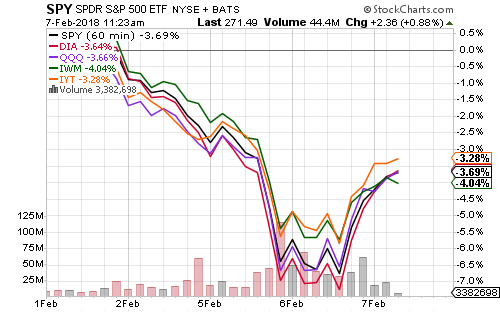

Equities experienced a highly volatile trading week. The Russell 2000 fell 4.49 percent, best of the major indexes.

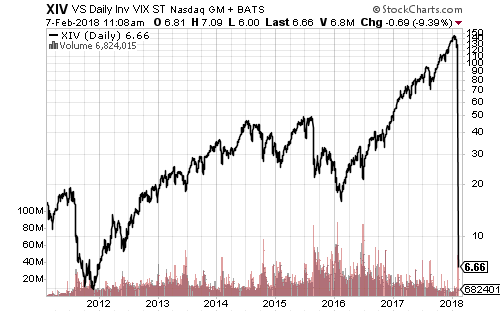

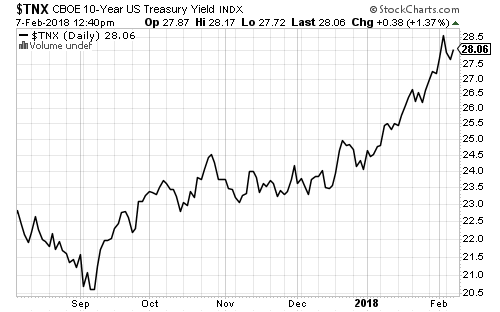

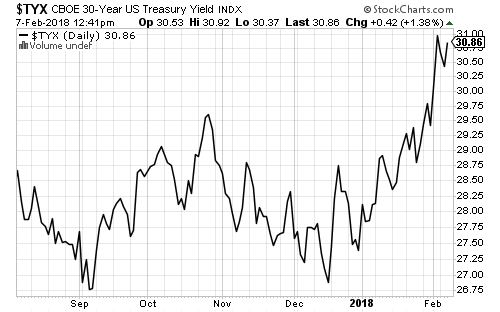

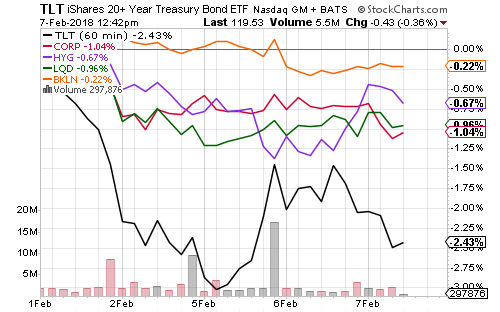

Rising interest rates pushed equities lower last week, which in turn pushed the VIX, to its highest level in more than a year. February 2nd was the biggest day for the VIX futures contract with nearly 80,000 contracts traded. On Monday, that number nearly quadrupled as shorts were squeezed. The VIX peaked at 50 on Monday, up from 11 in January, destroying traders heavily short volatility. The VelocityShares Daily Inverse VIX (XIV) lost 95 percent of its value on Monday and will be liquidated later this month.

