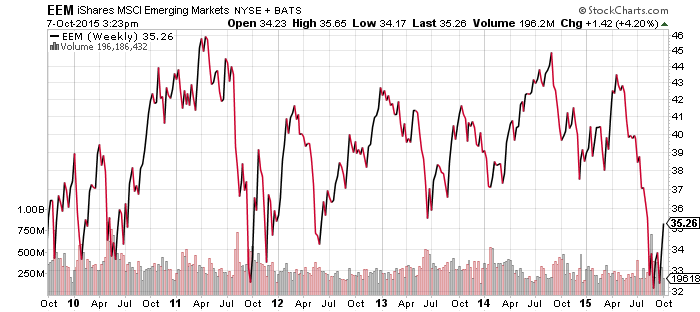

iShares MSCI Emerging Markets (EEM)

Emerging market ETFs are near their 52-week lows and remain an important bellwether of market trends, especially in light of continued economic troubles in countries such as China and Brazil. The past week has proven encouraging for the sector, though, with EEM gaining more than 7 percent. One factor aiding the asset class may be the fact that the Chinese market has been on vacation for a full week, but resumes trading today.

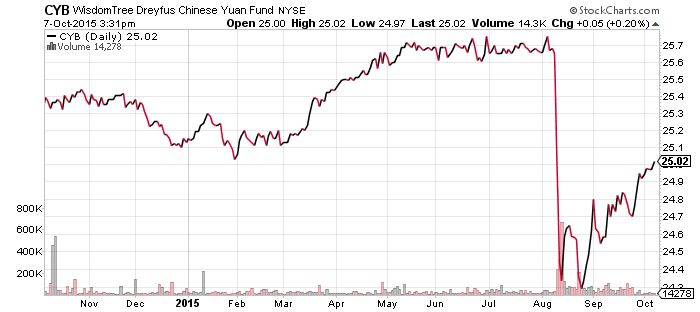

WisdomTree Chinese Yuan (CYB)

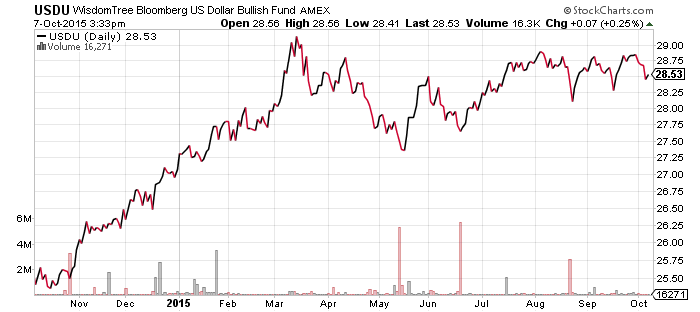

WisdomTree Bloomberg USD Bullish (USDU)

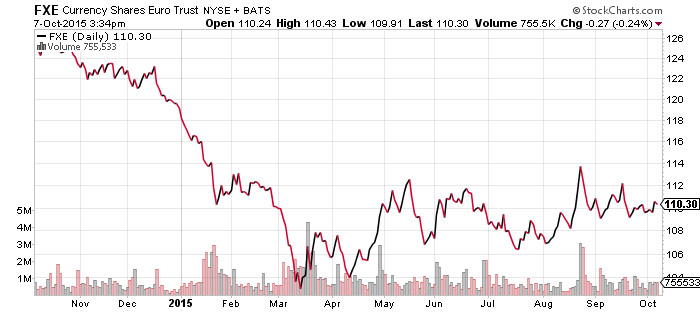

CurrencyShares Euro Trust (FXE)

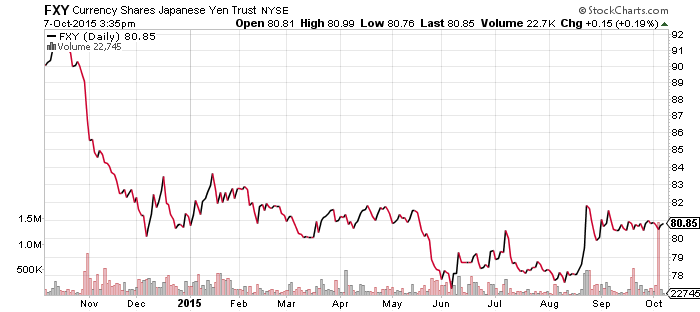

CurrencyShares Japanese Yen (FXY)

