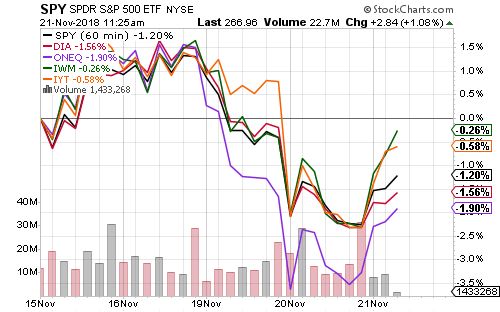

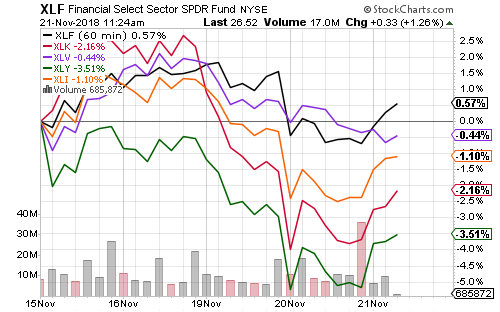

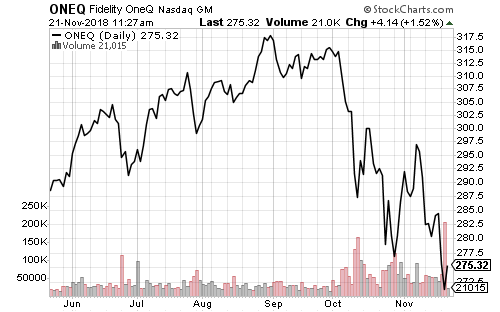

Small-caps and the Dow Transports have outperformed over the past week. Technology dragged the major indexes lower.

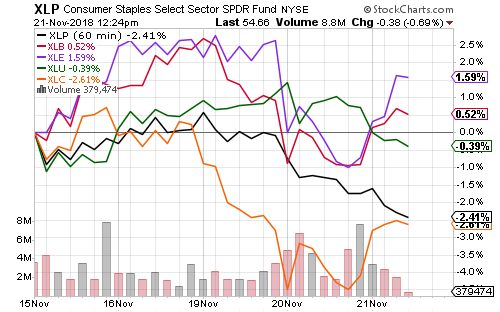

Technology weighed on consumer discretionary and communications services this week. Even though crude oil tumbled to a new low this week, energy and material stocks outperformed.

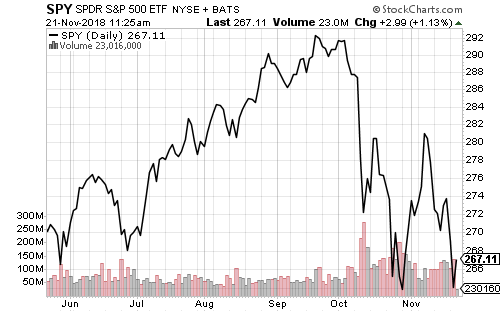

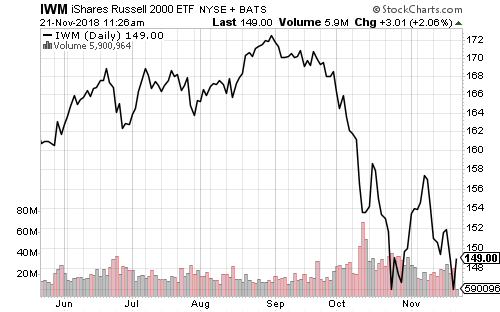

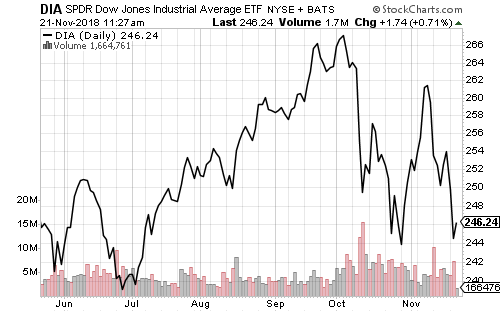

The S&P 500 Index and the Russell 2000 Index made double-bottoms on Tuesday. The Dow Industrials shows a similar pattern.

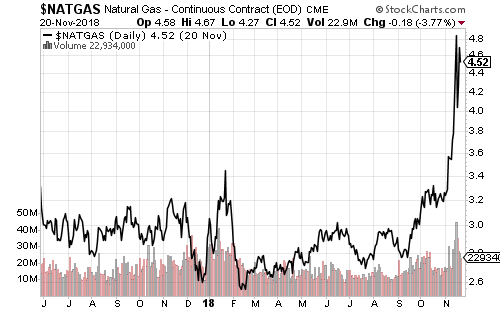

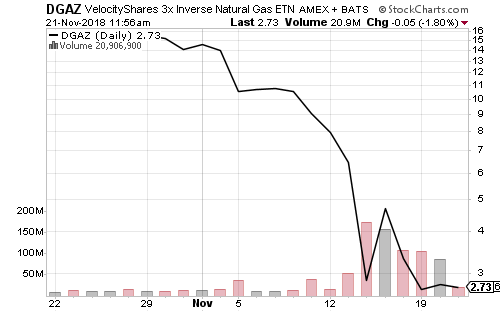

Natural gas rose above $5 before settling back. Low inventory and cold weather drove prices higher.

The spike in natural gas highlights the risk in leveraged ETFs. A triple-inverse natural gas fund lost 75 percent of its value and was at risk of going to zero had natural gas spiked even higher last Wednesday.

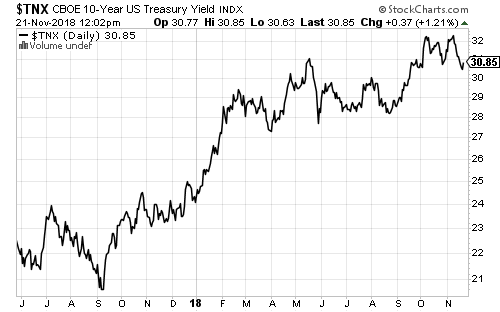

iShares 20+ Year Treasury (TLT) rallied as stocks dipped. Nevertheless, Treasury bonds remain weak.

An uptick in credit risk negatively impacted corporate bonds. PowerShares Senior Loan (BKLN) declined as investors start reevaluating rate hike expectations for 2019. They had been pricing in two hikes, but the Fed may decide to be less aggressive over the coming months.