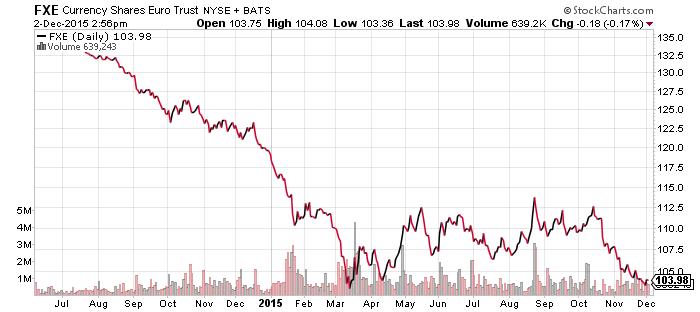

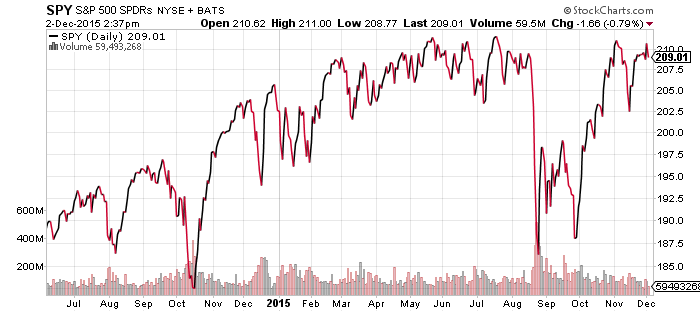

Stocks vacillated at the end of the week in response to central banks. The European Central Bank (ECB) disappointed investors on Thursday, igniting the most dramatic selloff since September. The central bank’s policy initiatives were deemed insufficient, merely meeting the expectations priced into the market. Although the ECB cut its deposit rate into deeper negative territory and extended its asset purchase program for another six months as expected, many investors had anticipated a larger stimulus package.

