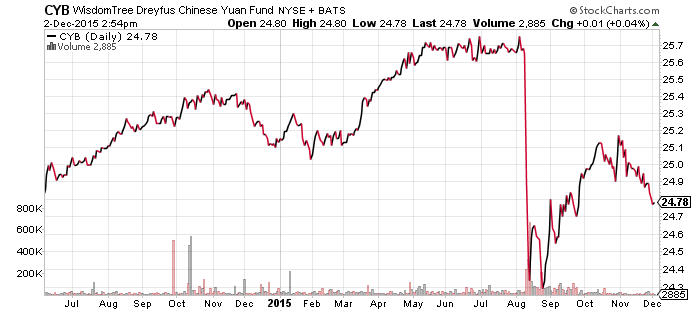

WisdomTree Chinese Yuan (CYB)

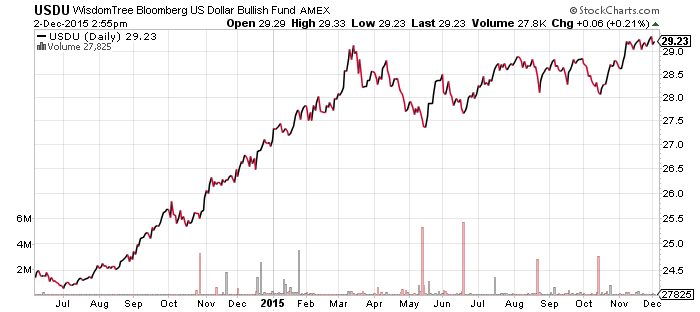

WisdomTree Bloomberg USD Bullish (USDU)

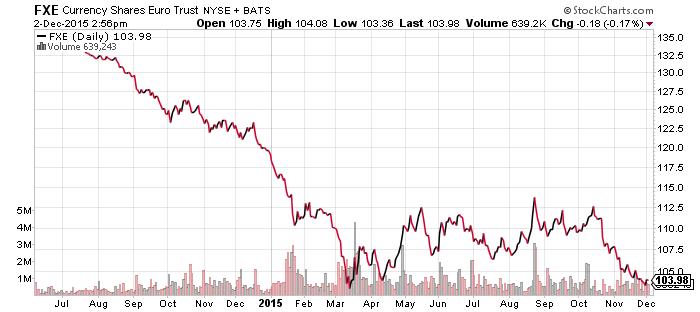

CurrencyShares Euro Trust (FXE)

CurrencyShares Swiss Franc (FXF)

CurrencyShares Swedish Krona (FXS)

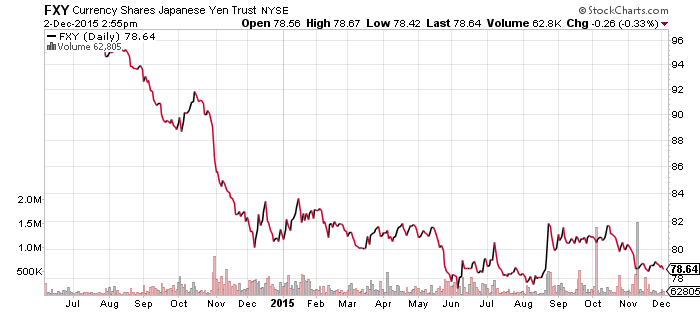

CurrencyShares Japanese Yen (FXY)

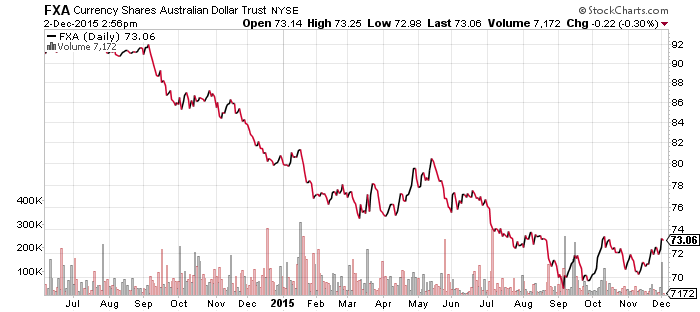

CurrencyShares Australian Dollar (FXA)

