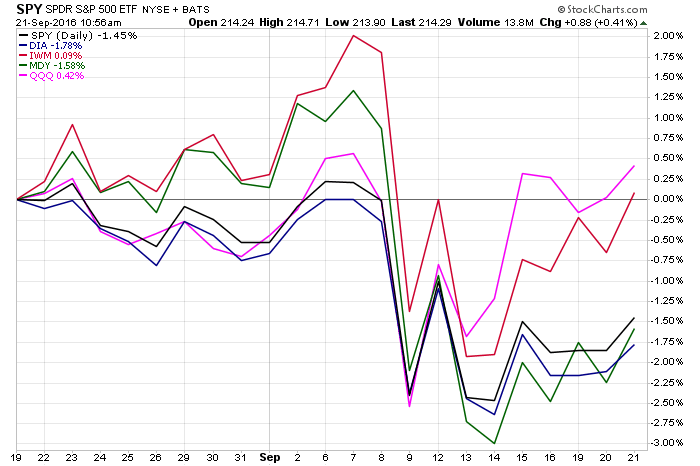

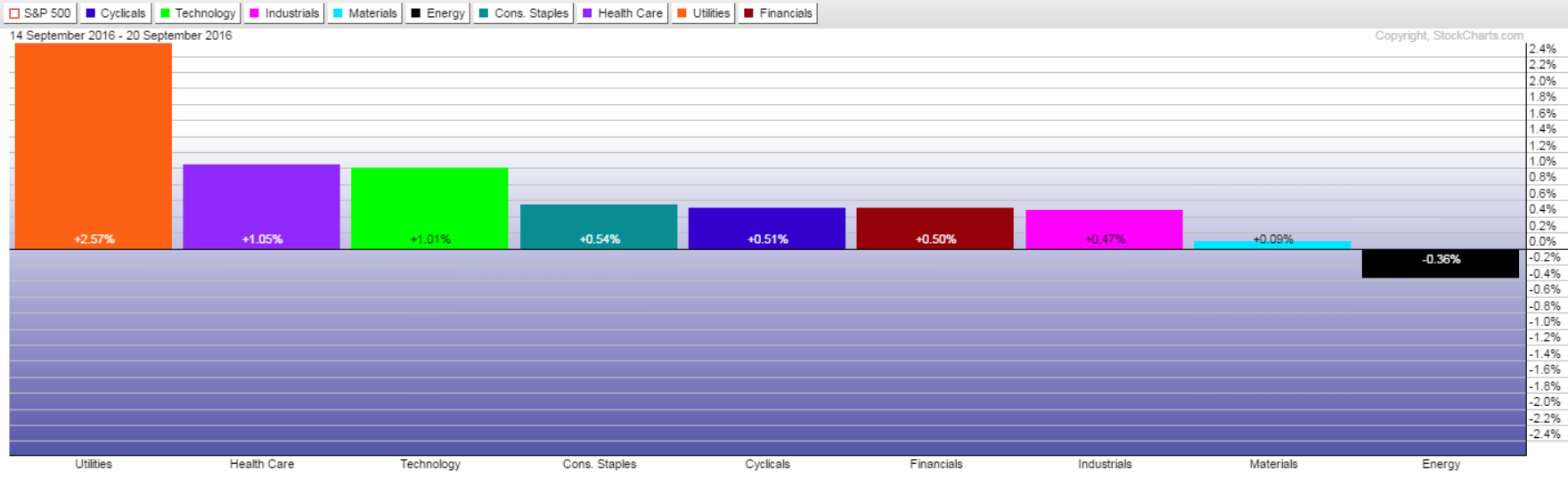

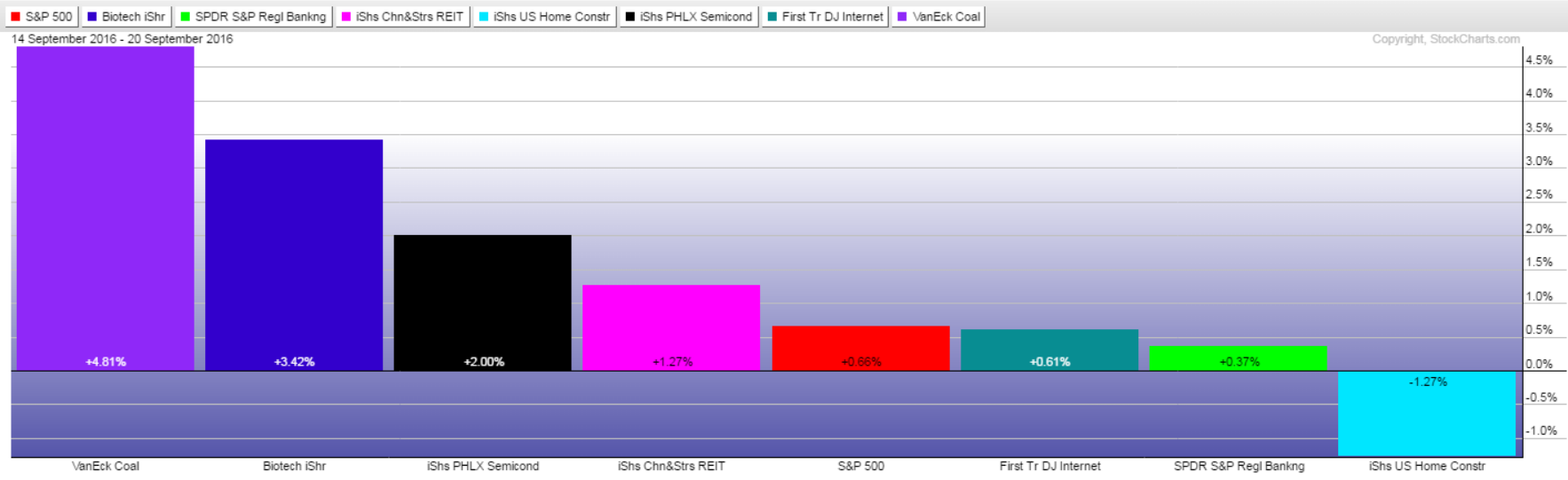

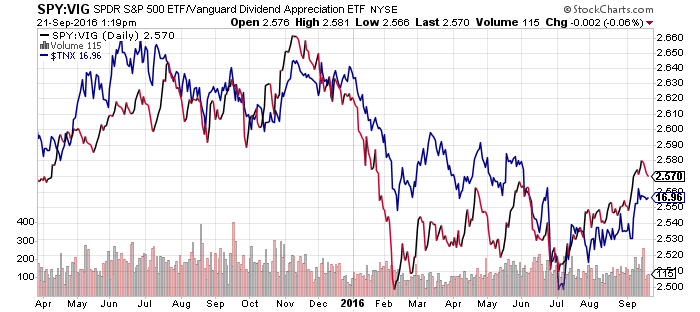

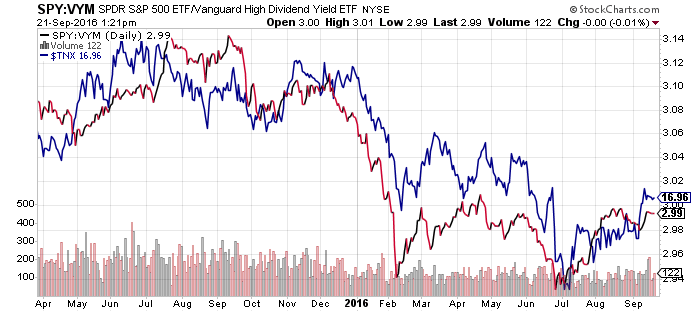

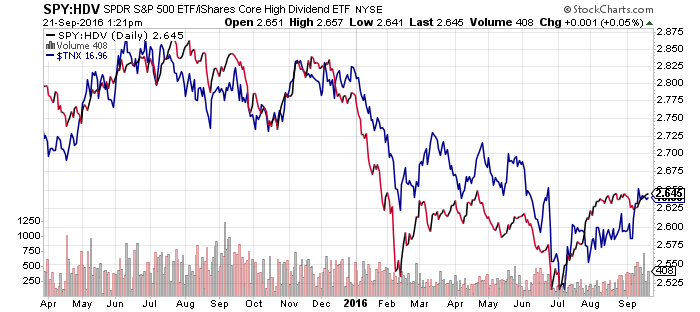

The Federal Reserve left rates unchanged at this week’s meeting, initiating a mid-week U.S. stock rally. The Nasdaq advanced to a new all-time high, while the S&P 500 Index erased early September losses and turned positive on the month. Dividend funds, utilities and real estate shares outperformed the broader market following the Fed’s announcement. Financials also rallied, with SPDR S&P Regional Banking (KRE) climbing about 2 percent on the week.

