The month ending May 15 saw the Dow Jones Industrial Average and S&P 500 Index close at new all-time highs. The Dow was also the best performing domestic index with […]

Month: May 2015

ETF Watchlist for May 20, 2015

PIMCO 20+ Year Zero Coupon Treasury (ZROZ)

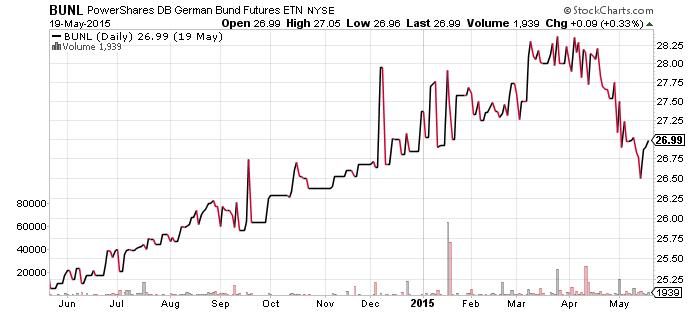

PowerShares DB German Bund Futures (BUNL)

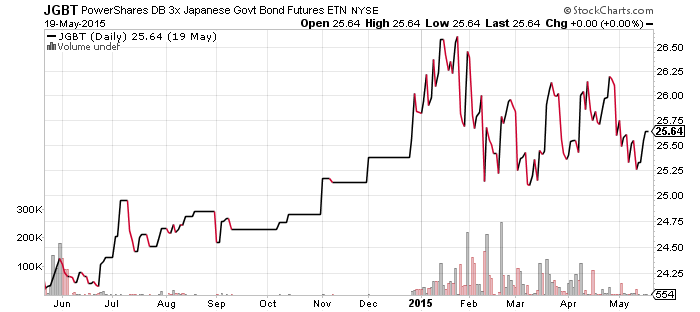

PowerShares DB 3X Japanese Govt Bond Futures (JGBT)

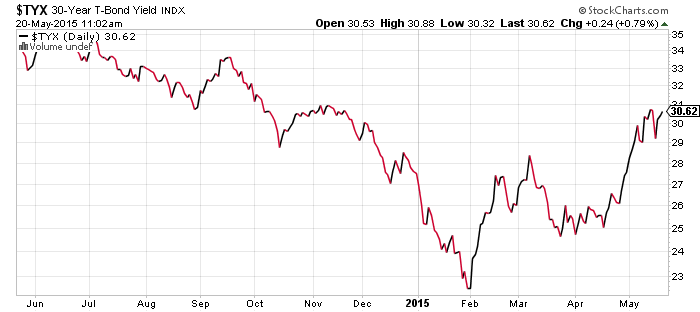

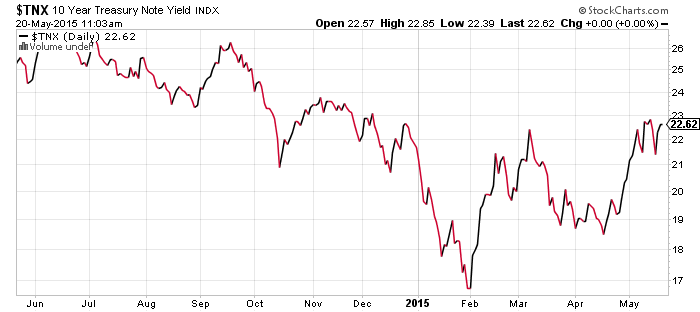

Interest rates remain in focus following a strong housing report on Monday. Housing has been one of the weak spots in the economy, but housing starts in April jumped 20 percent, the fastest pace since the financial crisis. The data isn’t enough to make investors change their expectations with regards to the Federal Reserve’s timing of a rate hike, but it did send long-term bond yields higher. As can be seen below, both the 30-year and 10-year yield are approaching their highs again. This will be an important short-term test: a move higher could lead to more bond selling, while a move lower would be seen as a double top.