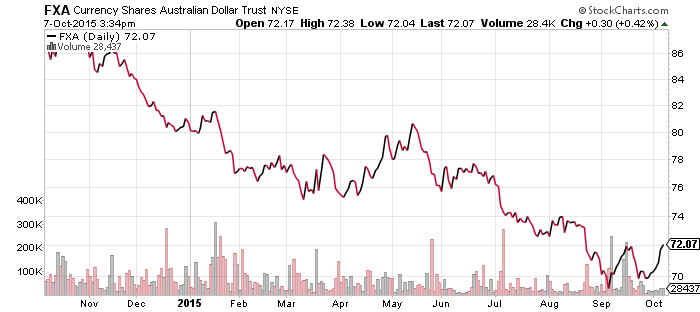

CurrencyShares Australian Dollar (FXA)

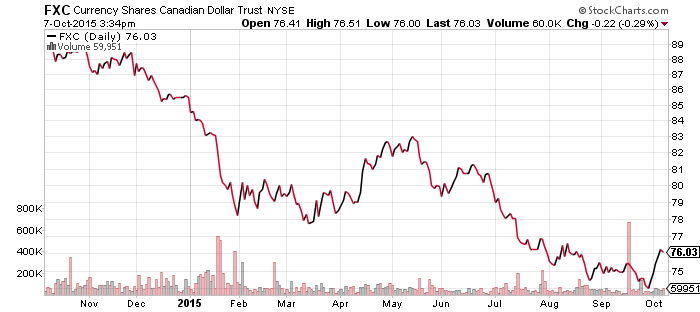

CurrencyShares Canadian Dollar (FXC)

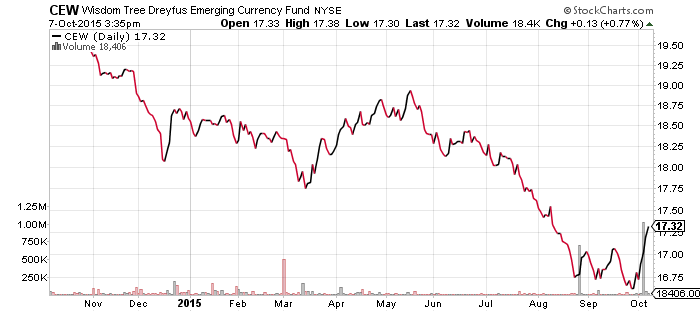

WisdomTree Emerging Market Currency (CEW)

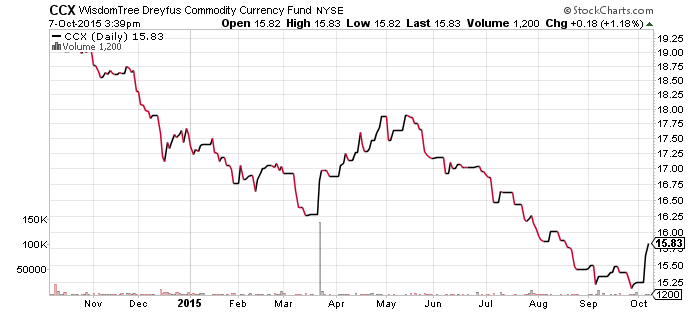

WisdomTree Commodity Currency (CCX)

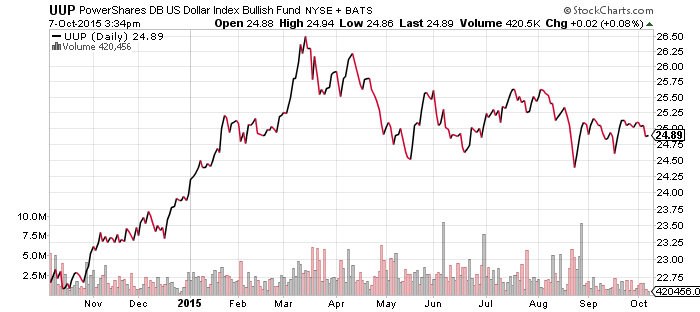

PowerShares DB U.S. Dollar Bullish Index (UUP)

Emerging market currencies rebounded along with their respective markets in the past week, but it didn’t have a large impact on the U.S. dollar, which remains in a short-term uptrend. Both USDU and UUP have been making a series of higher lows since August. The Australian and Canadian dollars also rallied while the yen held steady. The euro is effectively unchanged. The driving force behind emerging market currencies was a rebound in energy and commodity prices.

