The Federal Reserve hiked interest rates as expected today. The accompanying policy statement was more optimistic than in May on the economy.

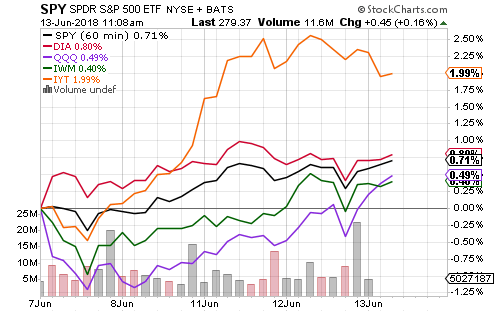

The Dow Transports outperformed this week, signaling confidence in Industrials.

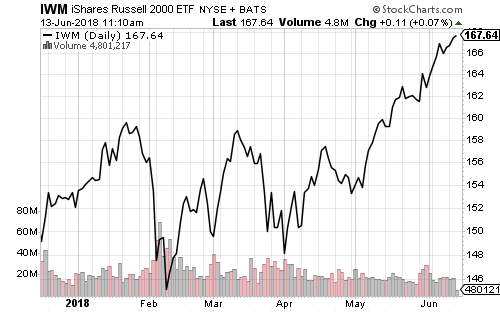

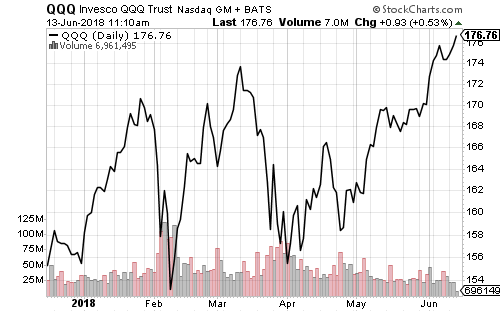

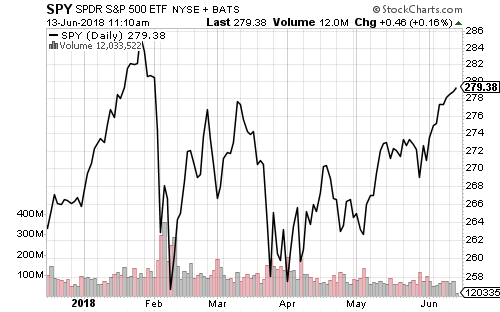

The Russell 2000 and Nasdaq hit new all-time highs, while the S&P 500 Index climbed above its March high.

