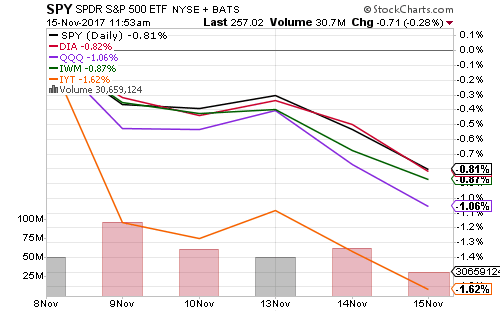

Major indexes declined over the past week as transports and technology pulled back from a lengthy bull run.

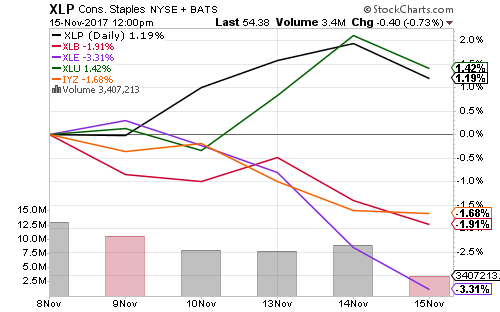

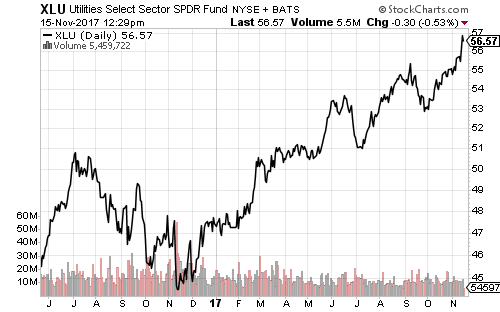

Consumer discretionary rallied over the past week, led by utilities and consumer staples. SPDR Utilities (XLU) is up 19 percent this year.

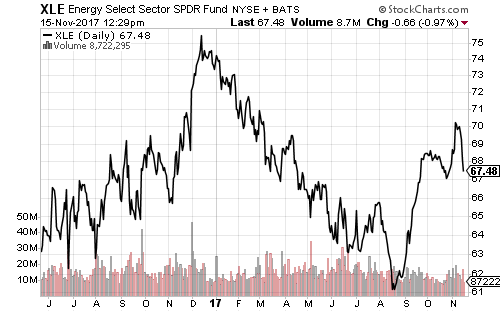

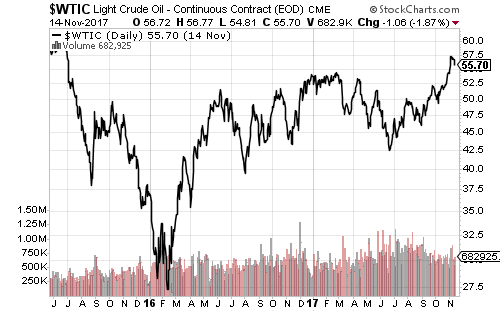

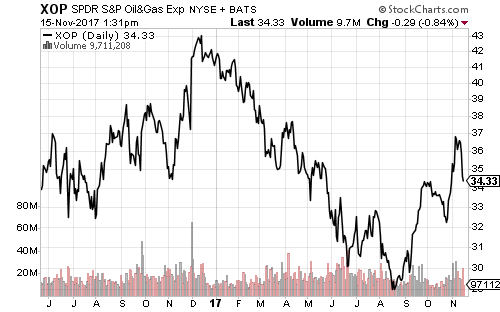

Energy shares sold off this week with oil prices. Strong production and inventory data in the U.S. pushed the price of West Texas Intermediate crude back to a $55 handle.

The August rally in energy shares is still in effect, but another down day or two could break the uptrend.

