The Investor Guide to Fidelity Funds for December 2018 is AVAILABLE NOW! Market Perspective: Expect Volatility to Continue The major indexes staged a strong rally to close out the month. The […]

Year: 2018

Market Perspective for December 10, 2018

Equities staged a midday rally, with the Nasdaq gaining 0.74 percent and the S&P 500 Index 0.17 percent. The Dow Jones Industrial Averaged 0.14 percent on the day. Major indexes bounced off long-term support levels that have held in 2018, which is a positive sign for investors.

Major market sectors diverged in their performance. SPDR Technology (XLK) rallied 1.38 percent, while SPDR Financials (XLF) slid 1.39 percent. Healthcare, industrials and consumer discretionary all saw small gains in line with the major indexes.

The Job Openings and Labor Turnover Survey (JOLTS) showed 7.1 million job openings in October. The data indicates there are one million more job openings than the number of unemployed.

November producer and consumer price indexes are due midweek. Analysts believe core CPI will rise 0.2 percent. The PPI gained 0.6 percent in October, but it is expected to decline 0.1 percent in November.

China’s consumer and producer inflation was slower than expected. Consumer prices fell 0.3 percent in November and producer prices dipped 0.2 percent.

British Prime Minister Theresa May canceled a vote on the Brexit plan. The news sank the pound by 1.5 percent against the dollar and pulled the euro 0.5 percent lower. iShares MSCI United Kingdom (EWU) fell 1.19 percent.

West Texas Intermediate crude fell 3 percent to $51 a barrel. WTI hasn’t closed below $50 in 2018. Natural gas was stable at $4.50 per mmBTU.

Tuesday brings the National Federation of Independent Business small business confidence index. November retail sales will be out on Friday along with various flash PMIs for December.

Adobe (ADBE), Costco (COST), Ciena (CIEN) and SodaStream (SODA) are highlights in a light week for earnings reports.

Global Momentum Guide for December 10, 2018

Click Here to view today’s Global Momentum Guide WEEKLY SECTOR MOVERS The MSCI EAFE declined 2.27 percent last week, the Dow Jones Industrial Average 4.50 percent, the S&P 500 […]

Market Perspective for December 7, 2018

The markets declined this week, but they failed to create a potential panic. The S&P 500 Index failed to sustain a break below 2630 on Thursday and Friday. Going back to November 20, this level has been tested six times and support has yet to be broken.

ISM services PMIs out this week confirmed the strengthening in the U.S. economy showed by the manufacturing PMIs. The ISM survey climbed to 60.7, beating last month’s 60.3. Unemployment held steady at 3.7 percent. Average hourly earnings remained at 0.2 percent.

President Trump and Chinese President Xi Jinping met at the G20 summit last weekend to discuss trade. The U.S. will delay implementing tariffs on all Chinese imports at least until March 1, while China would repeal retaliatory tariffs on autos and purchase more U.S. agricultural exports.

Crude oil hit $54 a barrel before settling at $52.13 on Friday. OPEC and Russia agreed to support oil prices with production cuts. This should stabilize the market.

The U.S. Dollar Index was steady this week, gaining slightly versus emerging market currencies.

ETF & Mutual Fund Watchlist for December 5, 2018

Markets are closed today for the funeral of President George H.W. Bush. Tuesday closed with major indexes falling approximately 3 percent. Numerous financial commentators blamed fund companies for selling due to rules-based models. The more likely and simpler explanation is: it’s simply another correction.

In January the S&P 500 topped, suffered a sharp correction and then rebounded. The index then retested the lows for a few weeks and then ascended to new all-time highs. In October we witnessed a similar pattern involving a correction, a rebound and a new test of the lows. We believe this current correction follows the same pattern, and a rebound is likely.

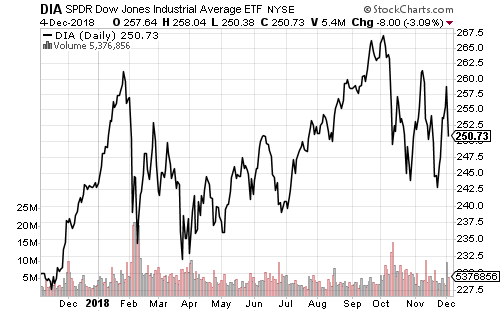

The Dow Jones Industrial Average has followed a similar pattern.

