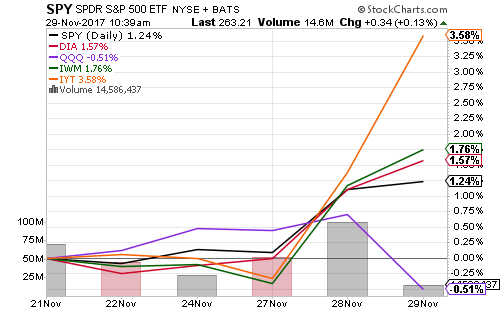

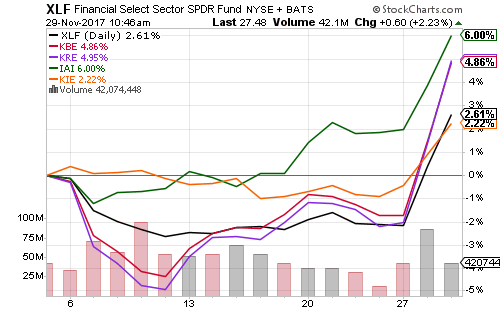

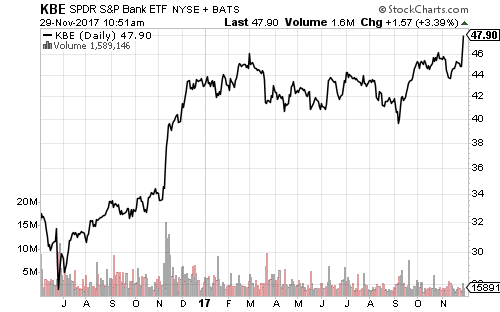

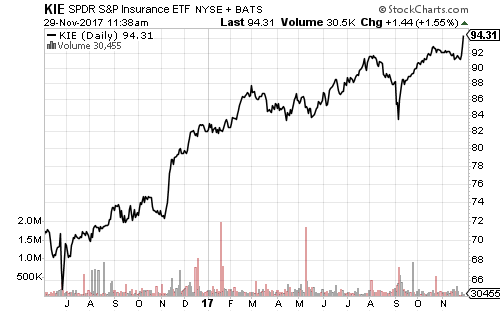

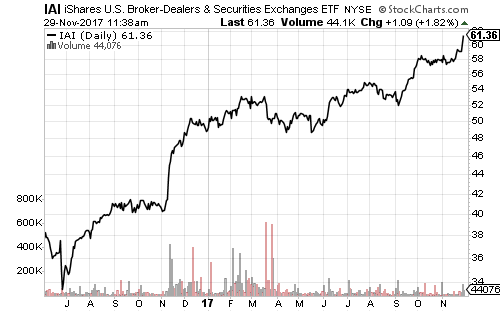

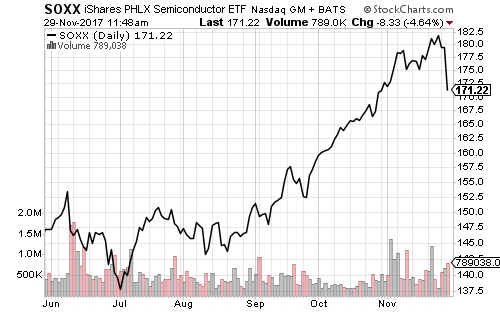

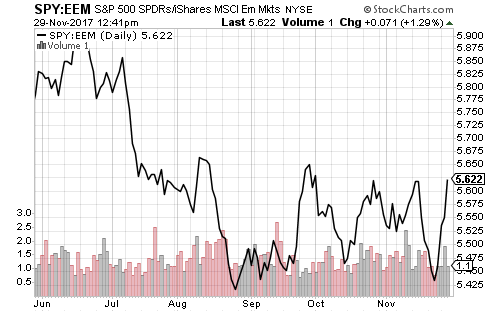

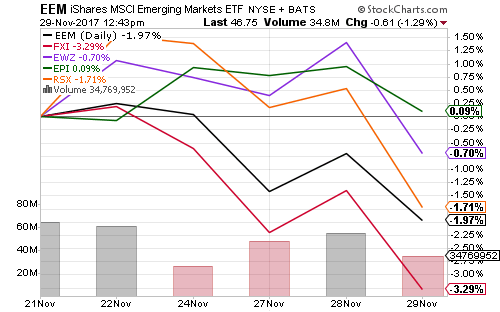

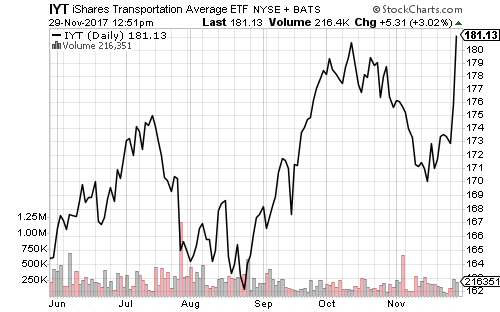

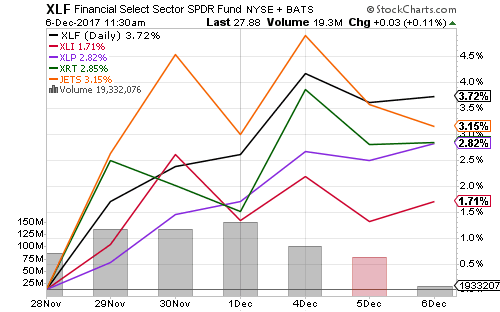

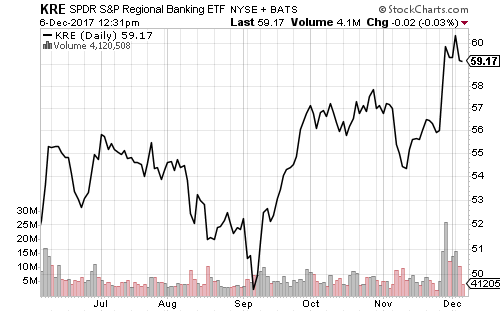

