SPDR S&P 500 (SPY)

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P MidCap 400 (MDY)

iShares Russell 2000 (IWM)

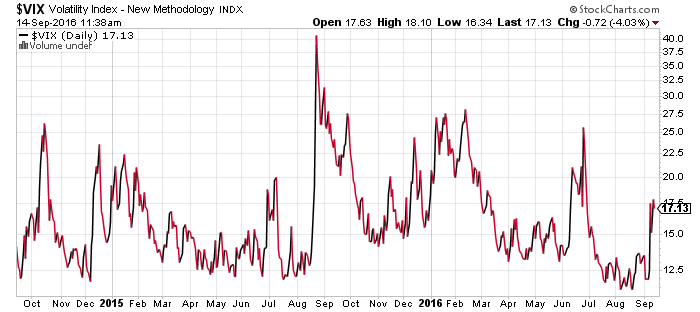

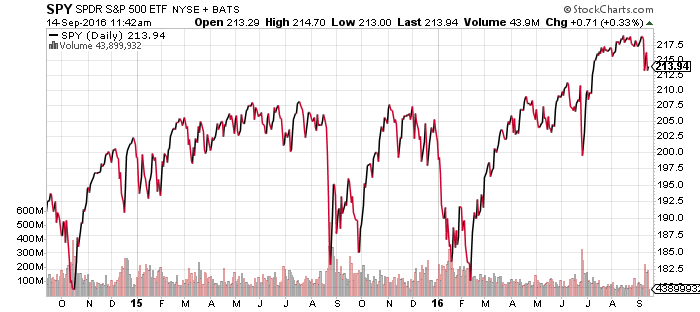

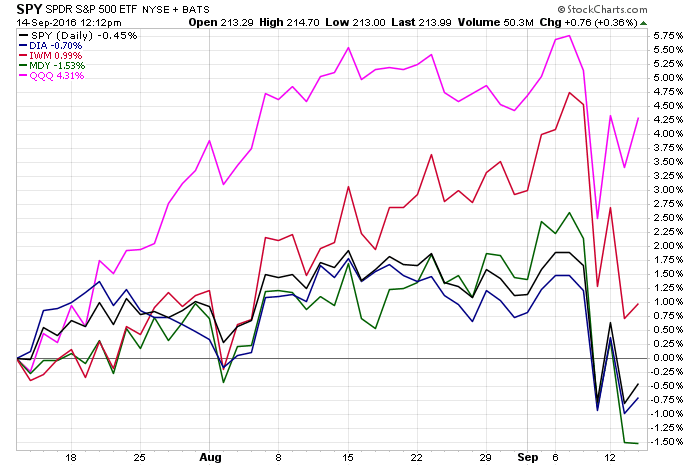

The past four trading days have been dominated by volatility. The S&P 500 Index is off its all-time high, but has significant support around the 2100 to 2120 level, or about $208 to $210 for SPY. Above this level the bulls are clearly in control of the market. The Friday drop in stock prices (which ended Monday morning) terminated at the 2120 levels. On Tuesday, stocks fell and the 2120 level was again the termination point.

The Nasdaq and Russell 2000 Index are up over the past two months following solid July and August gains. The S&P 500, Dow Jones Industrial Average and S&P MidCap 400 are down slightly due to sideways trends during the summer calm spell.

Fidelity Floating Rate High Income (FFRHX)

DoubleLine Core Fixed Income (DLFNX)

Thompson Bond (THOPX)

Fidelity Corporate Bond (FCBFX)

iShares iBoxx Investment Grade Bond (LQD)