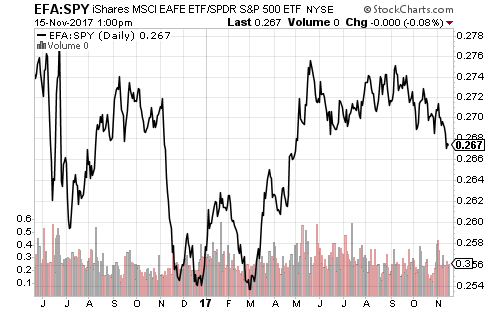

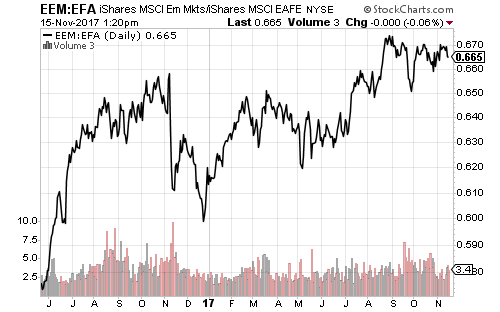

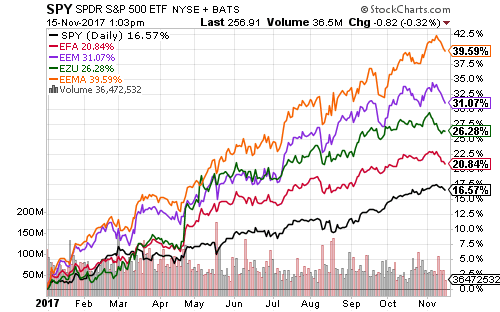

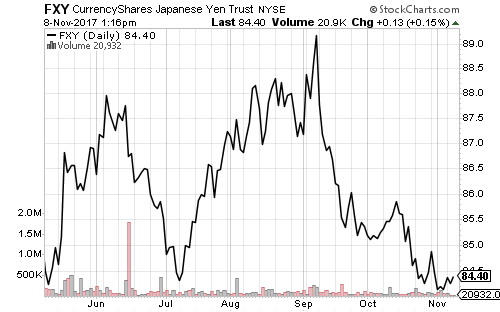

International stocks have outperformed domestic stocks in 2017, but the advantage in broad funds ended in May, when SPDR S&P 500 (SPY) surpassed iShares MSCI EAFE (EFA).

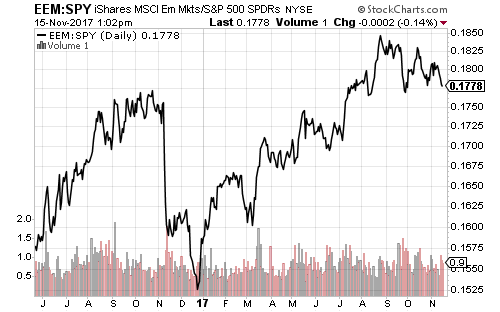

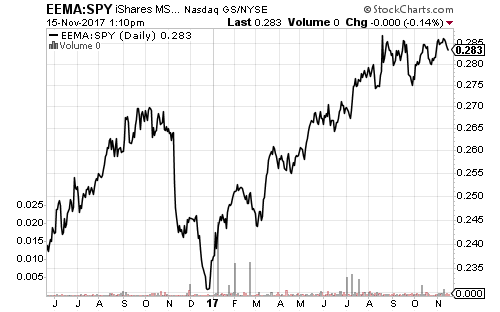

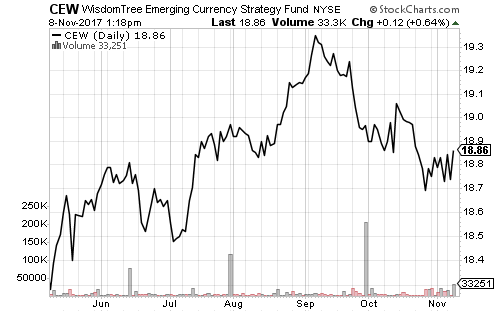

Emerging markets peaked versus domestic shares in August. Compared to the developed EAFE, emerging markets have underperformed since September. Asian emerging markets were among the best performers this year, but they also appear to be topping (relative to the S&P 500).

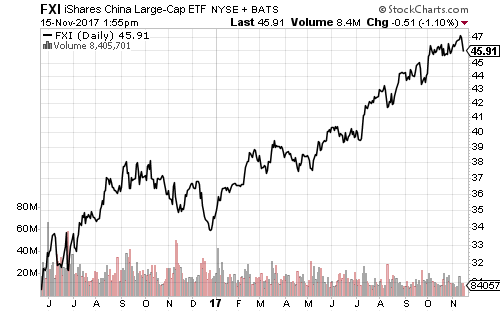

Chinese economic data was weak in October. Fixed-asset investment slowed. The current rate of investment growth is consistent with the end of prior slowdowns, not the start. Emerging markets and commodities could be in for a rough 2018 if Chinese growth continues to slow. iShares China Large-Cap (FXI) fell more than 1 percent in Wednesday trading, but has remained in a clear uptrend since the February 2016 low.

