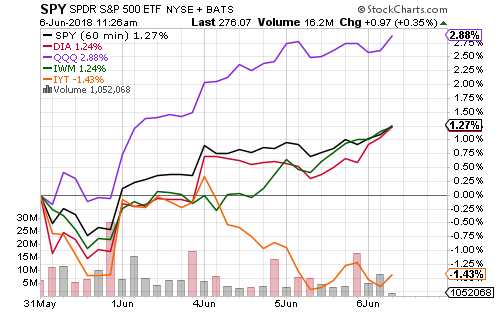

The Nasdaq led sector performance over the past week as both the Nasdaq Composite and the Nasdaq 100 (tracked by Invesco QQQ) made new all-time highs. The Russell 2000 Index also pushed to a new high after breaking out in mid-May.

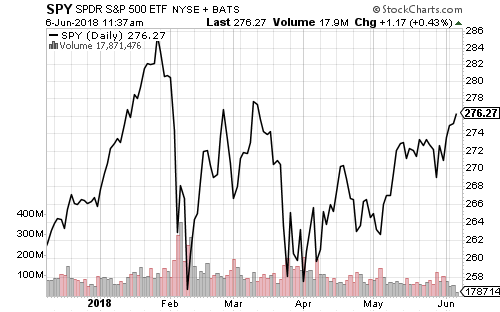

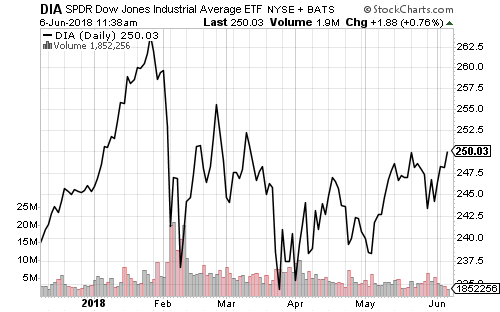

Both the S&P 500 and Dow Jones Industrial Average have trailed the Nasdaq.

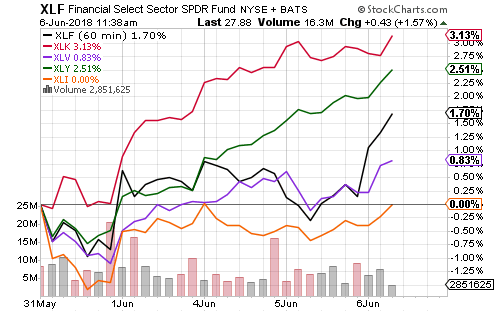

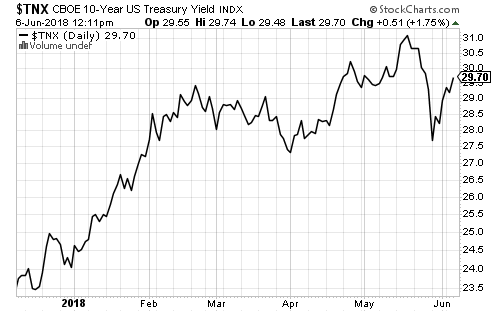

Technology led the week’s rally, followed by consumer discretionary, although 40 percent of its gains came courtesy of Amazon (AMZN). Financials spiked on Wednesday after the 10-year Treasury yield rallied towards 3 percent.

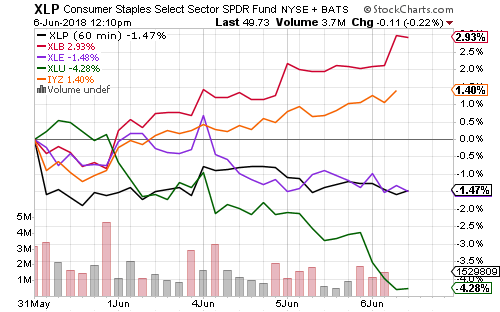

Materials outperformed among the smaller S&P 500 sectors. Utilities lagged as rising interest rates reignited selling.

The 10-year Treasury yield rebounded last week. There will likely be resistance at the psychological level of 3 percent.

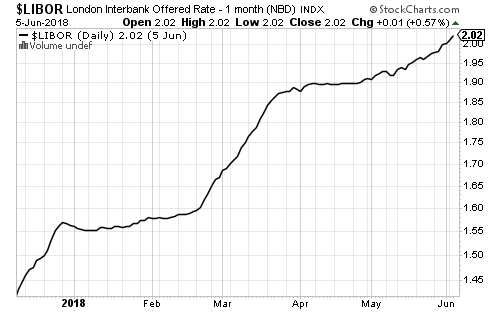

The Federal Reserve is expected to hike interest rates next week. Libor has priced in the move.