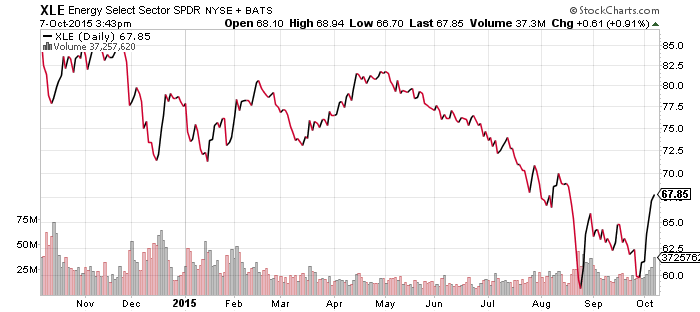

SPDR Energy (XLE)

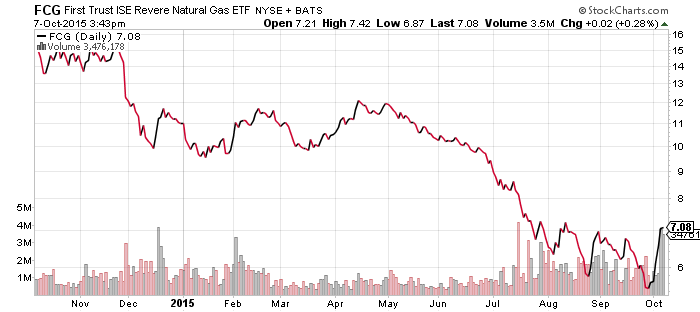

FirstTrust ISE Revere Natural Gas (FCG)

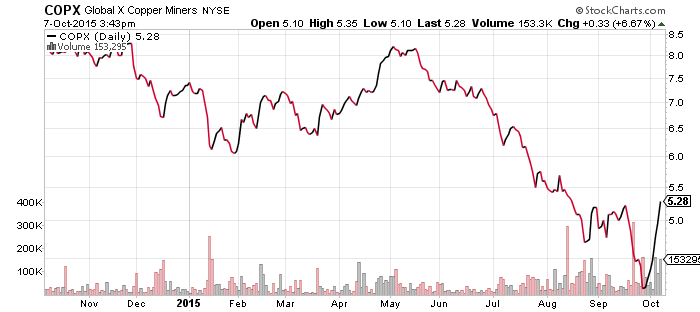

Global X Copper Miners (COPX)

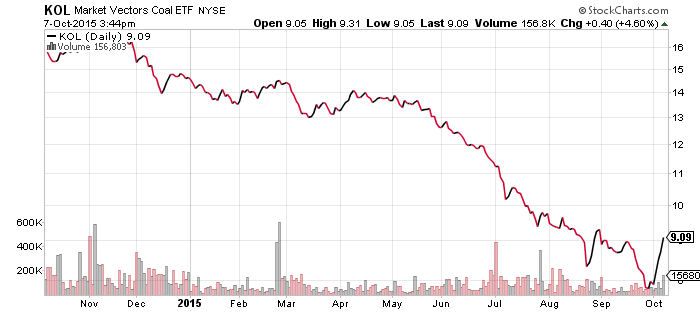

Market Vectors Coal (KOL)

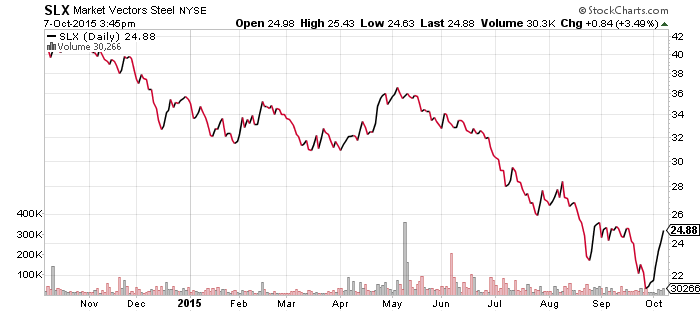

Market Vectors Steel (SLX)