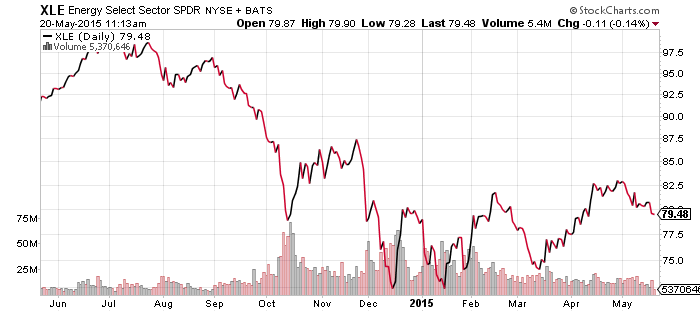

SPDR Energy (XLE)

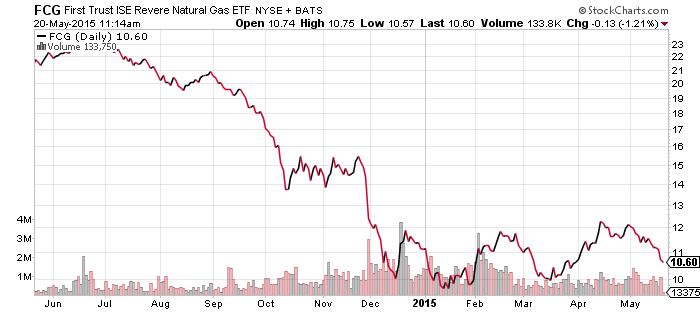

FirstTrust ISE Revere Natural Gas (FCG)

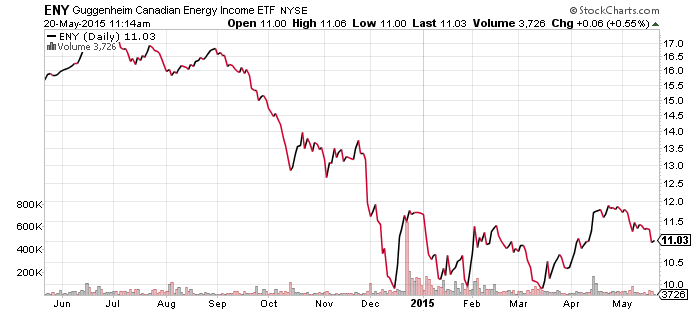

Guggenheim Canadian Energy Income (ENY)

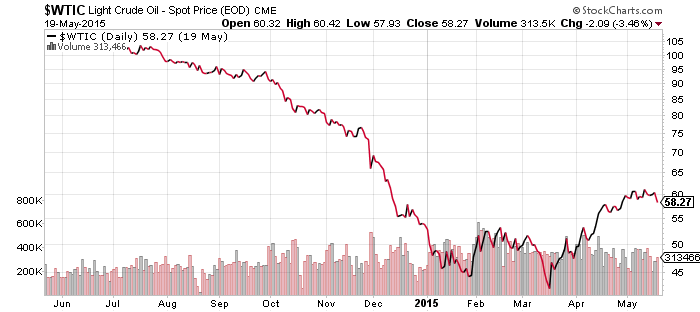

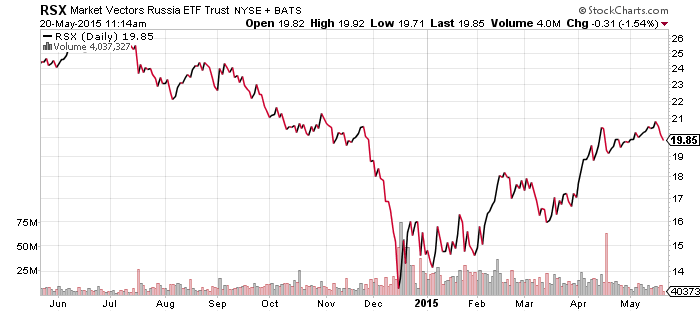

Market Vectors Russia (RSX)

Oil prices appear to have peaked in the short-term, with momentum fizzling. Equity traders anticipated the move and energy shares have been among the worst performing in the market over the past few weeks. In the case of Russia, the rebound is also losing steam. Look at the volume at the bottom of the chart: volume was strong into March, but since then has been falling off as RSX rises. The ETF also retreated before crossing $21, which would have signaled a bullish outbreak. Overall, bearishness is set to continue for the energy sector, with a reversal likely hitting equity related funds first.