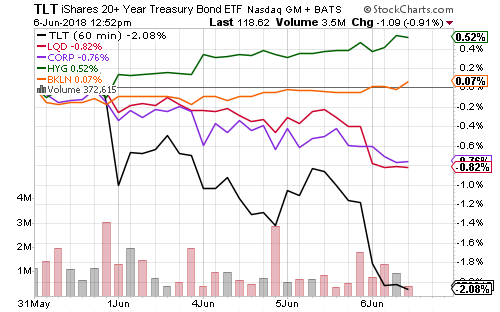

High-yield bonds outperformed last week. Strong economic data lowered credit risk. Floating-rate funds held steady, while bonds with more interest rate risk and less credit risk declined.

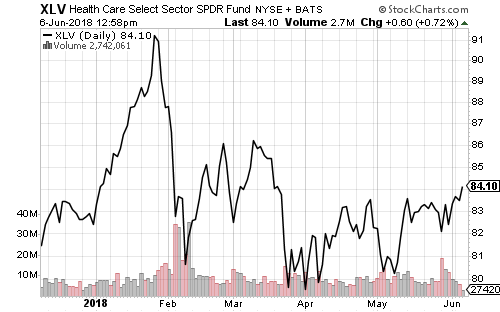

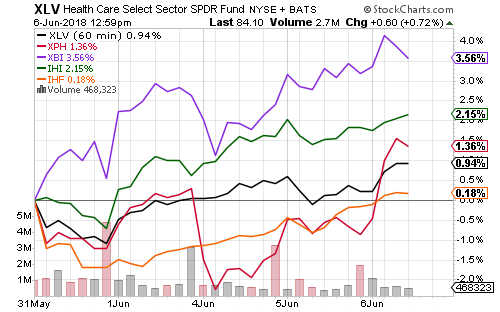

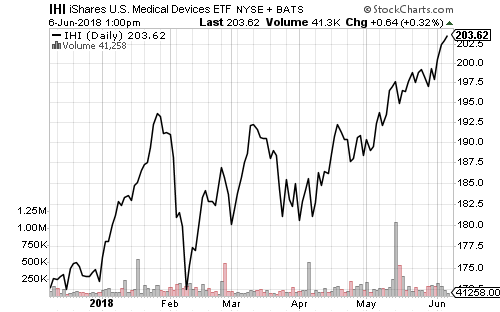

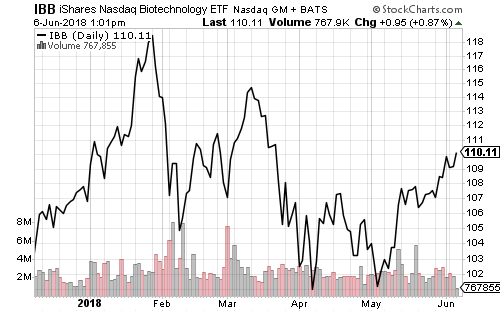

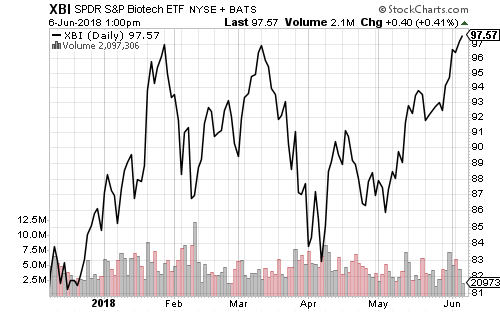

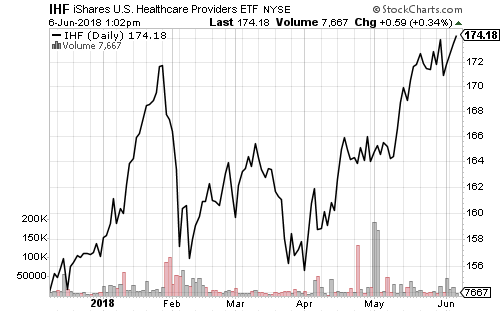

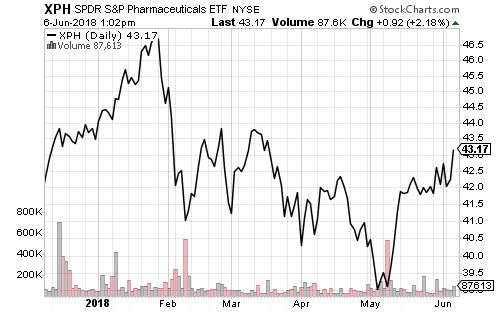

Healthcare stocks have underperformed in 2018, but with small caps and technology leading the market higher, the sector has room to catch up. Small- and mid-cap biotech, medical devices and healthcare providers are at new all-time highs. Only pharmaceuticals and large-cap biotechnology shares have lagged.

