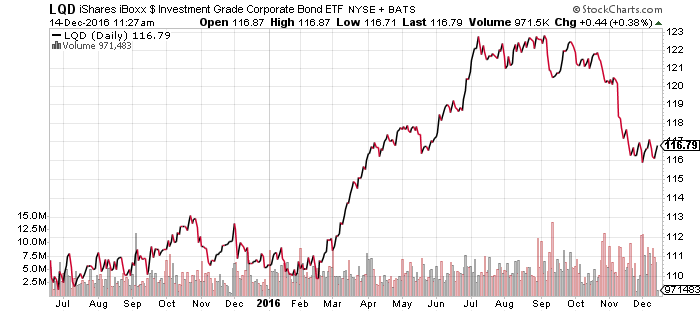

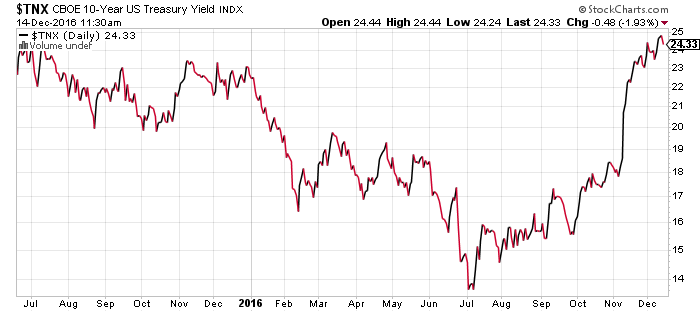

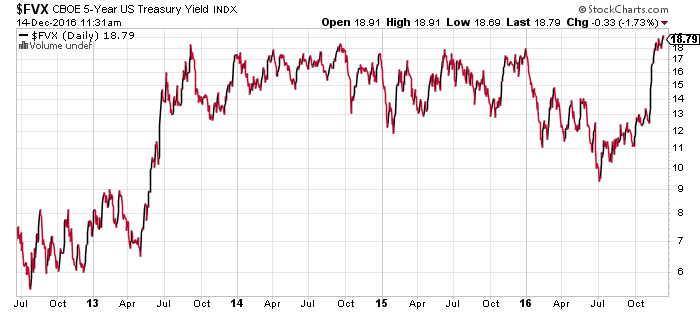

Fixed income at the long end of the yield curve is likeliest to experience a corrective move. Investment-grade bonds have already stabilized, as reflected in the Fidelity Corporate Bond (FCBFX) and iShares iBoxx Investment Grade Bond (LQD) charts below. The 10-year Treasury yield also pulled back slightly ahead of the Fed’s hike. The 5-year Treasury yield has moved above its long-term trading range, but remains at risk.