Tax reform sparked a rotation into financials, transportation and retail over the past week. A sell-off in Asian shares added to a rotation out of the technology sector.

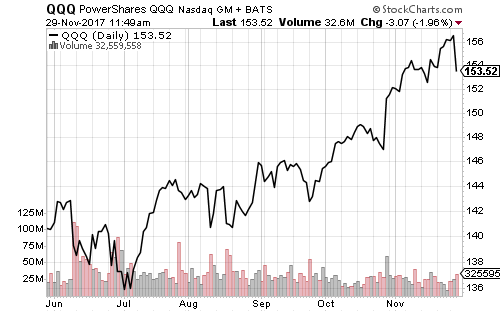

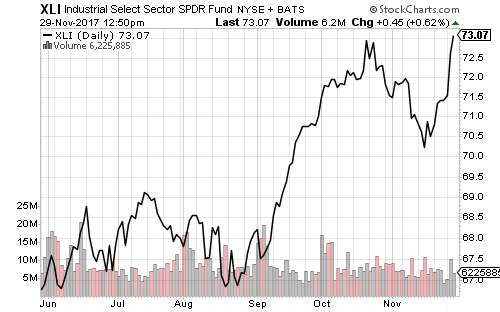

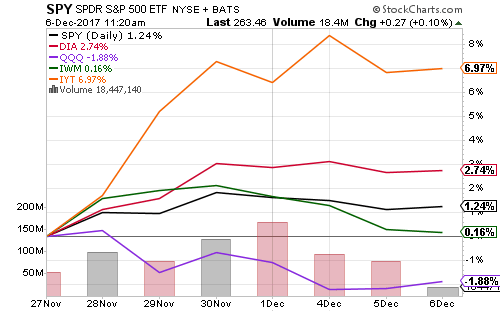

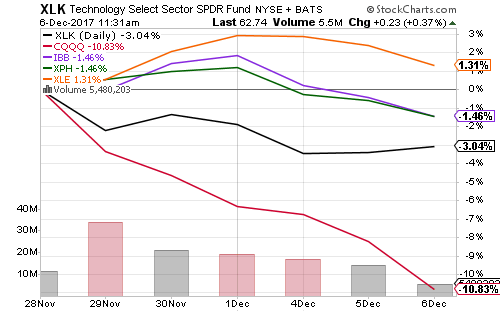

Diverging sector performance led to a wide index return variance. The Dow Transports and Dow Industrials saw substantial gains, while technology shares pulled the Nasdaq to a loss.