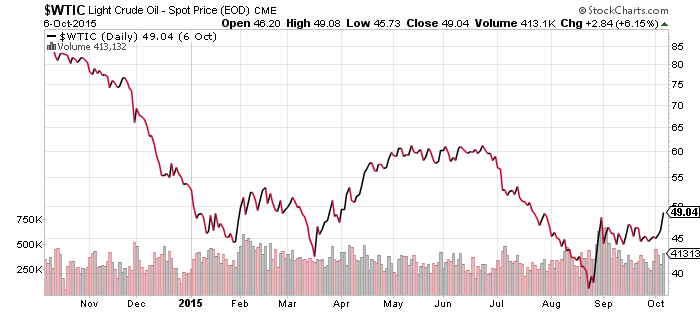

A jump in prices pushed black gold to its highest level since mid-summer, propelling the energy sector with it and catching short-sellers unaware. Despite the rebound, the oil market remains in an intermediate-term and long-term bear market.

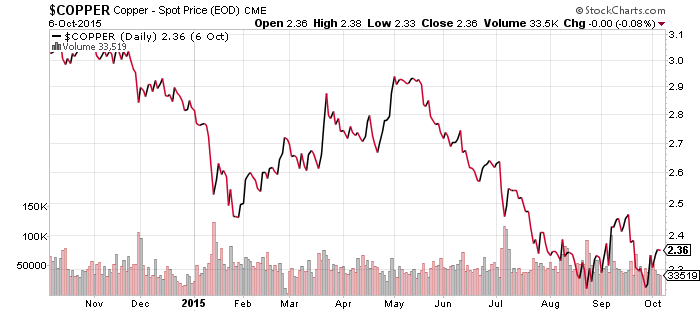

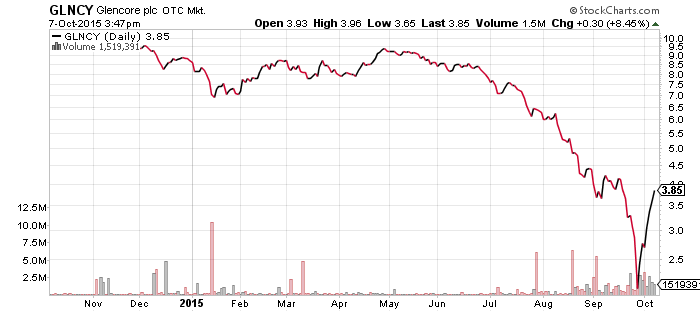

Copper prices did not see a rebound of similar size, but copper mining shares rallied strongly along with steel makers and coal miners. The rally may have been touched off by a rebound in shares of Glencore (or vice versa), a major commodities trader. Many bears believe the firm is headed for bankruptcy, but shares spiked over the past week after the firm’s declaration of financial backing. We saw similar events during 2008, but at the time those statements of liquidity didn’t hold up because investors feared the firms’ debt load was unsustainable. Glencore may only survive if commodity prices remain elevated. For now, the firm has been given at least a temporary reprieve.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

