Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The MSCI EAFE Index climbed 1.76 percent last week, the Nasdaq 1.36 percent, the S&P 500 1.16 percent, […]

Month: September 2018

Market Perspective for September 14, 2018

Technology, consumer discretionary, industrials and healthcare led the market this week. The Nasdaq gained 1.36 percent.

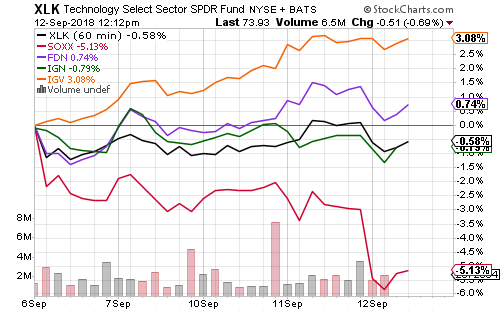

Software heavyweight Microsoft (MSFT) advanced this week, boosting iShares North American Software (IGV) 3.54 percent higher. SPDR Technology (XLK) gained 1.85 percent. Netflix (NFLX) lifted SPDR Consumer Discretionary (XLY) 1.16 percent. iShares U.S. Medical Devices (IHI) advanced 2.61 percent and heavily influenced SPDR Healthcare’s (XLV) gain of 1.06 percent. SPDR Industrial (XLI) increased 1.91 percent, despite tariff rhetoric.

The National Federation of Independent Business small business confidence index reached a new all-time high in August. The prior record was set in 1983.

Job openings rose again in July, to an all-time high of 6.9 million. Job openings have exceeded unemployed workers since April.

Inflation rose slower than forecast in August. Producer prices fell 0.1 percent and missed expectations of a 0.2 percent increase. Consumer prices increased 0.2 percent and core prices rose 0.1 percent. Both missed by 0.1 percentage points. Speculations are still betting on two more hikes this year, one later this month and another in December.

Initial claims for unemployment slumped to 204,000 last week. It’s the lowest weekly figure since December 1969. The 4-week moving average fell to 208,000.

August retail sales missed forecasts of 0.3 percent growth, coming in at 0.1 percent. Sales ex-autos were up 0.2 percent. While autos were partly responsible for the retail sales miss, the sector was also responsible for a surprise uptick in August industrial production to 0.4 percent growth. These strong reports boosted the Atlanta Federal Reserve’s GDP Now third-quarter GDP growth forecast from 3.8 to 4.4 percent.

The University of Michigan’s Consumer sentiment exceeded expectations in early September. The index had been running slightly cooler than the Conference Board’s measure and economists forecast a reading of 96.2, but it jumped to 100.8. Current economic conditions climbed with consumer expectations. Aside from a higher reading earlier this year, the last time the index was this high was back in 2004.

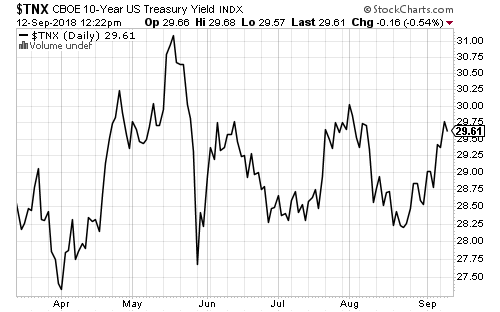

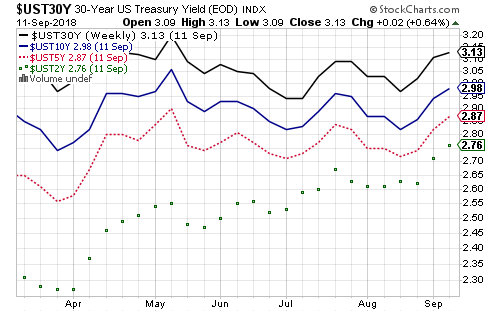

Bond yields rallied along with solid economic data this week. The 10-year Treasury traded above 3 percent for the first time in six weeks. The 5-year yield hit a four-month high. Crude oil rallied above $70 a barrel mid-week on a surprise inventory draw but gave back most of the gains. It finished at $69 a barrel.

ETF & Mutual Fund Watchlist for September 12, 2018

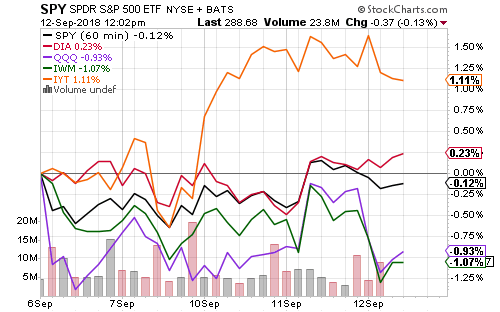

Through Wednesday, the Dow Transportation Index was holding gains of more than 1 percent and the Dow Industrials had a small increase. The Nasdaq and Russell 2000 were lower by 1 percent.