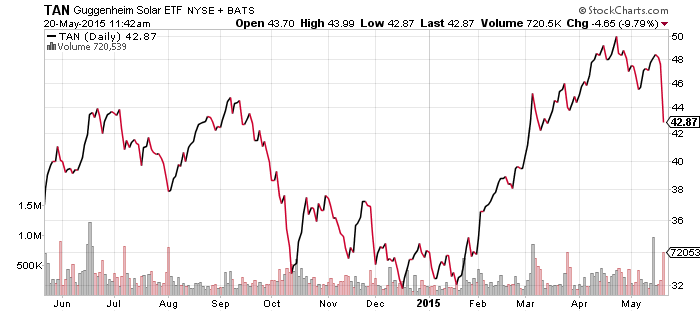

Guggenheim Solar (TAN)

We have been looking for a correction in TAN down to the low $40s, but we didn’t expect to get it in one day: TAN is down 9 percent in early Wednesday trading. One issue the industry is facing are concerns about debt levels at Chinese solar companies. One firm that came into focus this past week was Yingli (YGE), which is down about 50 percent over the past month. Shares saw most of their losses after the firm said there was “substantial doubt about our ability to continue as a going concern” if it cannot meet debt payments. YGE is only 0.89 percent of TAN’s assets as of Tuesday’s close and it’s up 22 percent in early Wednesday trading, so it can’t be blamed for today’s drop.

Instead, that title goes to Hanergy, whose stock plunged 47 percent in less than a half an hour before being halted. The firm’s stock gained more than 400 percent since August as Chinese investors poured into it. Hanergy’s earnings came from selling off factories and many analysts questioned why the stock price had surged over the past nine months. The trigger for the latest plunge, if current reports are accurate, was selling by creditors. Hanergy used stock as collateral for loans and when the loans weren’t paid on time, a creditor sold the shares. Once news of that broke out, the lenders all started dumping shares.

Coming into today’s open, Hanergy represented 12 percent of TAN’s assets. The drop in price from Hanergy alone is equivalent to 5.6 percent of TAN’s assets. Long term, if solar firms in China start going bust at a faster pace it will be deflationary for the industry, pulling prices lower as debt free companies emerge from bankruptcy.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

