The Investor Guide to Fidelity Funds for April 2018 is AVAILABLE NOW! Links to the April Data Files have been posted below. Market Perspective: Labor Rates Continue to Improve The Russell […]

Month: April 2018

Market Perspective for April 6, 2018

Equities were choppy this week, with indexes gaining roughly 5 percent off their Monday lows, but closing lower on Friday as trade rhetoric escalated. Companies most exposed to potential Chinese retaliation such as Boeing (BA) and Caterpillar (CAT) declined sharply.

Smaller S&P 500 sectors saw marginal losses of less than 1 percent this week. SPDR Energy (XLE) declined 0.09 percent to lead major sectors. Consumer discretionary also fell less than 1 percent. Weakness was concentrated in financials, technology, healthcare and industrials. SPDR Technology (XLK) fell 2.09 percent.

Economic data was strong this week. March manufacturing PMIs eased slightly from prior month levels, signaling robust expansion. February construction spending increased from a flat January. Auto sales beat expectations handily and increased to an annualized pace of 17.5 million vehicles. Factory orders increased 1.2 percent in February. The March ADP employment report and the services PMIs were all positive.

Weekly jobless claims hit 242,000 last week, but still near four-decade lows. The strengthening U.S. economy caused the trade deficit to expand to $57.6 billion in February. Employers added 103,000 employees in March. February’s new job total was revised significantly higher to 326,000. The unemployment rate held steady at 4.1 percent and average hourly earnings increased 0.3 percent, in line with forecasts.

China fired another shot at major U.S. exports. China buys 70 percent of soybeans sold in international markets and relies on U.S. imports to feed its livestock. The U.S. new tariffs on as much as $100 billion in Chinese imports, in addition to the previously announced $60 billion.

Despite volatile trade rhetoric from China and the United States, the U.S. dollar edged higher on the week. SPDR S&P 500 (SPY) declined 1.31 percent. iShares MSCI EAFE (EFA) slid 0.43 percent. iShares MSCI Emerging Markets (EEM) slid 2.51 percent and WisdomTree Emerging Currency (CEW) declined 0.71 percent. iShares China Large-Cap (FXI) slid 2.75 percent. China is South Korea’s largest trading partner. iShares MSCI South Korea (EWY) decreased 3.02 percent on the week.

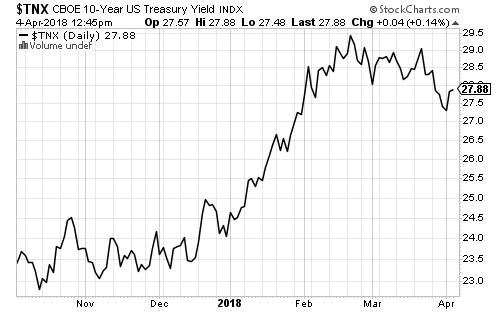

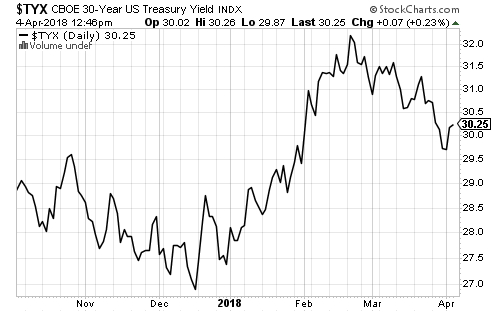

Long-term bond yields increased this week on strong economic data and rebounding equities. The 10- and 30-year treasury yields rose to 2.78 and 3.02 percent. Short-term rates also climbed as rate hike expectations stabilized.

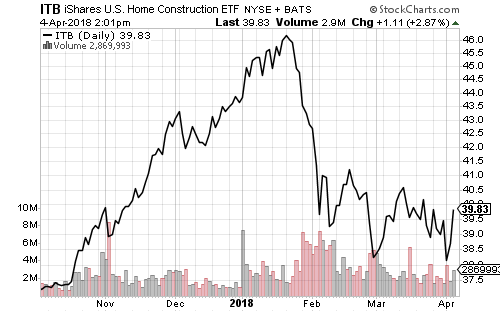

Lennar (LEN) crushed earnings forecasts this week and shares rallied more than 10 percent. iShares U.S. Home Construction (ITB) increased 1.85 percent. Monsanto (MON) missed earnings and revenue estimates, but positive guidance lifted shares. VanEck Agribusiness (MOO) slipped 1.97 percent.

