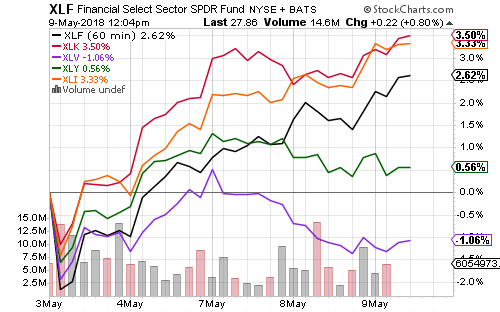

The Russell 2000 Index flirted with a new all-time high on Monday. Energy and healthcare were the strongest sectors. Utilities and real estate lost ground as traders sold rate-sensitive stocks.

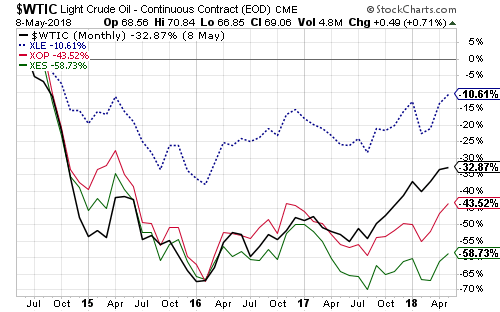

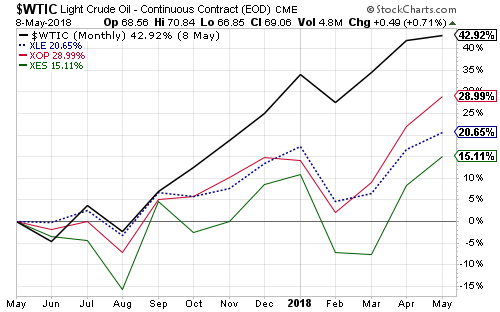

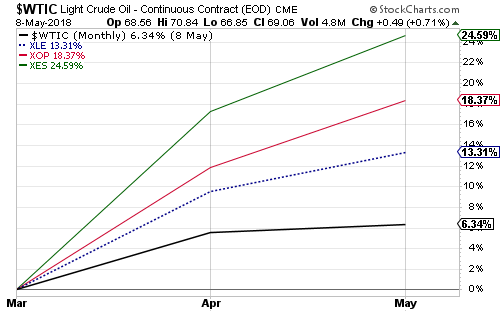

Crude oil opened the week above $70 a barrel. Bulls are looking for a rally past $73.25, an advance that would open up triple-digit price targets for the bulls.

Analysts forecast a 0.3-percent increase in April retail sales and a 0.5-percent rise in sales ex-autos.

April industrial production is expected to rise 0.6 percent. Economists see weekly jobless claims at 215,000, close to last week’s 211,000.

The homebuilder confidence index for May, as well as housing starts and building permits for April will be out this week.

Several Fed officials will speak this week. Congress will hold hearings on Richard Clairda, President Trump’s nominee for vice chairman at the Fed, along with Michelle Bowman, a nominee for one of the open governor seats. Both would be voting members. The odds of a June rate hike are 100 percent in the futures market.

Chinese fixed-asset investment, real estate investment, home prices and industrial production for April will be out this week. European industrial production, inflation, and first-quarter GDP, as well as Japan’s first-quarter GDP will also be out this week.

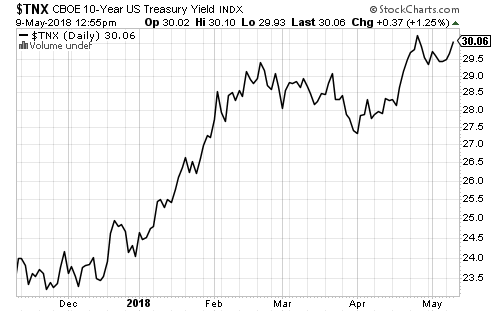

Interest rates rose on Monday. The 10-year Treasury traded at 2.99 percent, the 30-year at 3.12 percent. Short-term rates such as one- and three-month Libor, along with the 2-year Treasury, have held steady for several weeks. With the Fed expected to raise rates in less than a month, short-term rates could begin rising this week.

Home Depot (HD) will also report earnings; analysts are looking for $2.06 per share, an increase of 23 percent over last year. Cisco (CSCO) is expected to deliver 9 percent earnings growth.

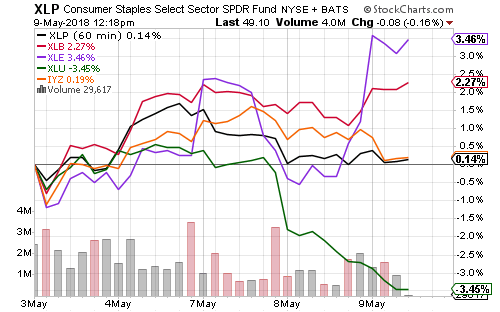

Retail earnings will include Macy’s (M), J.C. Penney (JCP), Children’s Place (PLCE) and Nordstrom (JWN). Campbell Soup (CPB) and Deere & Co. (DE) will also report this week.

Analysts forecast 13 percent earnings growth for Wal-Mart (WMT) this week.