The Investor Guide to Vanguard Funds for December is AVAILABLE NOW! Links to the December data files are posted below. Market Perspective: Conservative Stocks Protect Investors in 2022 Cooling inflation boosted […]

The Investor Guide to Vanguard Funds for December is AVAILABLE NOW! Links to the December data files are posted below. Market Perspective: Conservative Stocks Protect Investors in 2022 Cooling inflation boosted […]

Click Here to view today’s Global Momentum Guide The Dow Jones Industrial Average declined 1.66 percent last week, the Russell 2000 Index 1.85 percent, the S&P 500 Index 2.08 […]

All three major indexes ended down for the week. Most notably, Nasdaq lost approximately 2.8 percent as the tech stocks didn’t fare well. The S&P 500 declined 2.2 percent for the week, while the Dow Jones Industrial Average lost 1.7 percent.

Among the S&P 500 sectors, it was the consumer discretionary sector that lost the most at 3.6 percent. Perhaps this is not surprising as the year-to-date, it lost 34.8 percent. Information technology lost 2.7 percent for the week and is now down 26.6 percent year-to-date.

The energy sector gained 1.8 percent. No other sector apart from energy in S&P 500 ended the week in the green.

The Federal Reserve increased interest rates for the seventh time. This time around, the increase was half a percentage point, versus 0.75 percent we have become accustomed to. The market was spooked because the Fed officials hinted that the benchmark rate might be even higher next year. The market seemed to haven’t anticipated further hikes in the next year, which spooked it.

A disappointing US retail sales report weighed on the markets on Thursday. The report further strengthens the thought that the Fed might have future rate increases and the economy slides toward a recession. The report showed a decline of 0.6 percent in November, the largest in eleven months, and further raising concerns the thought that the economy might be sliding further into recession.

The problem doesn’t seem to be curtailed in the United States alone.

The central banks around the world in countries like Switzerland, the United Kingdom, European Union also increased the interest rates. The statement by the bank of England that the economy seems to be in a recession further weighed down on stocks globally.

The inflation for the month of November came in at 7.1 percent and remains stubbornly high. If you exclude food and energy costs, the core inflation was only 0.2 percent as compared to the previous month. This marks the slowest inflation increase since August 2021.

With the final two weeks of 2022 nearing, the focus will now shift to the earnings. According to Wall Street analysts, the S&P 500 is slated to record an average growth rate of approximately 5 percent. Even if these forecasts come true, it will be a big slowdown from the 2021 growth rate of 47.9 percent. Truth be told, the 2021 growth rate was high because of the base effect due to Covid 19 crisis. However, even when you consider the average growth rate of the last ten years, it has been around 8.5 percent.

One of the most essential reports next week will be the personal consumption expenditures price, set to be released on Friday. Any negative surprise in this number will surely give rise to more interest rates in the future. The last time this report was released, inflation rose by 5 percent in October, excluding food and energy prices. The number, however, was lower than 5.2 percent in the month before that.

According to the historical data, the next twelve months after the Fed interest rate cycle peak are positive for equity and bonds. That is why equity markets are expected to fare better once the Fed stops hiking rates. If that happens, we might see a broad market rally at the beginning of next year.

As for the numbers next week, quite a few important reports are being released. To start with, on Monday, there is the housing market index report by the National Association of Home Builders. The US bureau of economic analysis will also release the third quarter GDP estimate on Thursday. Additionally, weekly employment claims will be released on the same day.

Key Reports to Look for This Week

Monday:

Housing Market Index by the National Association of Home Builders

Tuesday:

Housing Starts, US Census Bureau

Wednesday:

Existing Home Sales

Consumer Confidence Index

National Association of Realtors

Thursday:

US Bureau of Economic Analysis,

Third-quarter GDP (Estimate),

US Department of LaborWeekly Unemployment Claims,

Friday:

