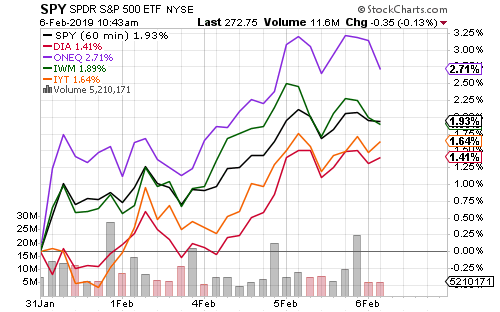

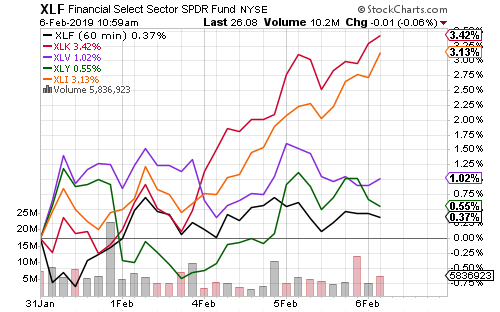

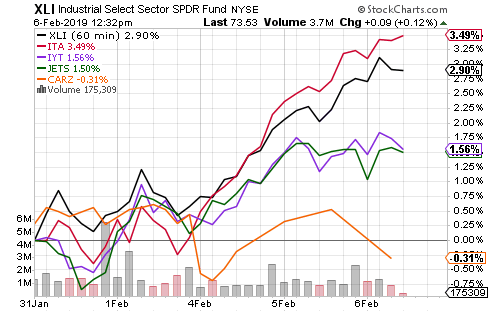

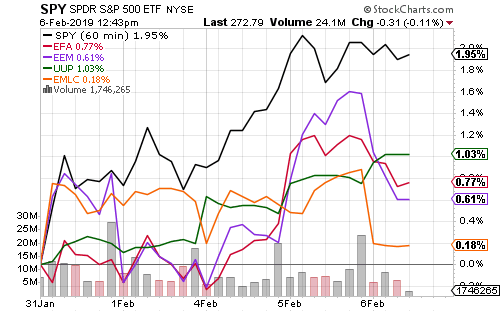

Equity returns were mixed on Monday with the Russell 2000 Index gaining 0.84 percent and the Dow Jones Industrial Average slipping 0.21 percent. Sector performance on the day were led by the 0.53 percent rally in SPDR Industrials (XLI).

This will be a busy week for economic data. The National Federation of Independent Businesses will release its small business confidence index for January. The Job Openings and Labor Turnover Survey (JOLTS) for December will also be released.

Economists predict the government will report consumer inflation rose 0.1 percent in January. Core CPI is forecast to rise 0.2 percent. They see producer prices rising 0.2 percent. Retail sales for December, will be out this week. The University of Michigan’s advanced report on February consumer sentiment is out on Friday.

The U.S. Dollar Index advanced 0.4 percent on Monday, its highest level since December. The stronger dollar weighed on commodity prices. Crude oil slipped 0.51 percent on the day, after rebounding from a 2.2 percent decline in early trading.

Government, investment grade and corporate bonds also traded lower on the day, but high-yield bonds managed a small increase. iShares iBoxx High Yield Corporate Bond (HYG) returned 0.04 percent.

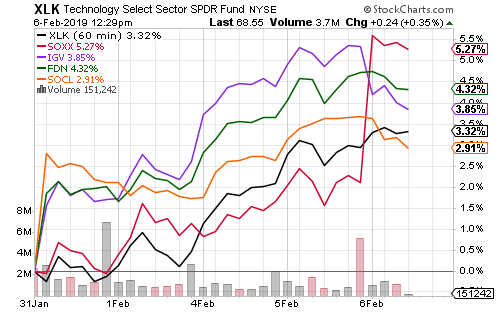

Coca-Cola (KO), Pepsi (PEP), Cisco (CSCO) and Nvidia (NVDA) headline earnings reports this week. Also reporting are Eli Lilly (LLY), Marathon Oil (MRO), Occidental Petroleum (OXY), TripAdvisor (TRIP), Under Armor (UAA), Applied Materials (AMAT), Duke Energy (DUK), CME Group (CME), Baidu (BIDU), Kraft Heinz (KHC) Deere & Co. (DE) and Newell Brands (NWL).