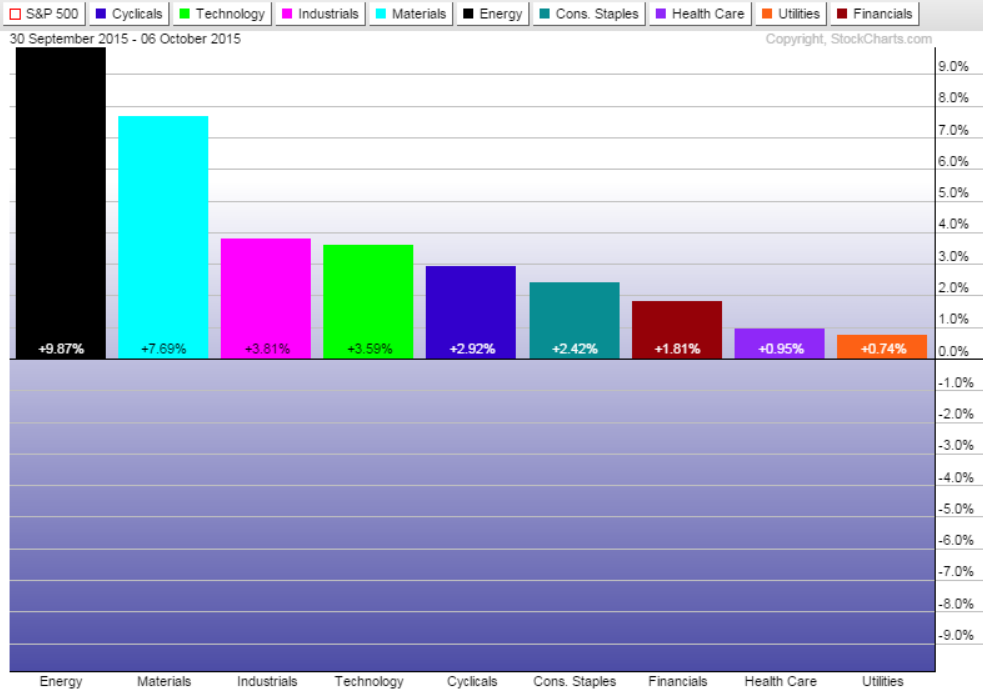

Energy was far and away the best performing sector in the S&P 500 Index last week, but it was not alone in positive territory. All sectors were up, with a 0.74 percent gain in utilities trailing the field. Behind the gain in energy was a solid advance in materials, nearly double the return of the next best sector, industrials.

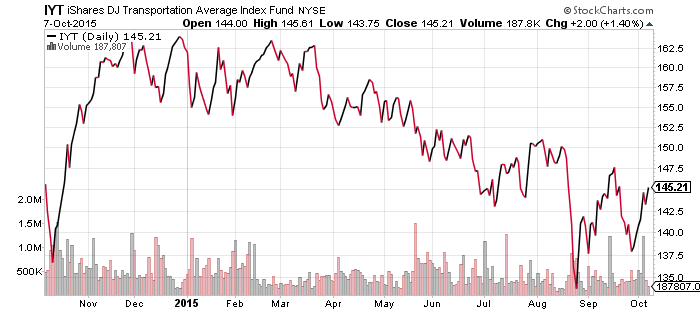

A rise in energy prices is sometimes problematic for transportation stocks, but the oversold sector rallied along with commodity shares in the past week. IYT is well off its August lows, but has yet to break the downtrend begun in early 2015.

Falling interest rates were partly responsible for the rally in the utilities and real estate sectors last week, but the slide in rates have since halted in October.

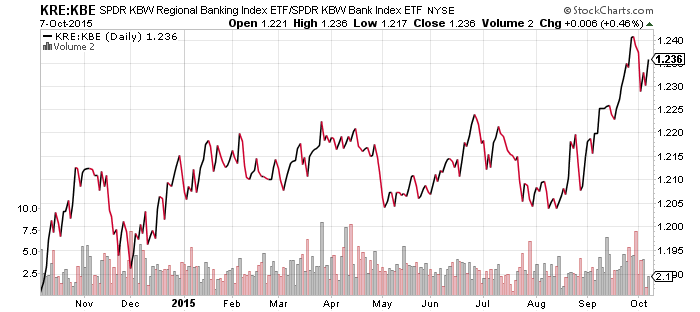

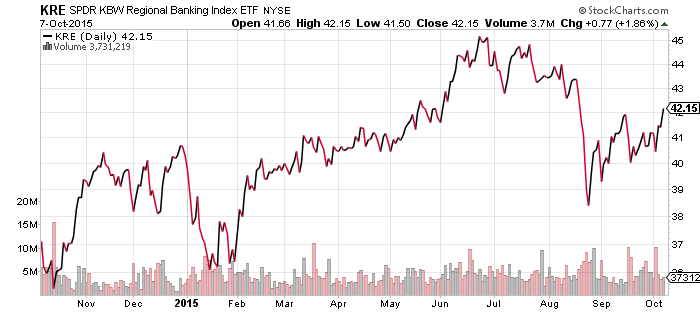

Financial shares moved higher and regional banks improved their relative performance, regaining some ground versus the larger banks. Low interest rates have been a hurdle for the sector, but continued strength in the smaller banks remains a bullish sign.