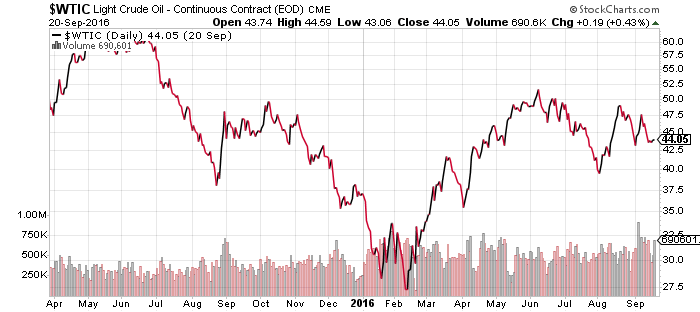

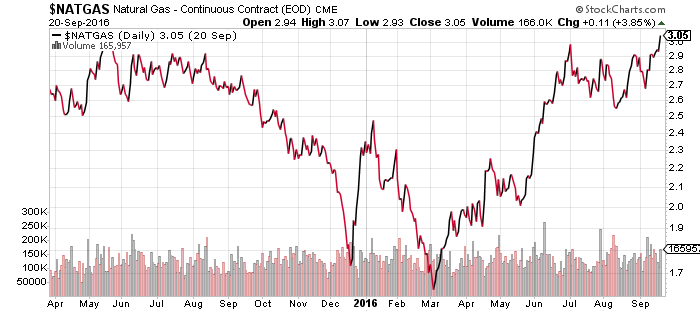

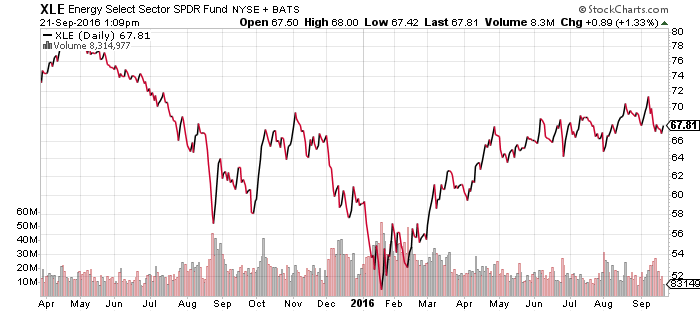

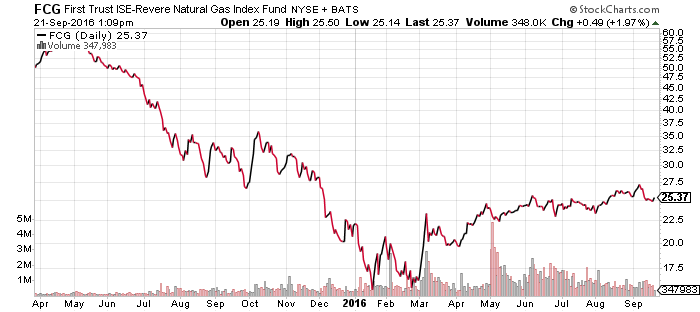

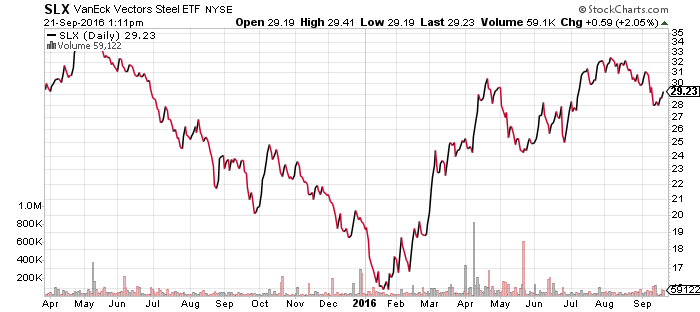

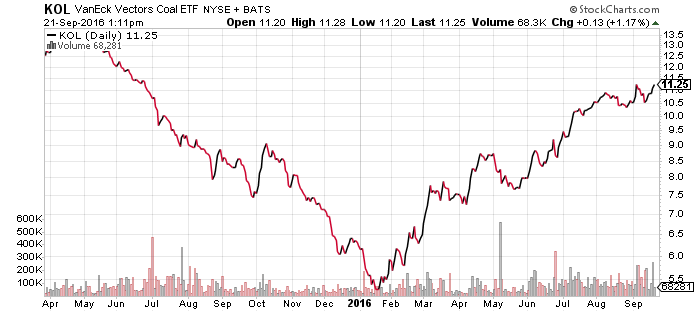

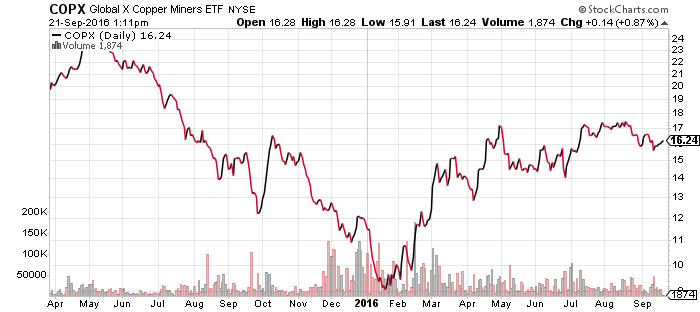

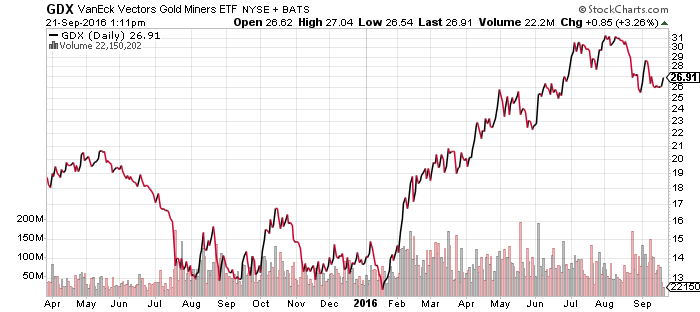

Commodities also benefited from the rate hike delay. Gold rose 2 percent on the week, despite closing lower on Friday. West Texas Intermediate crude oil gained slightly less than 5 percent on the week following a larger-than-expected draw down in oil inventory and rumored production freezes ahead of next week’s OPEC meeting. Commodities and foreign shares also benefited from the weaker U.S. dollar.