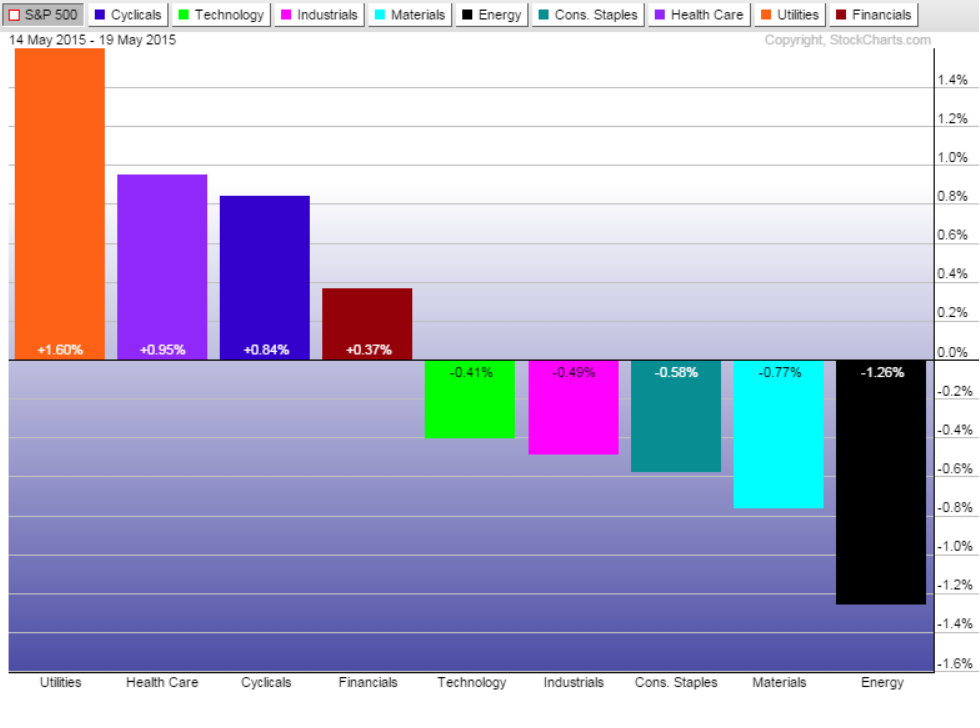

Utility firms were the best performing sector over the past week, thanks to a retreat in interest rates. Those rates have spiked higher today though, and if they keep moving higher, utilities will be under pressure again. The $45 level for XLU is an important resistance level.

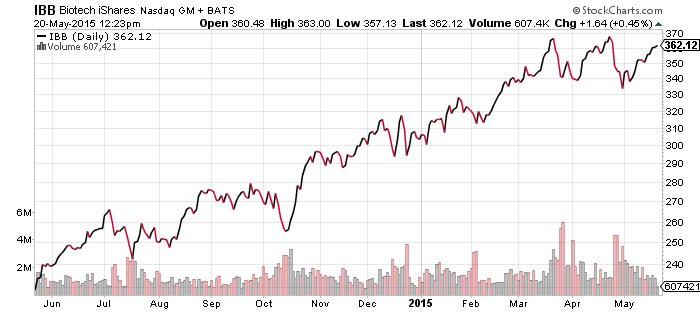

Biotechnology is trying to challenge its old highs. IBB is less than 3 percent below its all-time high and a 3 percent move in one day isn’t such a rare thing for the volatile sector. Failure to break to old high would be short-term bearish, and if IBB pushed back near the high and failed, it could set up a head-and-shoulders pattern with a target down nearing $310, about 13 percent below current prices. On the flip side, a move higher would signal a new rally is underway.

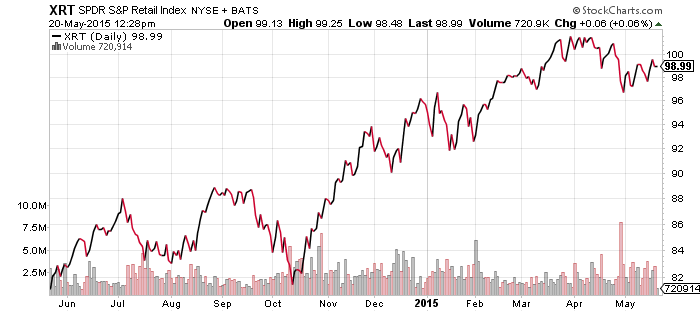

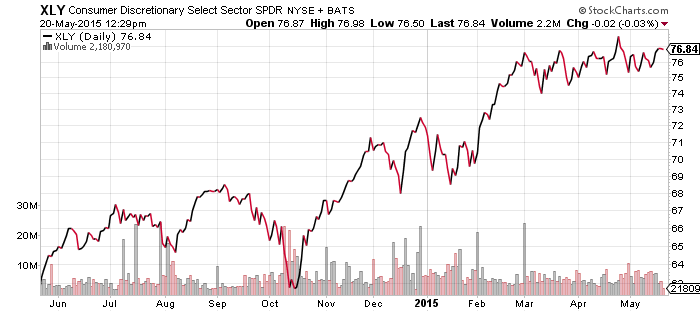

Retail stocks are in the middle of their earnings season. Wal-Mart (WMT) missed yesterday, but the retail and consumer discretionary ETFs were barely dented.