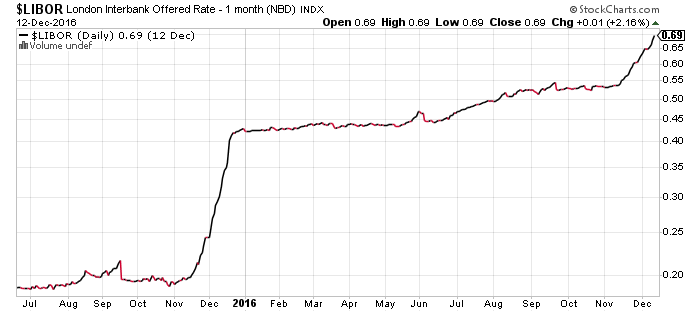

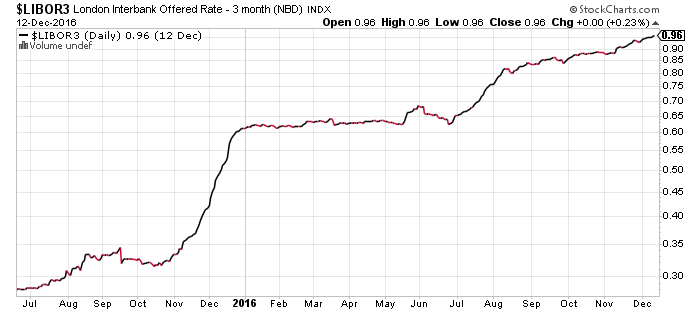

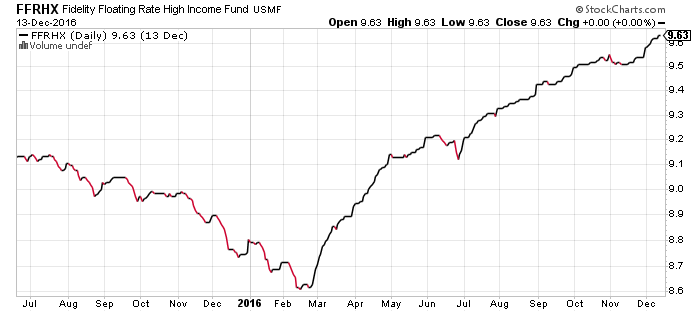

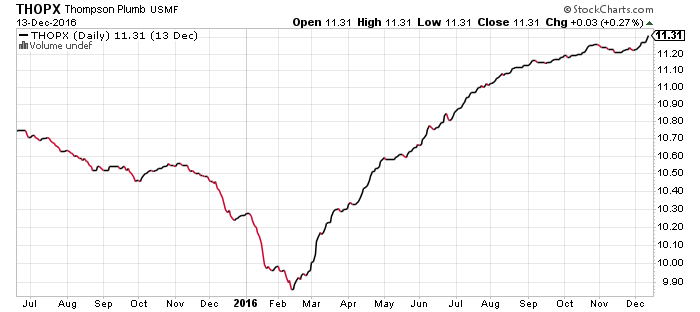

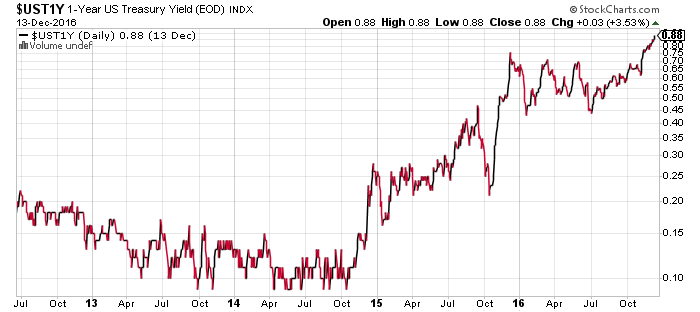

Short-term yields, however, remain in an uptrend. Both 1- and 3-month LIBOR, the 1-year Treasury yield, and floating-rate funds all moved higher over the past week. Whether long-term rates rise or fall in the week ahead, floating rate funds should hold steady under the prospect of rising interest payments.

