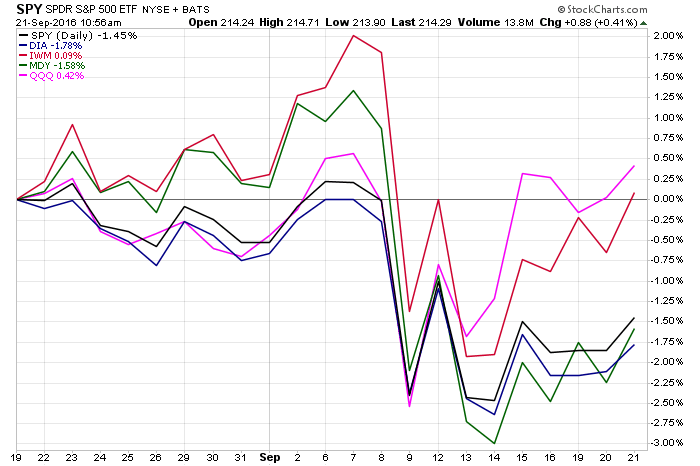

SPDR S&P 500 (SPY)

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P MidCap 400 (MDY)

iShares Russell 2000 (IWM)

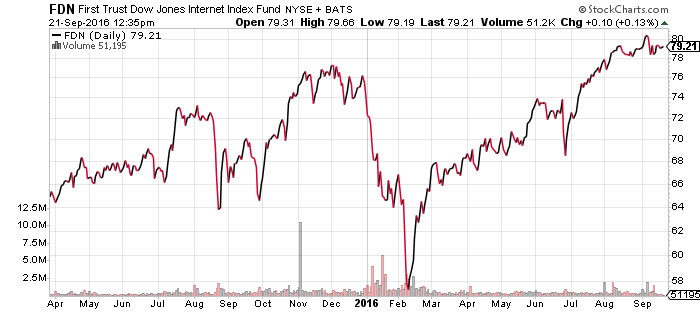

The Nasdaq and small-cap Russell 2000 Index recovered from early September losses and are positive on the month. The strength in more volatile assets generally signals bullish market sentiment.

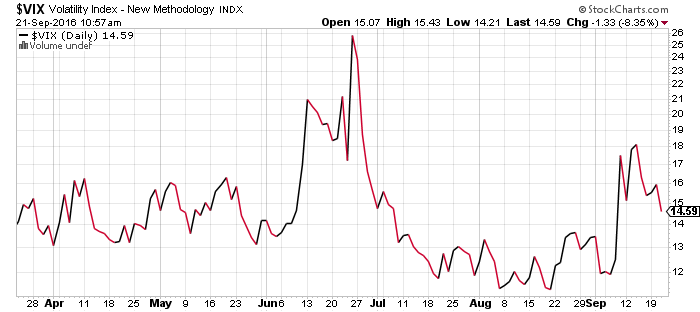

The CBOE Volatility Index also declined over the past week, back to levels seen last spring. Despite a few overseas predictions for a September rate hike, the Fed announced it would leave interest rates unchanged on Wednesday, alleviating anxiety. The VIX immediately tumbled almost a full point following the announcement.

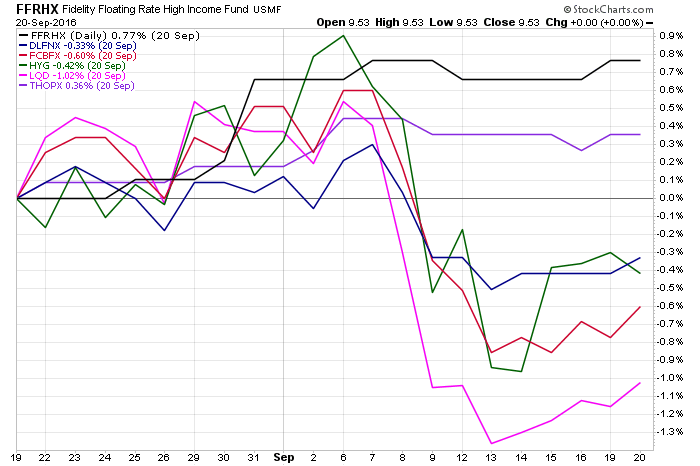

Fidelity Floating Rate High Income (FFRHX)

