The Investor Guide to Fidelity Funds for November 2017 is Now Available! Links to the November Data Files have been posted below. Market Perspective: Consumer Confidence Highest Since 2000 Strong […]

Month: November 2017

Market Perspective for November 6, 2017

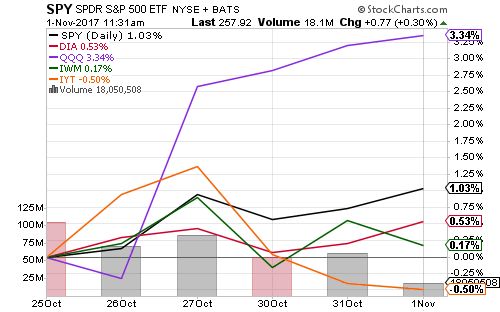

November has been one of the best months for equities over the past several decades and the S&P 500 and Dow Jones Industrial Average have risen every day thus far.

Monday’s rally was led by consumer cyclicals, technology and energy. Oil rallied on instability in Saudi Arabia. Crude oil rallied above $57, the highest it has been since July 2015. Energy service stocks Schlumberger (SLB) and Baker Hughes (BHGE) saw substantial single digit moves on Monday.

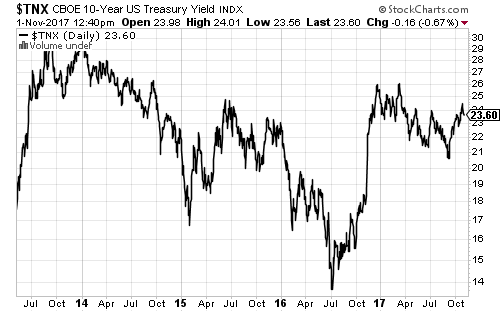

The 10-year Treasury yield fell to near 2.3 percent on Monday, the lowest since mid-October. Three-month Libor closed at 1.39 percent last week as markets priced in a December rate hike. The Federal Reserve will lift interest rates to a range of 1.25 to 1.50 percent. Floating-rate funds benefited, with Virtus Seix Floating Rate (SAMBX) hitting a new all-time high.

Economic data will be very light this week. The September Job Openings and Labor Turnover Survey (JOLTS) and the University of Michigan’s Consumer Sentiment survey for early November are due. Weekly oil inventory and rig counts could have outsized impact given tensions in Saudi Arabia.

Chinese economic data out this week will include October trade, inflation and money supply data. The producer price index is expected to slow from 6.9 to 6.6 percent year-on-year. Producer prices unexpectedly accelerated in September with lending. The Chinese National Congress delayed deleveraging efforts in October, but credit growth should resume its slowdown. Industrial commodities such as copper, steel, iron ore and aluminum are highly sensitive to the Chinese economy.

October was the best month for the U.S. dollar in 2017. Political and economic developments were bearish for the euro and yen. The rally in oil weighed on Monday, but the dollar is up thus far in November.

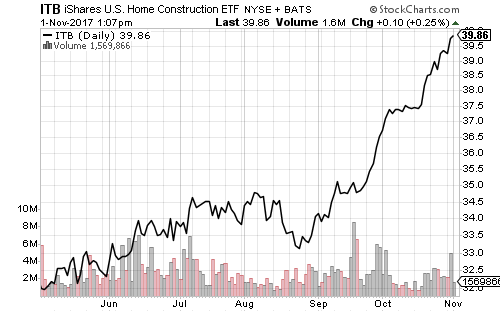

iShares U.S. Home Construction (ITB) dipped last week on news the mortgage interest deduction would be limited to $500,000, but it rallied on Monday after House Republicans were reportedly tweaking the bill to win over some dissenters. President Trump’s visit to Japan proved positive for the defense sector as iShares U.S. Aerospace & Defense (ITA) crept higher. Japanese stocks rallied on Monday. The Nikkei is trading at its highest level since 1996.

Shares of Amazon (AMZN) rallied more than 1 percent on Monday and provided most of the lift for the consumer discretionary sector.