Housing shares, which initially flirted with a breakdown, rebounded towards their average prices dating back to February. The August breakout is history, but shares could challenge this trading range again if they rally back towards the $29 level.

SPDR Gold Shares (GLD)

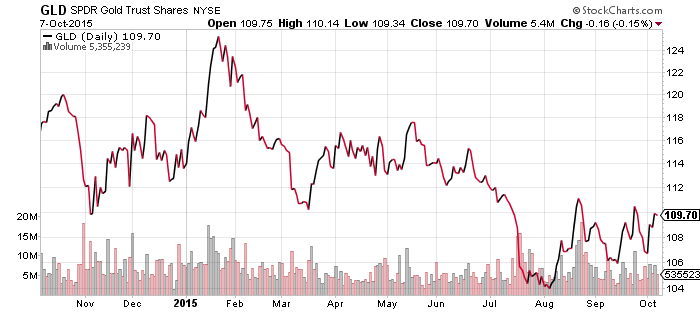

Although commodities have witnessed gains, gold has been behaving much like currency, which typically rises when the market is in turmoil or when investors think a fourth round of quantitative easing may be a possibility. GLD is up from its lows at $104 in August and made a series of higher lows, but these small rallies often die. A rally above the August high would be short-term bullish, but a retest of those lows remains the most likely outcome.

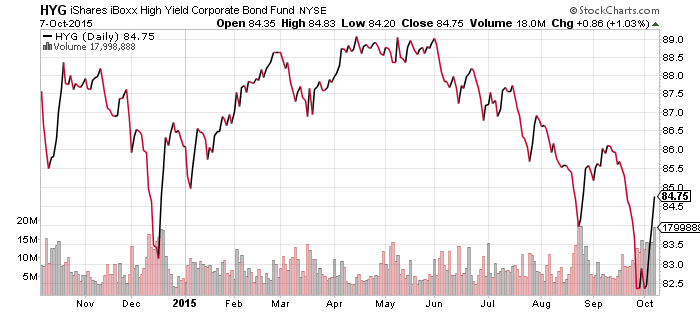

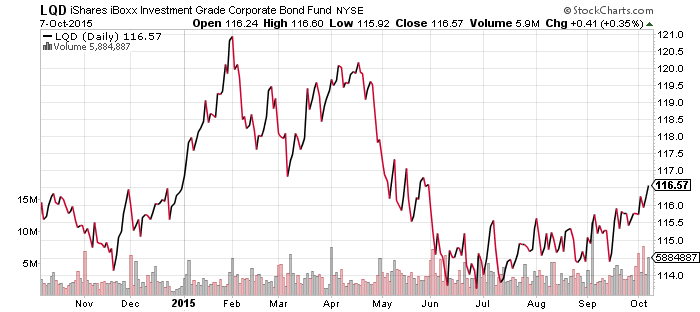

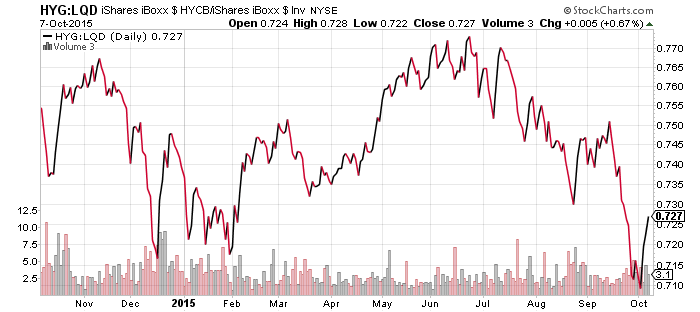

iShares iBoxx High Yield Corporate Bond (HYG)

iShares iBoxx Investment Grade Corporate Bond (LQD)

One of funds most affected by weak energy prices in the past year has been high-yield debt. Due to shale oil companies raising capital with high-yield bonds, the high-yield index funds have been under some pressure as oil prices reached new lows. Last week’s sharp rally was therefore good news, and high-yield bonds rallied relative to investment grade bonds.