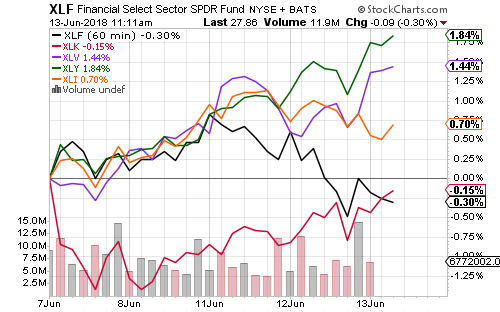

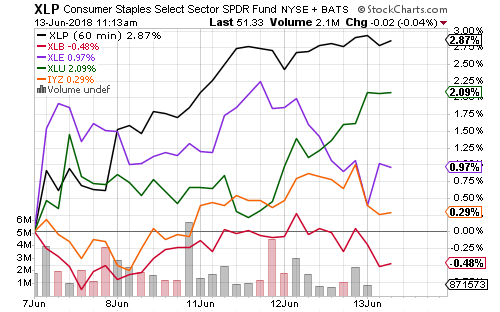

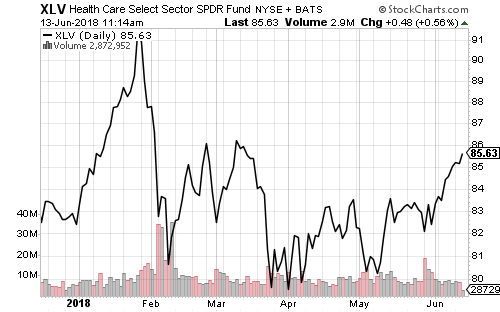

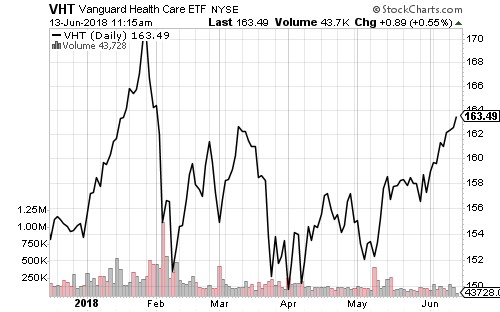

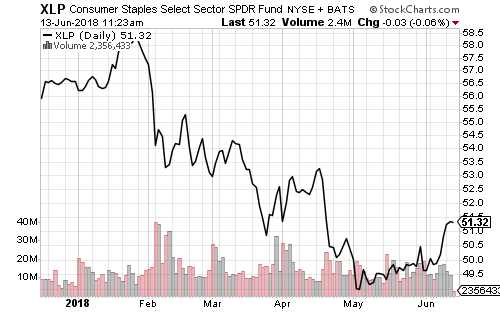

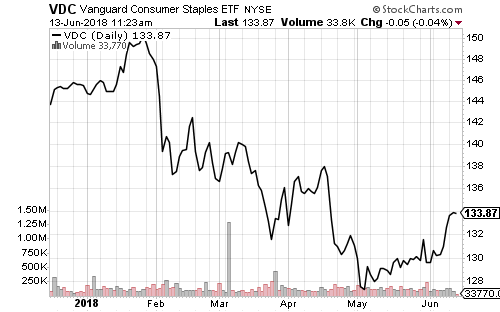

Consumer discretionary, consumer staples and utilities led the S&P 500 higher this week. Healthcare extended its rally.

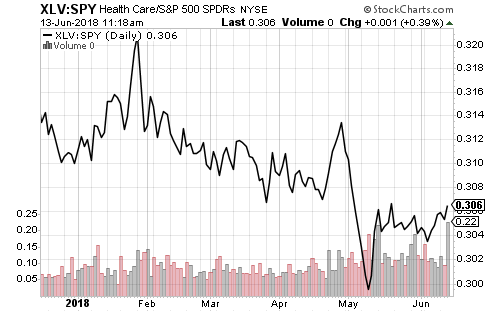

SPDR Healthcare (XLV) is below its March high, but a 4-percent advance would take Vanguard Healthcare (VHT) to a new high.

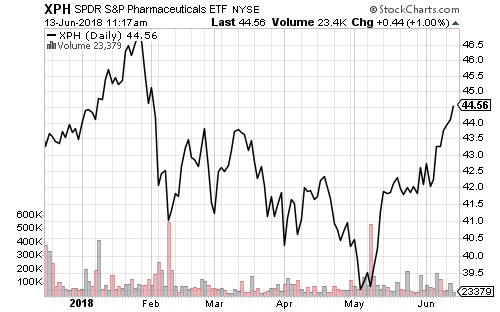

Pharmaceuticals weighed on the Healthcare sector until its bottom in May. Since joining the advance, however, the overall sector has outperformed the S&P 500 Index.

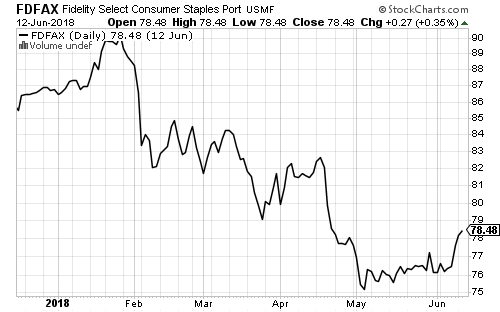

Consumer staples experienced a strong rally over the past week. It is still in a downtrend for the year, but it could break out in the coming week. The SPDR (XLP) and Vanguard (VDC) ETFs are 14 and 12 percent below the January highs. Fidelity Select Consumer Staples (FDFAX) is nearly 15 percent off its high for the year.