DoubleLine Core Fixed Income (DLFNX)

Thompson Bond (THOPX)

Fidelity Corporate Bond (FCBFX)

iShares iBoxx Investment Grade Bond (LQD)

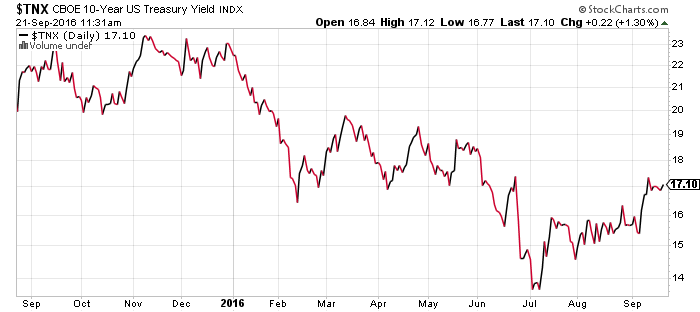

Bond yields steadied over the past week, with the 10-year Treasury yield holding around 1.7 percent. Investors took the opportunity to climb back into corporate and investment-grade bonds.

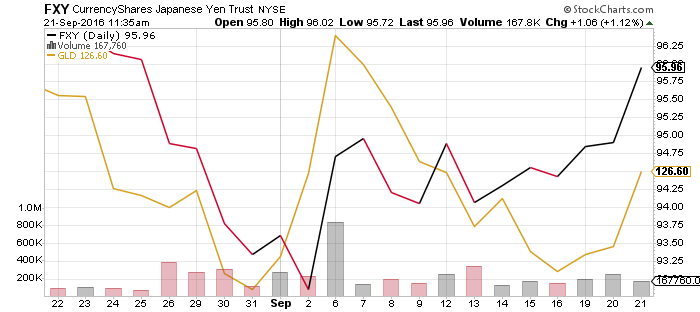

The Bank of Japan left interest rates at 0.10 percent following its meeting on Wednesday, but changed its asset buying strategy. The BoJ will try to increase long-term interest rates (in this case bonds with maturities beyond 10 years) by either increasing purchases of short-term bonds or decreasing purchases of long-term bonds.

A positive yield curve allows banks to profit by borrowing short and lending long. When the Bank of Japan cut rates below zero, however, it flattened the yield curve, making it harder for banks to profit. Financial stocks in Japan fell continuously until July of this year, when the BoJ started to signal a shift in strategy.

The market reaction was mixed. The yen strengthened, while the Nasdaq Japan Financials Index climbed 5.8 percent on Wednesday. Overall, the impact on U.S. interest rates is muted at the moment, but if Japan is able to lift longer-term bond yields, it should reduce some buying pressure from yield-hunting Japanese investors.

The 10-year Treasury yield slid in the wake of the Fed’s announcement to hold rates steady, providing another lift for bond funds.

