Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The Russell 2000 Index rose 4.83 percent last week, the Nasdaq 3.45 percent, the MSCI EAFE 2.85 percent, […]

Month: January 2019

Market Perspective for January 11, 2019

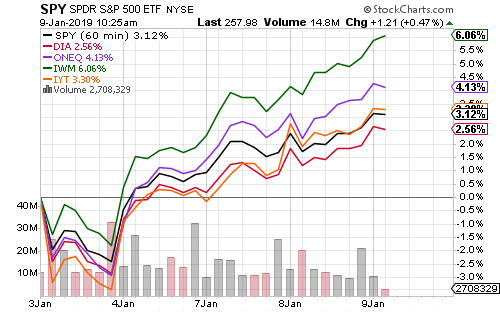

The stock market extended its rally this week. The Russell 2000 Index led the major indexes with a gain of 4.83 percent.

Industrials were the best performing S&P 500 sector. SPDR Industrial (XLI) climbed 4.71 percent. Union Pacific (UNP), General Electric (GE) and Boeing (BA) rose 11.21 percent, 8.63 percent and 7.89 percent, respectively.

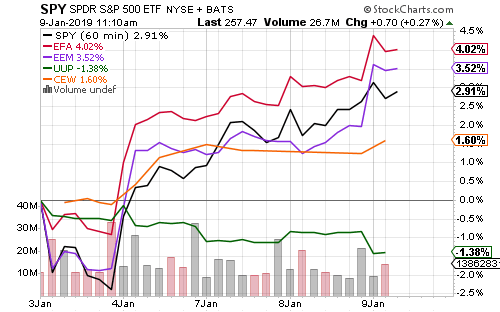

SPDR S&P 500 (SPY) rose 2.54 percent, iShares MSCI Emerging Markets (EEM) 2.61 percent and iShares MSCI EAFE (EFA) 1.89 percent.

Crude oil climbed back above $50 this week and natural gas rebounded above $3 per mmBTU. SPDR Energy (XLE) rallied 3.57 percent on the week. First Trust ISE Revere Natural Gas (FCG) advanced 6.47 percent.

The Job Openings and Labor Turnover Survey showed 6.9 million openings in November, down from 7.1 million in October, but still more than the number of unemployed Americans. Initial claims for unemployment fell back towards multi-decade lows at 216,000. Economists forecast 227,000.

Headline consumer price inflation decreased 0.1 percent in December, due to falling energy prices. Headlines inflation dipped below 2 percent for the first time since 2016 as well. Core inflation held steady at 0.2 percent.

China’s producer price index fell 1.0 percent in December and the 12-month PPI fell to 0.9 percent. Both data points signal the domestic Chinese economy is still slowing.

General Motors (GM) gained 7.03 percent on Friday after it pre-announced 2018 earnings would be stronger than expected and lifted its 2019 guidance. CEO Mary Barra said the automaker will deliver earnings between $5.80 and $6.20 per share for 2018 and between $6.50 and $7.00 in 2019. Prior to the announcement, the consensus earnings forecast for 2019 was $5.92 per share.

Lennar (LEN) and KB Home (KBH) both beat earnings estimates. KB Home gained 2.32 percent on the week and Lennar 12.62 percent.

The Investor Guide to Fidelity Funds for January 2019

The Investor Guide to Fidelity Funds for January 2019 is AVAILABLE NOW! Market Perspective: 2019 Will Be a Good Year for Equities Equities staged a major comeback in December and extended […]

ETF & Mutual Fund Watchlist for January 9, 2019

Major indexes extended their post-Christmas rallies, led by a more than 6 percent advance in the Russell 2000 through Wednesday morning.

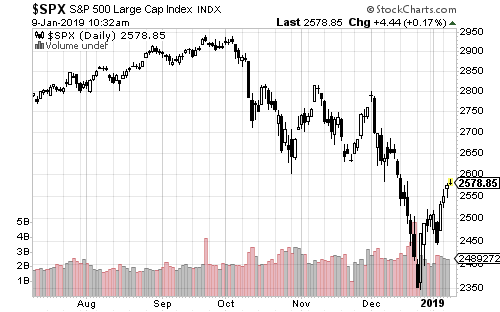

Technical traders are focused on the area between 2600 and 2650 on the S&P 500. If the index breaks those technical barriers, we could see a relative quick jump to 2800. However, a short-term pullback will likely happen. Odds favor the rally taking a breather over the next 2 weeks, creating a good buying opportunity.