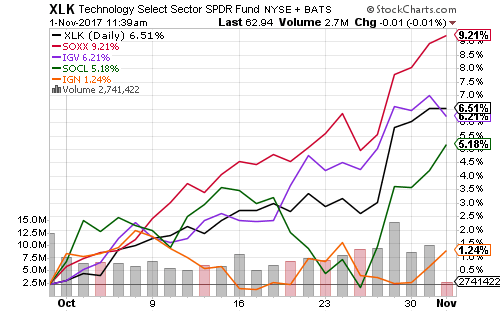

Chipmakers rallied last week after Broadcom (AVGO) made a $103-billion offer for Qualcomm (QCOM). The two firms are the fourth- and fifth-largest companies (by market capitalization) in iShares U.S. Semiconductors (SOXX). This week, Nvidia (NVDA), the second-largest holding in SOXX, will report earnings.

Priceline (PCLN), CVS Health (CVS), Marriot International (MAR), Emerson Electric (EMR), Twenty-First Century Fox (FOX), Humana (HUM), Regeneron (REGN), Rockwell Automation (ROK), Disney (DIS), Astrazeneca (AZN), Johnson Controls (JCI), ArcelorMittal (MT) and J.C. Penney (JCP) will also report.

Global Momentum Guide for November 6, 2017

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR PERSPECTIVE The Nasdaq gained 0.94 percent last week, the MSCI EAFE 0.90 percent, the Dow Jones Industrial Average 0.45 […]

Market Perspective for November 3, 2017

Strong Apple (AAPL) earnings contributed to the Nasdaq’s 0.94-percent gain this week, while the Dow Jones Industrial Average advanced 0.45 percent.

The labor market strengthened in October with 261,000 new jobs, up from 18,000 in September. The unemployment rate fell to 4.1 percent, the lowest since 2000. Average hourly earnings were flat. Weekly initial claims for unemployment dipped to 229,000 in the week ended October 28. Strong employment conditions lifted consumer confidence last month. The Conference Board’s Consumer confidence survey spiked to 125.9, an increase of more than 6 points from September. It was also the best reading in nearly two decades.

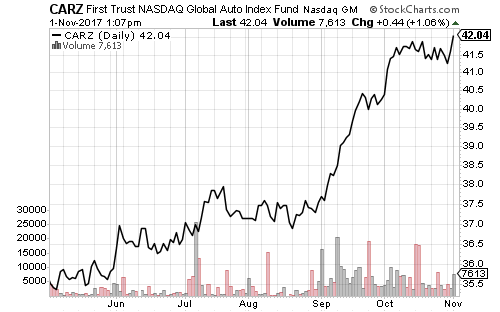

Factory orders increased by a faster-than-expected 1.4 percent in September. The manufacturing and service PMIs for October improved. Productivity growth hit 3 percent in the third quarter. September construction spending increased 0.3 percent, despite flat predictions. Auto sales hit an annualized pace of 18.1 million in October, the second consecutive month above 18 million.

Positive economic reports briefly pushed the Atlanta Federal Reserve’s fourth quarter estimate to 3.3 percent. Economists predict growth of 2.7 percent. The Federal Reserve left rates unchanged at this week’s meeting, as anticipated. Data and growth projections have pushed the odds of a December rate hike to 100 percent.

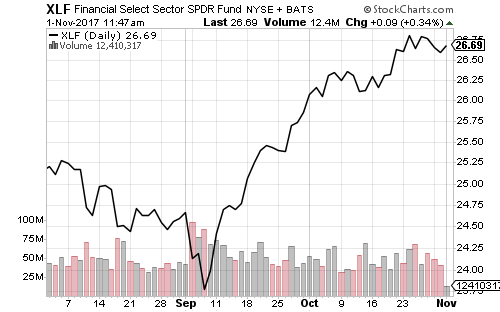

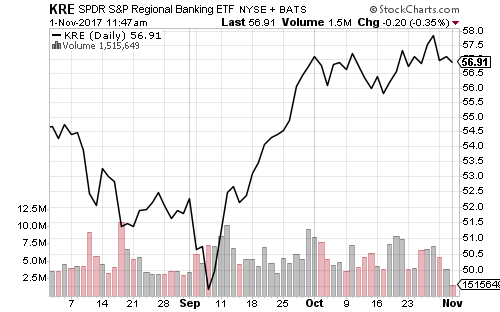

President Trump announced the appointment of Jerome Powell to replace Federal Reserve Chair Janet Yellen when her term expires in January. Although investors expect him to stay the course on interest rates, they also believe he’ll support broader bank deregulation.