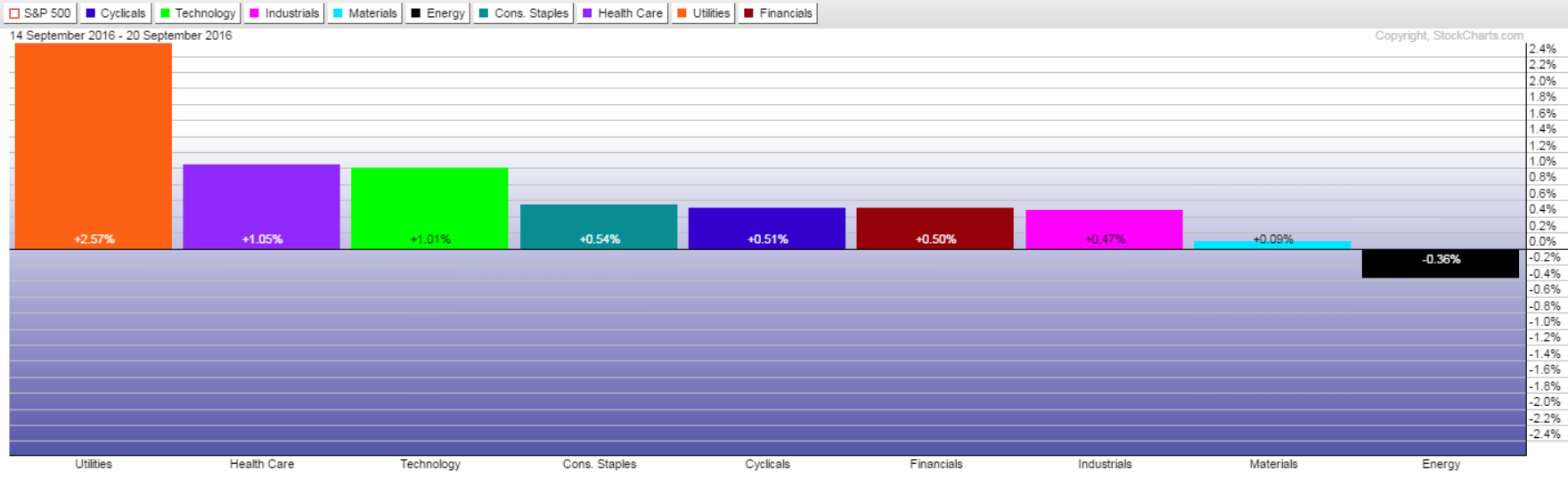

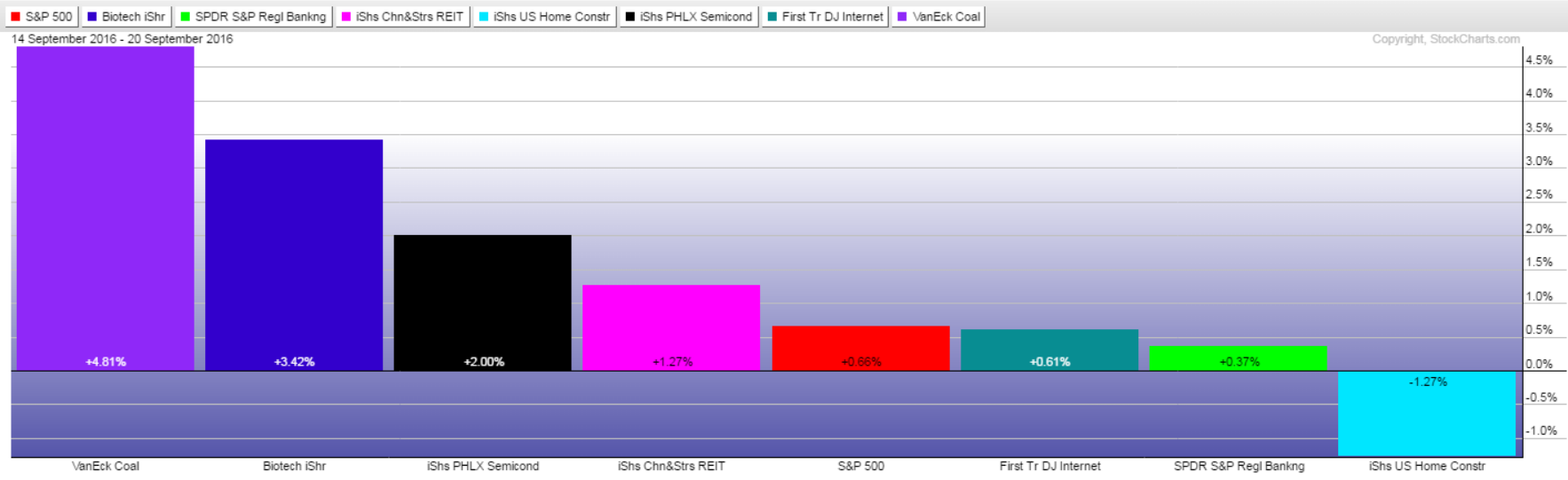

Sector Performance

Energy and oil prices fell last week, while interest rate stabilization fueled a rebound in the utilities sector. Healthcare and technology were both up about 1 percent.

