Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The MSCI EAFE rallied 2.88 percent last week, the Dow Jones Industrial Average 2.21 percent and the S&P […]

Month: September 2018

Market Perspective for September 21, 2018

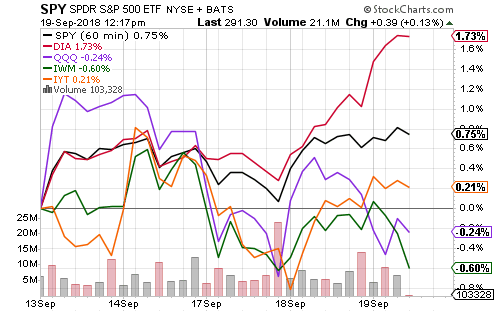

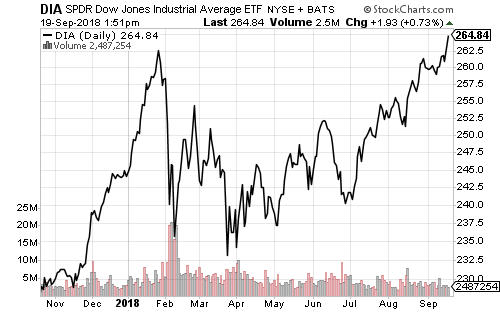

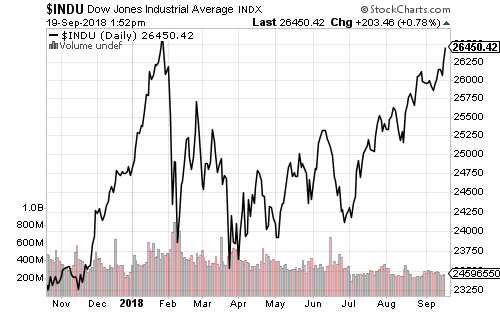

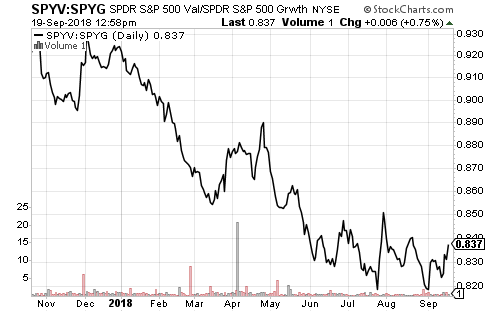

Equities hit new all-time highs this week led by a strong rebound in value sectors and the Dow Jones Industrial Average. The DJIA rallied 2.25 percent and the S&P 500 Index climbed 0.85 percent. The Nasdaq fell 0.15 percent.

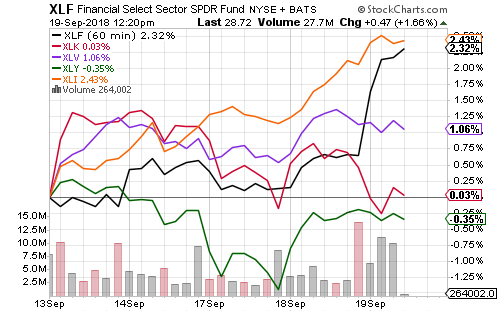

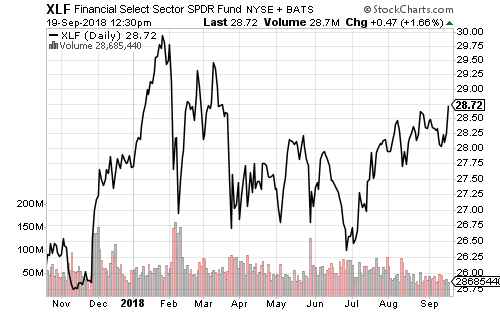

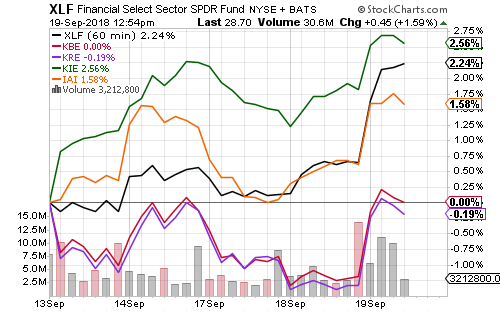

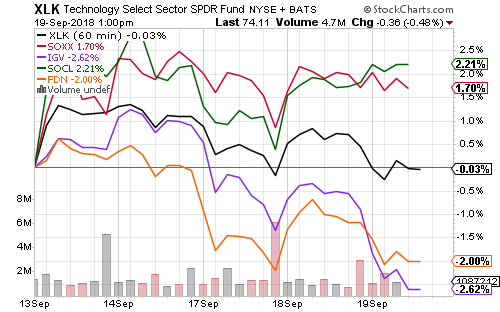

SPDR Financials (XLF) gained 2.26 percent to lead major sectors with strength in insurers. SPDR Industrials (XLI) rose 1.66 percent. SPDR Technology (XLK) lost 0.10 percent. SPDR Communication Services (XLC) rose 0.64 percent as allocations began migrating to the new sector.