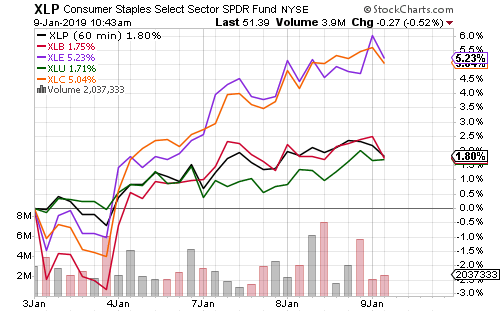

Consumer discretionary led major sectors higher this week thanks to strength in Amazon (AMZN). The online retailer became the largest company by stock market capitalization. Energy rallied as crude oil topped $50 a barrel for the first time in a month.

The U.S. Dollar Index weakened and the greenback slid versus emerging market currencies. iShares MSCI EAFE (EFA) and iShares MSCI Emerging Markets (EEM) both outperformed SPDR S&P 500 (SPY), with the difference entirely due to the weaker dollar.

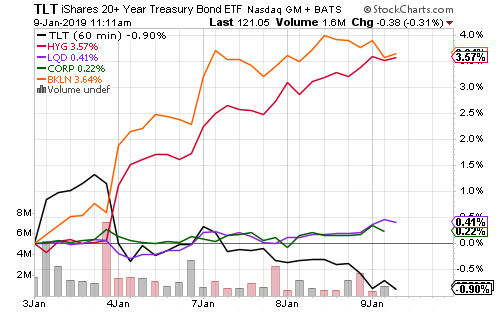

High-yield credit and floating rate funds have rallied this week. Investment grade and corporate bonds saw a small boost from the move in credit spreads. Falling bond yields accompanied rising stock prices and weighed on U.S. treasuries, with the long-term bond losing more than 2 percent from its high last week.

Market Perspective for January 7, 2019

Stocks extended their rally on Monday, led by the 1.78 percent increase in the small-cap Russell 2000. SPDR Consumer Discretionary (XLY) gained 2.27 percent, thanks to Amazon’s (AMZN) advance of 3.38 percent. Amazon became the largest stock by market capitalization. SPDR Energy (XLE) and SPDR Communication Services (XLC) climbed more than 1 percent on the day.

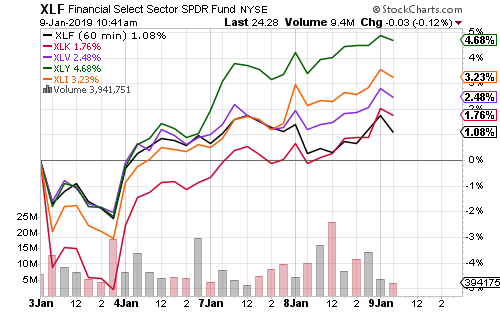

Financial market stocks fell due to a new stock market announcement. Morgan Stanley, Fidelity Investments, Citadel Securities, Bank of America Merrill Lynch, UBS, Charles Schwab, E-Trade and TD Ameritrade will co-own the new market and claim it will cut transaction costs for investors. Competitors were hit hard. CBOE Holdings (CBOE) fell 1.21 percent, IntercontinentalExchange (ICE) 3.03 percent and Nasdaq OMX Group (NDAQ) 2.61 percent.

Several Federal Reserve officials will make public speeches this week and the minutes of the December meeting will be made public on Wednesday. On Friday, Federal Reserve Chairman Powell said the Fed was listening to the markets and that policy was flexible. Stocks rallied in response. The first speaker this week, Atlanta Fed President Raphael Bostic, said he sees only one rate hike in 2019.

The National Federation of Independent Businesses will release its small business confidence index this week. The Job Openings and Labor Turnover Survey (JOLTS) for November is out on Tuesday. In October, there were a record 7.1 million job openings.

Friday brings consumer prices inflation for December. Analysts expect headline prices to decline 0.1 percent as crude oil and natural gas prices fell, but see core inflation stable at 0.2 percent.

The U.S. Dollar Index fell 0.40 percent on Monday, though the weaker dollar didn’t benefit broad international ETFs. SPDR S&P 500 (SPY) climbed 0.75 percent, iShares MSCI EAFE (EFA) 0.41 percent and iShares MSCI Emerging Markets (EEM) 0.24 percent.

Crude oil traded above $49 today before settling back at $48.67. Natural gas dipped to $2.94 per mmBTU.

Delta Air Lines (DAL) headlines a light week for earnings announcements. Analysts are looking for $1.28 per share and $5.57 for the full year. Constellation Brands (STZ), Lennar (LEN), KB Home (KBH), SUPERVALU (SVU) and Bed Bath & Beyond (BBBY) also report.