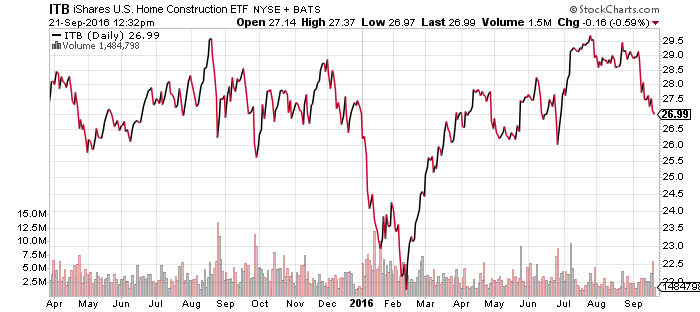

Home builders fell following disappointing earnings reports and slightly slower-than-expected housing starts in August. ITB remains locked in its trading range as a result.

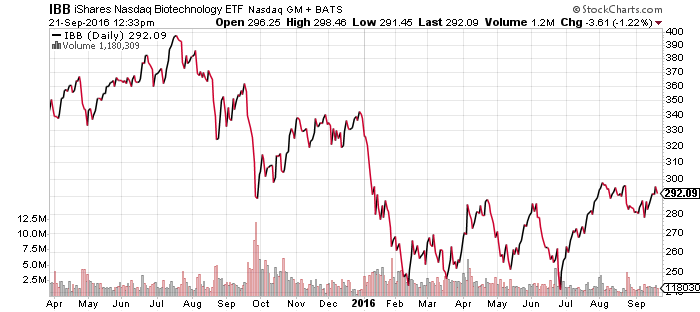

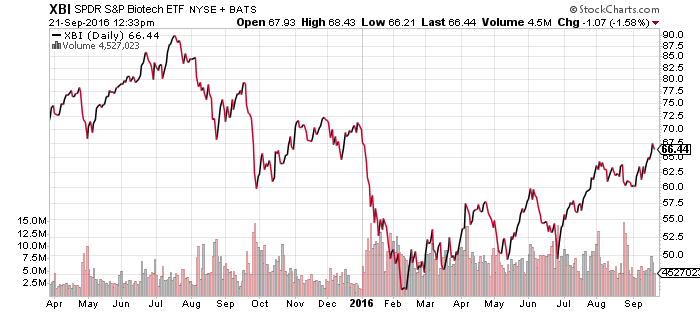

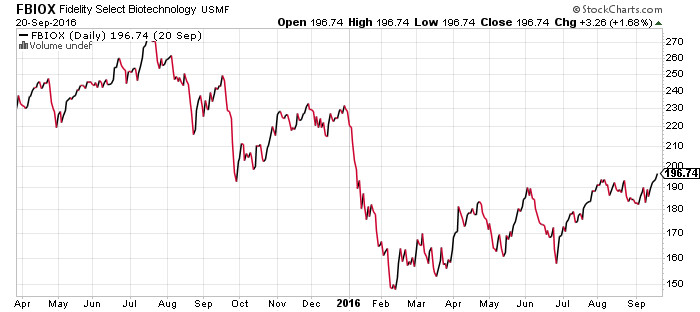

Biotechnology funds pushed to their highest levels since January last week. Both XBI and FBIOX are moving higher, but IBB is still below early August highs. Biotech has become a driving force behind the healthcare sector.