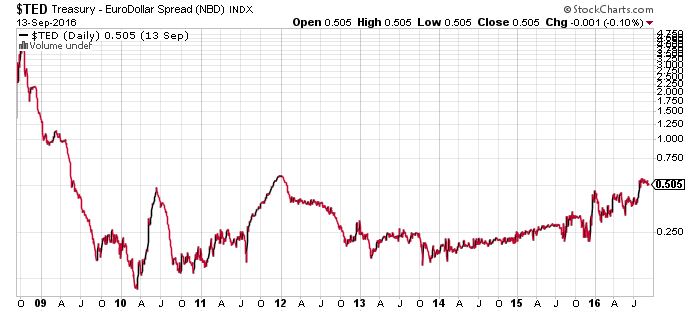

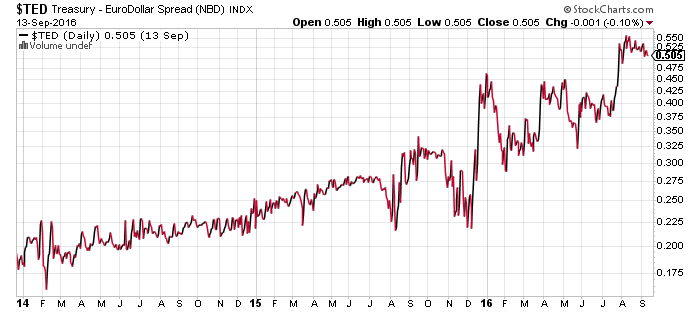

Rising interest rates around the globe have influenced much of the recent volatility. New U.S. money market regulations forcing funds to sell (or stop buying) commercial paper and instead hold U.S. treasuries are exacerbating the situation. The new rules are designed to prevent another situation similar to the 2008 financial crisis, when money markets froze and sparked a brief financial panic. Money market funds can avoid the new rules (which include allowing the value of the fund to fall below $1, freezing redemptions and instituting high fees during periods of extreme volatility) by holding U.S. government bonds. The new rules will take effect in October and are likely to result in a rising spread between the interest rates paid by banks and corporations and those paid by the U.S. government.

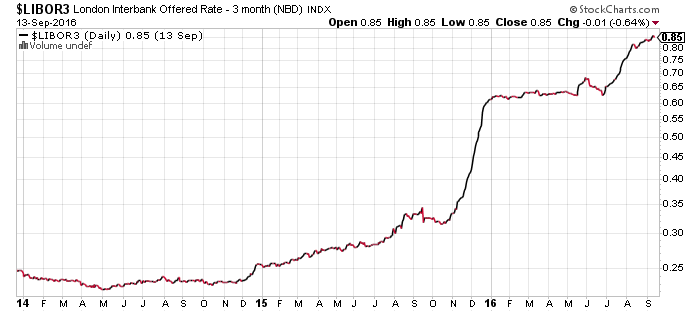

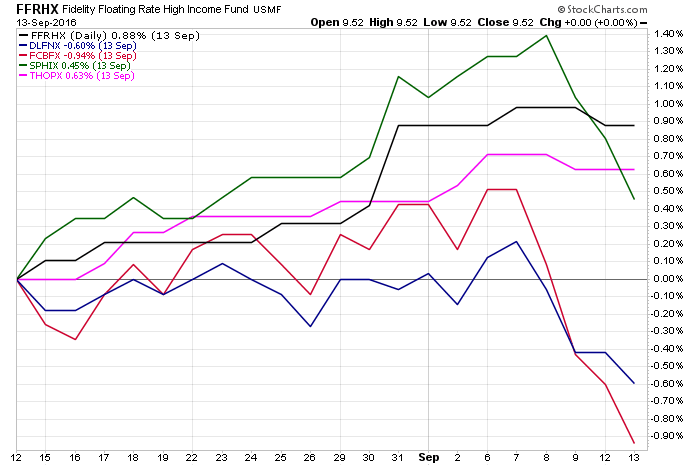

Rising interest rates benefit funds that hold bonds and loans which adjust their interest rates, such as Fidelity Floating Rate High Income (FFRHX). These funds are likely to see increased dividend payments over the next year as long as these rate increases hold, which is why FFRHX has not declined along with other bond funds over the past week. The actual interest rate many of these securities are based on is LIBOR, the London Interbank Offered Rate. The chart below reflects the clear spike in late 2015 as investors priced in the Fed rate hike, then stabilization followed by another rally starting in July.