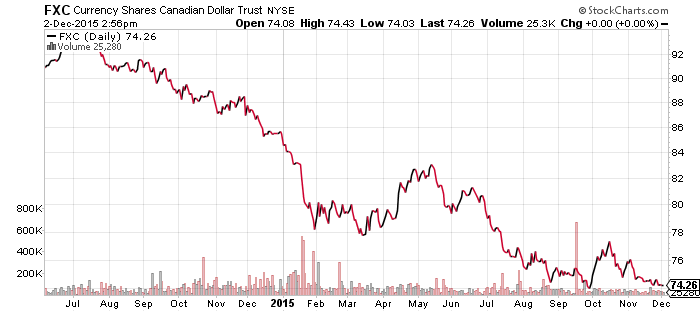

CurrencyShares Canadian Dollar (FXC)

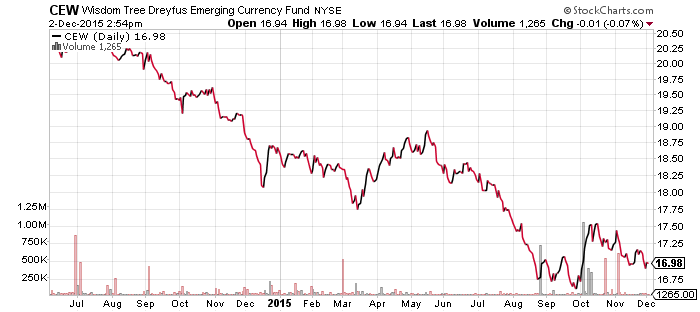

WisdomTree Emerging Market Currency (CEW)

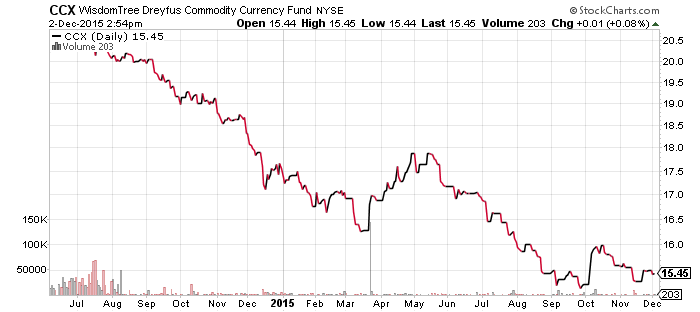

WisdomTree Commodity Currency (CCX)

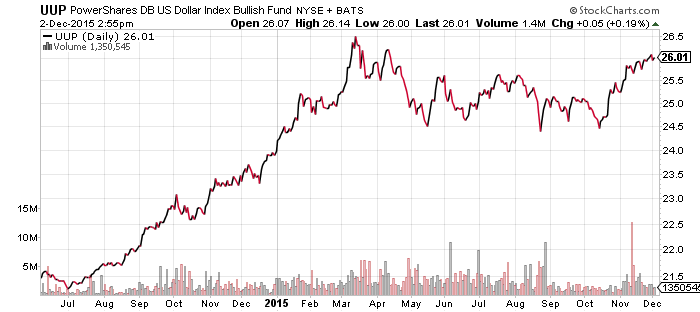

PowerShares DB U.S. Dollar Bullish Index (UUP)

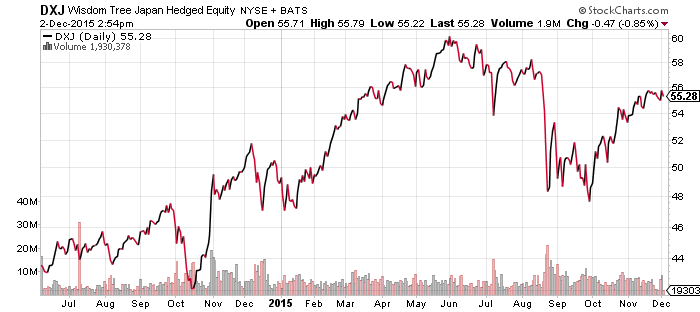

WisdomTree Japan Hedged Equity (DXJ)