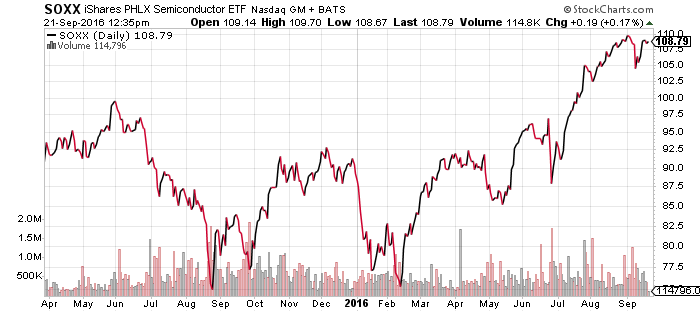

VanEck Vectors Semiconductor ETF (SMH) saw assets climb 106 percent to more than $500 million. This moved the fund’s assets under management ahead of iShares PHLX Semiconductor’s (SOXX) $483 million.

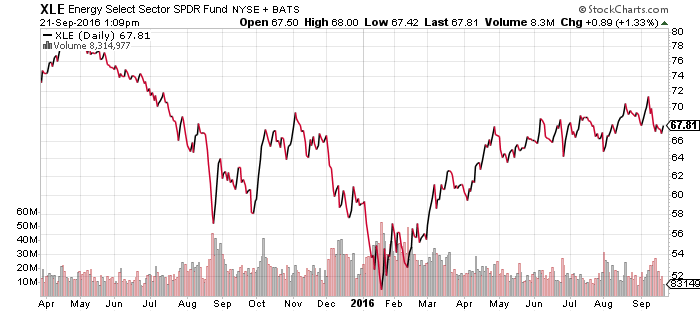

SPDR Energy (XLE)

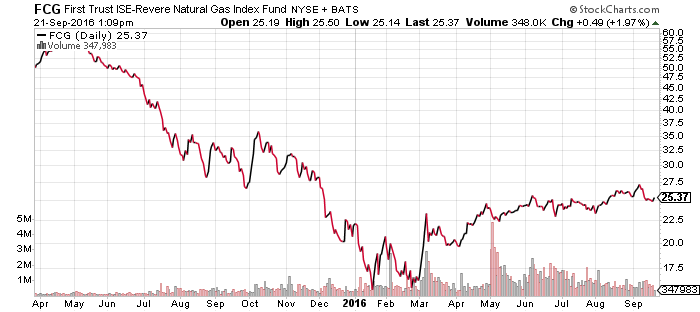

First Trust ISE-Revere Natural Gas (FCG)

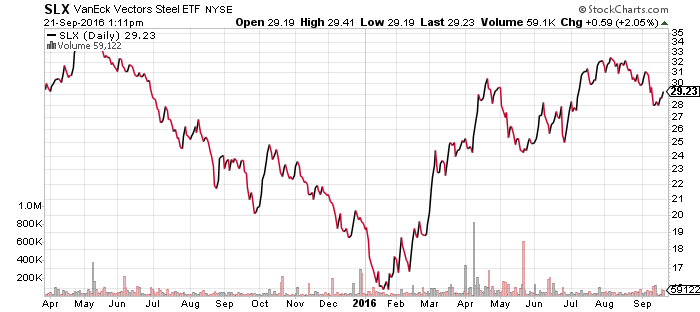

Market Vectors Steel (SLX)

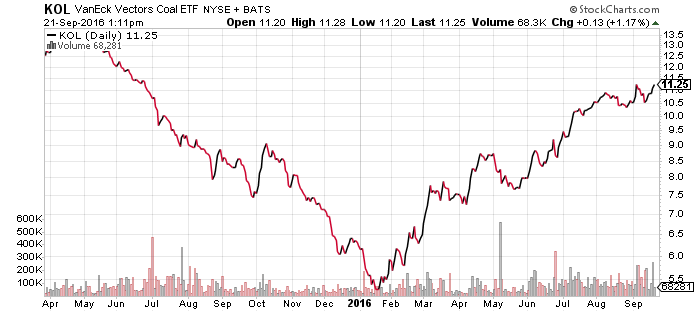

Market Vectors Coal (KOL)