Investment-grade and corporate bond funds have slipped as interest rates increased. High yield funds such as SPHIX and iShares iBoxx High Yield (HYG) have declined as well. Thompson Bond (THOPX) held up better as managers came into 2016 expecting the current interest rate environment.

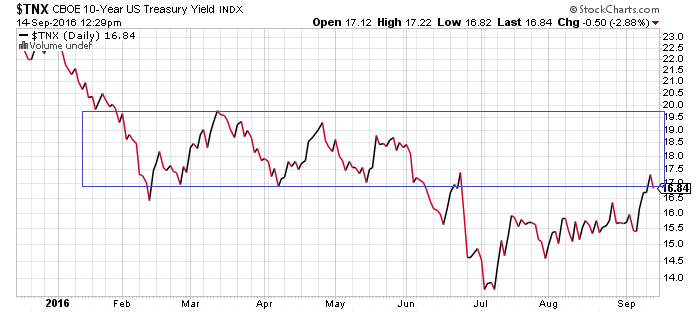

The 10-year Treasury yield briefly climbed about 1.7 percent in the past week, pushing it back into the trading range seen earlier this year. This will be a key test for the bond markets in the days and weeks ahead. A move higher will be a continuation of the current trend, while a move back below 1.70 will stabilize bond prices.

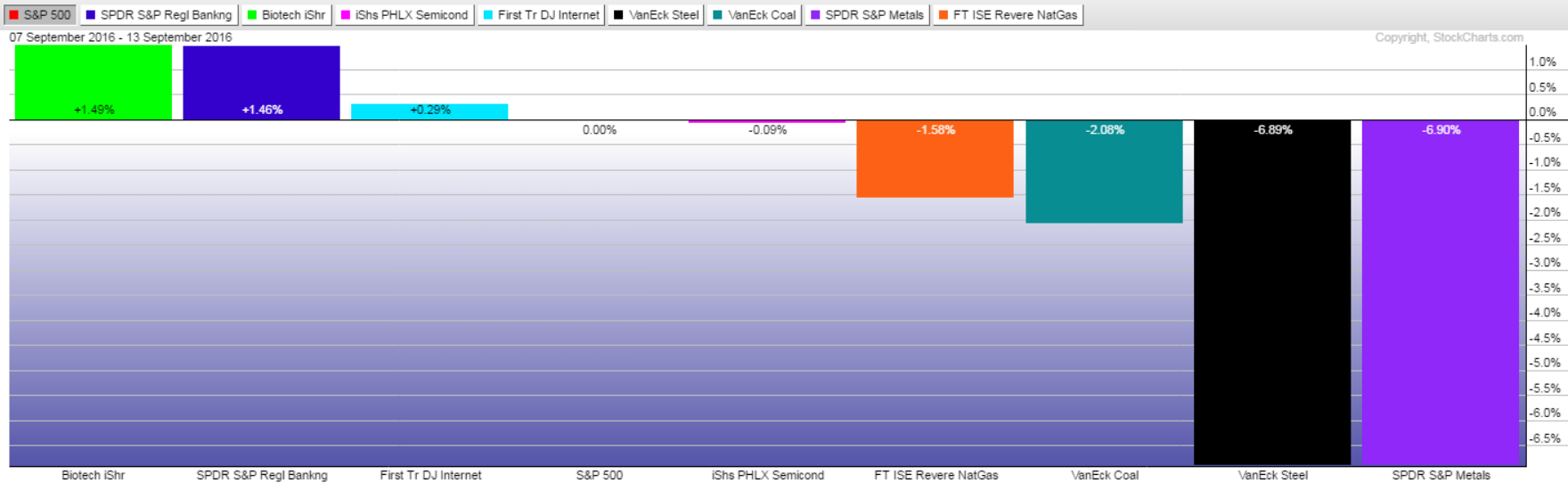

Sector Performance

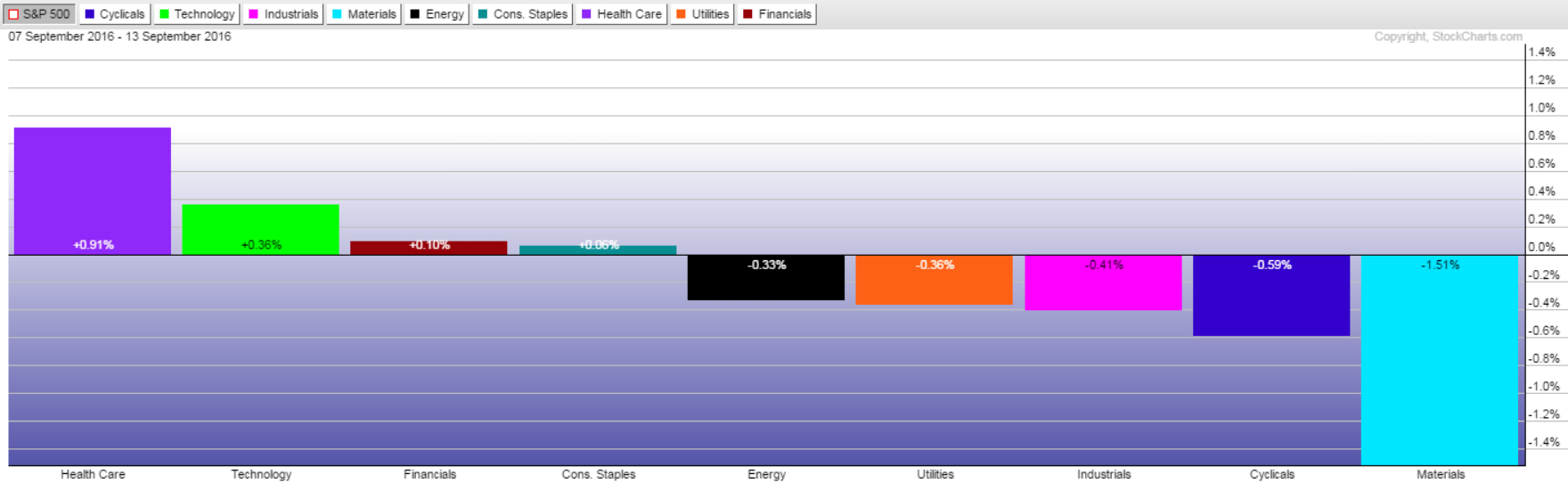

All sectors fell last week, but the chart below isolates relative index performance for clarification. Financials benefited from rising interest rates, while healthcare and consumer staples, traditionally defensive sectors, held up better than expected. Materials fared poorly as the possibility of higher interest rates and a stronger U.S. dollar hit commodities.

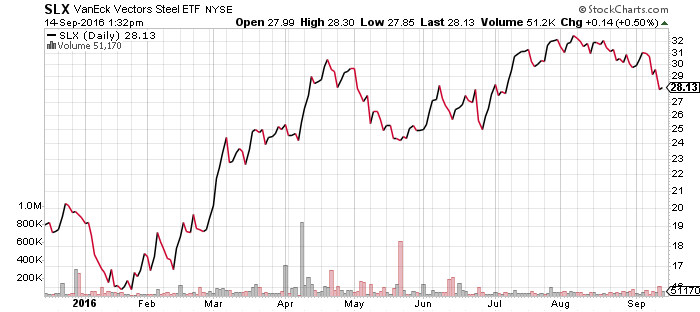

Among subsectors, the biotechnology and regional banking sectors saw some of the strongest relative performance, while commodities such as steel and mining saw large losses on the week.