PowerShares U.S. Dollar Index Bullish Fund (UUP)

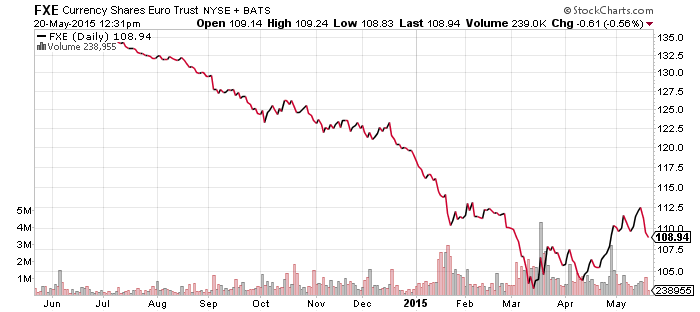

CurrencyShares Euro Trust (FXE)

Global X FTSE Greece 20 (GREK)

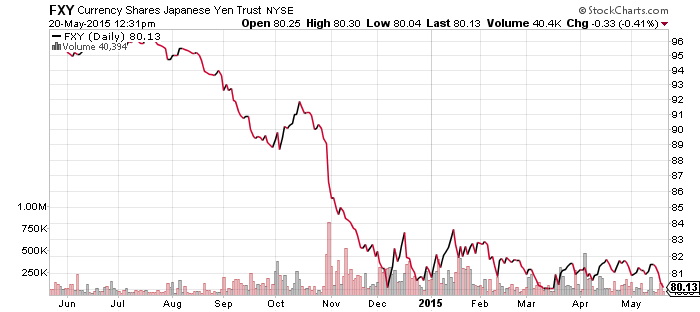

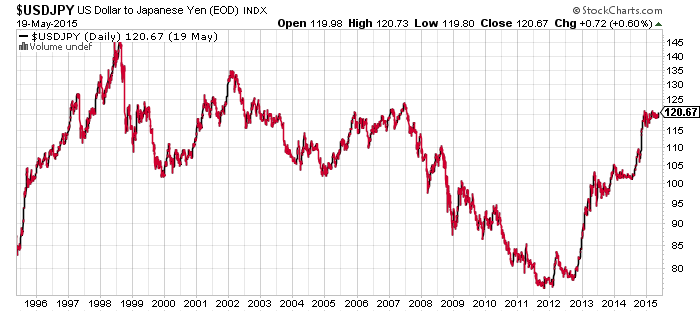

CurrencyShares Japanese Yen (FXY)

