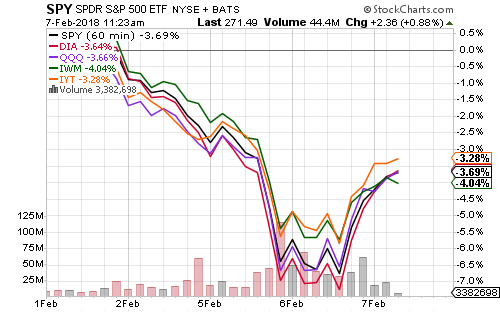

This week’s selling bout pulled major indexes down 4 percent. The overdue rout can largely be attributed to shifting volatility in an improving economic climate.

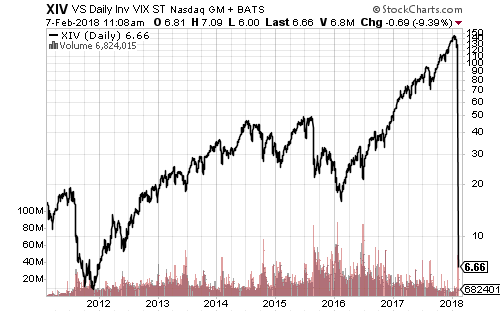

Although punctuated by periods of higher volatility, overall volatility has fallen steadily during the past decade. Many investors paid for protection against a market decline by buying puts on their stocks. Some speculators bet on higher volatility by buying futures and ETFs tracking volatility indexes.

Traders continued building short-volatility positions into the recent bout of selling, when the shorts were finally squeezed. On Friday, a record high of 78,000 VIX contracts were bought. On Monday, that number almost quadrupled. An inverse VIX ETF (XIV) collapsed and will be liquidated later this month.

After hours on Monday, traders and investors realized the spike in the VIX was caused by a short-squeeze in derivative products. Markets rallied back on Tuesday.

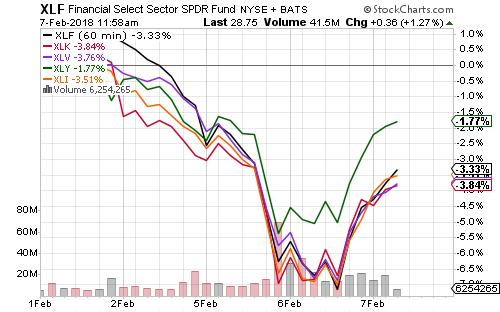

Financials led performance ahead of the dip due to rising interest rates. Consumer discretionary led the market higher as its largest component, Amazon (AMZN), advanced in the week.

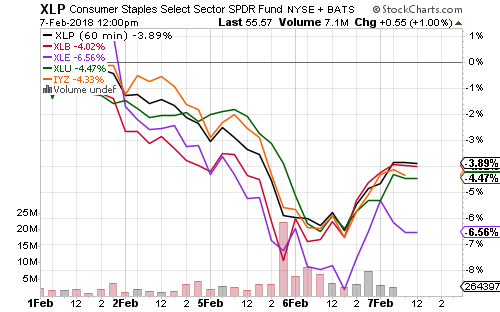

Consumer staples, utilities, telecom and materials have all performed similarly over the past week.

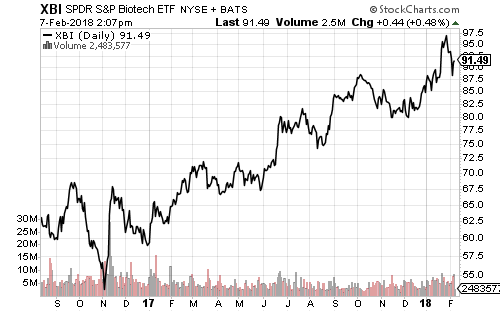

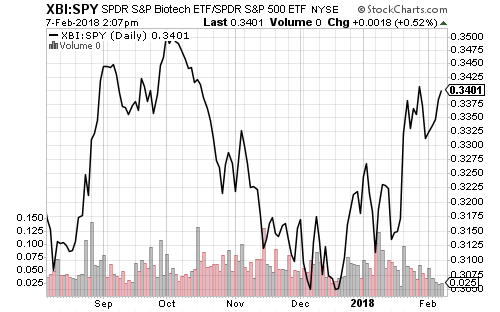

Biotechnology held up well during the weakness considering its high volatility. Investors anticipate more mergers and acquisitions in the sector, lifting funds with small- and mid-cap companies such as SPDR S&P Biotech (XBI).