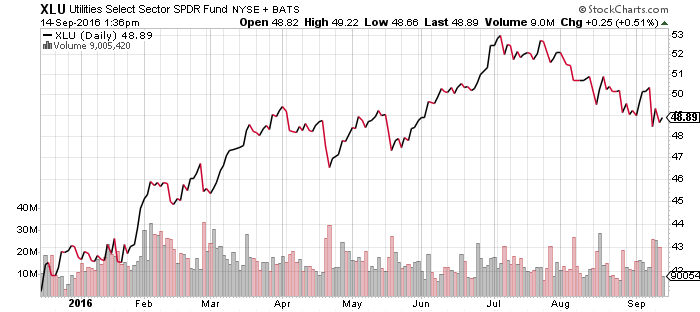

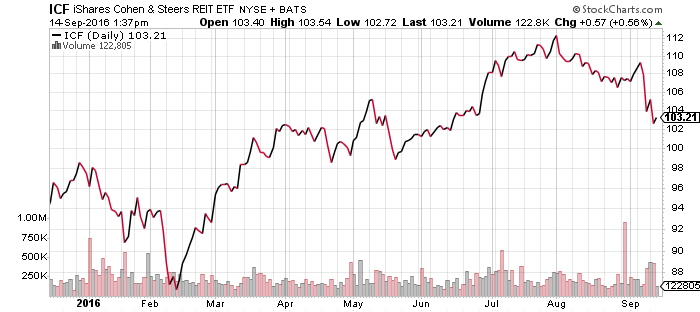

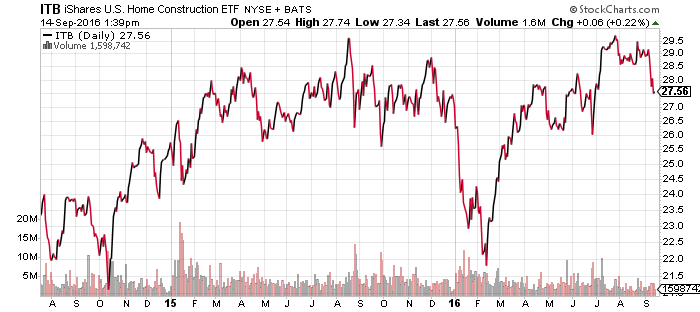

Rate-sensitive sectors such as utilities and real estate remained in a short-term downtrend, while home builders retreated to levels seen in spring 2015, placing it back in the middle of a long-term trading range.

SPDR Energy (XLE)

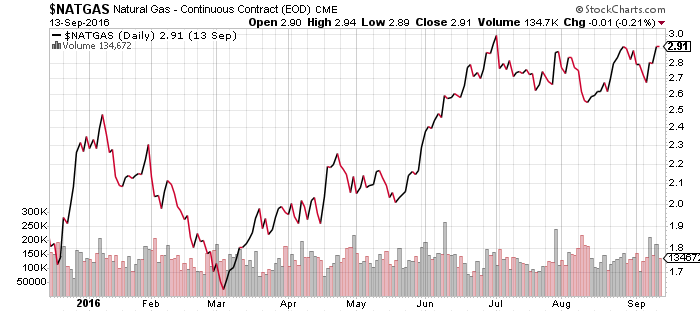

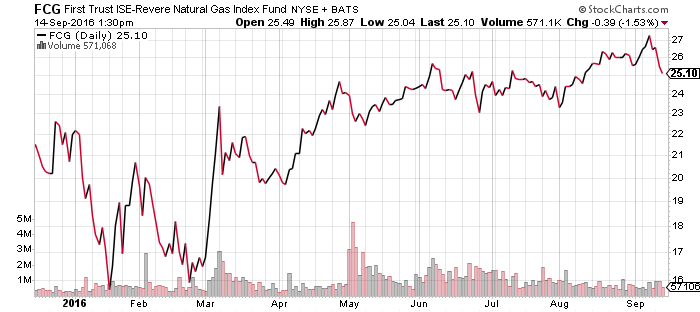

First Trust ISE-Revere Natural Gas (FCG)