Initial claims for unemployment fell to 201,000, the lowest claims total since 1969.

Homebuilder confidence for September matched August’s figure. Housing starts in August beat expectations at an annualized pace of 1.28 million. Starts have increased 6.9 percent in 2018 versus the first eight months of 2017. Existing home sales in August held at an annualized pace of 5.34 million.

The flash manufacturing PMI reflected strengthening in the manufacturing sector. Europe’s flash PMI was lower than expected.

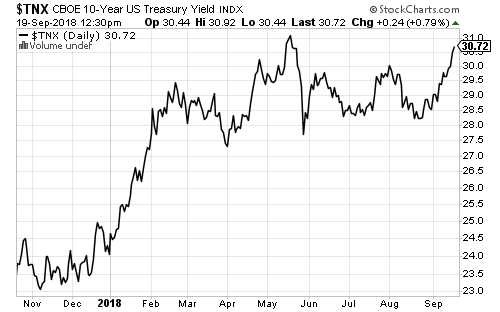

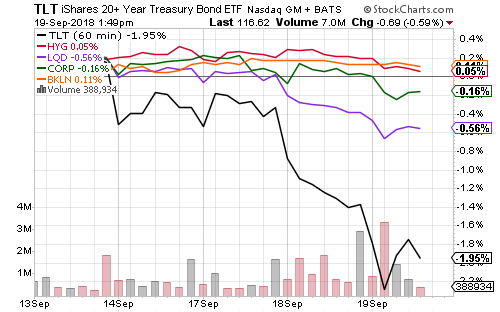

Long-term interest rates started rising ahead of next week’s rate hike. The 10-year Treasury yield hit 3.10 percent before pulling back. Floating-rate funds outperformed this week. Invesco Senior Loan (BKLN) rose 0.22 percent.

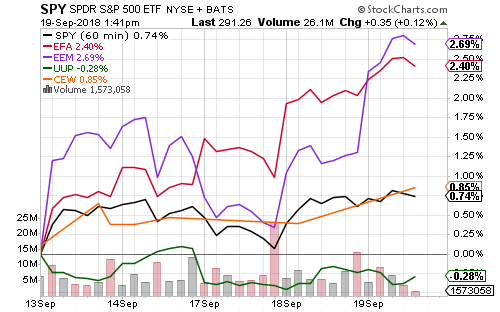

Foreign stocks rebounded strongly this week with foreign currencies. iShares MSCI EAFE (EFA) and iShares MSCI Emerging Markets (EEM) advanced 2.80 and 3.03 percent, respectively. SPDR S&P 500 (SPY) returned 0.84 percent. Invesco DB U.S. Dollar Index Bullish (UUP) slid 0.75 percent. WisdomTree Emerging Currency (CEW) gained 0.86 percent.

Earnings reports and reactions were mixed this week. FedEx (FDX) shares fell more than 3 percent on the week, while Oracle’s (ORCL) gained more than 3 percent. General Mills (GIS) sank nearly 7 percent on the week after reporting contracted margins. Shares of Micron (MU) rallied after it beat profit expectations, but general weakness in the semiconductor sector left shares nearly flat on the week.

ETF & Mutual Fund Watchlist for September 19, 2018

The past week of trading featured a rotation from growth to value as interest rates increased. The Dow Jones Industrial Average outperformed the Nasdaq by nearly 2 percentage points. This week’s rally lifted SPDR DJIA (DIA) to a new all-time high, joining the S&P 500, Nasdaq and Russell 2000 in exceeding the January high.

Industrials have been consistently strong over the past week, while financials drove Dow outperformance Tuesday and Wednesday. Rising interest rates weighed on utilities.

