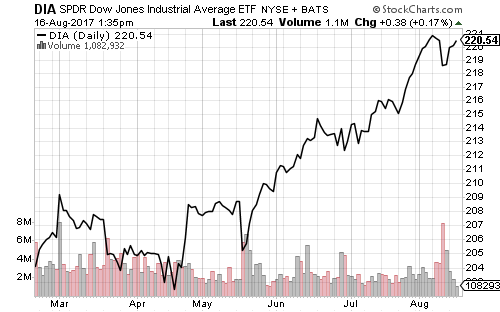

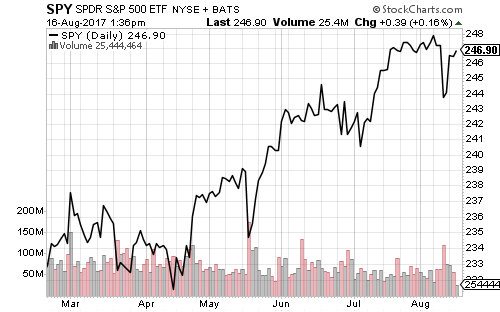

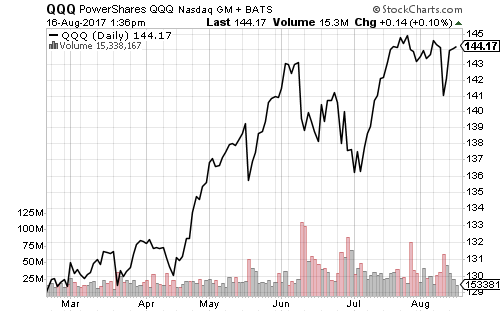

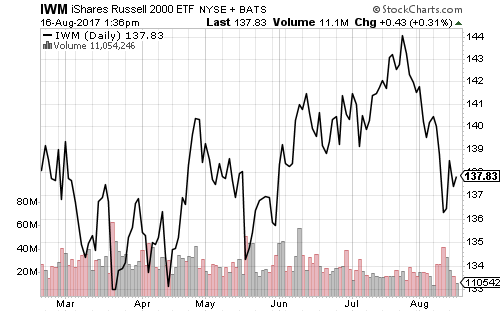

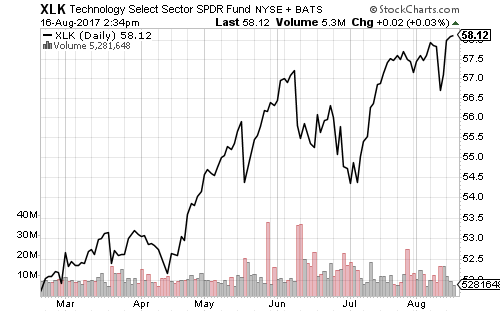

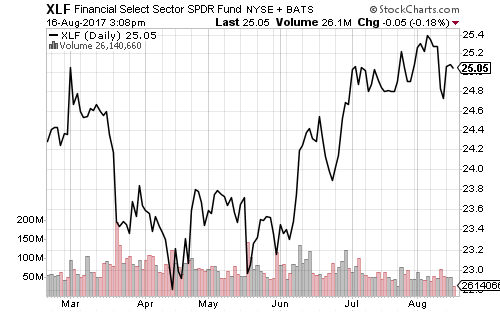

Equities bounced on Monday, pushing the Dow Jones Industrial Average back over 2200, and geopolitical tensions eased after the Chinese government blocked imports from North Korea. Stocks were also boosted by better-than-expected Japanese GDP. The Japanese economy grew 1 percent in the second quarter, or 4 percent annualized versus the consensus forecast for 2.5 percent growth. Technology and financials led Monday’s rebound.