Market Vectors Steel (SLX)

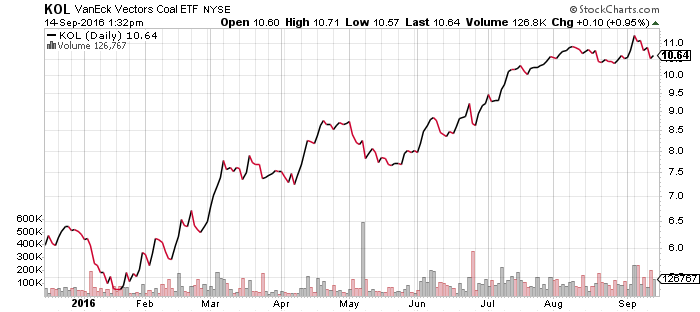

Market Vectors Coal (KOL)

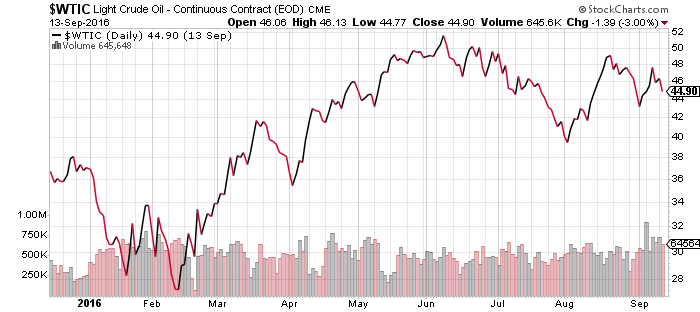

West Texas Intermediate Crude fell over the past week. The Energy Information Administration recently stated domestic crude oil demand was overstated, and it revised its data to show larger exports. This also helps explain the stubbornly high inventory in the United States, which has kept oil prices suppressed. Oil inventory fell last week, but the inventory of refined products such as gasoline increased, pointing to lower crude demand going forward.

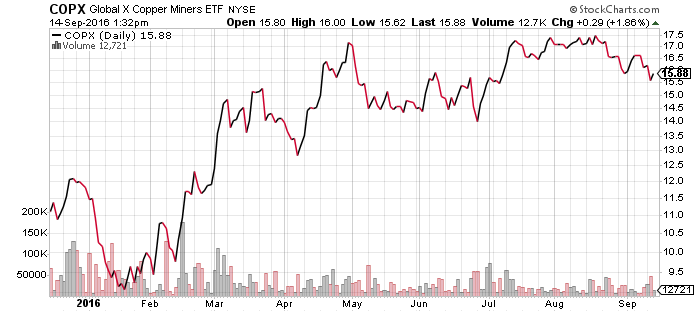

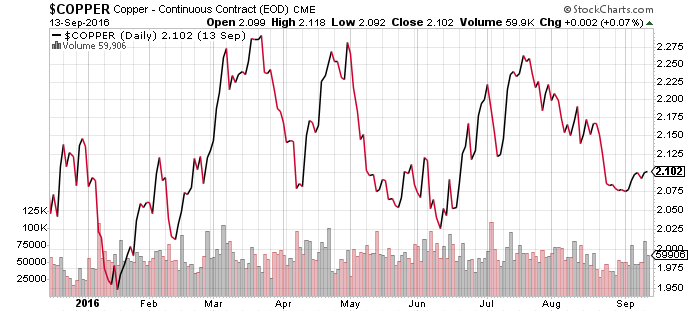

Chinese economic data was largely the same in August as in July, lending no help to commodities under pressure from rising global interest rates. While coal, steel and copper funds all pulled back, they also remain in a bullish pattern for 2016, trading close to their 52-week highs.