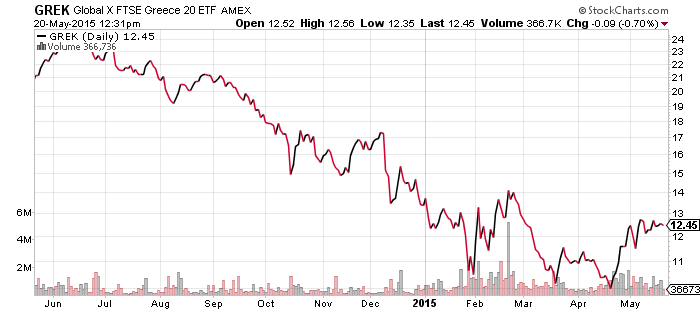

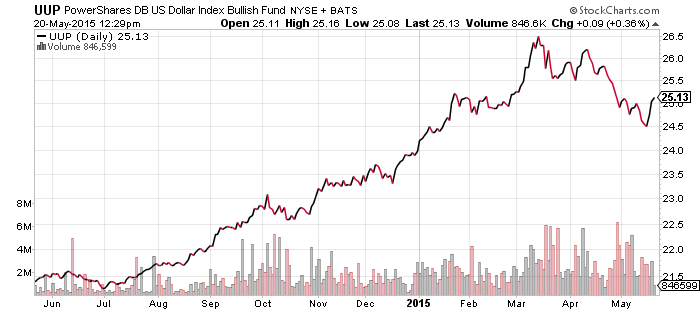

Greece remains a concern for currency markets. Both the euro and U.S. Dollar Index are approaching important short-term levels this week. There is support for the euro around $1.10, or $107.50 for FXE. Similarly, the UUP faces resistance below the $25.50 level. If the intermediate-term trend has shifted to bullish for the euro and bearish for the dollar, both of these should reverse after hitting support/resistance.

The more interesting chart is the Japanese yen. The yen has flatlined since December, but the USDJPY exchange rate is approaching its low point. A break lower could unleash another big leg down for the yen, with the next targets at 125 and then 135.

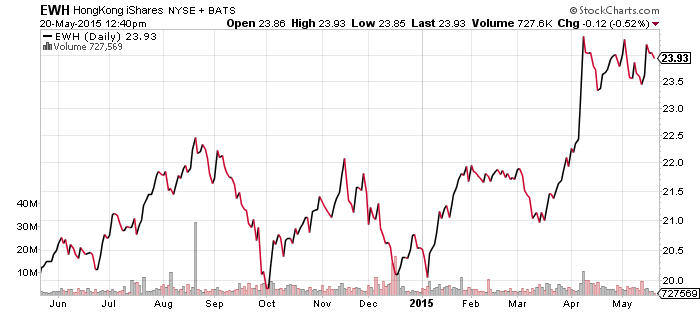

iShares MSCI Hong Kong (EWH)

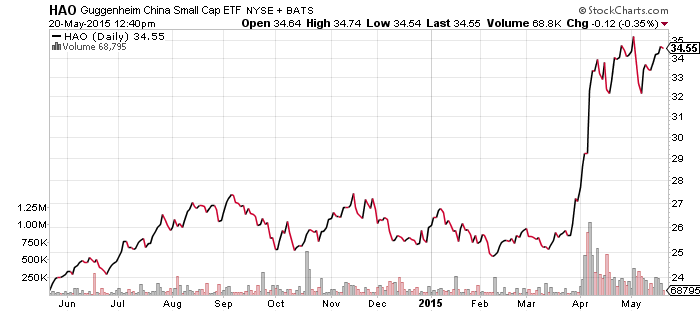

Guggenheim Small Cap China (HAO)

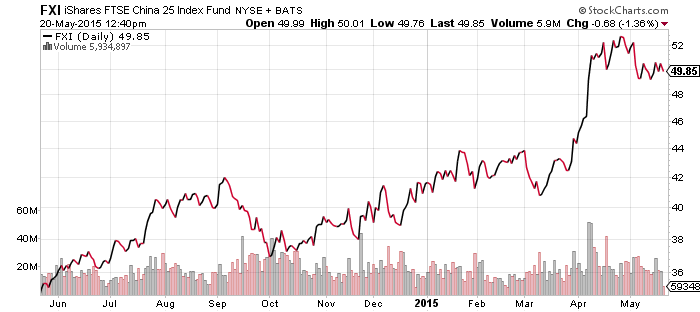

iShares China Large Cap (FXI)

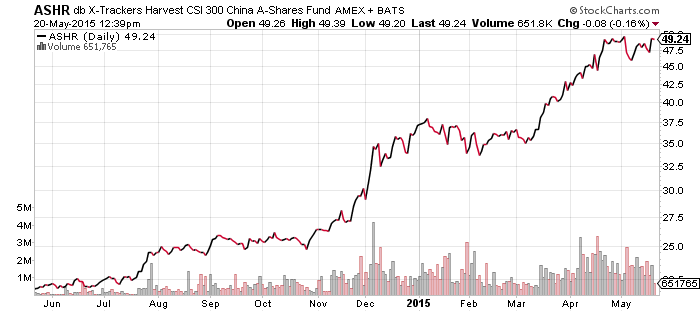

db X-Trackers China A Shares (ASHR)

China’s mainland share index remains below the high set in late April, but a government order for banks to lend to local governments, a huge investment in rail and plans for tax cuts and more reforms sparked bullish sentiment. With the government having unleashed the latest plan, in addition to rate cuts a week earlier, failure to set a new high in the coming days and weeks could be a sign the current rally is over and a correction is coming.