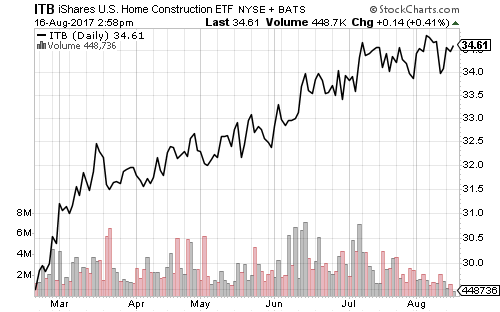

The homebuilders index for August, in addition to housing starts and building permits for July, will also be available this week. The consensus forecast calls for 1.229 million starts, up from 1.215 million in June.

Other data this week will include June business inventories, July capacity utilization and industrial production, the Philly Fed and Empire State index of regional economic activity, plus the University of Michigan advance consumer sentiment survey for August.

With many eyes turned towards North Korea, the iShares MSCI South Korea (EWY) fund is a good indicator of current sentiment. After falling 8 percent over three weeks, EWY bounced as much as 2 percent on Monday.

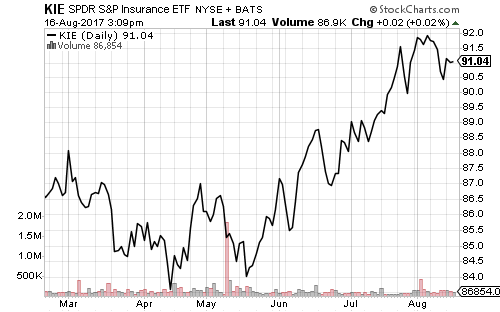

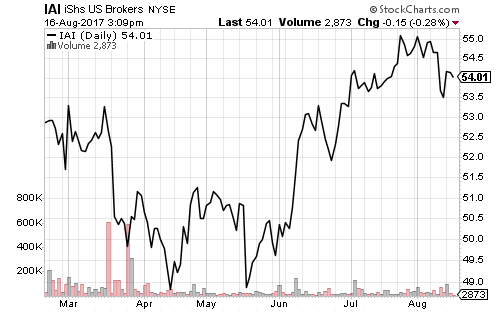

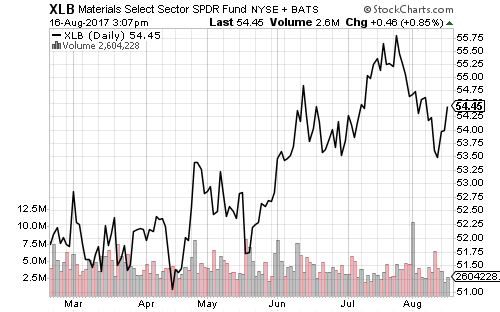

Defense is currently one of the strongest market sectors. iShares U.S. Aerospace & Defense (ITA) is trading close to its all-time high set last Wednesday. The financial and industrial sectors are also near all-time highs.