Apple (AAPL) earned $2.07 per-share, well above estimates of $1.87. It also beat sales estimates by nearly $2 billion. iPhone sales were 1.5 percent above forecasts. Shares gained 5.75 percent on the week.

Pfizer (PFE) beat earnings and announced potential changes to its consumer health division. Shares rallied on the news. Kraft Heinz (KHC) missed sales estimates, but beat earnings by 1 penny. Starbucks (SBUX), MetLife (MET) and Occidental Petroleum (OXY) also reported strong quarterly earnings this week.

The U.S. dollar saw a small gain this week due to weakness in the Japanese yen. Although the odds of a December rate hike increased, the 10-year Treasury yield retreated below 2.4 percent. While long-term rates fell, the 2-year Treasury yield climbed above 1.6 percent. Short-term higher-yielding credit funds, such as Thompson Bond (THOPX), marched higher on the week.

Stocks rallied as House Republicans unveiled a proposed tax cut plan this week, while homebuilder stocks dipped. The bill includes a reduction in the mortgage deduction from $1 million to $500,000. iShares U.S. Home Construction (ITB) declined 0.6 percent for the week, but remains near its 52-week high.

Crude oil closed the week above $55 a barrel for the first time in over two years after the U.S. rig count declined.

ETF & Mutual Fund Watchlist for November 1, 2017

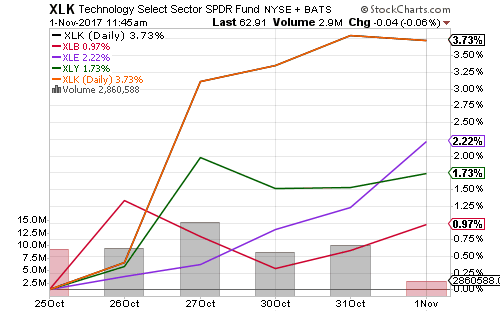

Microsoft (MSFT), Alphabet (GOOGL) and Intel (INTC) powered last week’s technology sector rally. Facebook (FB) and Apple (AAPL) will report this week. Both are top-ten holdings in funds such as SPDR Technology (XLK).

Semiconductor stocks have led performance over the past month. Intel (INTC) recently boosted an already strong earnings season.

Consumer discretionary derived a great deal of strength from Amazon’s (AMZN) cloud services division. Energy, materials and utilities also rallied last week.

Financials were flat on the week, extending the consolidation phase to two weeks.