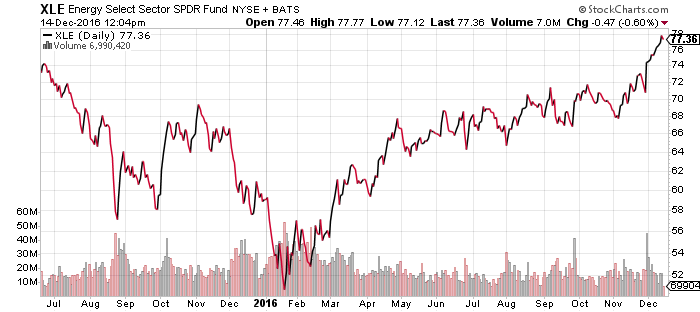

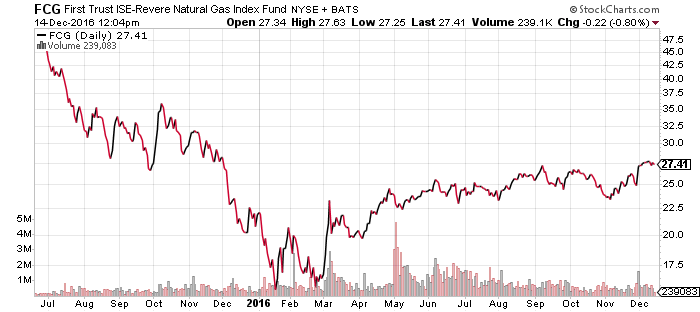

Energy

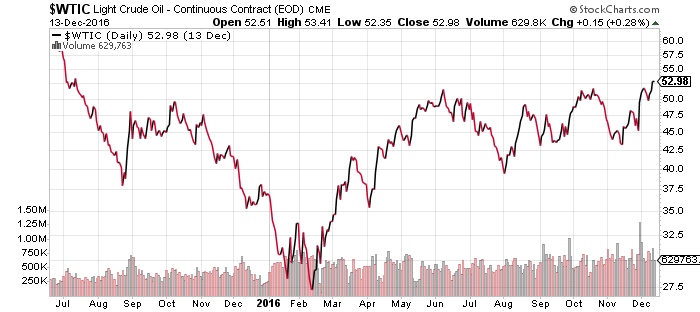

West Texas Intermediate Crude couldn’t sustain its rally this week, sliding back to $51 a barrel during Wednesday trading. Inventory and production data were mixed. The Department of Energy announced a 2.56-million-barrel inventory decline and a smaller-than-expected increase in gasoline inventory. Rig counts and production, however, are moving higher in the United States following a rush by shale producers to hedge above $50 a barrel.

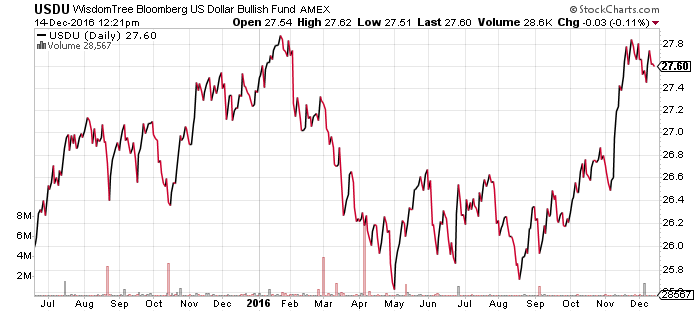

WisdomTree US Dollar Bullish (USDU)

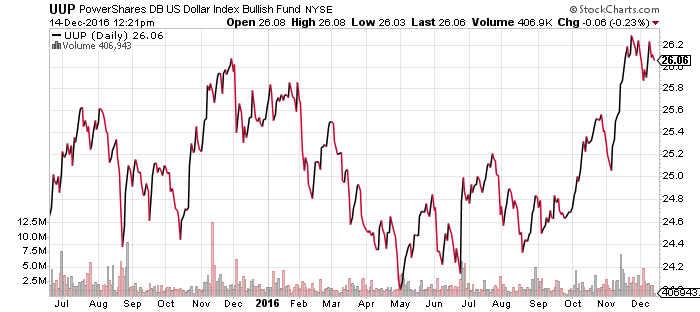

PowerShares DB US Dollar Bullish (UUP)

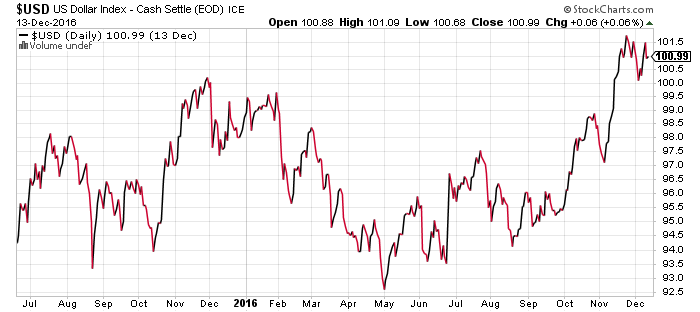

The U.S. dollar has broken out to the upside, but is still not far from a nearly 2-year trading range. Higher interest rates are bullish for the U.S. dollar, but if traders pushed the dollar up in expectation of a rate hike, they may reverse those trades following the Fed hike. A dip below 100 on the U.S. Dollar Index won’t end the dollar’s bull market, but it will create some confusion in the short-term. If the dollar can hold above 100, it will signal a strong bullish floor has formed.