ETF & Mutual Fund Watchlist for April 4, 2018

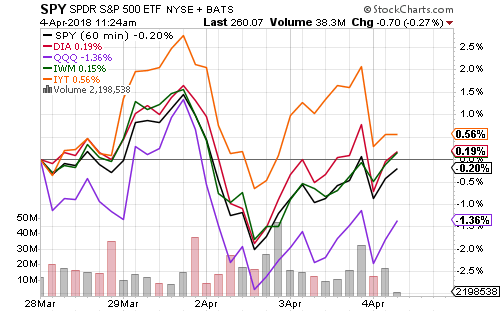

Equities moved into the black on Wednesday, solidly rebounding from Monday’s losses. The Dow Transports, Dow Industrials, and the Russell 2000 led index performance, while the Nasdaq lagged.

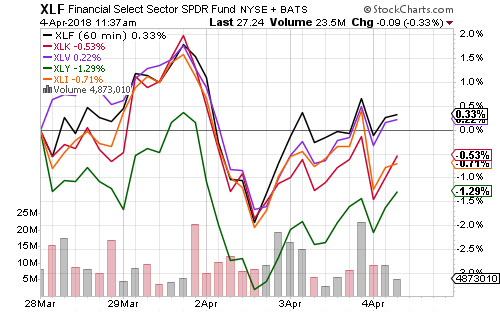

The financial and healthcare sectors led the market this week. Consumer discretionary’s 20 percent weighting in Amazon (AMZN) weighed on performance.

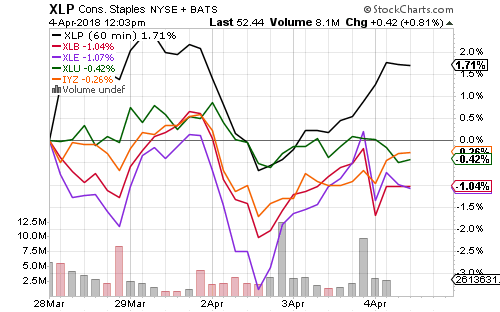

Consumer staples staged an impressive rally this week, outperforming other sectors by more than 1 percent.

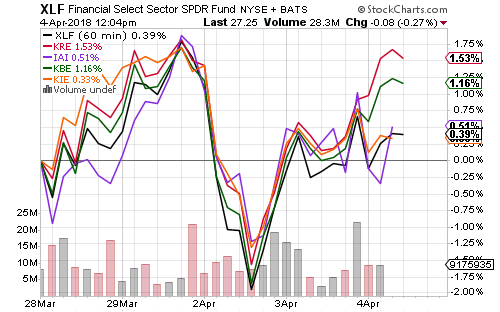

Small and regional banks pulled the financial sector higher this week as Congress moved closer to passing bank deregulation.

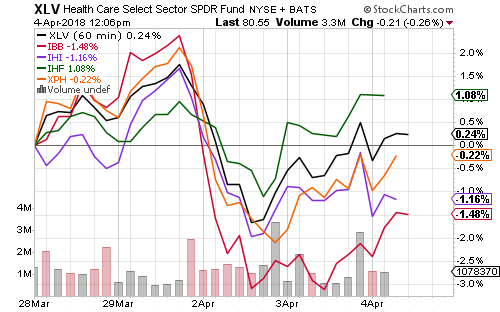

Providers led healthcare over the past week, while biotechnology was pulled lower by the general trend in the Nasdaq.

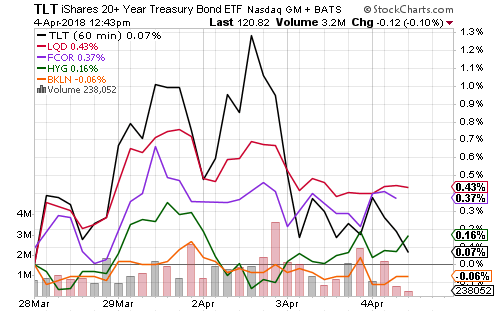

Long-term interest rates dipped this week, lifting bond prices. Credit risk also eased slightly, helping the corporate and high-yield sector. Investment-grade and corporate bonds enjoyed the best performance, while floating-rate funds saw a small decline.

The 30-year Treasury bond yield slid below 3 percent on the week before bouncing. The 10-year held above 2.7 percent. Both have remained in short-term downtrends since peaking in February.