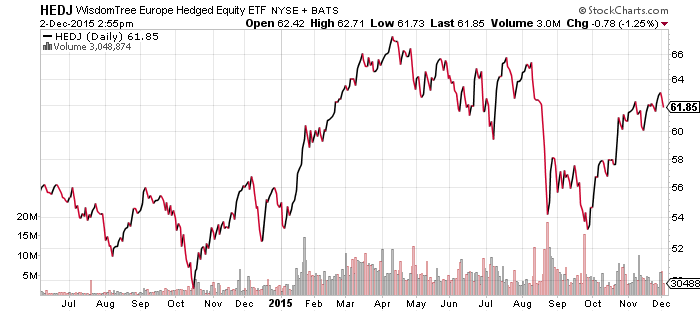

WisdomTree Europe Hedged Equity (HEDJ)

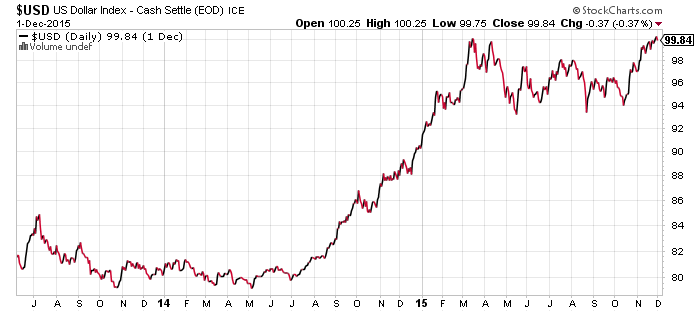

Janet Yellen’s public comments Tuesday sent the dollar higher. She raised the point, voiced last month by other Fed officials, that a hike in interest rates will be a signal of confidence in the economy. Nevertheless, upon the disappointment of the failure of the European Central Bank to deliver enough stimulus to assist in faster growth, the green back has shown signs of exhaustion and we may see a pullback over the very short-term.

China’s yuan was added to the IMF’s SDR basket on Monday as expected, leading to an immediate drop in the yuan. Officials in China deny any concern for further weakness in the yuan, but the market remains bearish on the currency versus the U.S. dollar.

Canada’s loonie failed to break to a 52-week low in the past week, despite negative economic data that elicited a brief drop in the currency. September GDP was down 0.5 percent month-over-month, the worst monthly figure in 6 years, but GDP grew 2.3 percent for the quarter, the best of 2015 thus far. The Australia dollar has been rallying versus the greenback as well. The Swedish krona, like the loonie, is showing strong resistance to pushing below its 52-week lows. The Swiss franc has been an exception.

Overall, these funds comprise key support/resistance levels for multiple currencies. The length of time is significant, for instance FXS has triple-bottomed over eight months.

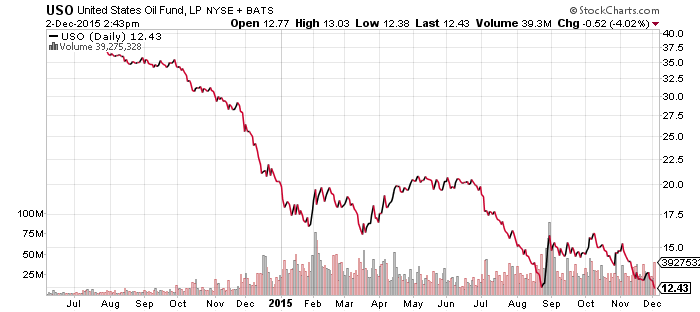

United States Oil (USO)

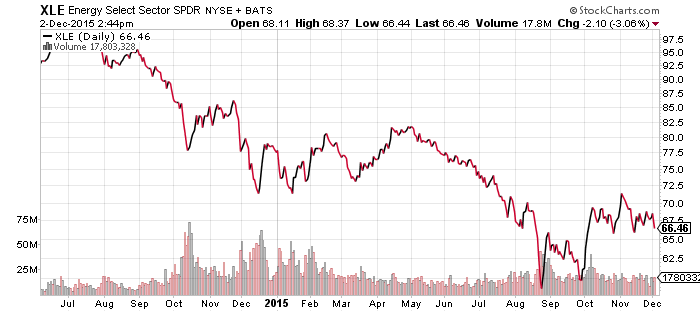

SPDR Energy (XLE)

