The January Issue of the ETF Investor Guide is Now Available! Links to the January Data Files have been posted below. Market Perspective: Earnings Estimates Increase The equity markets are off […]

Month: January 2018

Market Perspective for January 22, 2018

The government shutdown ended on Monday after lawmakers agreed to a three-week spending bill. Stocks and the U.S. dollar rallied on the news. All major indexes finished higher on the day.

Shares of iShares Nasdaq Biotechnology (IBB) hit a new 52-week high, while SPDR S&P Biotech (XBI) hit a new all-time high. Merger activity drove the gains as Sanofi (SNY) purchased Bioverativ (BIVV) and Celgene (CELG) purchased Juno Therapeutics (JUNO).

Consumer discretionary shares rallied as Netflix (NFLX) hit a new all-time high ahead of earnings and reported subscription rates that far exceeded estimates. Consumer staples extended their weeklong streak of outperformance. Proctor & Gamble (PG) will report earnings this week. The stock is 12 percent of SPDR Consumer Staples (XLP). Wal-Mart (WMT), a top-10 holding in the fund, hit a new all-time high on Monday. CVS Health (CVS) and Pepsi (PEP) also rose strongly on the day.

The 10-year treasury yield extended its gains on Monday. It hit 2.66 percent, the highest level since September 2014. High-yield bonds held steady, but broad corporate and investment-grade bond funds followed government bonds lower.

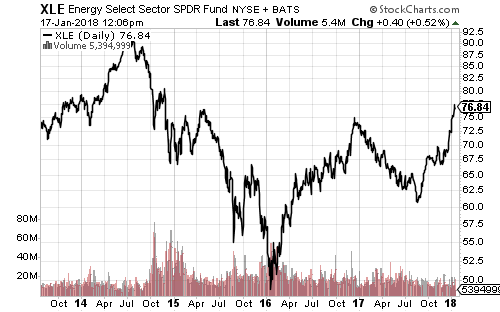

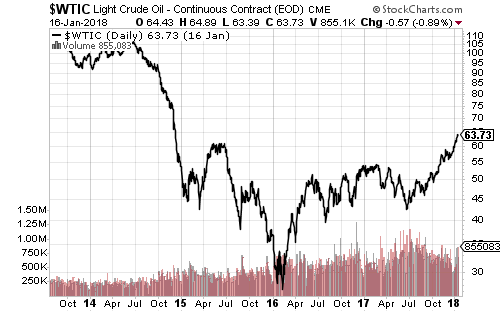

West Texas Intermediate crude oil held steady at $63 a barrel on Monday. SPDR Energy (XLE) pushed to a new 52-wek high. Sub-sectors were strong across the board.

Fourth-quarter GDP growth will headline this week’s economic releases. The median forecast is 3 percent, the average 2.7 percent. The Atlanta Federal Reserve forecast 3.4 percent growth as of January 18. December existing home sales are forecast to hit an annualized pace of 5.73 million. New home sales are expected to hit an annualized pace of 680,000, down from last month’s spike to 733,000. The flash PMIs for January will also be out this week with durable goods orders for December.

Earnings season is in full swing. Sectors and indexes with significant reporting this week will include biotechnology, consumer discretionary, healthcare, steel, and industrials. Halliburton (HAL), Netflix (NFLX), Petmed Express (PETS), Fifth Third Bancorp (FITB), Johnson & Johnson (JNJ), NVR Corp (NVR), Proctor & Gamble (PG), Travelers (TRV), Texas Instruments (TXN), Abbott Labs (ABT), Comcast (CMCSA), Ford (F), General Dynamics (GD), 3M (MMM), General Electric (GE), Caterpillar (CAT), Biogen (BIIB), Celgene (CELG), Freeport-McMoRan (FCX), Intel (INTC), Intuitive Surgical (ISRG), Northrop Grumman (NOC), Stabucks (SBUX), Colgate-Palmolive (CL), AbbVie (ABBV) and Honeywell (HON) are all on tap.