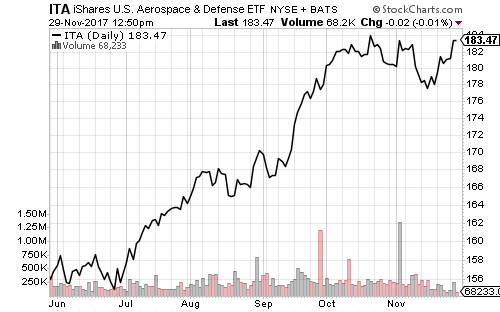

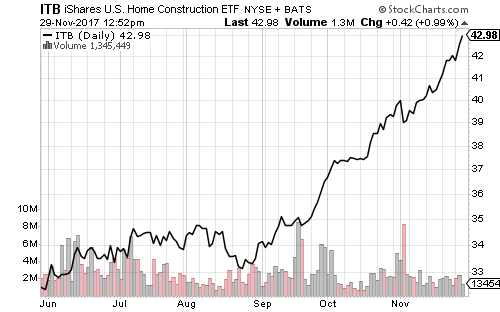

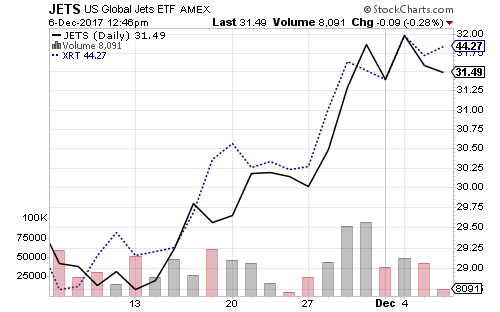

The tight correlation between sectors links the rise in stocks to proposed tax reform. SPDR S&P Retail (XRT) and U.S. Global Jets (JETS) represent industries that pay corporate tax rates approaching the U.S. maximum of 35 percent and have traded in lockstep over the past month. Banks, industrial and consumer stocks also tend to pay higher tax rates. They all outperformed the market over the past week.