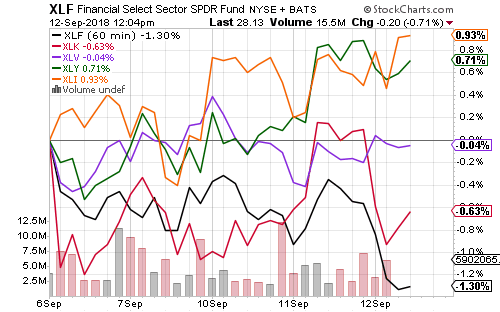

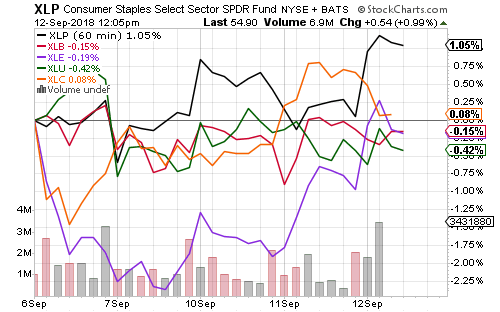

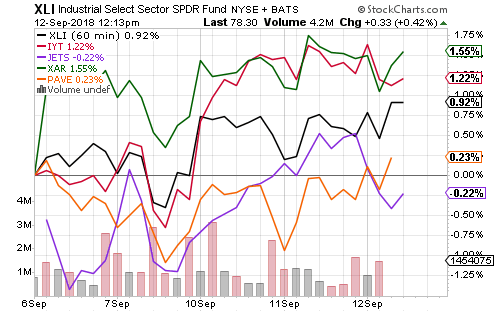

Industrials, consumer staples and consumer discretionary were the week’s best performing sectors.

Defense, transportation and materials subsectors boosted industrials ahead of anticipated hurricane damage.

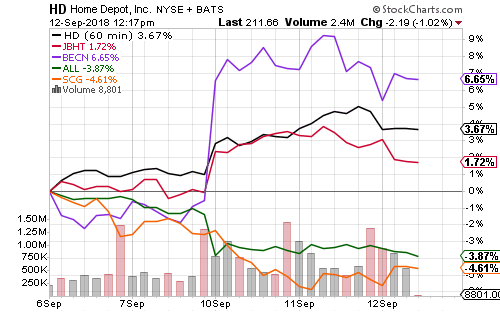

Home Depot (HD), Beacon Roofing Supply (BECN) and trucker J.B. Hunt (JBHT) have all rallied as the storm has strengthened. Insurer Allstate (ALL) and local utility Scana (SCG) slumped.

Semiconductors pulled the technology sector lower last week and offset strength in software.

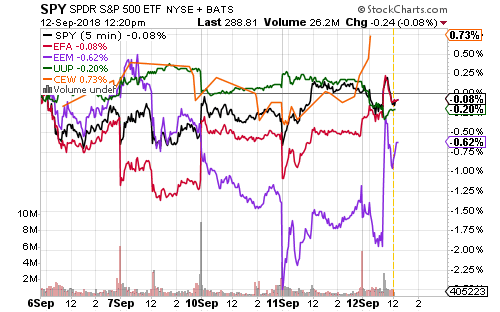

Foreign stocks rebounded sharply on Wednesday morning after reports that the U.S. may reinitiate trade talks with China. The U.S. Dollar Index weakened and the Chinese yuan jumped higher, although previous rumors have not resulted in any substantial outcomes.

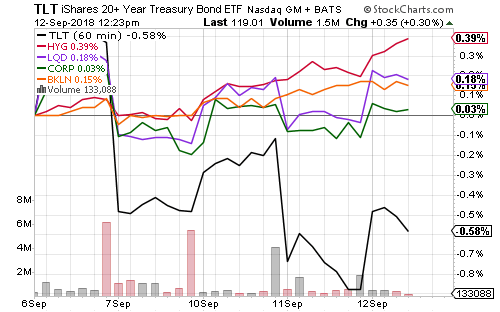

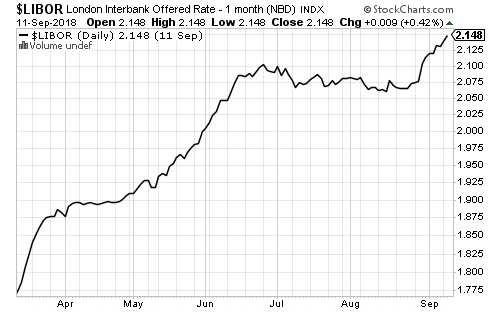

The 10-year yield rallied to near 3 percent this week, topping out at 2.98 percent. Rising yields weighed on long-term Treasury bonds, but corporate, investment grade, high-yield and floating-rate funds all moved higher. With odds of a September rate hike at 100 percent, Libor continued pricing in higher interest rates. The Federal Reserve will lift the Fed funds rate to a range of 2.00 to 2.25 percent at the September 26 meeting.