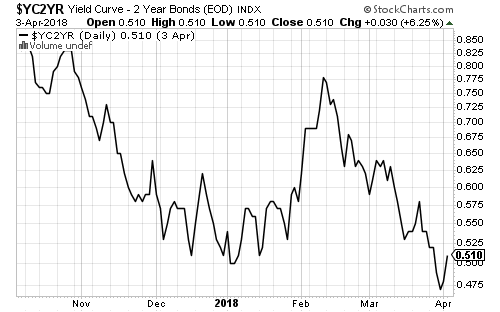

Long-term bonds declined this week, but short-term rate expectations held steady. This week’s job report could be very important for the bond market. The ADP employment report showed 241,000 new jobs in March. Economists expect the Bureau of Labor Statistics will report 175,000 new jobs on Friday. They also see the unemployment rate falling from 4.1 to 4.0 percent.

The U.S. Dollar Index has been in consolidation for two-and-a-half months. Despite fears of a trade war, the dollar has moved towards the upper end of its trading range. The level to watch on PowerShares DB U.S. Dollar Index Bullish (UUP) is $23.75.

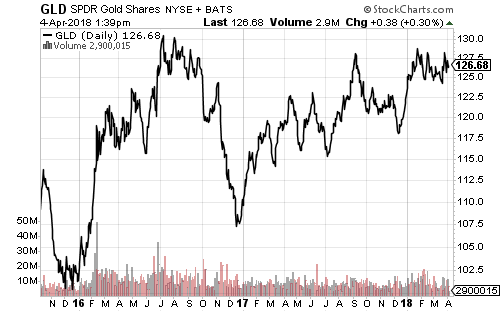

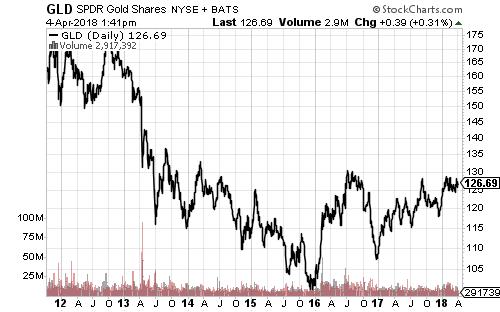

Gold has been falling over the past 20 months and needs around 3.5 percent to break above its summer 2016 highs.

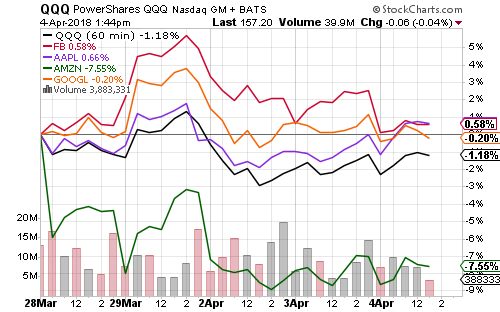

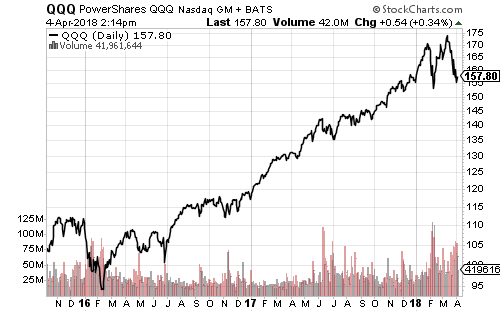

Although technology stocks have led the stock market decline since February, shares are still up from December 2017 levels.

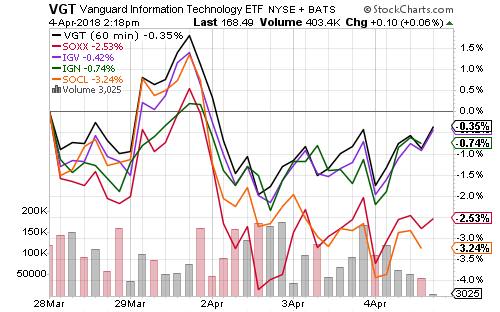

Within the technology sector, software and networking stocks saw small losses. Social media and semiconductors saw larger declines. Apple (AAPL) announced it was working on its own microprocessors, sending shares on Intel (INTC) down 8 percent on Monday before they rebounded.

iShares U.S. Home Construction (ITB) rallied on Wednesday after Lennar (LEN) beat earnings estimates. Analysts forecast $0.77 per share, but the company delivered $1.11 in earnings. Orders rose 30 percent. Revenue increased 28 percent, and beat analyst estimates by 12 percent.

Global Momentum Guide for April 2, 2018

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The Dow Jones Industrial Average gained 2.42 percent this week, the S&P 500 Index 2.03 percent, the Russell […]