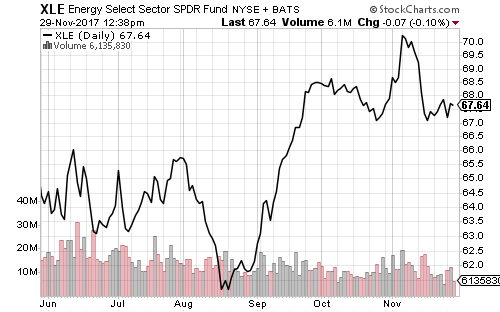

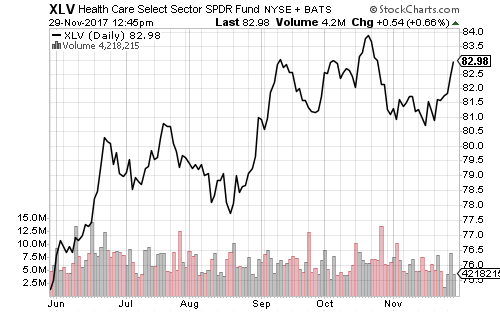

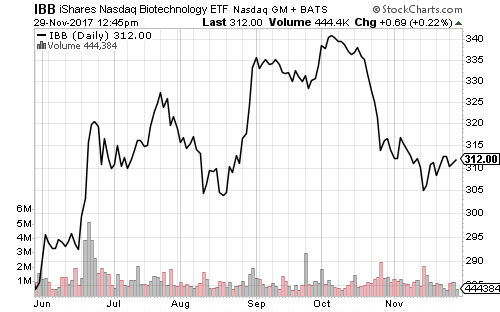

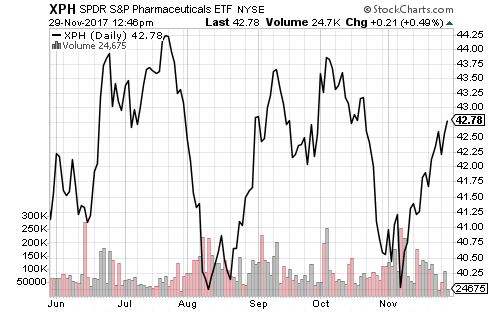

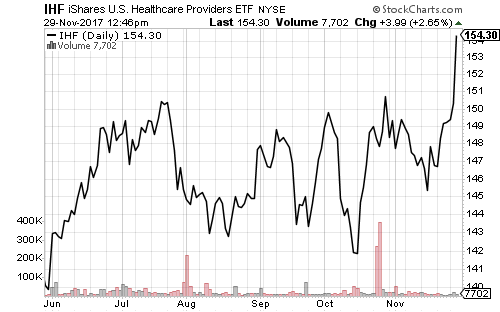

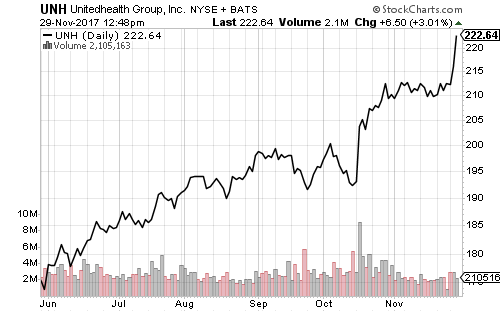

Biotechnology, pharma and energy have underperformed over the past week. Guggenheim China Technology (CQQQ) shares tumbled more than 10 percent over the past week as the sell-off in Asian tech shares intensified.

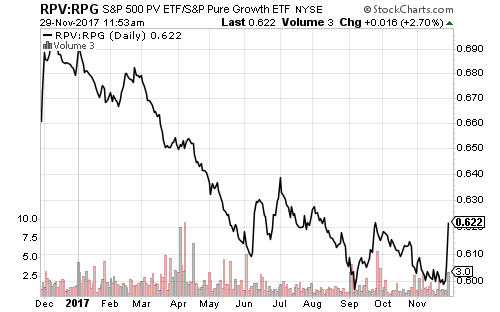

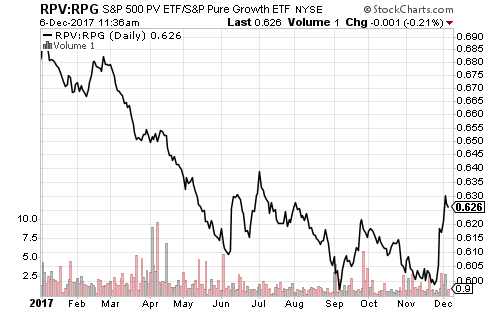

The chart below shows the relative price of Guggenheim S&P 500 Pure Value (RPV) to Growth (RPG). Value shares have outperformed by more than 4 percent over the past week.

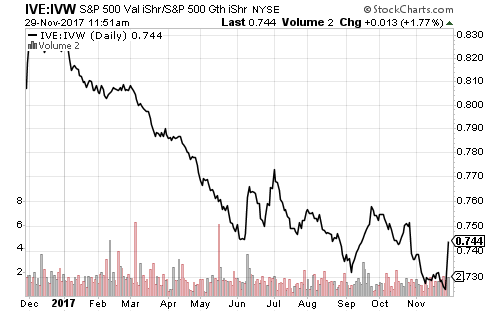

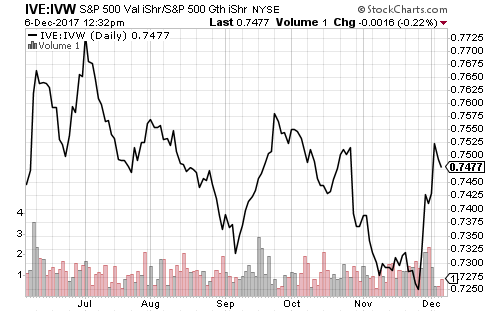

iShares S&P 500 Value (IVE) and Growth (IVW) should join RPV/RPG at a new short-term high if a major rotation is underway.

Given market history, a pullback is likely before an extended move.

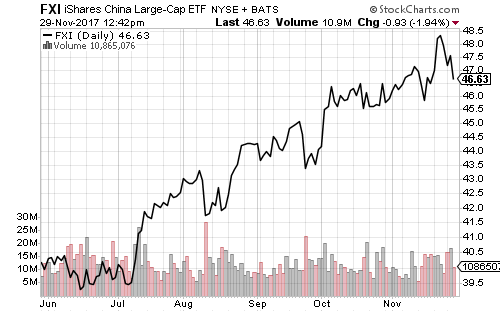

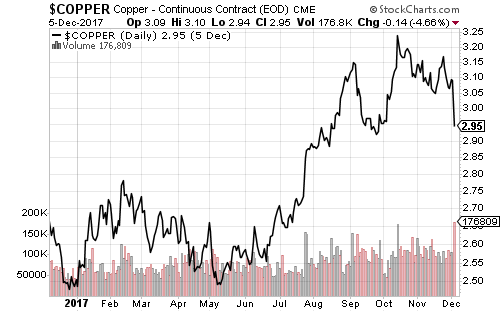

Chinese stocks have taken a blow over the past week after approaching long-term resistance. We have warned about the risk in recent weeks as China restricts credit growth. Some important monthly figures from October showed a slowdown in the real economy and this finally hit financial markets. Copper prices also declined sharply.