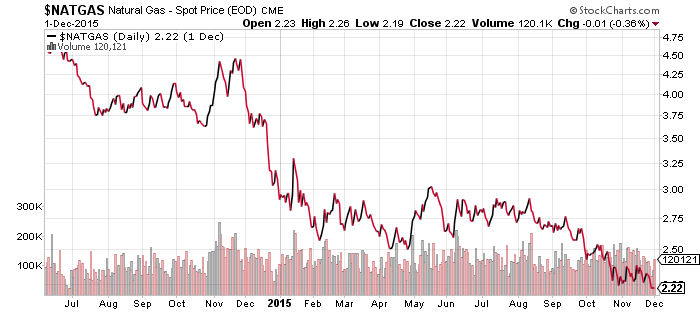

FirstTrust ISE Revere Natural Gas (FCG)

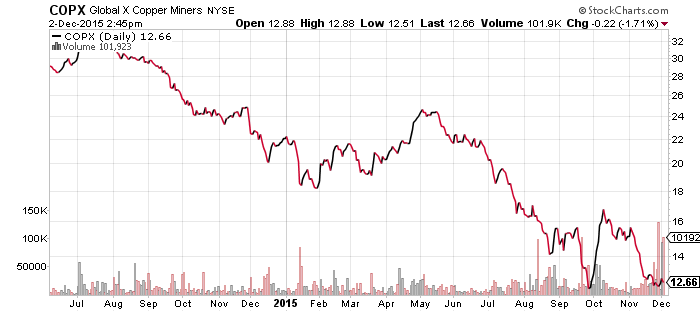

Global X Copper Miners (COPX)

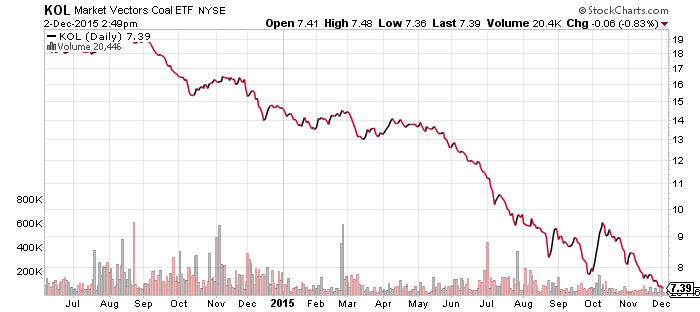

Market Vectors Coal (KOL)

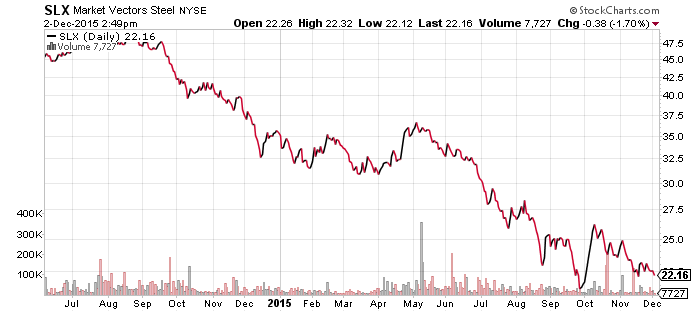

Market Vectors Steel (SLX)

Oil prices spiked on Wednesday when Iran announced a majority of OPEC members were in favor of production cuts. Saudi Arabia and other major oil producers later expressed disagreement, reversing the trend. U.S. production is also strong and inventories are rising, all negative factors for crude. West Texas Intermediate Crude, the main price for U.S. oil, is still off its lows of the year, Brent crude, which is a more important indicator for Europe, is very close to its lows in 2015 and could make a new closing low today.