SPDR S&P 500 (SPY)

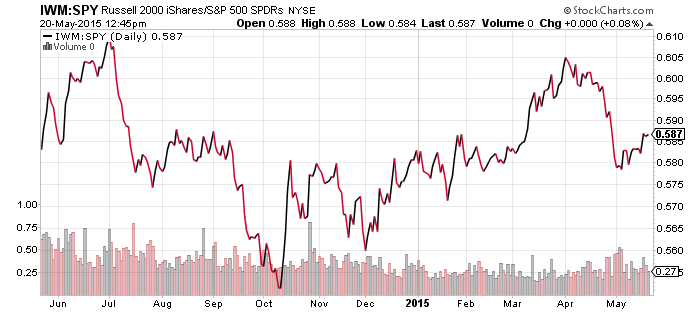

iShares Russell 2000 (IWM)

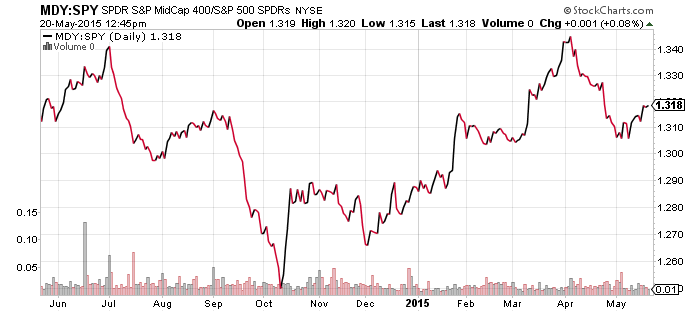

S&P Midcap 400 (MDY)

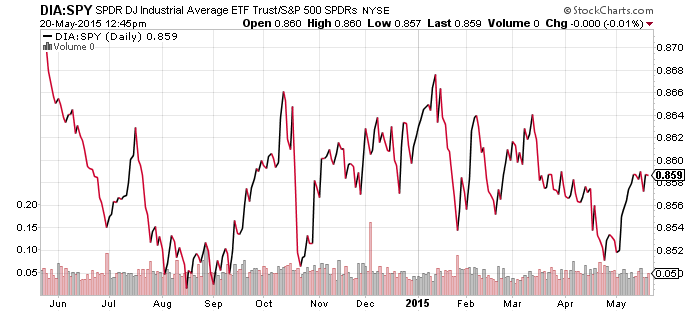

SPDR DJIA (DIA)

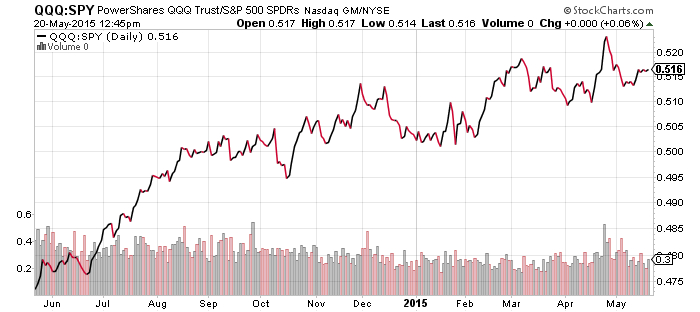

PowerShares QQQ (QQQ)

Mid- and small-cap shares outperformed the S&P 500 Index over the past week and short-term momentum indicators show this move should continue. The Dow and Nasdaq matched the S&P 500 Index.