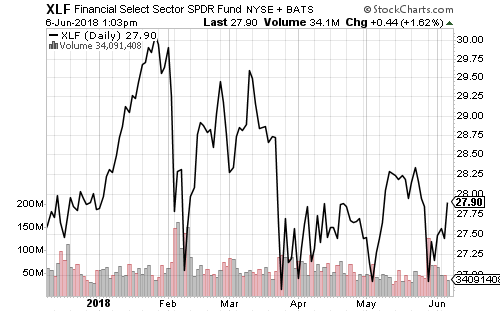

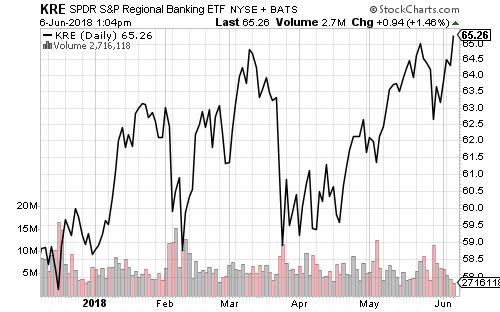

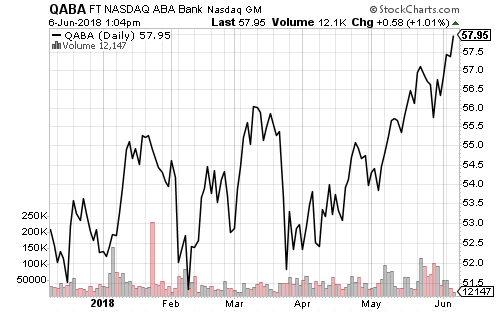

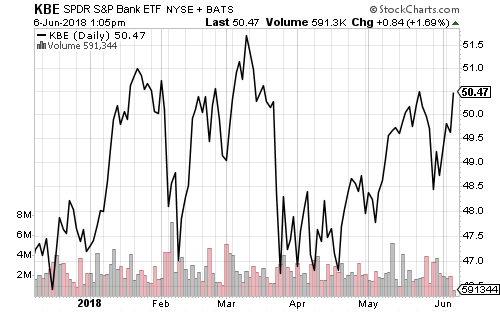

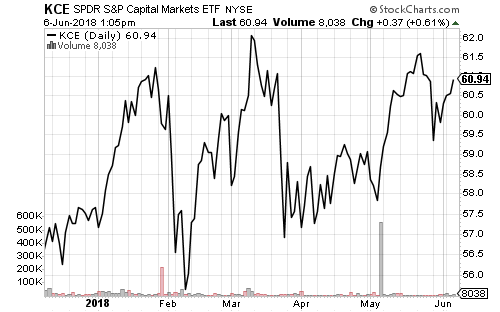

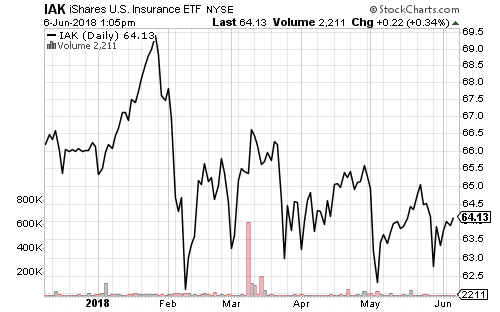

Rising interest rates and strong economic growth are beneficial to lenders, but the overall financial sector also has room to accelerate. Like healthcare, smaller financial institutions are trading at new all-time highs. Large-banks and brokers are near their highs, while insurance has lagged.

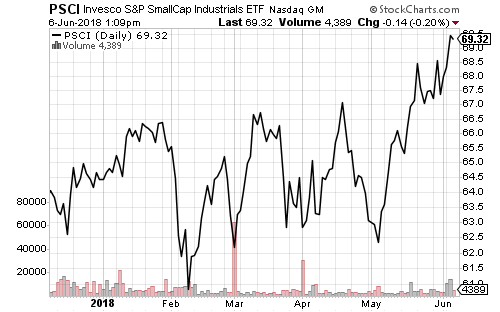

Industrials is another sector below its high, but its small-cap components are at new highs.

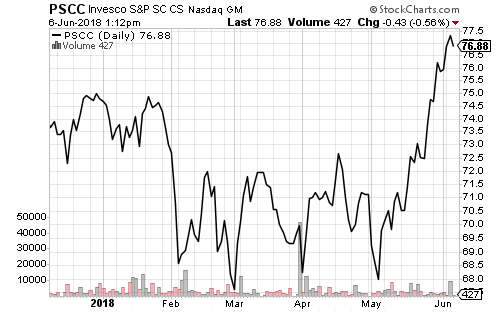

Consumer staples has also struggled over the past 2 years, but small-cap consumer staples are at an all-time high.

