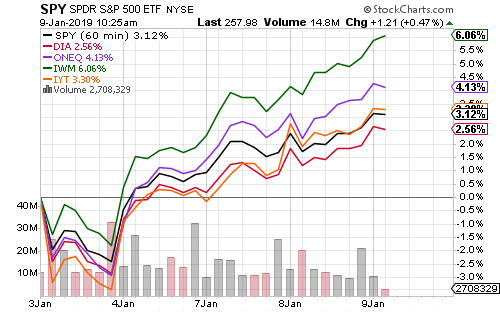

Major indexes extended their post-Christmas rallies, led by a more than 6 percent advance in the Russell 2000 through Wednesday morning.

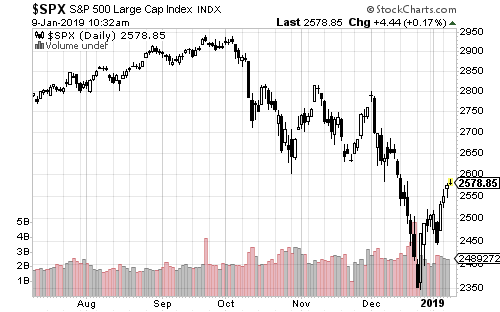

Technical traders are focused on the area between 2600 and 2650 on the S&P 500. If the index breaks those technical barriers, we could see a relative quick jump to 2800. However, a short-term pullback will likely happen. Odds favor the rally taking a breather over the next 2 weeks, creating a good buying opportunity.

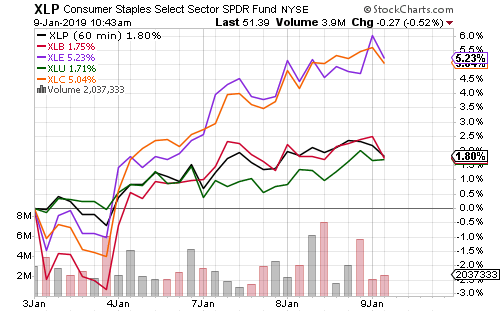

Consumer discretionary led major sectors higher this week thanks to strength in Amazon (AMZN). The online retailer became the largest company by stock market capitalization. Energy rallied as crude oil topped $50 a barrel for the first time in a month.

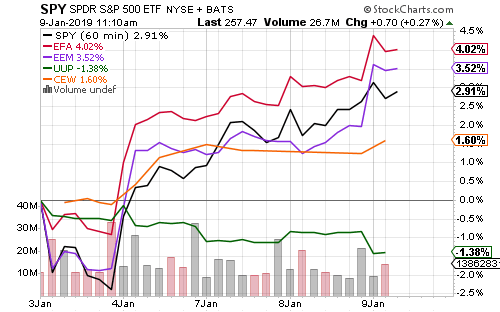

The U.S. Dollar Index weakened and the greenback slid versus emerging market currencies. iShares MSCI EAFE (EFA) and iShares MSCI Emerging Markets (EEM) both outperformed SPDR S&P 500 (SPY), with the difference entirely due to the weaker dollar.

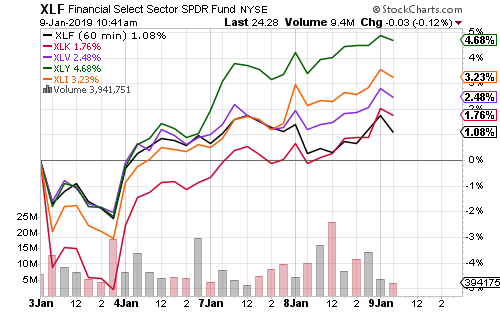

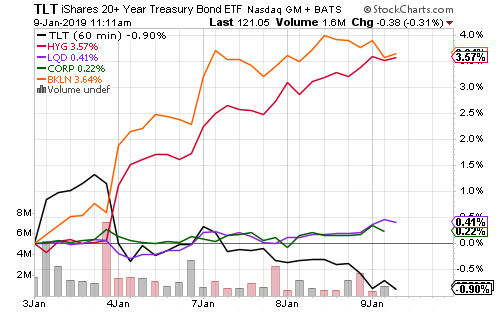

High-yield credit and floating rate funds have rallied this week. Investment grade and corporate bonds saw a small boost from the move in credit spreads. Falling bond yields accompanied rising stock prices and weighed on U.S. treasuries, with the long-term bond losing more than 2 percent from its high last week.