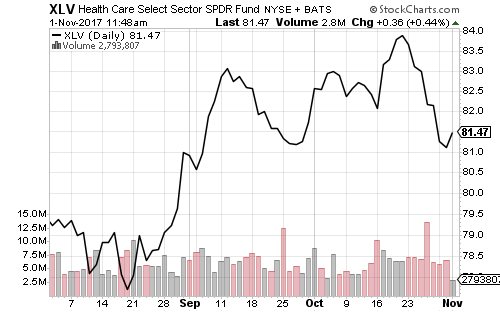

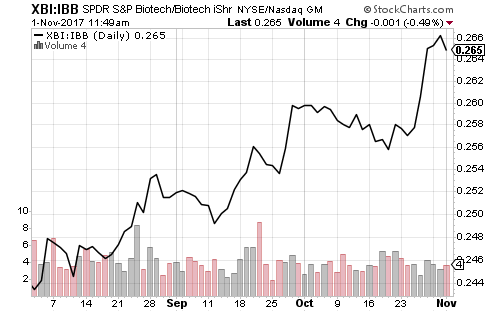

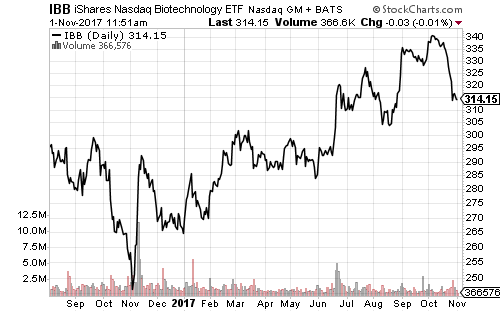

Earnings misses stung the healthcare sector last week. The weakness was concentrated in large-cap stocks, as evidenced by SPDR S&P Biotech (XBI) versus the market-cap weighted iShares Nasdaq Biotechnology (IBB). As the longer-term chart of IBB shows, the drop was one of the largest in the past year, but not out of the ordinary for this highly volatile sector.

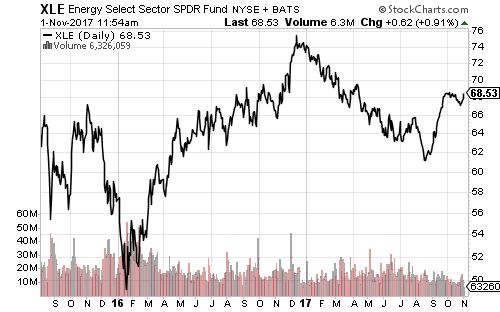

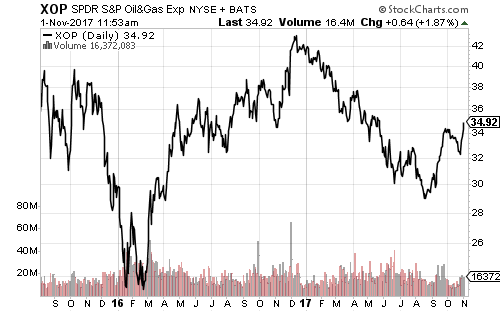

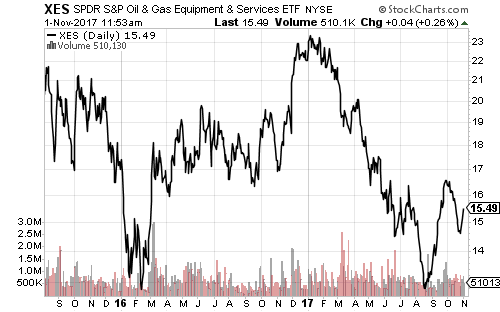

Energy stocks and crude oil are both on the verge of short-term bullish breakouts. SPDR Oil & Gas Exploration & Production (XOP) has already achieved a short-term breakout. SPDR Energy (XLE) should follow in the next week, while SPDR Oil & Gas Services (XES) is trailing. Long-term, however, the picture remains bearish.

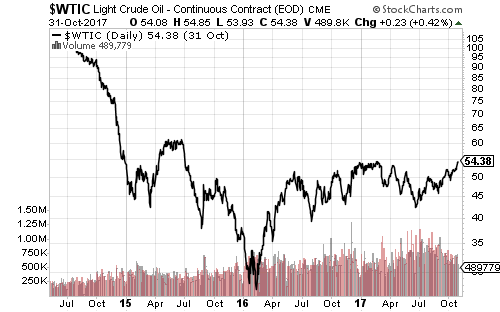

West Texas Intermediate crude hasn’t traded above $55 for more than a few hours since it lost that level in July 2015. It traded above $55 on Wednesday morning before falling back. If oil can climb above $55, it will be a short move to $60.