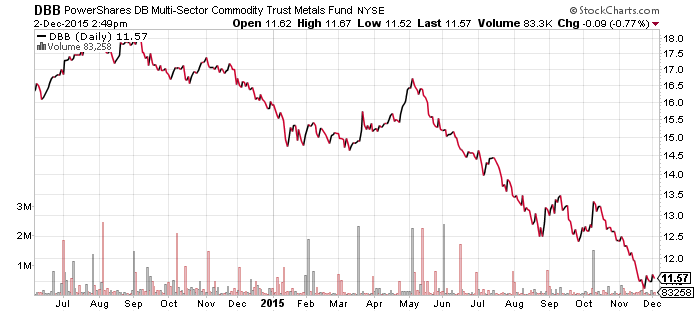

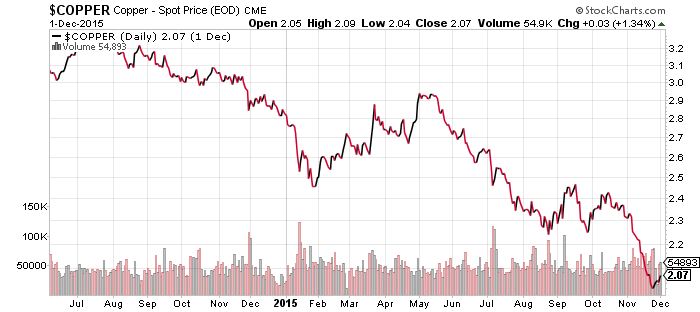

Other commodities rebounded last week, led by a bounce in copper, but equity investors didn’t buy the uptick.

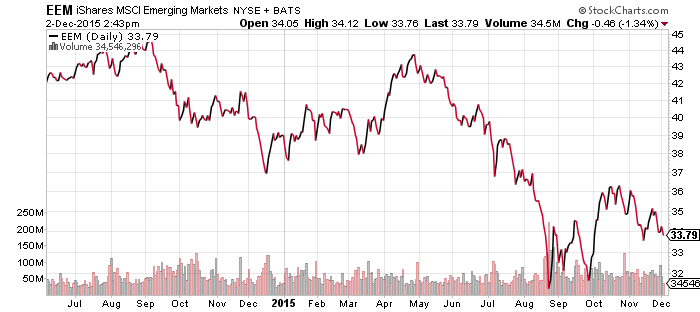

iShares MSCI Emerging Markets (EEM)

EEM is right at $34 a share, the midpoint between the recent high of $36 and low of $32. Those are the key levels in the near term. Short-term technical indicators such as relative strength are neutral.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

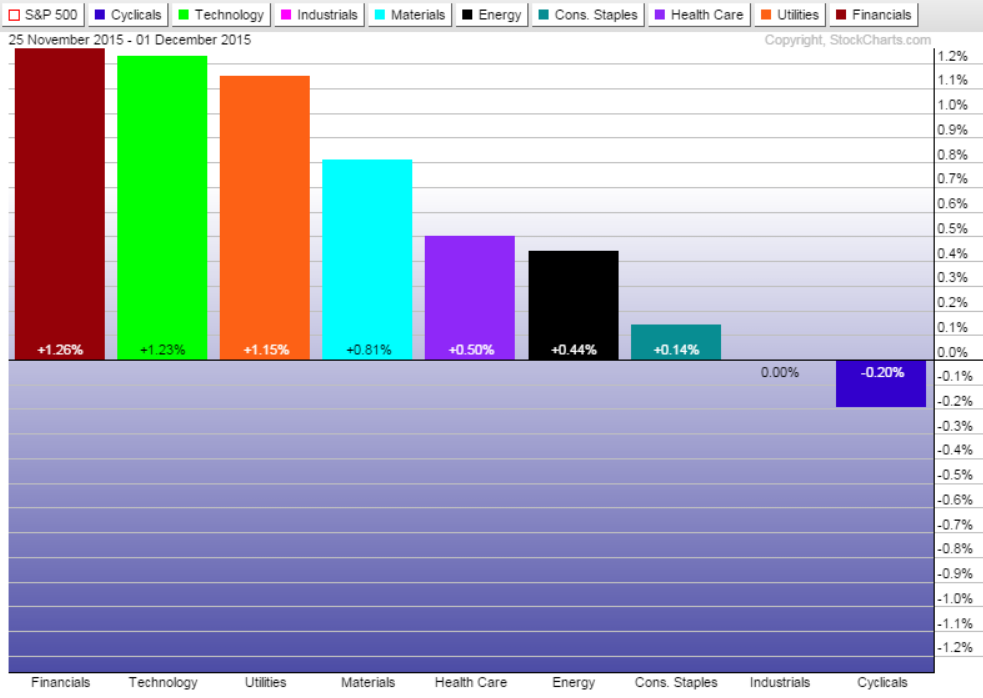

Financials and utilities were surprise winners in the past week. Rate hike expectations fueled the rise in financials. Utilities typically underperform when rates tick up, but they had a decent week as most of the market moved higher.

