The Investor Guide to Vanguard Funds for January is AVAILABLE NOW! Links to the January data files are posted below. Market Perspective: Review Your Rate Sensitive Allocations Equities enjoyed a […]

Month: January 2018

Global Momentum Guide for January 15, 2018

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The Russell 2000 Index advanced 2.05 percent last week, the Dow Jones Industrial Average 2.01 percent, the Nasdaq […]

ETF & Mutual Fund Watchlist for January 10, 2018

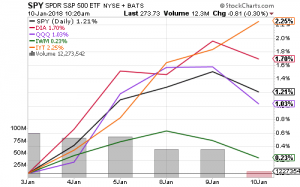

Transportation stocks led the market over the past week as traders rotated out of interest rate-sensitive utilities. The Dow Jones Industrial Average also advanced.

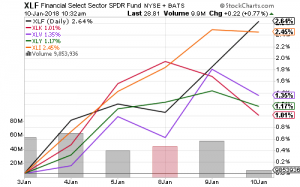

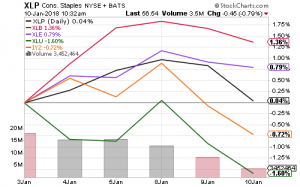

The financial sector was the best large-sector performer after interest rates spiked. Telecommunications and consumer staples trailed as investors shied away from high-yield stocks.

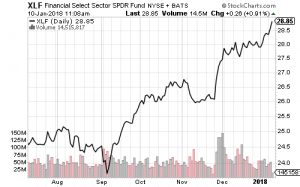

SPDR S&P Regional Banks (KRE) and SPDR Financial (XLF) outperformed this week and hit new 52-week highs.

Long-term interest rates jumped on Wednesday following a report that China might slow or stop purchasing U.S. treasuries. China hasn’t increased treasury holdings since 2014.

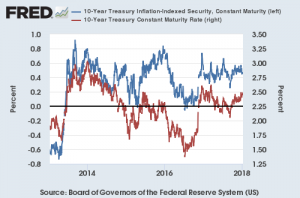

The 10-year yield is approaching its 52-week highs and a bullish breakout (bearish for bonds) could follow. The important near-term level is 2.6 percent, the high over the past 52-weeks. After that, the next key level will be 3.0 percent.

There’s no sign of a bond bear market in treasury inflation protected securities. The yield on the 10-year TIPS is near 0.50 percent. In 2013, it topped out close to 1 percent.

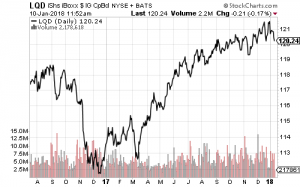

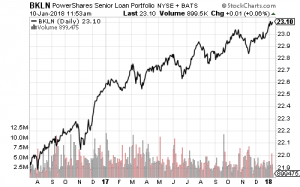

Rising long-term bond yields haven’t stung the investment-grade or corporate bond market. Federal Reserve rate hikes are pushing short-term yields higher. Floating-rate funds, such as PowerShares Senior Loan Portfolio (BKLN) and Virtus Seix Floating Rate High Income (SAMBX), are at new 52-week highs.

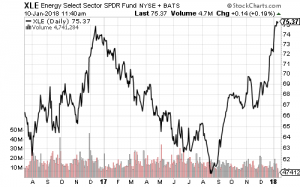

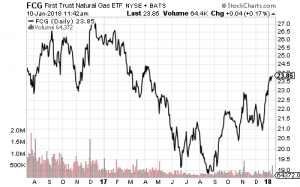

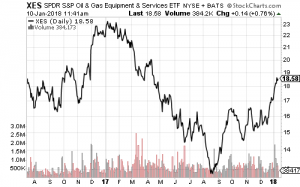

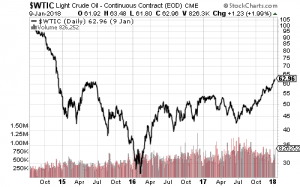

SPDR Energy (XLE) exceeded its 2017 high this week. Energy subsectors such as services and natural gas producers are performing better than XLE, but also have much further to go before achieving even 52-week highs. WTI climbed past $63 on Wednesday, the highest level since late 2014. This clears an important technical hurdle for oil as bullish traders up their targets to $70 or higher.