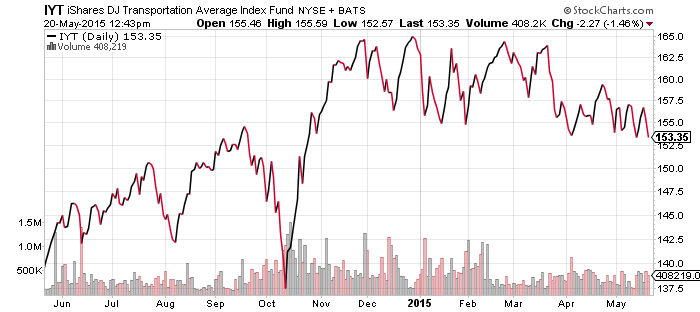

iShares DJ Transportation (IYT)

IYT is still hovering near its lows from April. A break of $152, opening up a potential drop into the low $140s, remains a possibility.

Market Perspective for May 18, 2015

The S&P 500 Index and Dow Jones Industrial Average set new all-time highs last week and over the coming days, the Nasdaq could join them. From Friday’s close, the Nasdaq needs a gain of less than 1 percent to hit a new all-time high. The Russell 2000 Index needs a gain of more than 2.5 percent to exceed the record it set in April.

Housing starts and building permits for April are out this week, along with April existing home sales, which are both leading indicators and inflation. Aside from weekly jobless claims, the flash PMI and Philly Fed report for May will be out.

Earnings season is almost over, with attention now shifting to the retail sector. Major companies reporting this week are Target (TGT), Home Depot (HD), Lowe’s (LOW) and Wal-Mart (WMT).

Economic data will be overshadowed by Wednesday release of the minutes of the last Federal Open Markets Committee meeting. Investors will focus on the timing of rate hikes. Recent weakness in some economic data has investors shifting their rate hike expectations out to late 2015 or even early 2016.

Long-term treasury interest rates peaked early last week and are currently sitting at or above their 200-day moving average. Based on the short-term momentum, a further decline is likely this week, which would be good for the rate sensitive utility, real estate and homebuilder sectors. Financials benefit from rising rates, so a decline will be a headwind for this sector.

Greece remains a center of attention and this attention is likely to increase over the next three weeks if there’s no debt deal. Greece made a payment to the IMF this month by using its SDR balance at the IMF, which must be replenished. The government is now scrambling to find cash for salaries and pensions of government workers. Payment tricks and not knowing how you will make your next payment is generally the end game for debtors, and another payment to the IMF is due on June 5.

Greece’s strategy has been high stakes bargaining, playing chicken with the Troika in the hopes that the Europeans want to avoid a default more than Greece. However, Greece’s people, reflected by the ruling Syriza party, are unwilling to bite the bullet. They want government jobs protected, not cut, and they also want to stay in the eurozone. This gives European creditors the upper hand because Greece cannot stay in the eurozone without agreeing to whatever the creditors want, and it cannot protect those jobs without leaving the Eurozone and printing its own currency.

The current thinking is that Greece will be given an offer it cannot refuse, similar to what happened to Cyprus. Greece will fold, more aid will be given, default will be avoided and the crisis will be delayed again. The euro/dollar exchange rate reflects this optimism. At $1.13 in Monday trading, the euro is closer to a key resistant level at $1.20 than it is to its low below $1.05. The euro exchange rate is the key asset to watch for forecasting the situation in Greece. There are no insider trading rules in currency markets because there are too many factors that affect their values. If a default appears likely, traders will be tipped off and the euro will tumble. If a deal looks likely, the euro will move sharply higher.

Global Momentum Guide for May 18, 2015

Click here to view the Global Momentum Guide for May 8, 2015 Weekly Sector Perspective The S&P 500 Index pushed to a new all-time record last week as stocks continued their 2015 […]

Investor Guide to Vanguard Funds for May 2015

May 2015 Market Perspective: Stocks Hold Firm as Interest Rates Rise Overall it has been a good month for the markets, despite investors having to deal with rising interest rates and […]