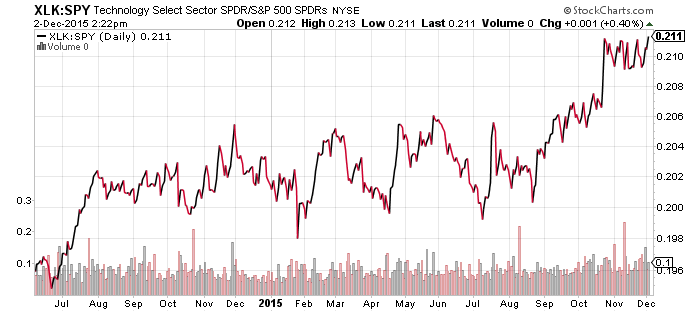

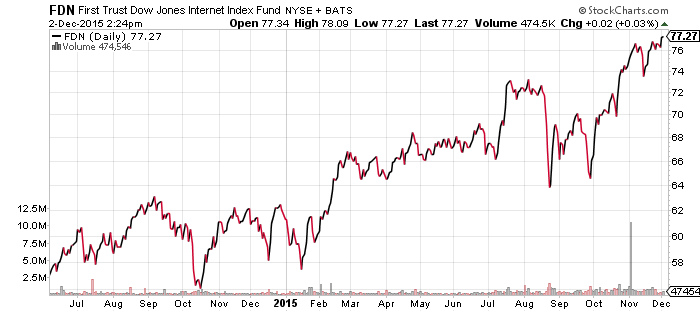

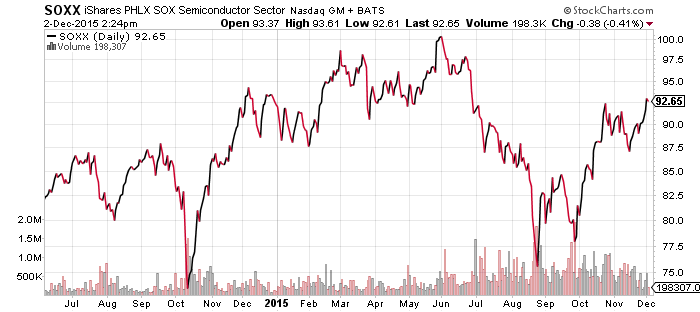

Technology is showing the most strength relative to the broader market in the past week. The price ratio of XLK to SPDR S&P 500 (SPY) is breaking out to a new 52-week high. Internet shares continue to push into record high territory, while subsectors such as semiconductors have also performed well in recent weeks.

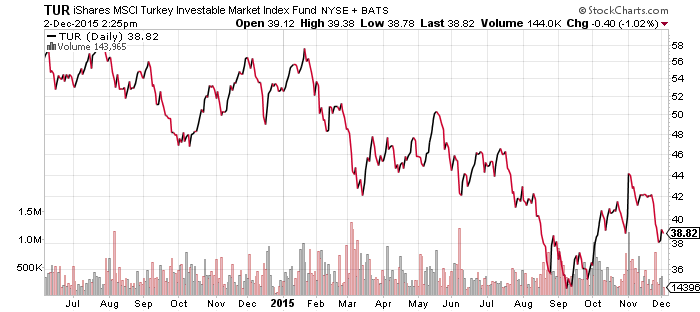

iShares MSCI Turkey (TUR)

Turkey fell last week after the country shot down a Russian jet under questionable circumstances. Tensions with Russia have heightened, but the overall trend in TUR was bearish to begin with. The long-term trend will establish itself here whether tensions dissipate or intensify.

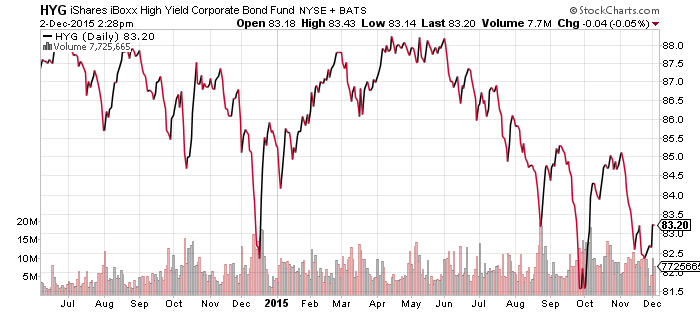

iShares iBoxx High Yield Corporate Bond (HYG)