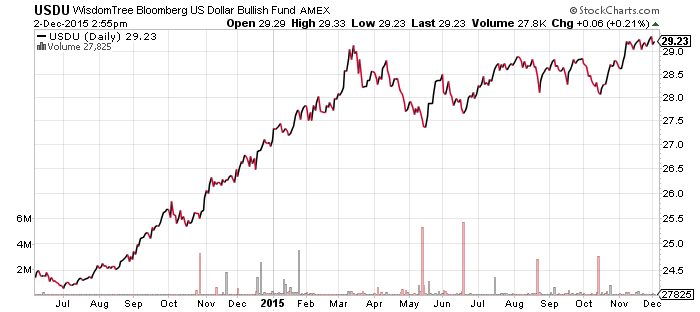

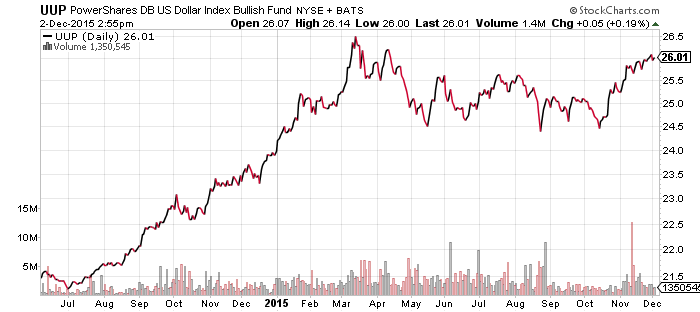

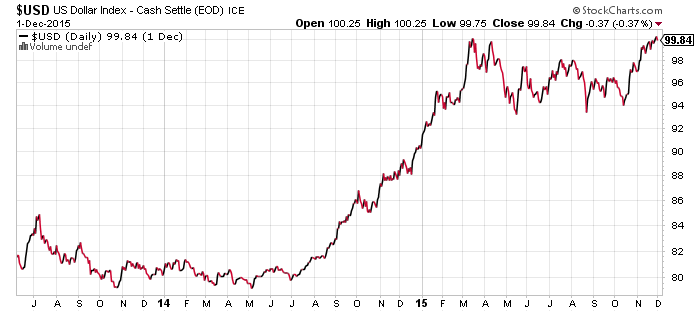

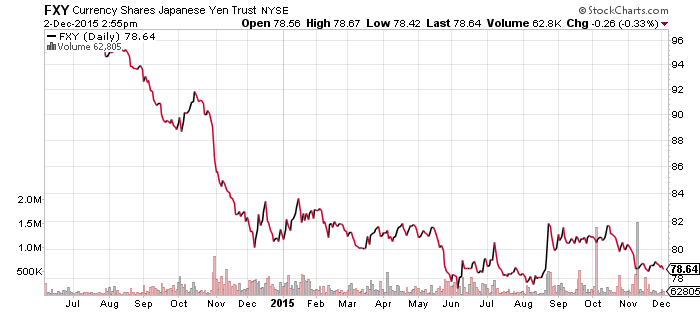

The move was completely reversed on Friday as the much-anticipated November non-farm payroll report exceeded expectations. Federal Reserve Chair Janet Yellen spoke on several occasions this week, asserting the Fed’s confidence in the economy and stating the Fed was on pace to raise interest rates at its December meeting, data permitting. Fed Chair Yellen’s economic threshold for the workforce was 100,000 jobs per month, based on labor participation rates and an aging population. The U.S. jobs report blew that number away, with the creation of 211,000 jobs, 11,000 more than expected. Additionally, the unemployment rate remained at a stable 5 percent and jobs data for September and October was revised higher.

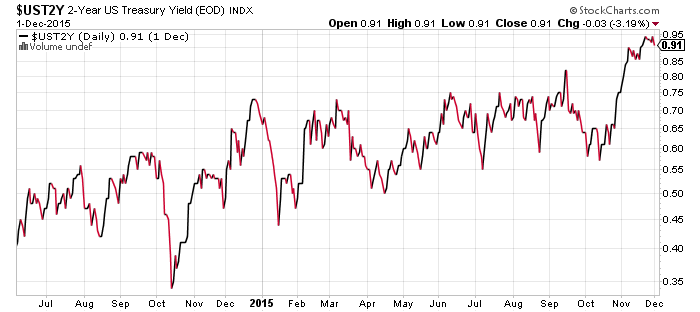

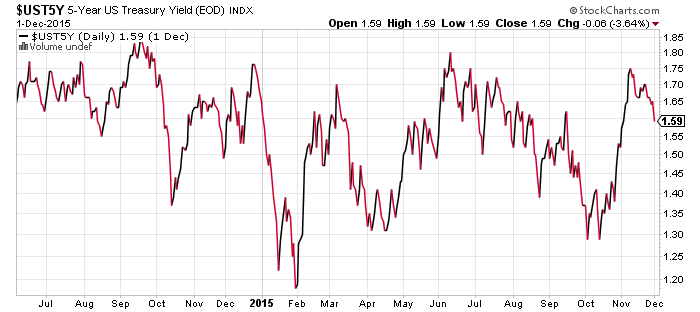

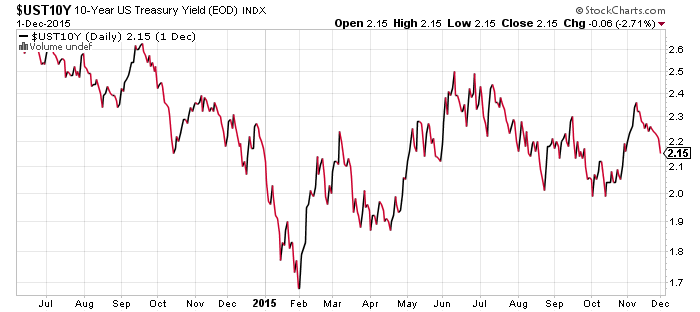

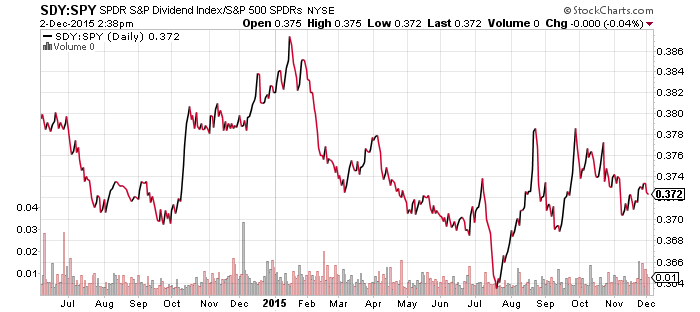

Jobs data hardened December rate hike expectations, raising futures odds up to 79 percent. Strong U.S. economic data failed to impact the euro, cornering ECB President Mario Draghi into commitments for further easing. With the U.S. set to tighten liquidity, the ECB will have to pick up the slack. Although stocks were up strongly from the open on jobs data, Draghi’s comments added a renewed bullish push.