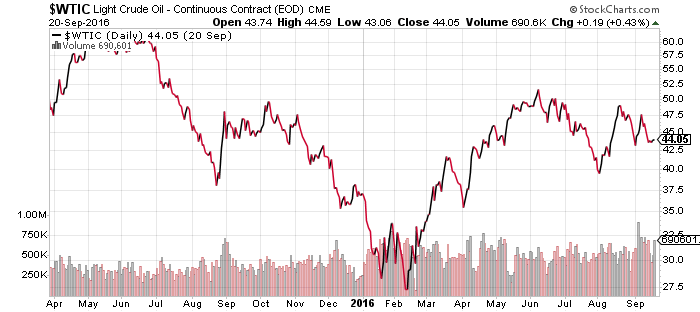

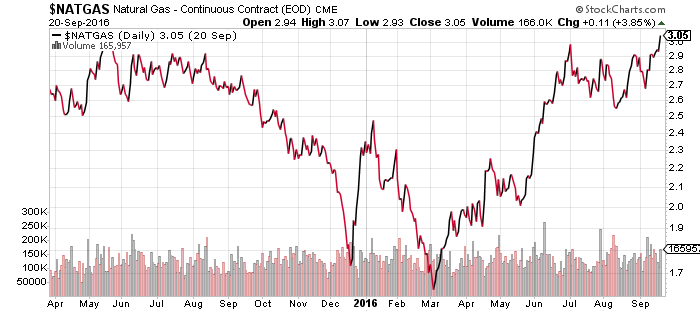

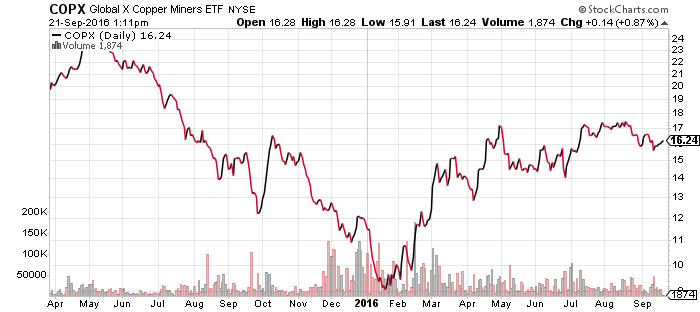

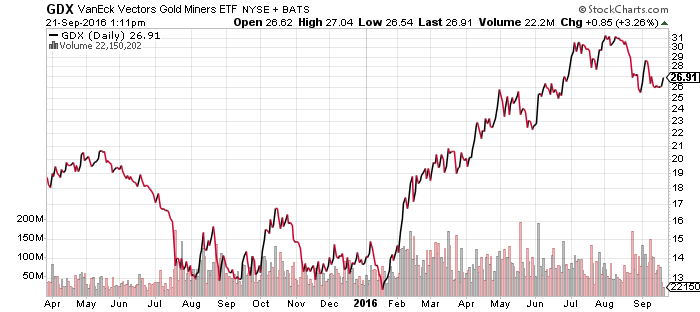

West Texas Intermediate Crude fell over the past week, while natural gas spiked to a new 52-week high. Investors bought coal and steel producers, while copper and gold miners saw smaller gains.

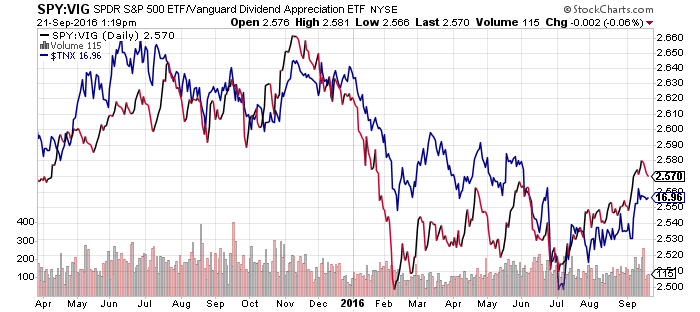

Vanguard Dividend Appreciation (VIG)