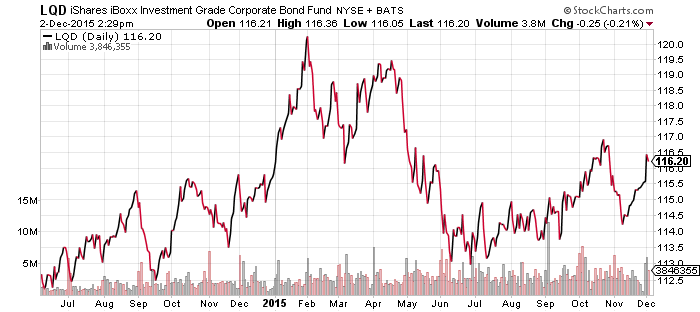

iShares iBoxx Investment Grade Corporate Bond (LQD)

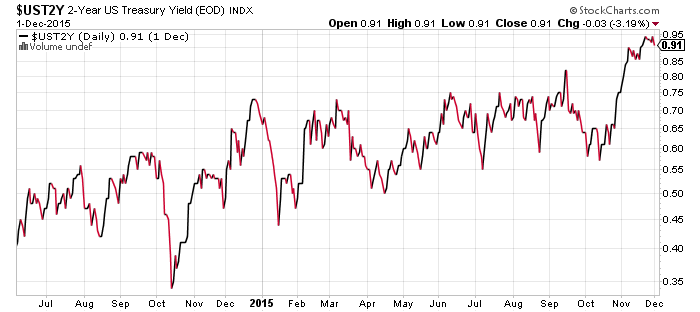

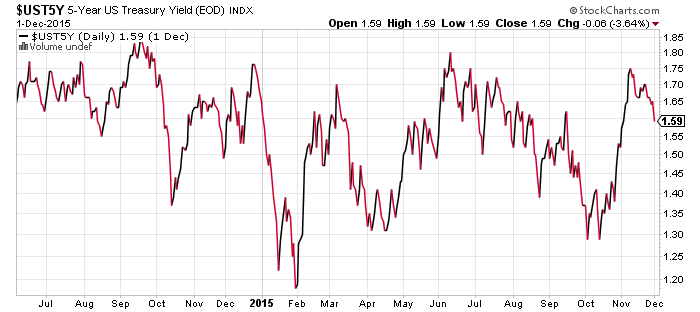

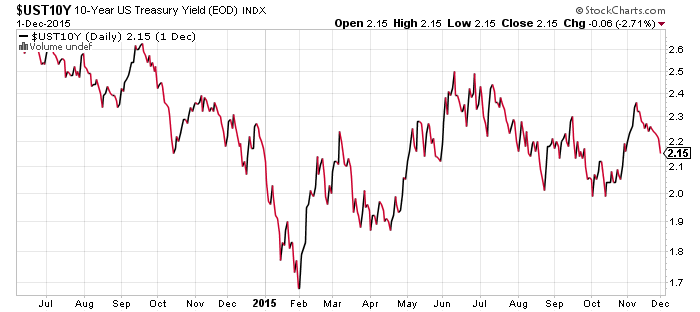

Both HYG and LQD benefited from a drop in interest rates over the past couple of days. The big move came on Tuesday when the ISM PMI fell below 50 for November. Although the Markit PMI was still above 50, speculators bet the Fed would not hike rates due to that number. Hawkish comments from Yellen yesterday have rates moving higher. As the charts show, the dip in rates was larger at the long-end, but the short-end is most impacted by a Fed hike.

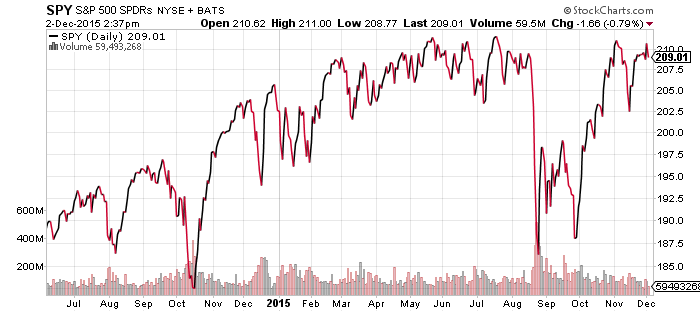

SPDR S&P 500 (SPY)