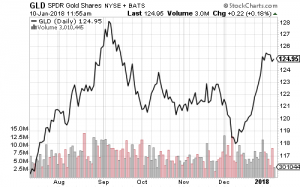

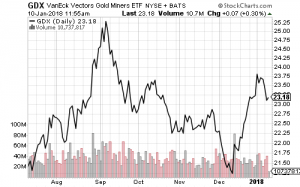

Gold enjoyed a strong rally in December, but rising real interest rates have halted the advance for now. The December import price index increased only 0.1 percent. Producer and consumer inflation for December will be out later this week.

Raw material producers in the steel, coal and copper sectors have built strong momentum at the start of 2018. A short-term pullback appears likely in the short-term given the speed of the advance. SLX is trading at a new multi-year high.

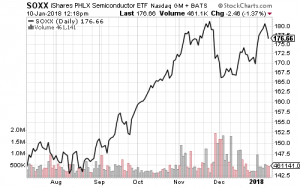

Intel (INTC) pulled semiconductor funds lower this week. The technology sector underperformed the S&P 500 Index last week due to weakness in semiconductors.

The Investor Guide to Fidelity Funds for January 2018

The Investor Guide to Fidelity Funds for January 2018 is Now Available CLICK HERE! Links to the January Data Files have been posted below. Market Perspective: Will Energy Rebound in […]

Market Perspective for January 8, 2018

Stocks opened to mixed trading on Monday before moving on to new all-time highs. Technology pulled the market higher, while healthcare weighed. Semiconductors rebounded from last week’s flawed CPU news. iShares PHLX Semiconductor (SOXX) approached its all-time high. The Dow Transports also pushed into record territory.

The National Federation of Independent Business will publish its small-business index tomorrow. November’s reading of 107.5 was the highest since 1983. The Job Openings and Labor Turnover Survey (JOLTS) is also due. Economists expect 6.0 million November job openings.

Economists forecast a 0.2-percent increase in December producer prices. CPI is expected to rise by 0.1 percent, core CPI 0.2 percent. Analysts predict December retail sales rose 0.5 percent, with sales ex-autos up 0.3 percent.

Chinese inflation data, Eurozone industrial production, unemployment rates, and the minutes of the December meeting of the European Central Bank are due midweek.

German Chancellor Angela Merkel started talks with the largest opposition party on Sunday to avoid a minority government or new elections. iShares MSCI Germany (EWG) opened the year strong, but slipped on Monday. Elsewhere in Europe, U.K. Prime Minister Theresa May might appoint a new cabinet official to prepare for an EU exit without a deal in place.

The 10-year Treasury yield approached 2.5 percent in Monday trading before easing back. The yield bottomed at 2.0 percent in September. The U.S. Dollar Index opened the week with a gain. It bounced off critical support late last week and is trading close to 3-year lows.

West Texas Intermediate crude traded at $61 and change on Monday. WTI’s first rebound following the 2014 sell-off was in early 2015. It spent two months, in May and June, trying to rally past $62 and failing. Bulls are looking for a run to $70, but bears may give them a fight at $62 this week.

Earnings season will officially kick off on Friday with J.P. Morgan (JPM), Wells Fargo (WFC), BlackRock (BLK) and PNC Financial Services (PNC). Analysts forecast earnings increases at three firms, but JPM 2 cents below year-ago levels. Investors may focus on guidance as banks should benefit greatly from tax reform. Homebuilders Lennar (LEN) and KB Home (KBH), and Delta Air Lines (DAL) will also report this week.