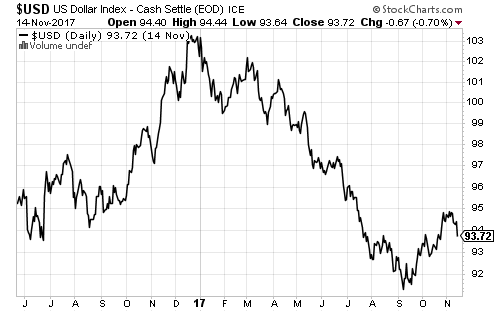

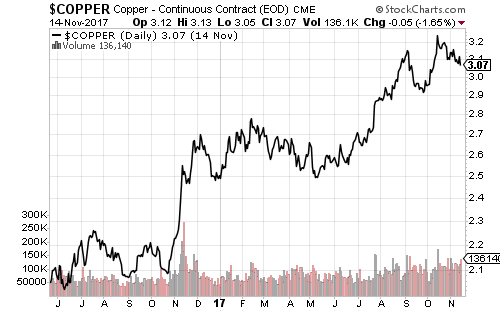

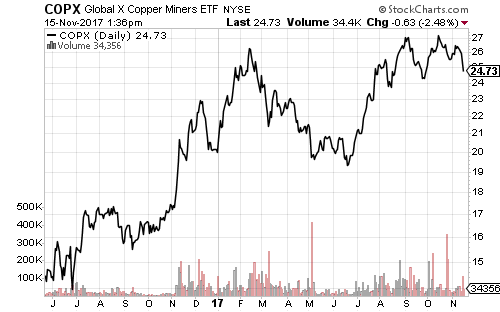

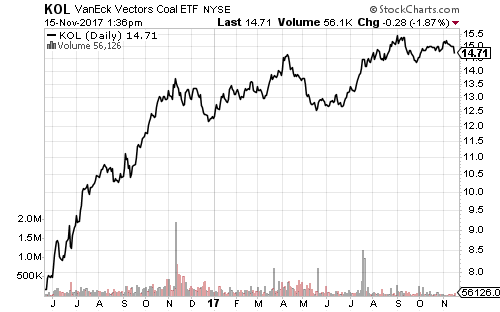

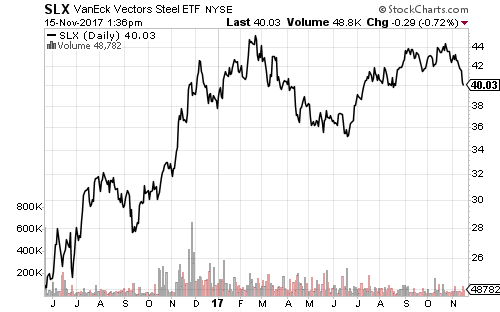

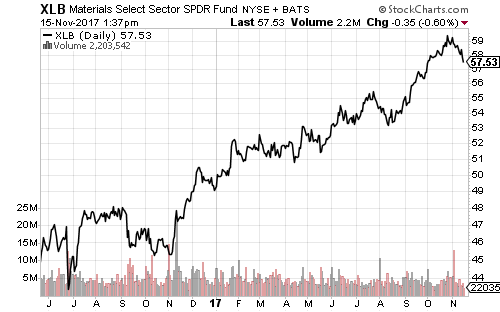

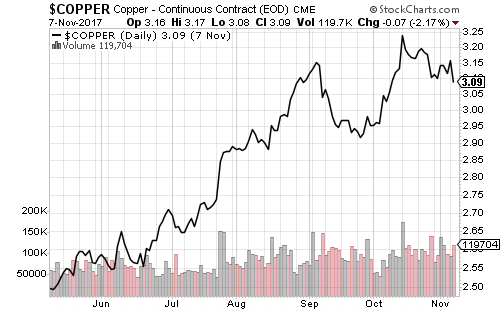

Copper remains near its 52-week high, but copper miners (COPX), Steel (SLX), and coal (KOL) stocks are turning over. SPDR Materials (XLB) has paced the broader market in 2017 and hasn’t suffered even a minor correction this year. The largest drawdown was in July and August, when it fell about 4 percent. Positive sentiment could offset the weaker Chinese data in the weeks ahead, but the risk of a pullback in materials is rising.