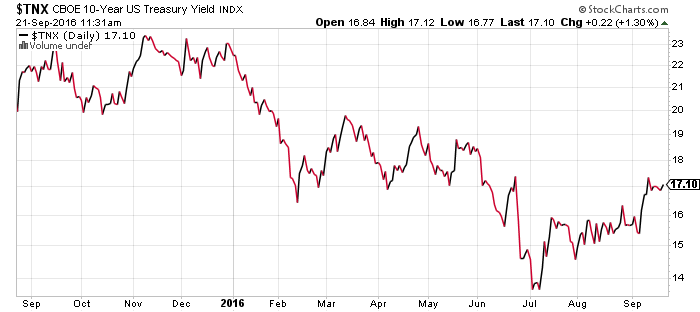

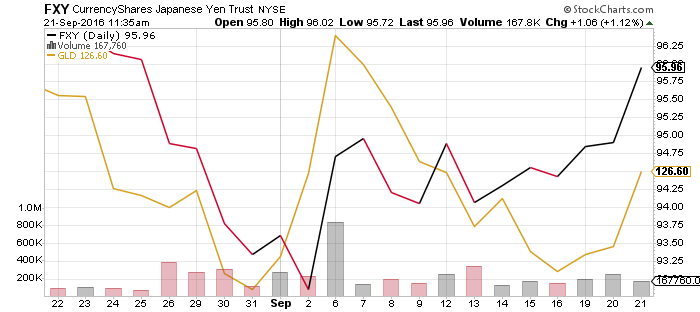

The Bank of Japan (BoJ) also left their benchmark interest rate unchanged, as anticipated. Although the BOJ did not increase its stimulus program, officials plan to target the yield curve in an effort to keep 10-year government bonds at or near zero percent while lifting longer-term interest rates. The 10-year bonds currently yield less than zero. Investors reacted positively to the BoJ news as well, sending global markets higher.

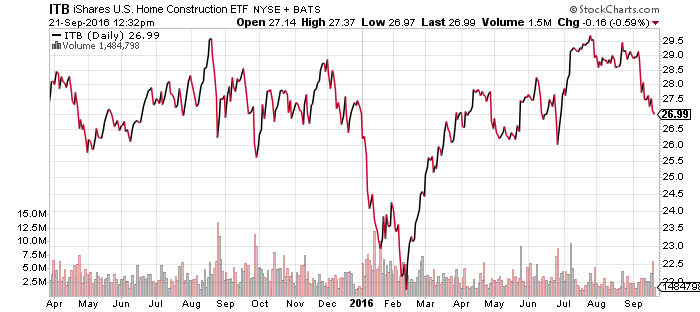

Continued strength in the labor market was tempered by weaker-than-expected housing data. First-time unemployment claims, already at four-decade lows, beat expectations with a drop to the lowest level in two-months. Markit’s flash PMI for September came in at 51.4, slightly below expectations of a 51.9 reading, but signaling sector expansion nonetheless. August housing starts slid 5.8 percent and the weekly mortgage purchase applications index declined 7.4 percent. Existing homes sales also fell 1 percent from July.

Adobe Systems, FedEx, Bed, Bath & Beyond, AutoZone and Rite Aid reported earnings this week. Shares of software giant Adobe Systems (ADBE) rose Tuesday to all-time highs after the company easily beat earnings estimates on a 20 percent rise in revenues. FedEx (FDX) also reported better-than-expected adjusted fiscal first-quarter earnings. While the integration of TNT Express hampered performance, the company saw strong growth in its ground parcel delivery business. Shares rose 7 percent and lifted the Dow Transports by 1.8 percent on the day.

Bed, Bath & Beyond (BBBY) missed estimates with lower overall sales and earnings figures, despite a 20 percent increase in online orders. AutoZone (AZO) reported a 6.4 percent increase in profits on higher revenue, handily beating estimates. Rite Aid (RAD) reported earnings and revenues lower than the comparable year-ago period. Shares of the company rose slightly as its merger with Walgreens (WBA) appears to be gaining governmental approval. RAD trades at an 11 percent discount to the buyout price offered by WBA, signaling investor skepticism regarding a successful deal.