Global Momentum Guide for January 22, 2018

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The MSCI EAFE Index rose 1.24 percent last week, the Nasdaq and Dow Jones Industrial Average both increased […]

Market Perspective for January 20, 2018

U.S. equities pushed on to new records this week despite profit-taking in some of the best performing sectors. The Nasdaq and Dow Jones Industrial Average both increased 1.04 percent to lead the major indexes. The Dow Transports fell 0.60 percent following a 20-percent gain over the past two months.

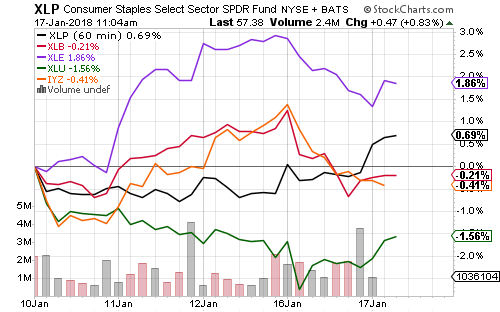

Healthcare and consumer staples were the best performing sectors this week. Healthcare providers and medical devices lifted SPDR Healthcare (XLV) 1.87 percent. Staples were strong across the board. Shares of Proctor & Gamble (PG), Coca-Cola (KO), Pepsi (PEP), Philip Morris (PM), Wal-Mart (WMT) and Colgate-Palmolive (CL) all increased at least 2 percent. SPDR Consumer Staples (XLP) advanced 2.45 percent on the week.

General Electric (GE) weighed on industrials. The company took a $6.2-billion charge on an insurance unit. This news rekindled concerns and shares fell to a new 52-week low.

Industrial production hit a new all-time high in December, exceeding the prior peak set in 2014. The home builders’ confidence index remained near its 18-year high. Jobless claims fell to a new 44-year low of 220,000.

The International Energy Agency sent oil prices modestly lower on Friday after predicting U.S. shale production will rise to a peak of 10.4 million barrels per day in 2018. This will move the U.S. ahead of Saudi Arabia, behind Russia’s 10.9 million bpd.

The U.S. Dollar Index hit a new 3-year low this week and the euro a 3-year high. PowerShares U.S. Dollar Bullish (UUP) fell 0.25 percent. iShares MSCI EAFE (EFA) gained 0.86 percent, same as SPDR S&P 500 (SPY). Domestic shares outperformed developed markets after backing out currency effects, a sign that developed markets are not assuming global leadership. In contrast, iShares MSCI Emerging Markets (EEM) rallied 1.88 percent, while WidsomTree Emerging Market Currency (CEW) only increased 0.02 percent.

The 10-year Treasury yield also hit a new 3-year high. Treasury, corporate, investment-grade and high-yield bonds all fell on the week. Floating-rate funds gained ground. PowerShares Senior Loan (BKLN) increased 0.26 percent.

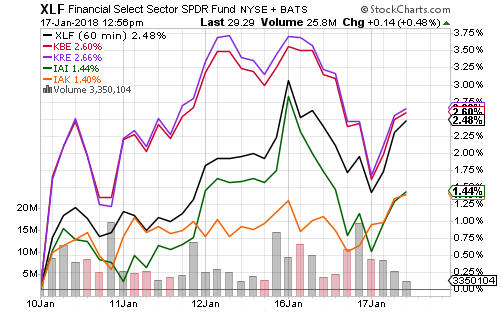

The financial sector dominated earnings. Shares of Citigroup (C), Bank of America (BAC) and Comerica (CMA) lifted the banking sector with earnings beats this week. Morgan Stanley (MS), M&T Bank (MTB), BB&T Corp (BBT), KeyCorp (KEY) also exceeded analyst estimates. Several companies beat estimates, but reported much lower net earnings because of taxes on repatriated earnings. International Business Machines (IBM) reported its first quarterly revenue growth in nearly 6 years this week, but shares fell on 2018 earnings guidance that was slightly below analyst expectations.

Goldman Sachs (GS) Goldman beat on net profit estimates for the quarter, but a one-time tax hit resulted in a net loss. Apple (AAPL) said it would repatriate most of its overseas earnings. The tax hit will be roughly $38 billion. Apple said it would invest some of the money in the U.S. and hire as many as 20,000 new employees.

ETF & Mutual Fund Watchlist for January 17, 2018

Transportation stocks led the market over the past week as traders rotated out of interest rate-sensitive utilities. The Dow Jones Industrial Average also advanced.