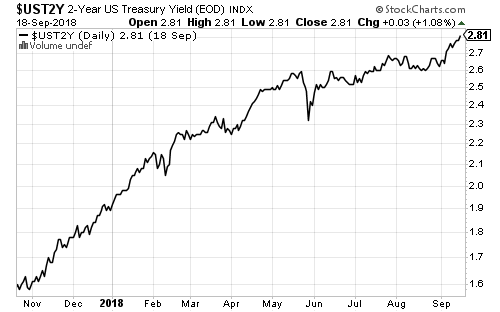

Interest rates are rising due to the likelihood of Federal Reserve rate hikes in September and December. The 10-year yield traded as high as 3.09 percent today. The 2-year yield is 2.78 percent, or roughly 0.30 percent less. The Fed funds rate is 2.0 percent. The Fed will definitely raise interest rates to 2.25 percent next week and the market expects the Fed will hike to 2.50 percent in December.

Rising interest rates lifted the financial sector to a new 6-month high today.

Insurers powered this week’s gains as weaker-than-anticipated winds from Hurricane Florence led to a rebound. Although there was devastating flooding, many homeowners do not have flood insurance. Allstate (ALL) was the most geographically exposed insurer. It has rebounded strongly since the storm weakened.

Strength in industrials and financials triggered value outperformance this week.

Internet and software stocks pulled technology lower this week.

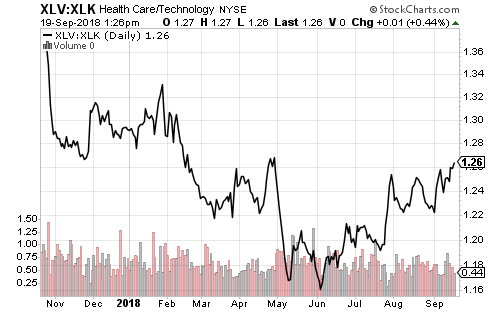

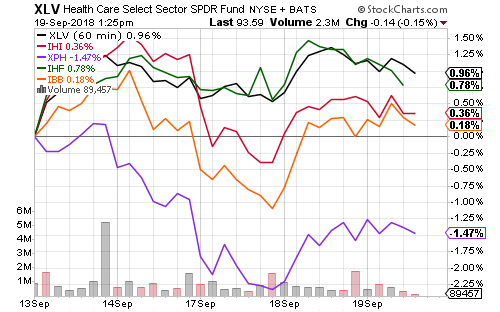

The healthcare sector is best positioned to take over market leadership. SPDR Healthcare (XLV) has been outperforming SPDR Technology (XLK) since June.

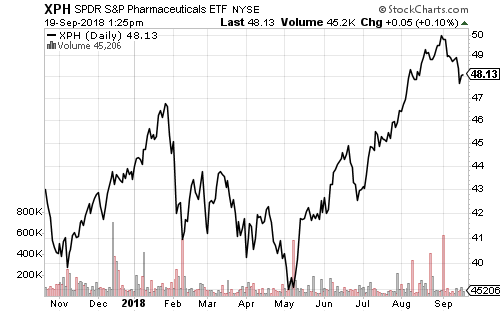

This past week pharmaceutical shares extended their weak September performance, but it’s a small pullback after a strong rally over the prior four months.

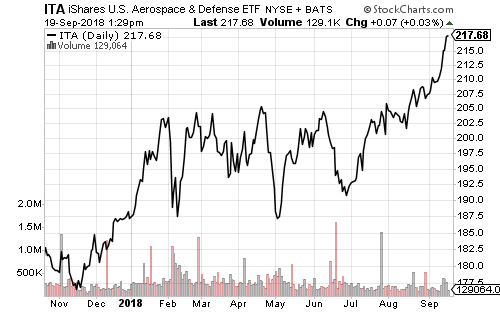

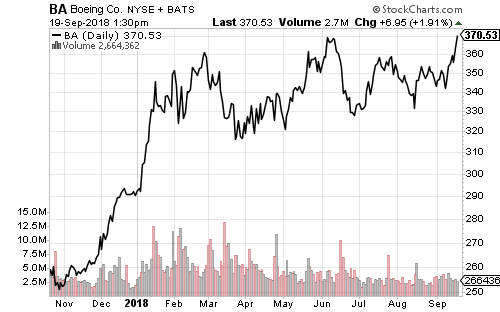

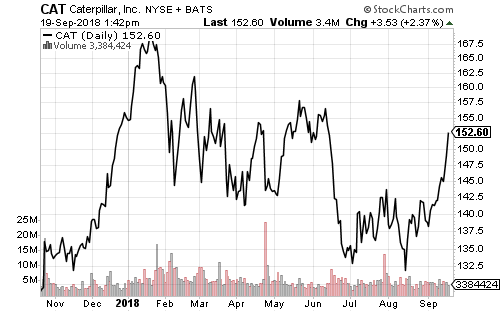

Defense and aerospace funds traded sideways from January through August as investors weighed the risk from tariffs. Boeing (BA) was the locus of concern since it sells many passenger jets to China. This week, it hit a new all-time high following the latest round of tariffs. “Tariff fatigue” is also helping industrials as stocks such as Caterpillar (CAT) rally.