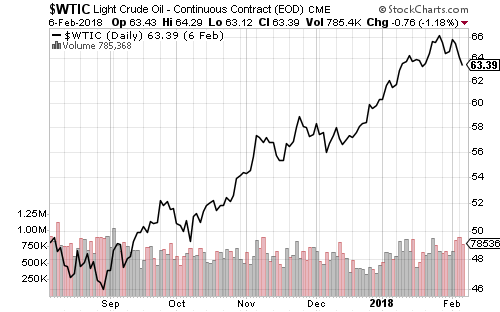

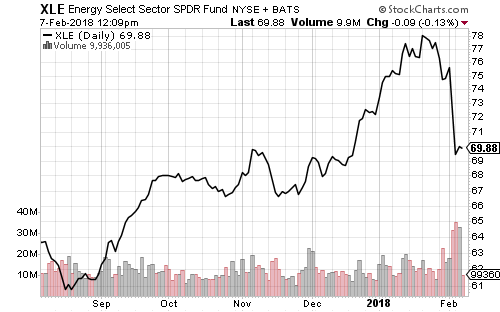

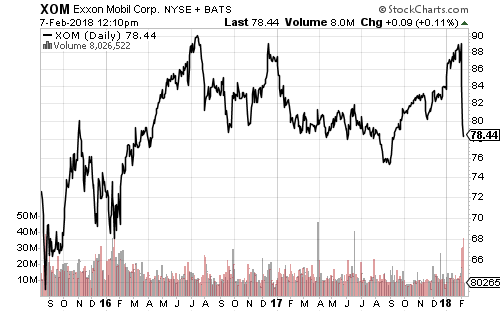

Energy has underperformed in the past week after an ominous, poorly timed conference call from Exxon (XOM). While oil market fundamentals have improved considerably, investors are still worried about a dip back to the $40s. After reporting strong earnings on Friday, Exxon management announced plans for increased investment, sending shares 12 percent lower. XOM is 22 percent of SPDR Energy (XLE). Chevron (CVX), 16.6 percent of XLE, also fell.

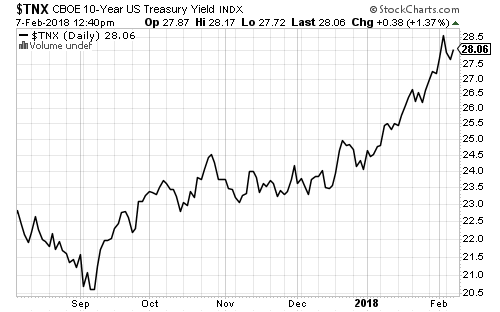

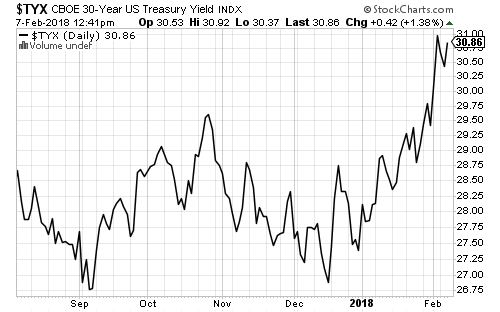

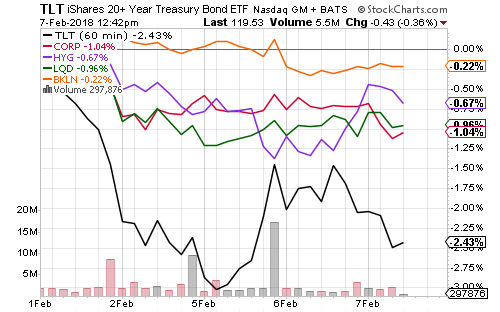

Rising interest rates triggered selling last week, setting up the short volatility traders for a squeeze. The 30-year Treasury yield jumped from 2.9 percent at the end of January to 3.1 percent.

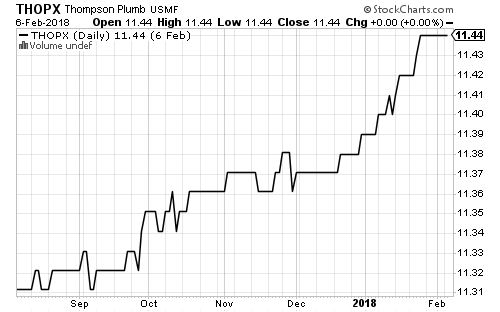

Thompson Bond (THOPX) and other floating-rate funds held steady, despite the dip in treasuries.

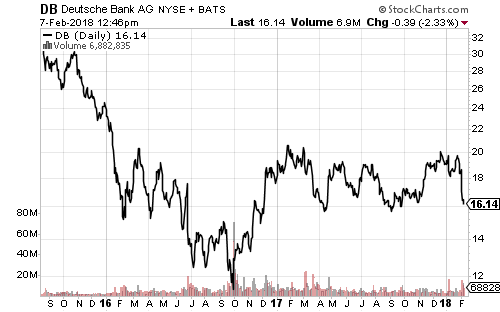

The largest conglomerate in China, HNA Group, has failed to repay loans on numerous properties and companies around the world. It became the largest holder of Deutsch Bank (DB) at 9.9 percent. Shares of Deutsche Bank have fallen nearly 20 percent in the past 10 days as investors worry HNA may begin selling assets.

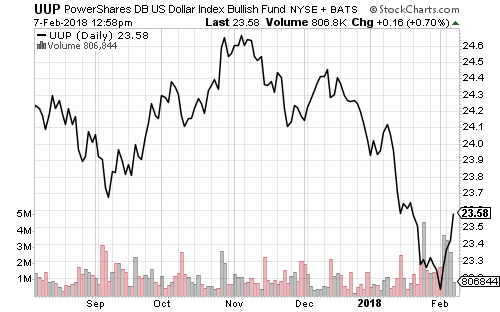

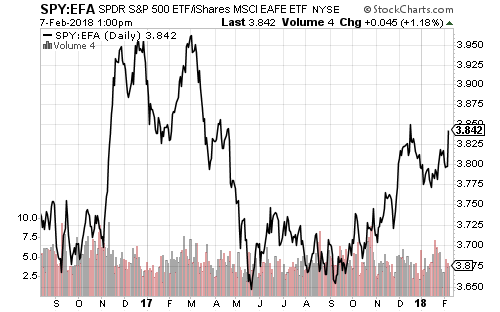

Developed-market equities underperformed as the U.S. dollar rallied.

SPY is approaching a relative high versus EFA. If the dollar begins a sustained rally, even the strong relative performance by emerging market funds could end. A rising dollar would be bullish for U.S. bonds and broadly bearish for commodities.