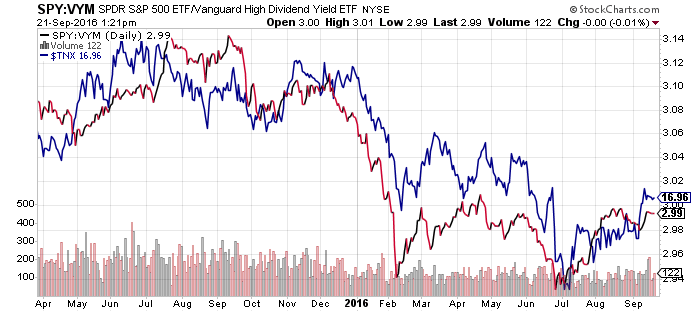

Vanguard High Dividend Yield (VYM)

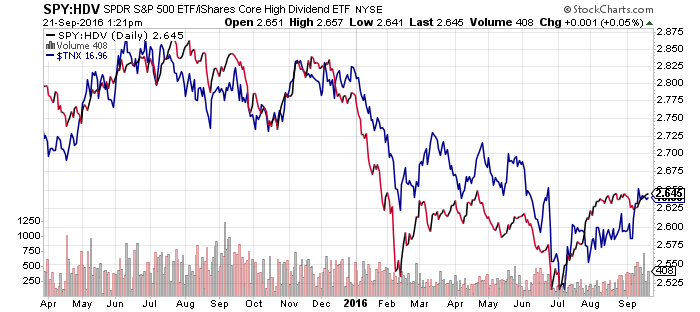

iShares Core Dividend (HDV)

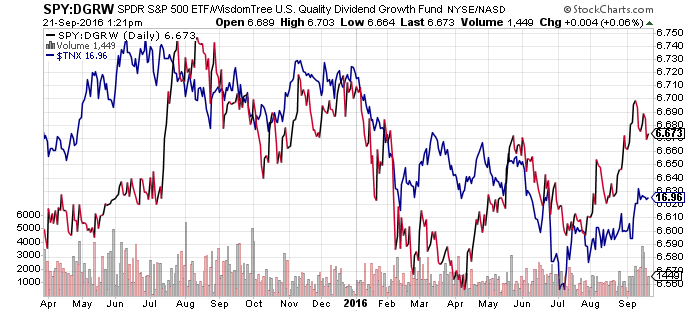

WisdomTree U.S. Quality Dividend Growth (DGRW)

SPDR S&P Dividend (SDY)

iShares Select Dividend (DVY)

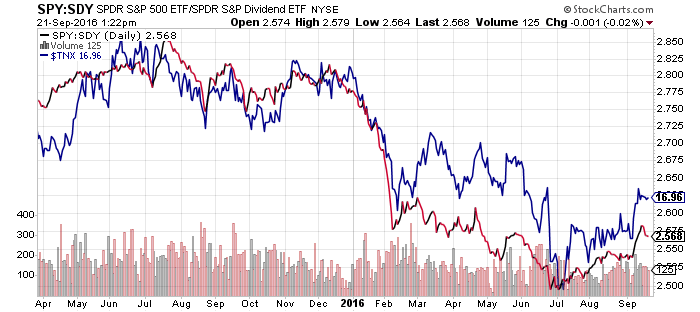

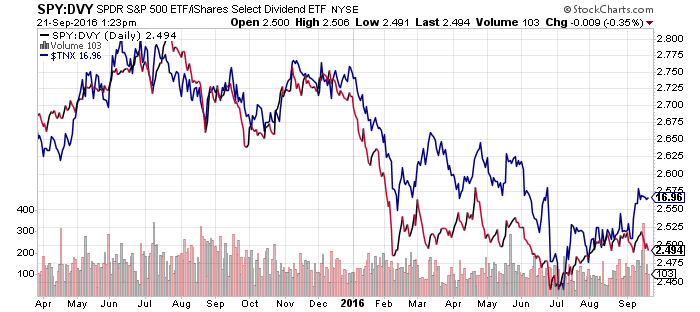

The chart below compares the price of SPDR S&P 500 (SPY) to various dividend funds, with a rising line showing outperformance by SPY. The blue line is the 10-year Treasury bond yield. Over the long-term this trend will not hold, but in the near-term, we’re likely to see a continuation of this trend.