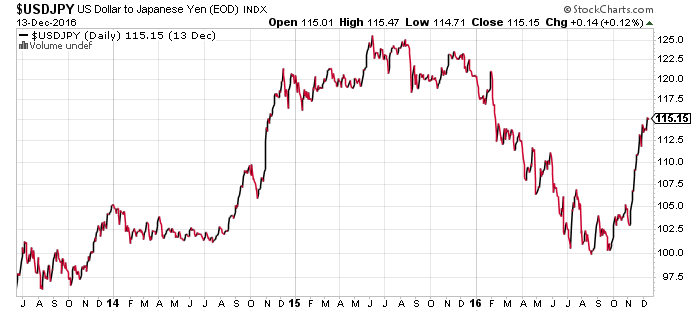

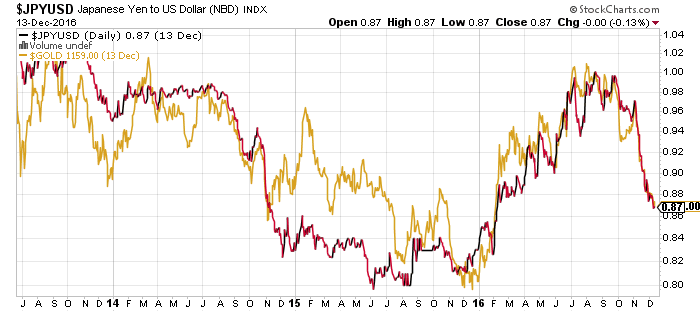

The yen would benefit from a near-term dollar reversal. It experienced a rapid drop from USDJPY 100 to 115 in the past two months. The yen is also key for the gold market: the two have moved in lockstep for several years. A rebound in the yen back towards USDJPY 100 will be good news for gold, while a slide back towards USDJPY 125 could push gold back to 52-week lows, near $1050 an ounce.

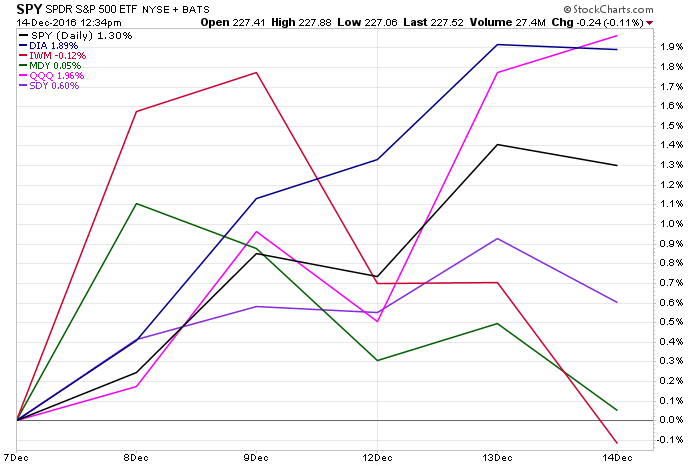

Index Performance

The Russell 2000 and S&P 400 Mid-Cap indexes were flat over the past five trading days, while the Nasdaq rallied nearly 2 percent after lagging for most of the past month. The Dow Industrials has been a stalwart outperformer since the election.