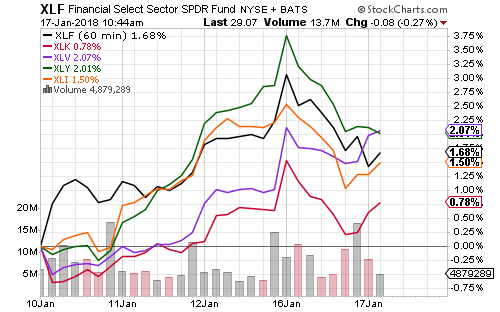

The financial sector was the best large-sector performer after interest rates spiked. Telecommunications and consumer staples trailed as investors shied away from high-yield stocks.

SPDR S&P Regional Banks (KRE) and SPDR Financial (XLF) outperformed this week and hit new 52-week highs.

Long-term interest rates jumped on Wednesday following a report that China might slow or stop purchasing U.S. treasuries. China hasn’t increased treasury holdings since 2014.

The 10-year yield is approaching its 52-week highs and a bullish breakout (bearish for bonds) could follow. The important near-term level is 2.6 percent, the high over the past 52-weeks. After that, the next key level will be 3.0 percent.

There’s no sign of a bond bear market in treasury inflation protected securities. The yield on the 10-year TIPS is near 0.50 percent. In 2013, it topped out close to 1 percent.

Rising long-term bond yields haven’t stung the investment-grade or corporate bond market. Federal Reserve rate hikes are pushing short-term yields higher. Floating-rate funds, such as PowerShares Senior Loan Portfolio (BKLN) and Virtus Seix Floating Rate High Income (SAMBX), are at new 52-week highs.

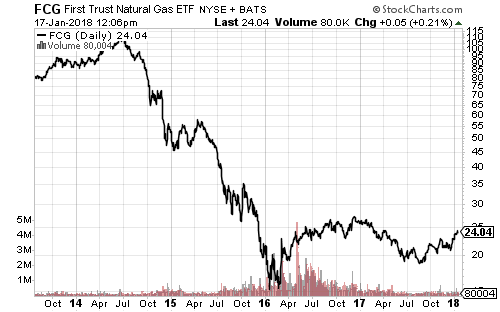

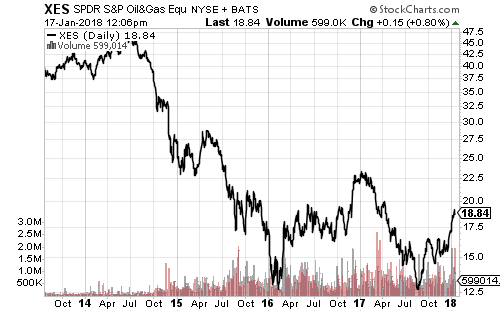

SPDR Energy (XLE) exceeded its 2017 high this week. Energy subsectors such as services and natural gas producers are performing better than XLE, but also have much further to go before achieving even 52-week highs. WTI climbed past $63 on Wednesday, the highest level since late 2014. This clears an important technical hurdle for oil as bullish traders up their targets to $70 or higher.

Gold enjoyed a strong rally in December, but rising real interest rates have halted the advance for now. The December import price index increased only 0.1 percent. Producer and consumer inflation for December will be out later this week.

Raw material producers in the steel, coal and copper sectors have built strong momentum at the start of 2018. A short-term pullback appears likely in the short-term given the speed of the advance. SLX is trading at a new multi-year high.

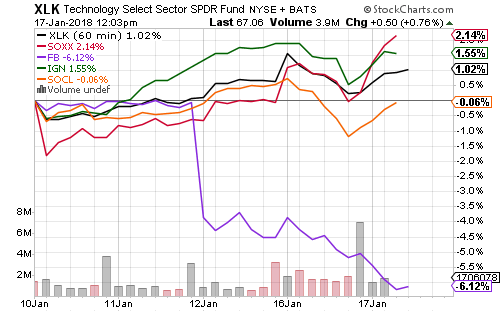

Intel (INTC) pulled semiconductor funds lower this week. The technology sector underperformed the S&P 500 Index last week due to weakness in semiconductors.