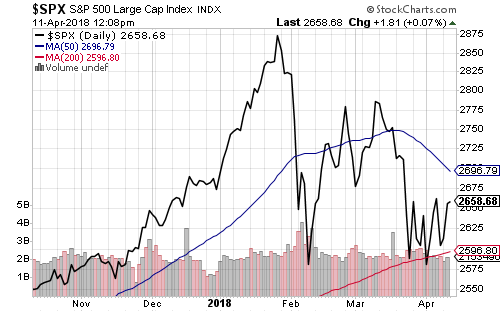

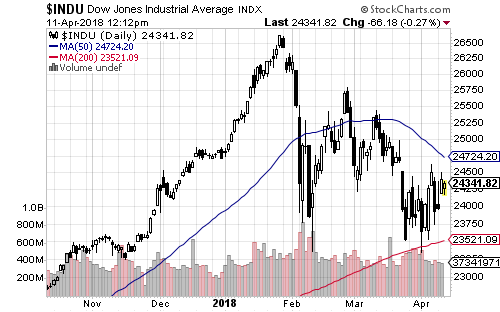

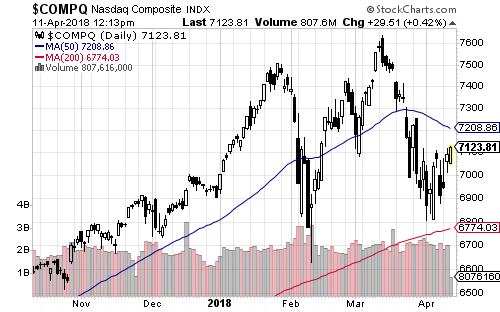

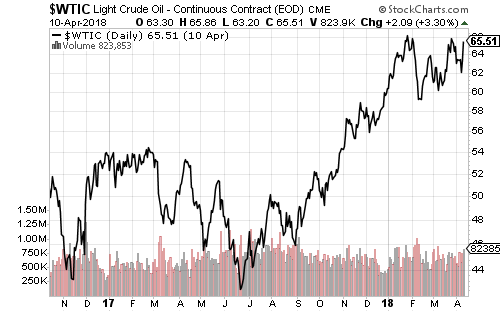

Stocks rose on Monday, led by industrials, consumer staples, energy, and materials. Crude oil declined as tensions in Syria eased.

Long-term bonds were choppy in Monday trading. Both the 10- and 30-year treasury yields have trended lower since a peak in mid-February, but are in a short-term April uptrend. The 10-year yield year-to-date high is 2.95 percent.

Retail sales for March beat expectations with the strongest auto sales since September. Auto sales rose 2 percent. Retail sales increased 0.6 percent including autos. Economists forecast 0.4 percent growth. Sales rebounded from 0.1 percent in February. Retail sales ex-autos grew 0.2 percent, matching estimates and February’s result.

The National Association of Home Builders confidence index hit 69, down from 70 last month. Homebuilders remain extremely confident (any reading over 50 signals optimism) thanks to sustained demand for new housing.

March housing starts, building permits, industrial production and capacity utilization are due on Tuesday. Economists are looking for an uptick in activity from February, with the exception of industrial production, with estimates of 0.4 percent growth in March, down from 0.9 percent.

San Francisco Fed President John Williams will become the head of the New York Federal Reserve Bank on June 18.

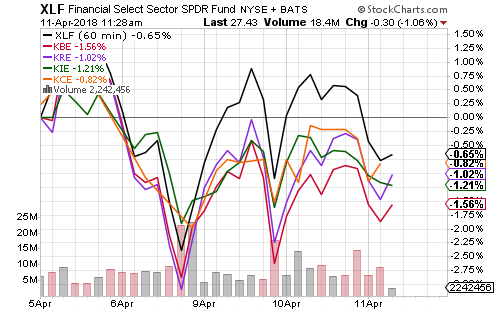

Fed Governor Randal Quarles will testify before Congress on Tuesday and Thursday, in addition to a speech on Wednesday. He is also the Vice-Chair of Supervision, which oversees the financial system. Congress has a bill to roll back Dodd-Frank regulations and Quarles will outline how the Fed will reduce the regulatory burden on small banks. His testimony will come alongside earnings reports from several important regional banks this week. SPDR S&P Regional Bank (KRE) has gained 3 percent in 2018.

On Monday, the U.S. Department of Commerce banned U.S. companies from selling components to Chinese firm ZTE for seven years. The action isn’t part of the trade dispute between China and the U.S. ZTE violated trade sanctions against Iran and compounded the situation by lying to U.S. investigators. ZTE makes communications hardware including mobile phones. U.S. suppliers of ZTE fell on Monday.

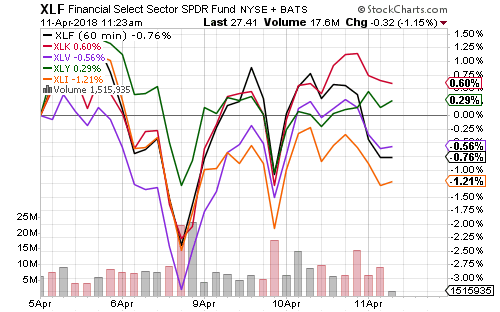

Bank of America (BAC) reported stronger-than-expected earnings on Monday. Earnings grew 51 percent and revenue climbed 4 percent.

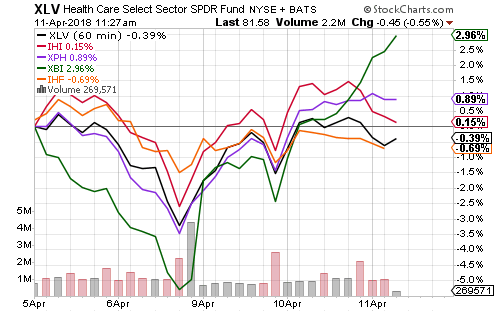

This will be an important week for earnings reports. Bank of America, Netflix (NFLX), Johnson & Johnson (JNJ), UnitedHealth Group (UNH), International Business Machines (IBM), Goldman Sachs (GS), CSX Corp (CS) Intuitive Surgical (ISRG), Abbott Labs (ABT), Alcoa (AA), Morgan Stanley (MS), U.S. Bancorp (USB), American Express (AXP), Bank of New York (BK), Taiwan Semiconductor (TSM), Novartis (NVS), Philip Morris International (PM), Proctor & Gamble (PG), General Electric (GE), Honeywell (HON), Schlumberger (SLB), State Street (STT) and Baker Hughes (BHGE) are all scheduled to report.