Foreign stocks rallied this week as the U.S. dollar took a breather. Both emerging and developed market funds outperformed. Emerging market currencies are also enjoying some stability after a nightmarish August.

Rising interest rates sank long-term bonds this week, but high-yield and floating-rate funds remained immune.

The Investor Guide to Vanguard Funds for September 2018

The Investor Guide to Vanguard Funds for September is AVAILABLE NOW! Links to the September data files are posted below. Market Perspective: Expect Rate Hikes to Continue The divergence between domestic and […]

Market Perspective for September 17, 2018

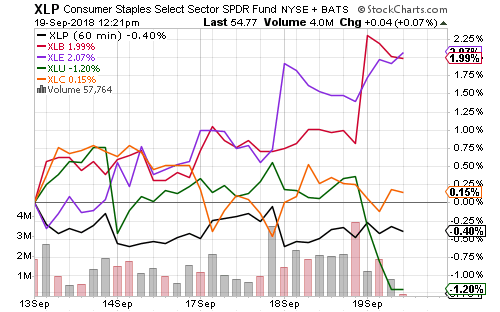

Stocks were mixed on Monday. Consumer staples, utilities and materials rose, offset by weakness in technology and consumer discretionary. The Dow Jones Industrial major index performance with a 0.35-percent decline.

SPDR Consumer Staples (XLP) gained 0.38 percent, SPDR Materials (XLB) 0.35 percent and SPDR Utilities (XLU) 0.33 percent. SPDR Technology (XLK) and SPDR Consumer Discretionary (XLY) fell 1.25 and 1.24 percent. Amazon (AMZN) weighed on consumer discretionary after news of bribes and data leaks. Employees at the firm have offered to share company data with merchants, as well as delete negative reviews, in return for cash. Twitter (TWTR) and Netflix (NFLX) were among the top-10 largest decliners on Monday. Online pharmacy Express Scripts (ESRX) and supermarket Kroger (KR) were among best performers.

Homebuilder confidence for September will be out on Tuesday, followed by August housing starts, building permits and existing home sales over the next two days. Economists are looking for a very slight downtick in homebuilder confidence, an uptick in starts, flat permits and slightly weaker home sales.

Economists also see jobless claims staying near four-decade lows at 208,000. Last week’s 204,000 initial claims brought the 4-week moving average to its lowest point since December 1969.

Flash manufacturing PMIs are due at the end of the week. The key figure to watch will be Europe’s PMIs relative to the U.S. because it will impact currency markets. The euro rallied versus the dollar last week after European Central Bank President Mario Draghi sounded hawkish on inflation. However, some investors have grown cautious over signs of slowing European growth. Europe’s manufacturing PMI was higher than the U.S. figure for all of 2017, but fell below the U.S. PMI in 2018. The shifting pace of growth in both economies contributed to this year’s strength in the dollar.

President Trump will announce a new round of tariffs on China later tonight. Although there was talk of restarting negotiations, both sides have intensified their rhetoric. National Economic Council Director Larry Kudlow said the U.S. was ready to talk whenever China shows they’re ready for “serious and substantive negotiations.” Over the weekend, China’s former Minister of Finance said the country could block key exports as part of a retaliation strategy.

The 10-year Treasury yield climbed past 3 percent on Monday. It cracked 3 percent back in April and held above that level for about a month before falling back into a tight trading range between 2.80 and 3.00 percent. Rates started moving across the board in late August with a September rate hike less than two weeks away. Libor, 3-month Libor, the 2- through 30-year Treasury yields have all been climbing as investors price in that hike. December rate hike odds are above 80 percent.

Crude oil rallied above $69 per barrel in early Monday trading, but settled back to $68 later in the day.

FedEx (FDX) and Oracle (ORCL) headline an otherwise light week for earnings news. Analysts predict $3.71 per share in earnings from FedEx and $0.69 per share from Oracle. Micron (MU) will report later this week. Shares have declined nearly 30 percent since March. Autozone (AZO) and General Mills (GIS) will also report this week.