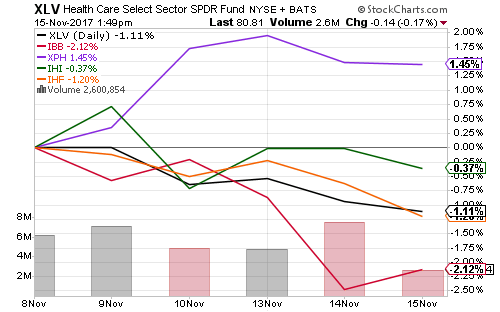

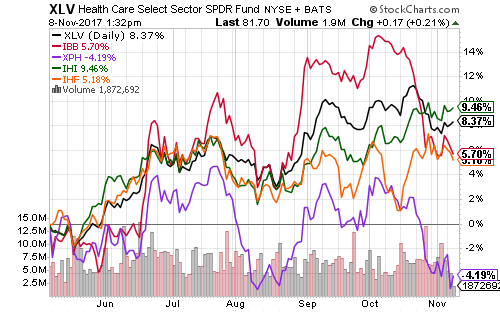

Pharma led healthcare subsectors over the past week amid Pfizer’s (PFE) rumored interest in Bristol-Myers (BMY) and Biogen (BIIB).

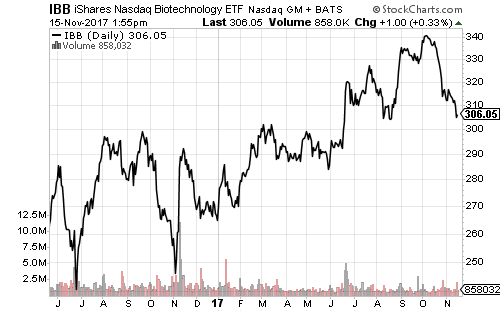

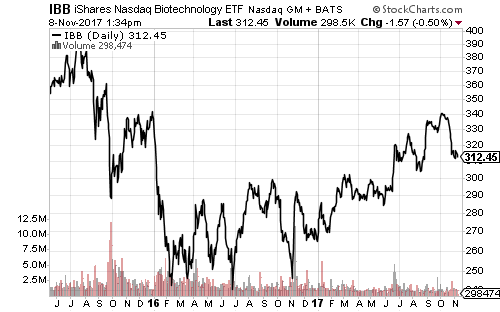

Biotech has almost fully reversed its June breakout. iShares Nasdaq Biotechnology (IBB) should bottom in the $290 to $305-dollar range, an area that has provided support going back to the summer of 2016.

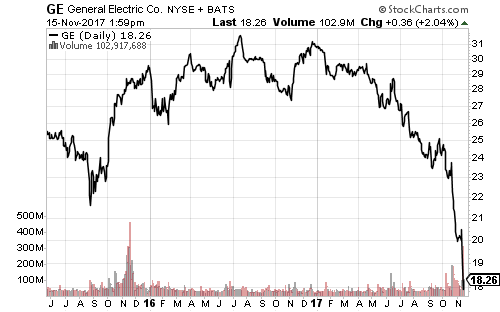

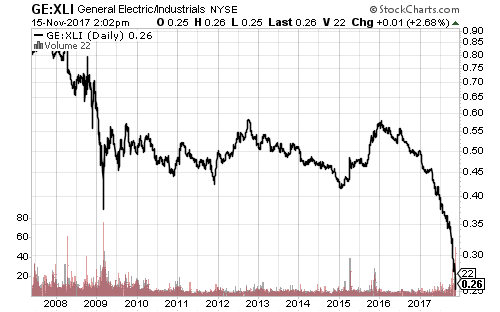

General Electric (GE) announced its long awaited dividend cut of 50 percent on Monday. Although the move was telegraphed, there was heavy selling on Monday and Tuesday as capitulation selling kicked in.

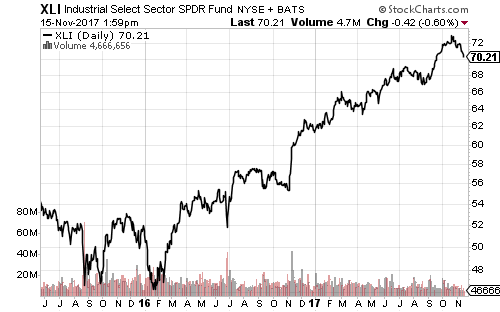

The slide in GE shares weighed on SPDR Industrials (XLI). GE fell 12.6 percent from the Friday close before rebounding. XLI lost roughly 0.6 percent as a result.