Fidelity Select Semiconductors (FSELX) +8

Fidelity Select Industrials (FCYIX) +7

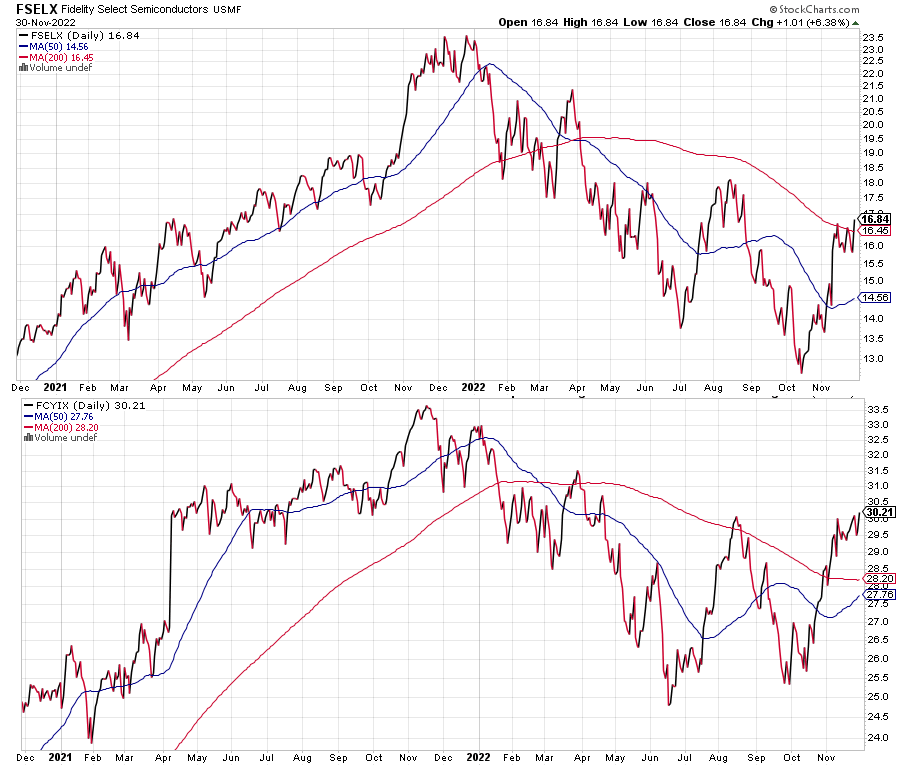

Semiconductors and industrials have been two of the strongest sectors in the past month, with both experiencing rising relative momentum. Fidelity Select Semicondcutors climbed eight positions, while FCYIX rose seven. Their moves are similar in size, but different in character.

FSELX rebounded from a loss of 45 percent this year. It has since rallied about 30 percent off its low, but it is still down more than 25 percent this year.

The top holding in FSELX is Nvidia (NVDA), with 22.41 percent of assets as October 31. Nvidia helped sink the fund this year, falling more than 60 percent at the October low before rebounding. The company’s graphics processing chips are popular with cryptocurrency miners, but the bear market in cryptocurrency has crimped demand.

As with the entire semiconductor sector, the bounce in FSELX has generated a strong relative momentum move, but the sector remains in the lower half of the momentum rankings. FSELX didn’t gain much absolute momentum as it moved ahead of very weak funds, but hasn’t yet established a bullish footing.

By contrast, Fidelity Select Industrials has ridden the strength in the Dow Jones Industrial Average. There are multiple ways of determining whether a bear market takes place or not, but the industrial-heavy Dow Jones Industrial Average barely qualified this year with a loss of around 20 percent at its low.

This year qualifies as a correction for industrial stocks. FCYIX is down less than 10 percent this year. After the post-Powell speech rally on November 30, the DJIA is down less than 5 percent on the year. All-time highs are possible by the end of the year if the rally continues at its recent pace.

FCYIX is a much more diversified fund than FSELX. Roper Technologies (ROP) is the largest holding with 9.73 percent of assets as of October 31. It is a mid-cap growth fund with an average market capitalization of $21 billion.

Also unlike FSELX, FCYIX is ranked among the top-10 Fidelity Select Sector funds for relative momentum. If the broader stock market rallies in 2023, the industrial sector is a high probability candidate for bull market leadership.