Personal Consumption Expenditures Price Index

Durable goods, US Census Bureau

New Homes Sales, US Census Bureau

The University of Michigan Index of Consumer Sentiment

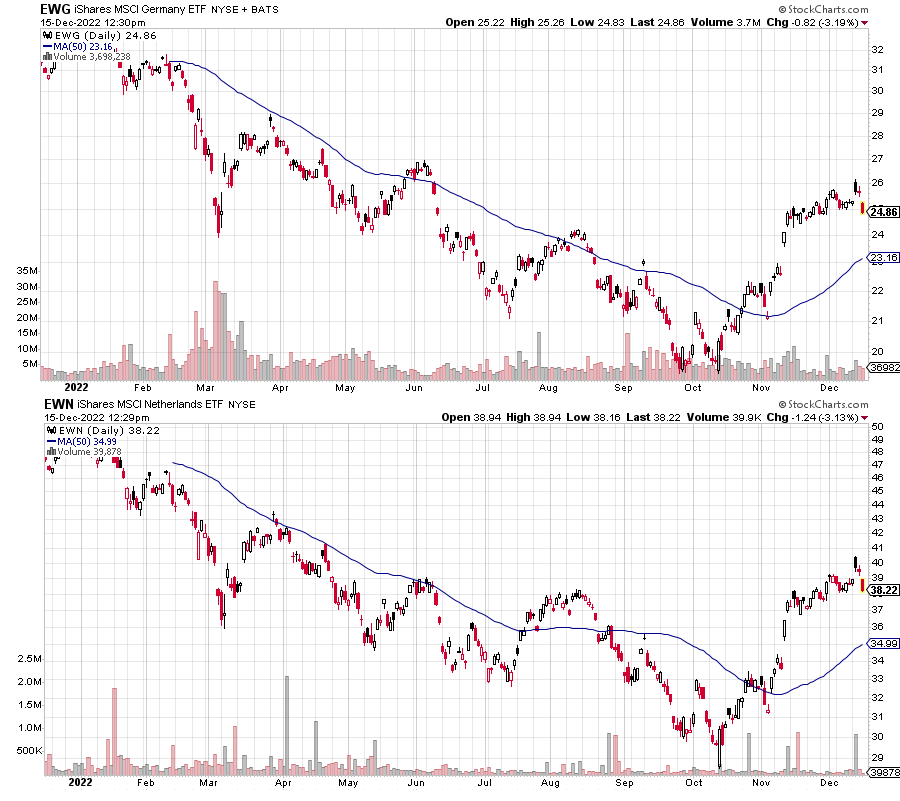

iShares Germany (EWG) and iShares MSCI Netherlands (EWN) both climbed thirty-five positions in the The Global Momentum Guide’s relative momentum rankings the past month. Both funds rallied close to 40 percent off their lows, boosted by a double-digit rally in the euro versus the U.S. dollar. Neither fund has climbed enough to make it near the top-10, but both could get there quickly if their rally continues.

Other European funds have joined them such as the iShares EMU Index (EMU), iShares MSCI Austria (EWO), iShares MSCI Sweden (EWD) and iShares Dow Jones Euro STOXX 50 (FEZ). The latter fund did make it into the top-10 of the rankings.

On the plus side, these funds are all climbing in the rankings. In a clear bull market, this would move them into momentum portfolio in a few more weeks. In a rangebound or bear market, these momentum moves often run out of steam once they make a run towards the top-10.

Working against them are new and existing headwinds. The latter first. The war in Ukraine and Russian sanctions in response have cost Germany about $500 billion thus far in bailouts and subsidies amid soaring energy costs. That’s roughly 10 percent of their economy. Other European countries, aside from those such as Norway that have ample energy supplies, are seeing similar costs. It is somewhat surprising how well their economy had held up to this point. Germany’s IfW, an economic research institute and think tank, raised its 2023 GDP growth forecast to 0.3 percent this month versus the prior 0.7 percent decline. If their economy manages any positive growth with energy such a massive headwind, it speaks to the underlying strength in Europe’s most important economy.

A new headwind is the European Central Bank. It raised interest rates by 50 basis points in December, matching the Federal Reserve’s hike, and it also announced quantitative tightening will start in March. It’ll start off slowly with 15 billion euros per month until the end of June before reassessing. The Bank of England also hiked 50 basis points despite the United Kingdom’s economy being in recession. Europe’s move is not surprising considering how much is being spent on energy and related costs. Spending money when energy costs rise is what helped entrench high inflation in the 1970s. As the Bank of England showed, and both the Federal Reserve and ECB have warned, central bankers will fight inflation even if the economy weakens.

The next couple of weeks will determine whether developed European markets can move back into leadership among international funds or if this is a bear market rally that has run out of steam. The weakest economies such as Italy and Greece have moved back into the top-10 because they are more volatile to the upside and downside. The euro’s exchange rate with the dollar will play an important role, as will the performance of emerging markets that currently rank ahead of countries such as Germany and the Netherlands.

Click Here to view today’s Global Momentum Guide The MSCI EAFE declined 0.22 percent last week, the Dow Jones Industrial Average 2.77 percent, the S&P 500 Index 3.37 percent, […]