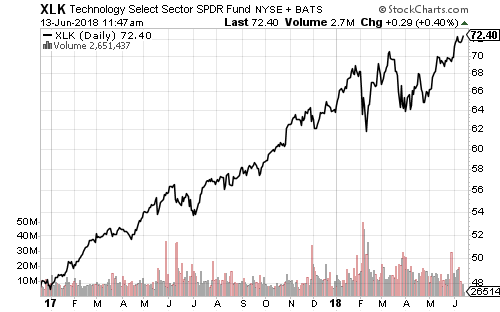

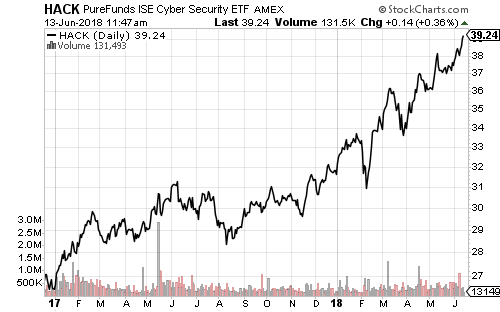

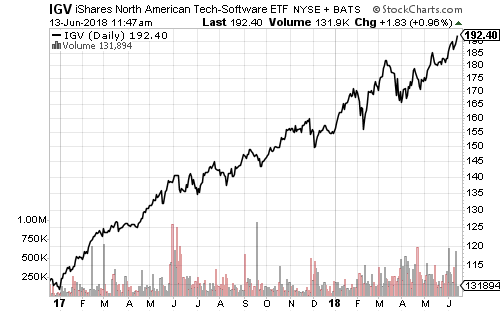

Technology continues to perform well. Software and cybersecurity subsectors have powered through volatility in 2018. As long as subsectors perform well, technology will maintain its spot as market leader.

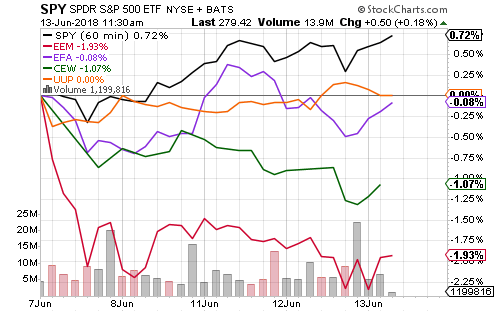

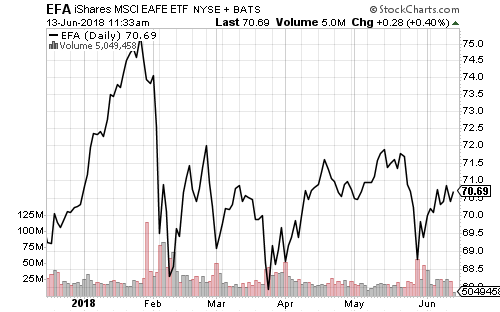

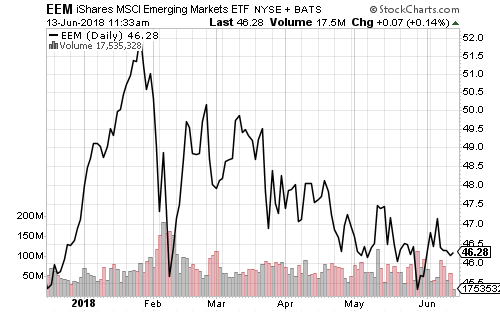

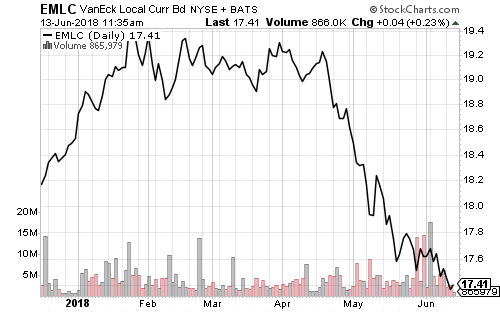

Emerging and developed markets have underperformed in the past week. A flat U.S. Dollar Index and weaker EM currencies weighed on EM stocks. Local currency EM bond funds fell to a new 52-week low on Tuesday.