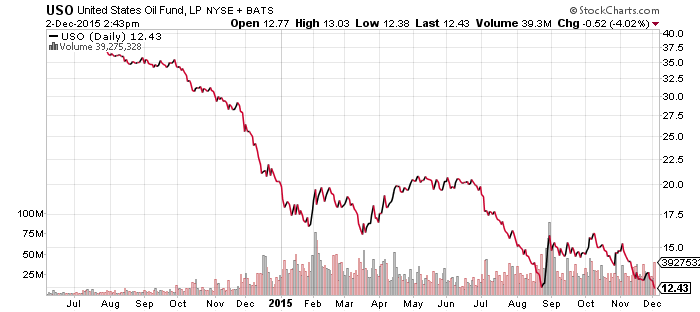

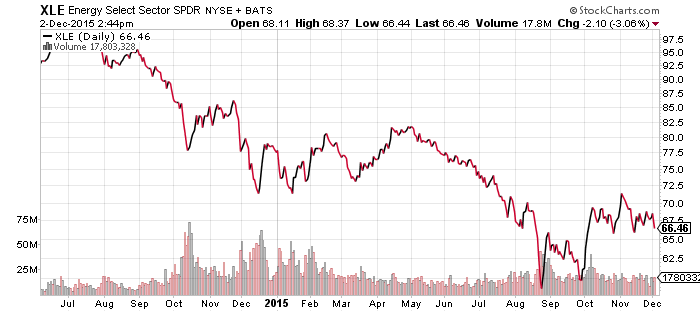

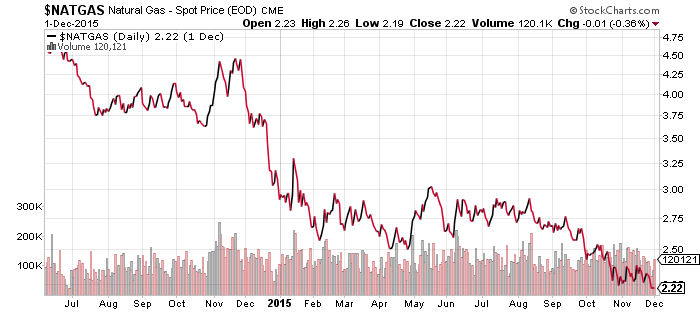

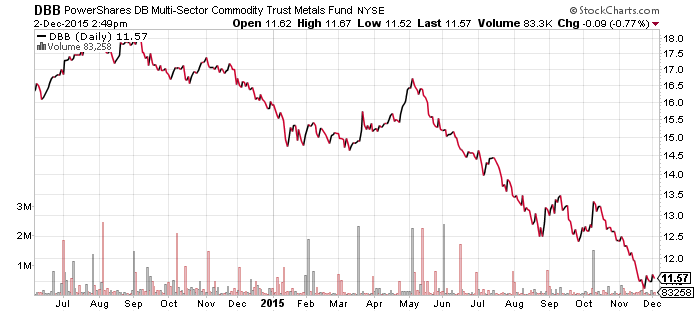

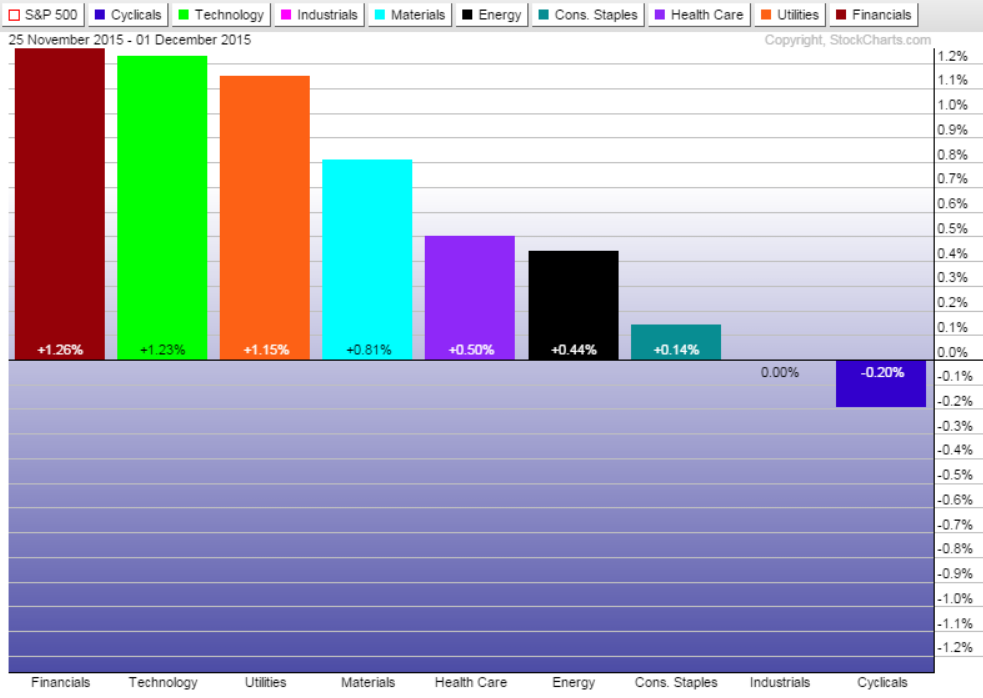

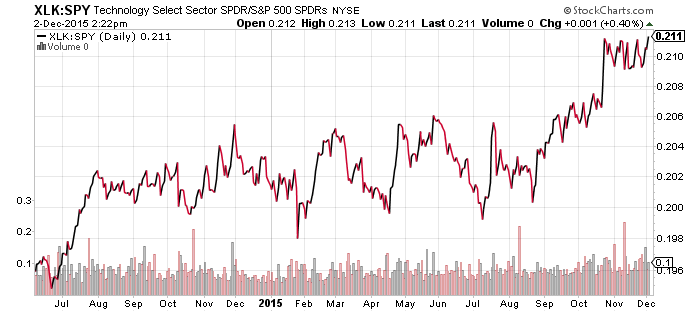

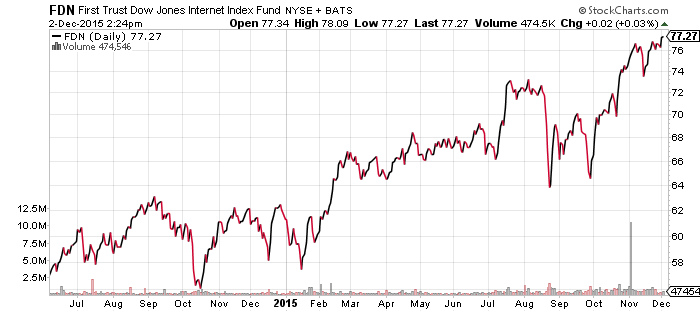

Technology, healthcare and consumer discretionary stocks led the market higher, while energy continued to struggle. Even rate sensitive utilities managed to climb more than 1 percent on Friday, but energy declined after OPEC’s decision to leave production unchanged in spite of Iran’s intention to increase production. This news sent oil slightly below $40 per barrel, but prices rebounded back to around $40 by the end of the day.

The Institute for Supply Management reported earlier in the week that its index of non-manufacturing activity was 55.9, below expectations of 58.0. The ISM Manufacturing index came in at 48.6 versus an expected 50.5, though the Markit PMI was higher at 52.8. The two surveys use similar data points, but weight them differently. Readings above 50 on either scale indicates expansion, while under 50 signals contraction. The weak ISM number is a concern as manufacturing is an important economic gauge, but a trend cannot be discerned from a one month blip in the data. Pending home sales for October ticked up 0.2 percent, and construction spending, a leading indicator for the market, was much higher than expected, up 1.0 percent in October.