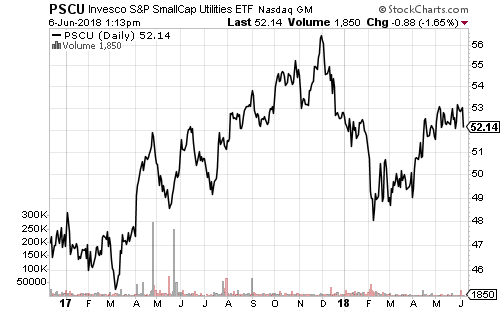

Small-cap utilities are outperforming large-caps, but rising interest rates are weighing heavily.

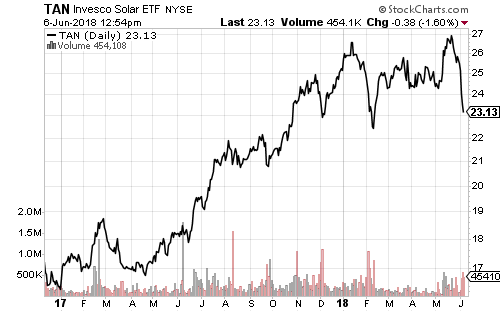

Solar stocks have performed well over the past year with rebounding energy prices. China, however, slashed investment for the rest of 2018. Chinese solar makers led the decline early in the week, while U.S., Canadian and European shares led the decline on Wednesday.

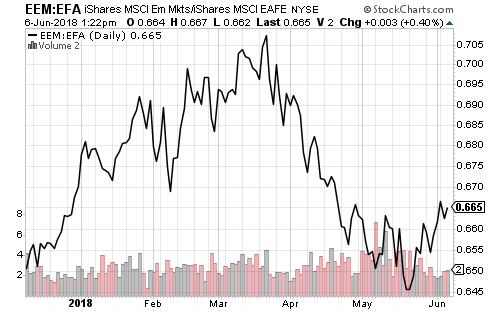

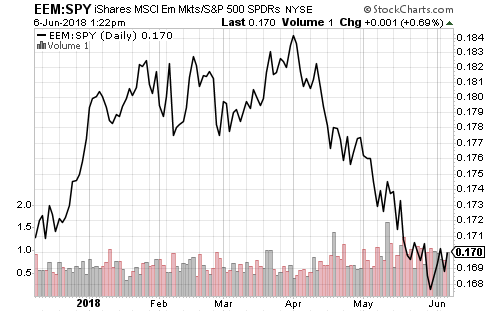

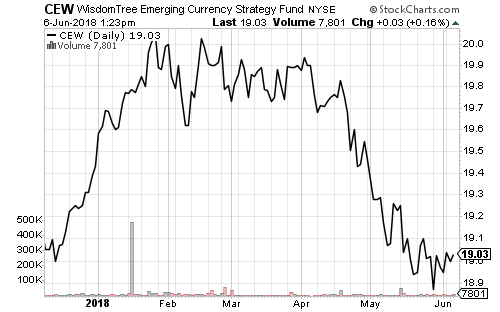

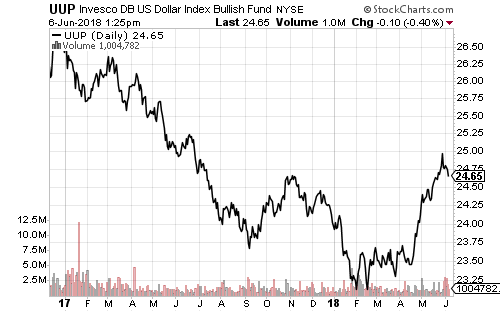

Emerging markets outperformed in the past week. EM currencies, however, remain under pressure. Brazil’s real fell to a fresh low versus the dollar. The Indian central bank surprised with a rate hike as the rupee trades near its lows for the year. In China, the central bank pumped a large amount of liquidity into the credit market as rising defaults and a wave of maturing debt pressured yields. A rebound in emerging markets will require a sustained reversal in U.S. dollar strength. The U.S. dollar weakened over the past week, but thus far looks like a normal pullback following a very strong rally.

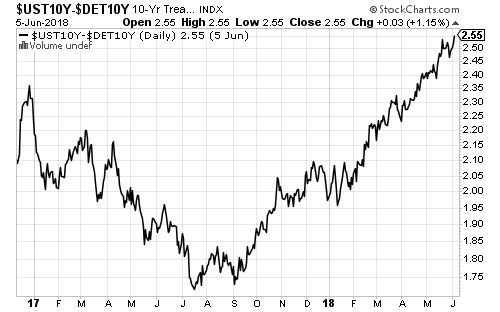

The spread between U.S. and German 10-year bonds widened again this week after economic data reflected strength in U.S. economy versus Europe in May. Bond investors are selling Italian bonds and buying German bonds. This widening spread provides support for the U.S. dollar as it attracts investment into U.S. treasuries.