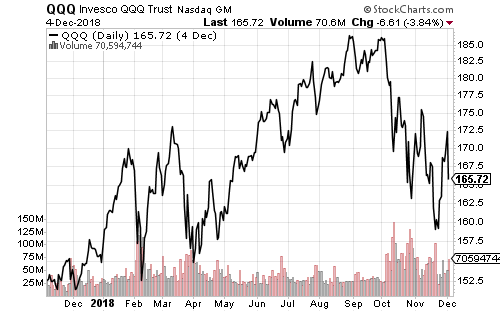

Invesco QQQ (QQQ) is significantly weaker now because technology has led the market lower. The Nasdaq hasn’t rebounded to a new high and didn’t bottom until November 20. Both the Dow and S&P made greater highs after bottoming, but the QQQ has to crack $172.50 to achieve that feat.

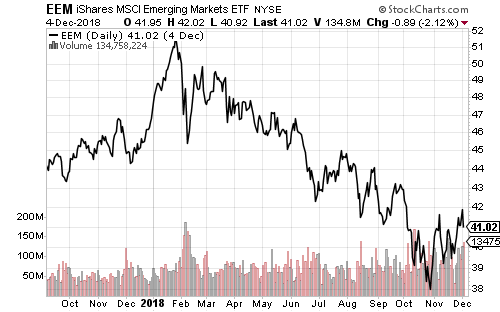

Emerging markets improved over the past week.

Political turmoil in the United Kingdom, Italy and France weighed on the MSCI EAFE Index of developed markets.

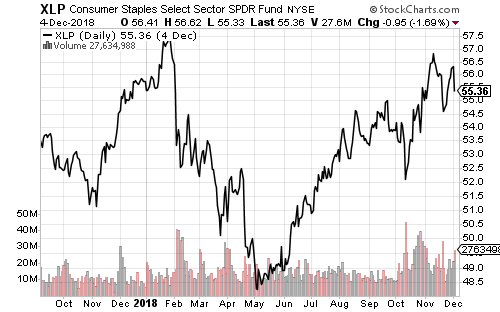

Traditionally defensive sectors have performed very well. Consumer Staples are near their peak for 2018.

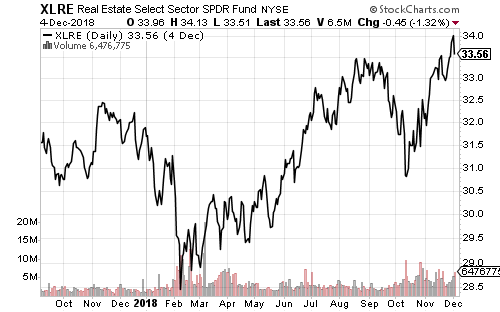

Real estate also made a new high over the past week.

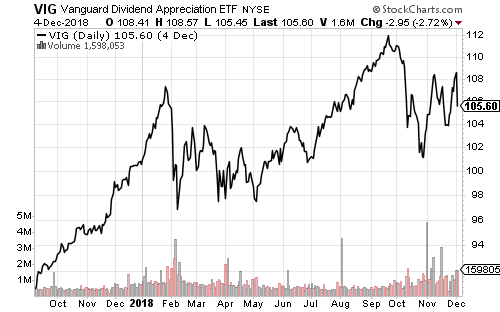

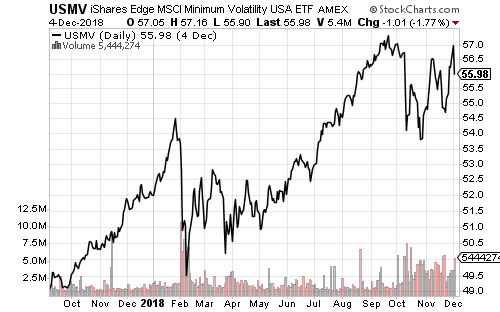

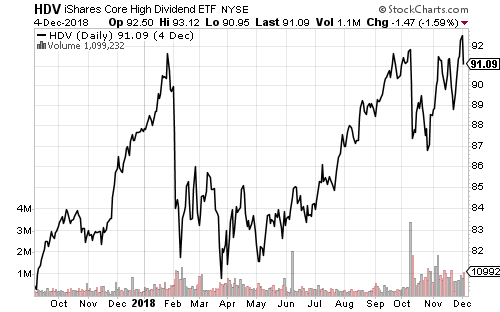

The relative strength of dividend and low volatility funds can be seen in the charts below. Vanguard Dividend Appreciation (VIG) bottomed in October and has outperformed. iShares Edge MSCI Min Vol USA (USMV) is close to its all-time high. iShares Core High Dividend (HDV) also made a new all-time high. These funds are each indicating a bullish signal for stocks.