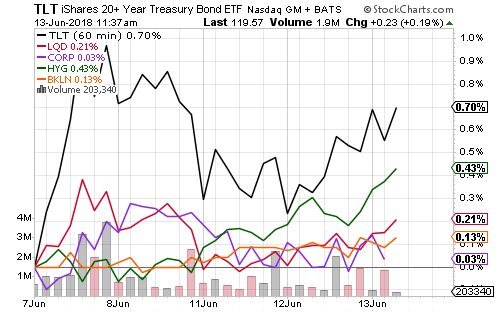

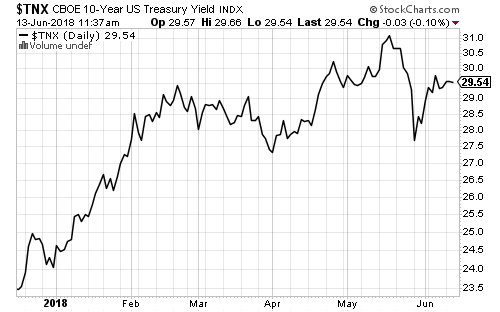

The Federal Reserve raised the Fed funds rates by 25 basis points today, to a range of 1.75 to 2.00 percent. Bonds have rallied all week as long-term interest rates were flat to lower. Government, high-yield, corporate and floating-rate funds all moved higher.

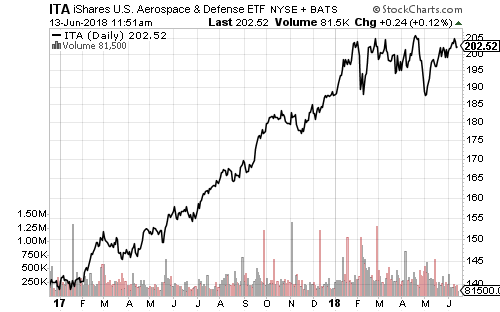

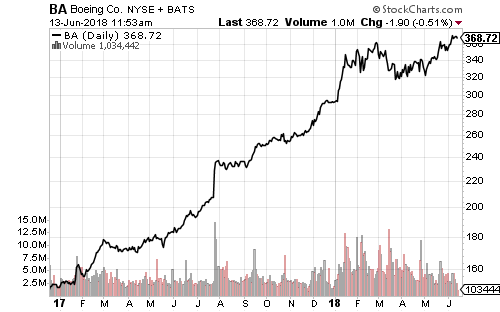

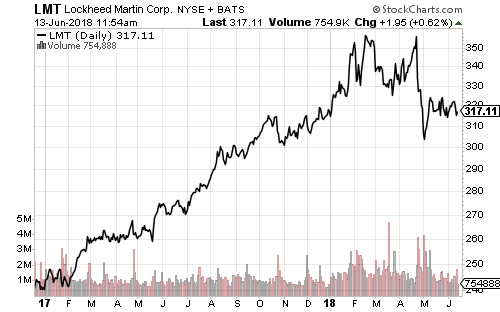

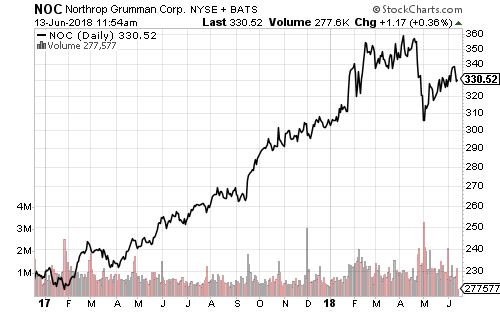

Defense stocks stabilized in 2018 after a strong run in 2017. Now the stocks are holding steady as fundamentals catch up with share valuations. Boeing (BA), the largest component of iShares U.S. Aerospace & Defense (ITA) is trading at a new all-time high. Defense contractors such as Lockheed Martin (LMT) and Northrop Grumman (NOC) have further to go.