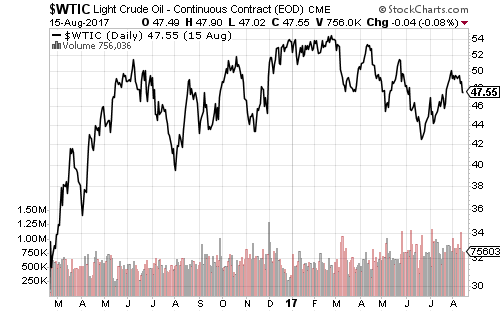

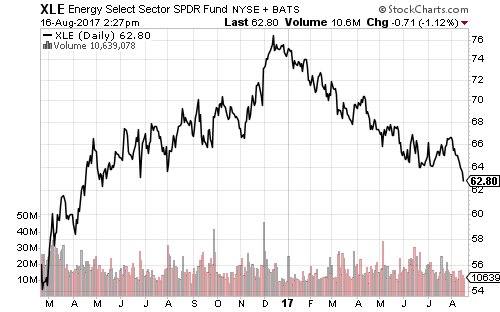

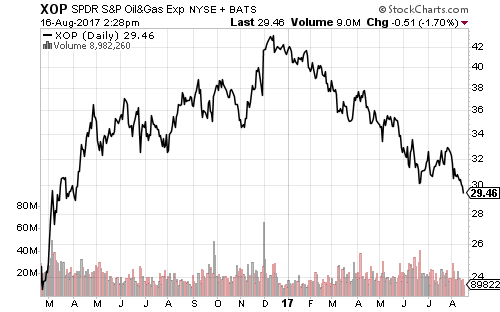

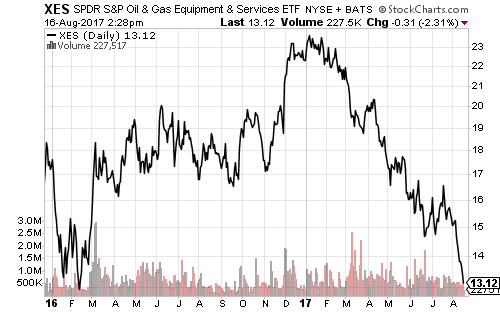

Energy remains weak. Oil weakened to $48 a barrel on Monday. Oil service funds traded at new 52-week lows on Monday, while independent producers and broad energy sector funds are on the verge of making new lows.

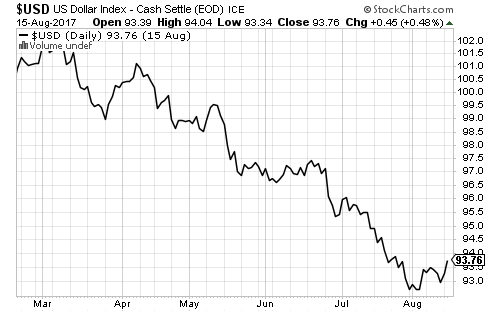

The U.S. dollar strengthened on Monday. The euro weakened with the yen. Interest rates were higher on Monday.

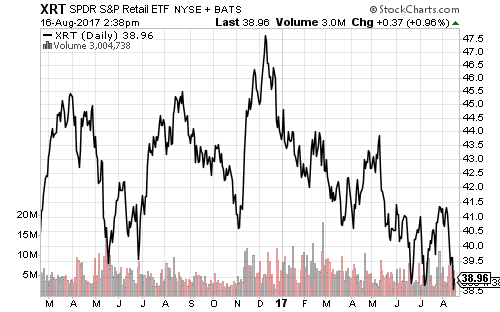

The minutes from the last Fed meeting will be out this week. Retail sales for July are due on Tuesday. Economists expect 0.4 percent growth.

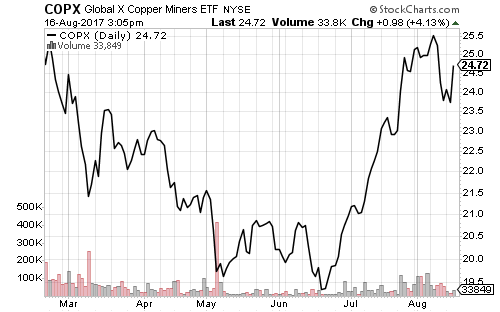

The Chinese economy slowed in July. Fixed-asset investment and industrial production weakened more than expected. New loans and money supply growth is due later this week.

Home Depot (HD), Wal-Mart (WMT) and Cisco (CSCO) will headline earnings reports this week. Analysts anticipate $2.21 per-share in earnings at Home Depot, up from $1.97 in the year-ago quarter. Wal-Mart (WMT) is expected to report $1.07, even with last year’s number. The consensus is looking for $0.55 at Cisco, down from $0.58 last year. Target (TGT), TJX Companies (TJX), Advance Auto Parts (AAP), Dick’s Sporting Goods (DKS), Urban Outfitters (URBN), L Brands (LB), Alibaba (BABA), Applied Materials (AMAT) JD.com (JD) Sysco (SYY), Canadian Solar (CSIQ), Deere (DE) and Gap (GPS) will also report this week.