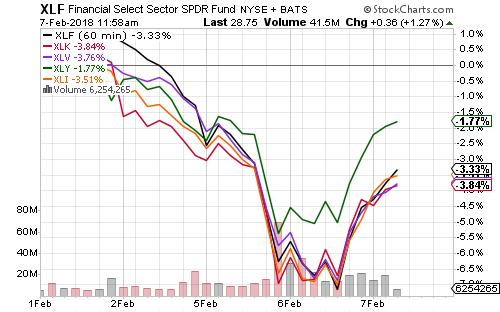

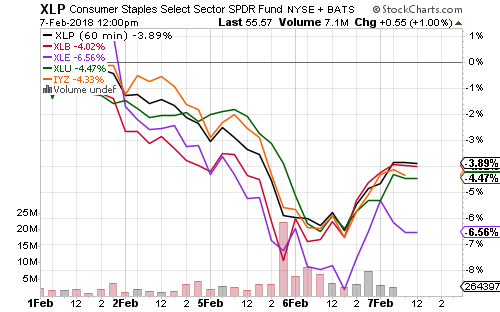

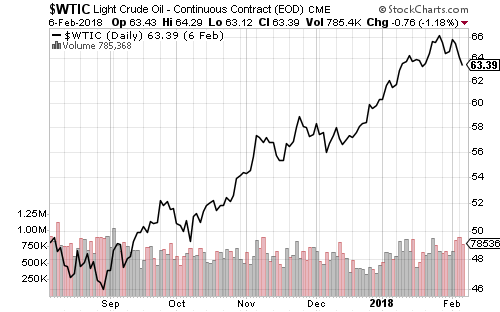

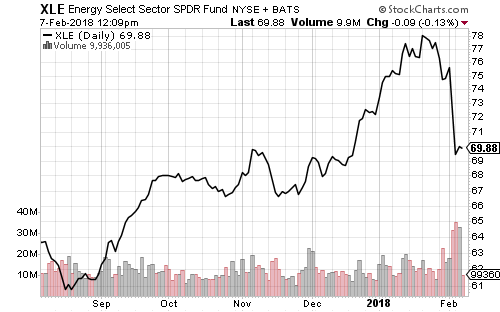

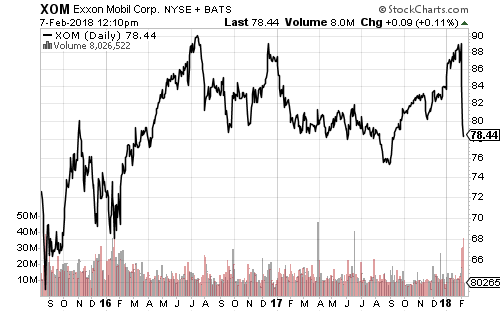

Sectors were highly correlated this week. Among the larger sectors, technology was the best performer. SPDR Technology (XLK) fell 4.44 percent. SPDR Financials (XLF) fell 5.72 percent. Consumer discretionary, healthcare and industrials were in between. Smaller sectors were more diverse in their performance. SPDR Utilities (XLU) declined 2.65 percent, while SPDR Energy (XLE) slid 8.10 percent.

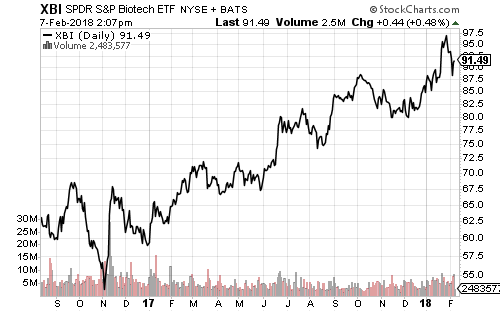

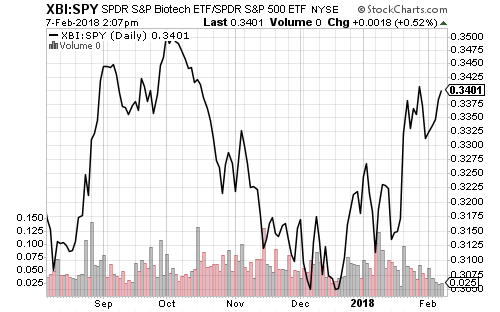

Some subsectors outperformed versus expectations this week. Biotechnology is normally more volatile, but SPDR S&P Biotech (XBI) slid 5.30 percent, in-line with the broader market. iShares PHLX Semiconductor (SOXX) outperformed the market with a dip of 4.77 percent.

Economic data was light this week. The ISM Services PMI rose to 59.9, up from 56 in December, signaling robust expansion. Initial claims for unemployment once again approached a 45-year low at 221,000, beating expectations of 232,000.

Chinese inflation slowed in January, supporting evidence of a slowdown as China’s government clamps down on credit growth.

The 10-year Treasury yield stabilized this week. It traded at a high of 2.88 percent but failed to breach the 2.9 percent level. It closed the week down slightly from last week’s close at 2.83 percent. The 30-year yield also stabilized, but still had some ground to make up. It rose slightly to 3.14 percent.

This week, Bristol-Myers Squibb (BMY) beat on earnings and revenue. General Motors (GM) and Disney (DIS) beat on both as well. Disney fell with the market, but GM shares were up 1.12 percent on the week. Gilead Sciences (GILD) delivered strong results but offered weaker guidance for 2018. Shares still outperformed the S&P 500 on the week, losing only 2.95 percent.

S&P 500 fourth-quarter earnings growth hit 14 percent at the end of this week. All sectors report rising earnings. All sectors except energy and utilities are beating earnings growth estimates. Earnings estimates for first quarter 2018 are rising. At the end of December, analysts forecast 11.5 percent growth. As of this week, the consensus estimate is 16.9 percent.

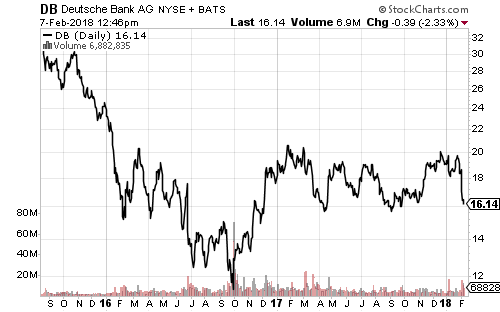

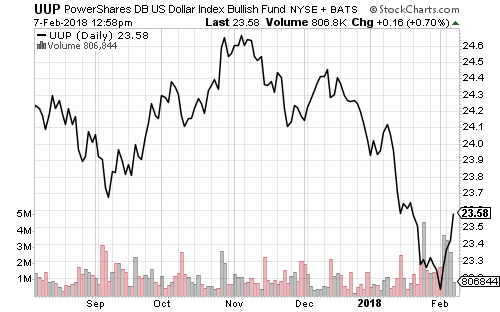

The U.S. Dollar Index has experienced a six-day winning streak. The euro fell 2 percent versus the U.S. dollar this week.

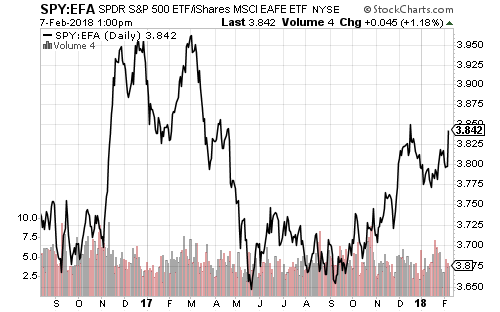

The S&P 500 Index outperformed most international funds this week. SPDR S&P 500 (SPY) declined 4.98 percent, iShares MSCI EAFE (EFA) 5.46 percent, and iShares MSCI Emerging Markets (EEM) 5.34 percent.