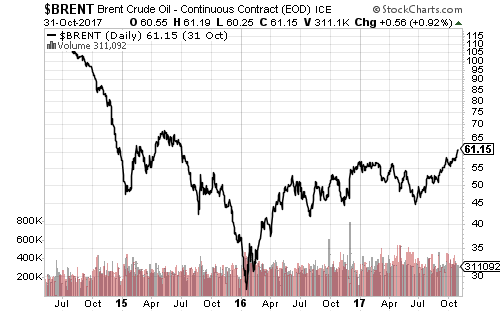

Brent crude has already shown a short-term breakout.

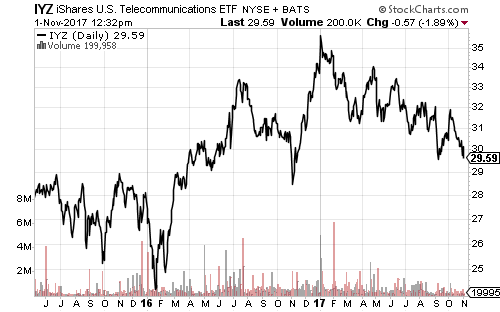

Telecom shares slumped this week after Softbank (SFTBY) called off a proposed merger between its Sprint (S) division and T-Mobile (TMUS). Shares of all three companies fell on the news.

Rising interest rates and AT&T’s (T) earnings miss have weighed on IZY. A new low will be likely as interest rates rise.

The 10-year Treasury yield climbed above 2.4 percent over the past week. Predictions of a bond market breakdown have increased, but as the long-term chart shows, rates are below 2014 levels.

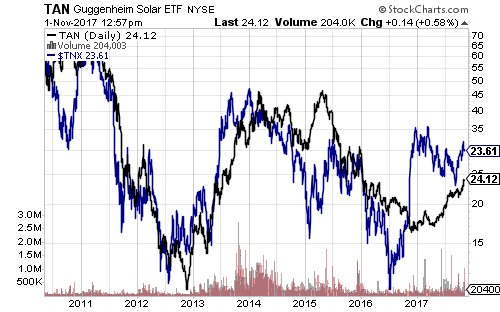

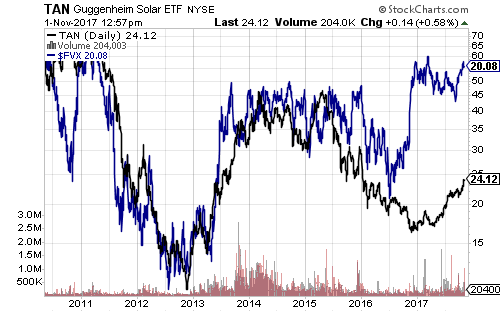

Solar stocks have historically moved with interest rates. Guggenheim Solar (TAN) has closely tracked the 5- and 10-year yields over the past several years. If interest rates continue to climb, history suggests that would be bullish for solar.

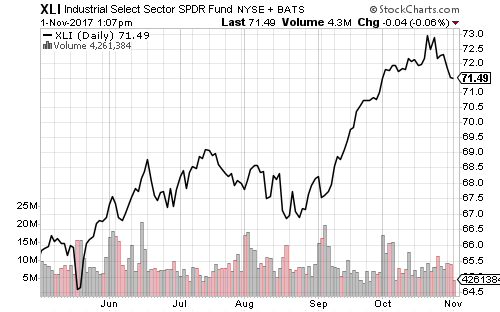

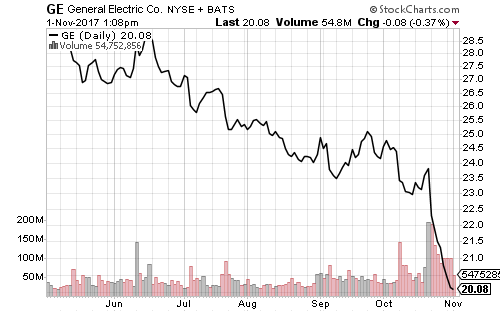

Automakers and homebuilders extended their gains in the past week, even as the industrial sector corrected. General Electric (GE), once the largest holding in SPDR Industrials (XLI), fell to third place behind 3M (MMM) GE has shaved more than 2 percent from XLI’s 2017 return, currently 16.5 percent.