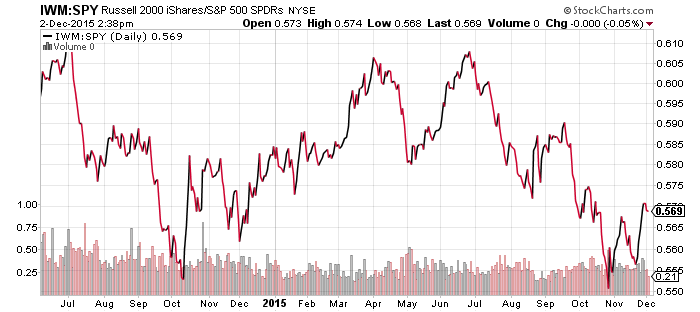

iShares Russell 2000 (IWM)

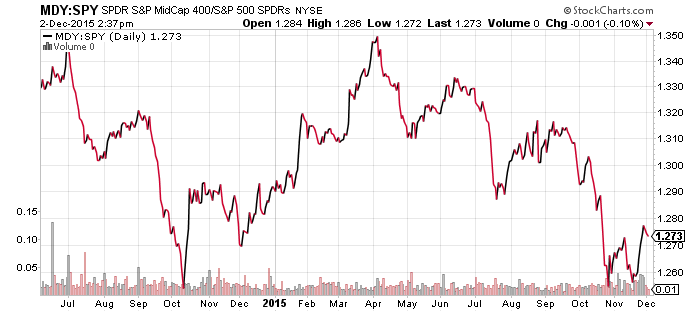

S&P Midcap 400 (MDY)

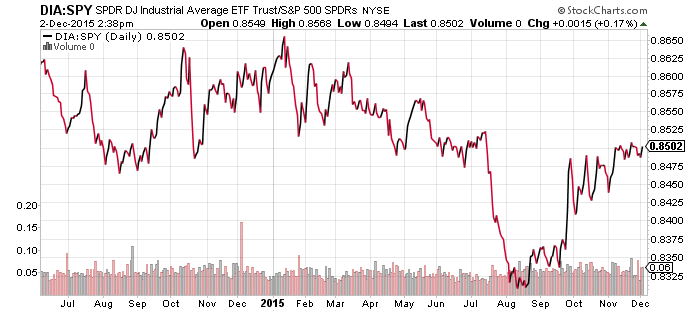

SPDR DJIA (DIA)

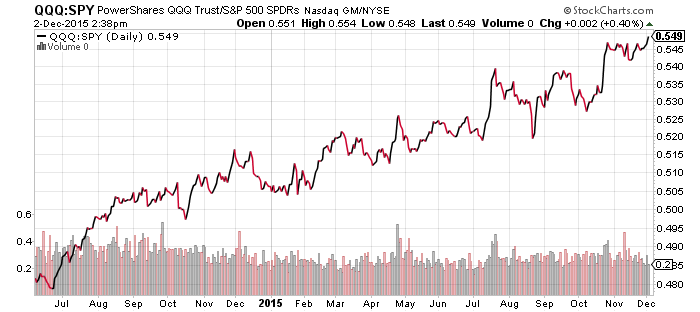

PowerShares QQQ (QQQ)

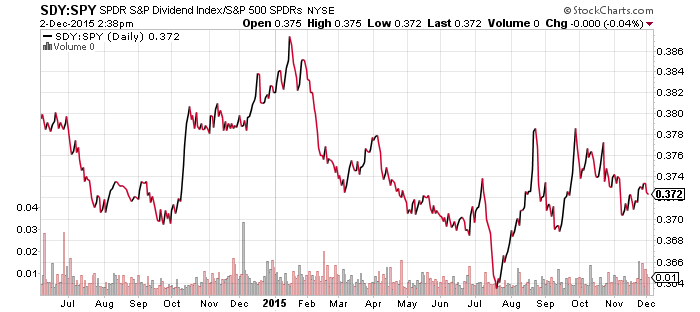

SPDR S&P Dividend (SDY)

Mid- and small-cap shares enjoyed another bounce in the past week as the U.S. Dollar Index climbed above 100. The tech heavy QQQ broke out to a new relative high versus the S&P 500 Index, similar to the breakout in XLK. The Dow continues to perform well. Relative to the S&P 500, the Dow is overweight consumer discretionary which is near its highs for the year having set a new 52-week high in November.