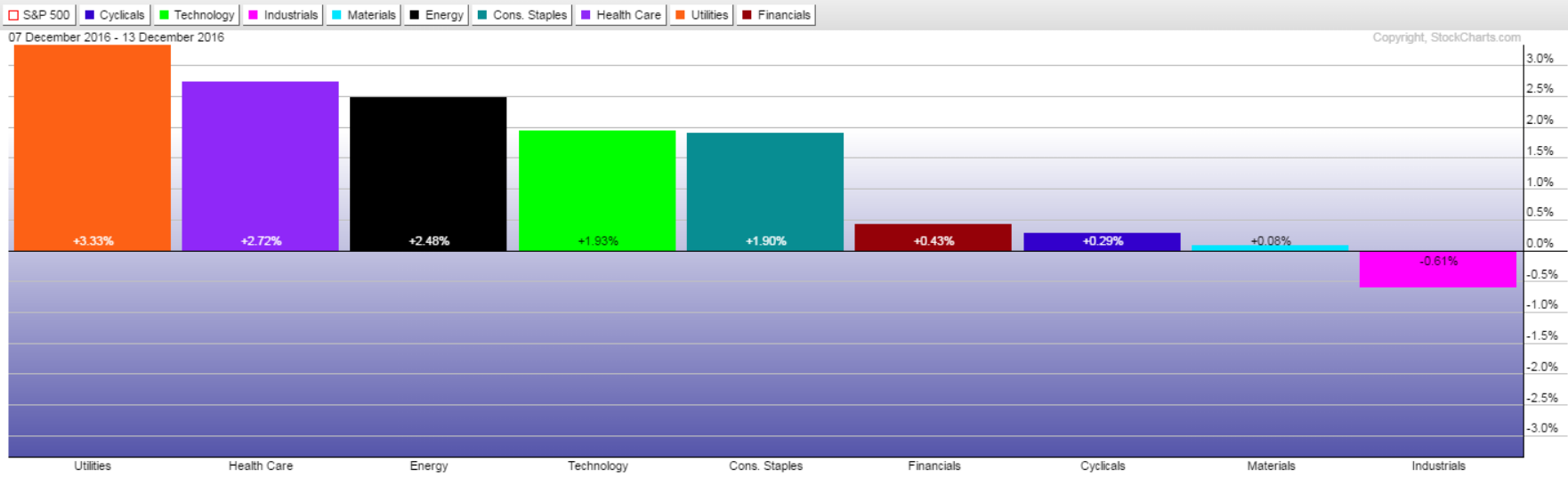

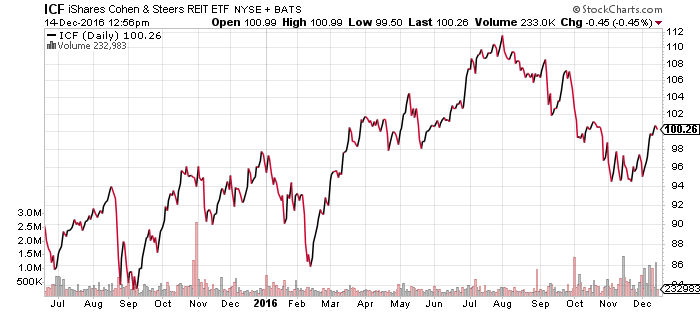

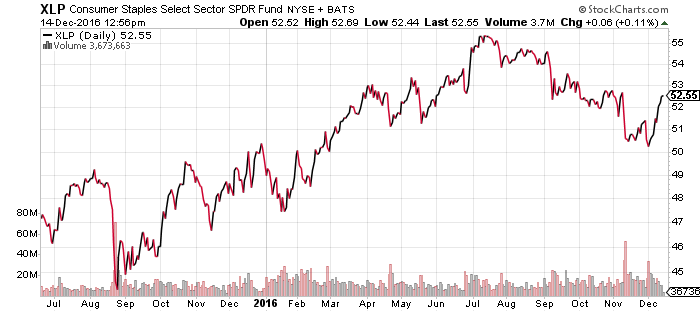

We also saw a corrective move in the sectors. Utilities and healthcare, two post-election laggards, were last week’s best performers. Industrials, materials, and financials were the opposite. Consumer staples and real estate also outperformed the broader market over the past week.