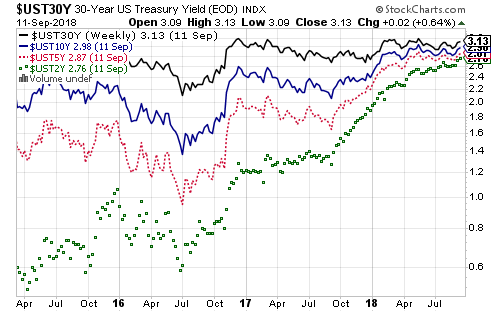

The 2-year Treasury yield was only 0.70 percent three years ago, but now sits at 2.76 percent. The 30-year yield has risen from 3.00 to 3.13 percent. The gap between the two bond yields has fallen from 2.30 percent to 0.37 percent. All of the increase has come at the short-end of the curve, a result of Fed policy.

The market started pricing in another hike in late August. Assuming the Fed also hikes in December as expected, the 2-year yield should rise to near 3 percent, if not above. The 52-week high for the 10-year yield is 3.11 percent. There has been some talk of the yield curve inverting, of 2-year Treasuries yielding more than the 10-year. With the economy on solid footing, however, the 10-year yield is more likely to breakout to the upside. Risk in the bond market remains in the long-end, while opportunity still lies at the short-end and with floating-rate funds.

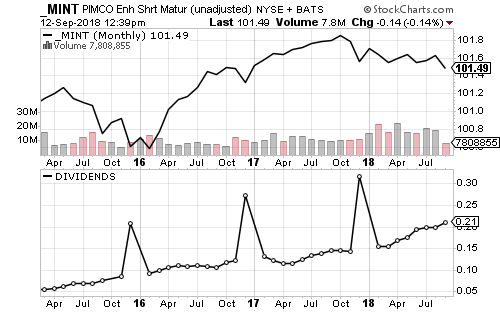

PIMCO Enhanced Short Maturity Active ETF (MINT) has steadily captured rising interest rates. MINT was paying monthly dividends of 5 cents three years ago, and now it is up to 21 cents per month. The unadjusted price of MINT has been very stable at around $100 to $102 per share. MINT’s yield has tracked with the rising yield on the 2-year treasury bond.

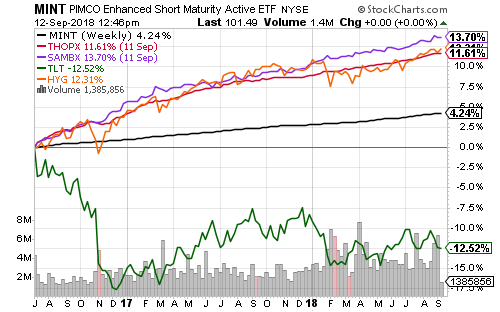

Higher yielding funds such as Thompson Bond (THOPX), iShares High Yield Corporate Bond (HYG) and Virtus Seix Floating Rate High Yield (SAMBX) have outperformed MINT. iShares 20+ Year U.S. Treasury is down since peaking in the wake of the Brexit vote.

The Investor Guide to Fidelity Funds for September 2018

The Investor Guide to Fidelity Funds for September 2018 is AVAILABLE NOW! Links to the September Data Files have been posted below. Market Perspective: Changes Coming to Sector Classifications August […]

Market Perspective for September 10, 2018

U.S. stocks moved higher on Monday with strength in industrials and consumer staples. The transportation subsector powered industrials. The Dow Transportation Index rose 1.82 percent ahead of Hurricane Florence, expected to make U.S. mainland landfall on Thursday morning.

The NOAA upgraded Florence to a category four hurricane on Monday. This storm is slow moving and gaining strength. Building supplies companies rose and Home Depot (HD) rallied more than 2 percent. Insurers slipped. Crude oil fell slightly, and natural gas gained 1 percent on Monday. Wal-Mart (WMT) also gained on the day.

The Jobs Openings and Labor Turnover Survey (JOLTS) for July will be out on Tuesday. There were 6.7 million job openings in June, more than the number of officially unemployed Americans. Wholesale inventories for July, which could affect third-quarter GDP estimates, will also be reported.

August inflation data will be out on Wednesday and Thursday. The Bureau of Labor Statistics’ PPI and CPI are forecast to rise 0.2 and 0.3 percent. Economists expect core CPI will have risen 0.2 percent.

Friday will bring retail sales and industrial production for August and the early consumer sentiment reading for September.

The Atlanta Federal Reserve will update its third-quarter GDP growth forecast tomorrow. It currently predicts 4.4 percent growth. The economist consensus is 3.1 percent.

China’s inflation data came in slightly better than expected on Monday. Chinese fixed-asset investment and industrial production is due later this week. New tariffs on Chinese imports could come as early as this week.

The European Central Bank will meet on Thursday and is expected to keep rates steady.

The U.S. Dollar Index moved lower after the British pound rallied on talk of a Brexit deal. Emerging market currencies were steady, but shares moved lower. Alibaba (BABA), top 10 holding in many emerging market funds, fell more than 3 percent after CEO and Founder Jack Ma announced plans to step down. iShares MSCI Emerging Markets (EEM) declined 0.99 percent. The weaker dollar drove iShares MSCI EAFE (EFA) 0.61 percent higher.

Earnings season has all but wrapped up. Supermarket chain Kroger (KR) will report this week, with earnings expected to fall 1 cent from a year ago to 38 cents per share.