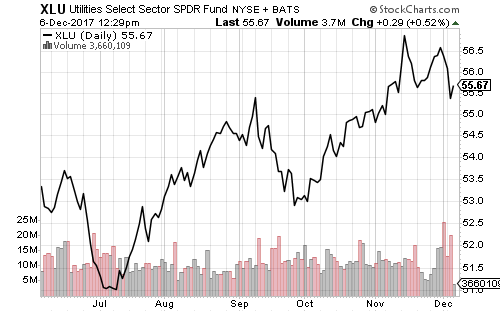

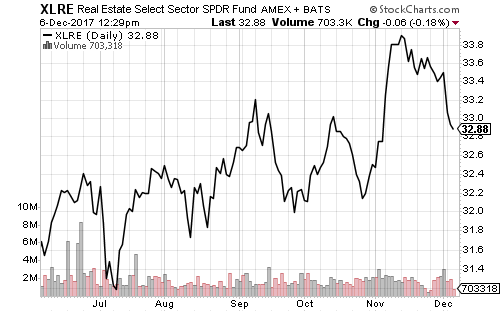

Rate-sensitive sectors, such as utilities and real estate have been moving lower in response to December’s anticipated rate hike. SPDR Real Estate (XLRE) is at a 3-month low and SPDR Utilities (XLU) isn’t far from joining it.

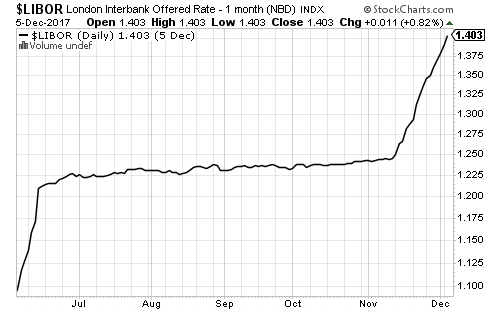

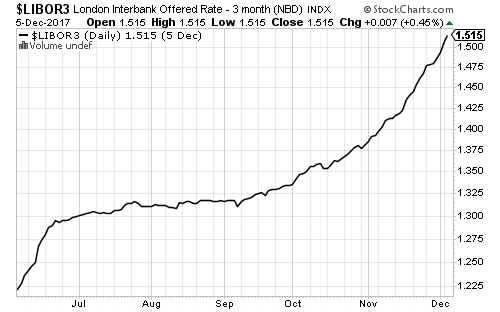

One- and three-month LIBOR have almost fully priced in a December rate hike over the past month.

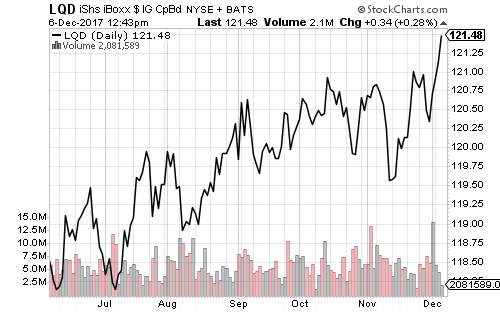

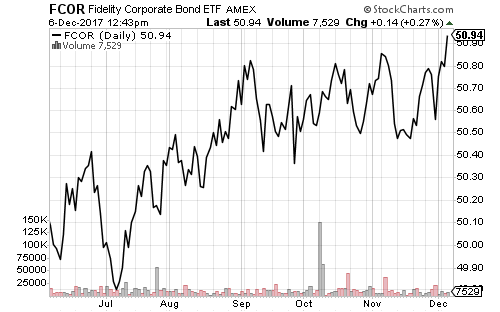

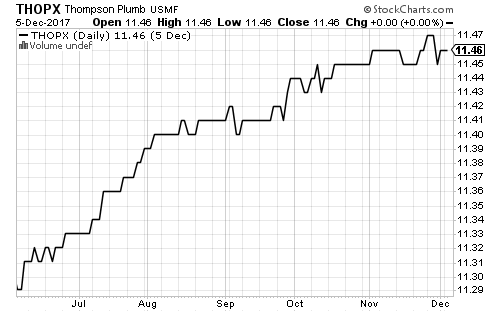

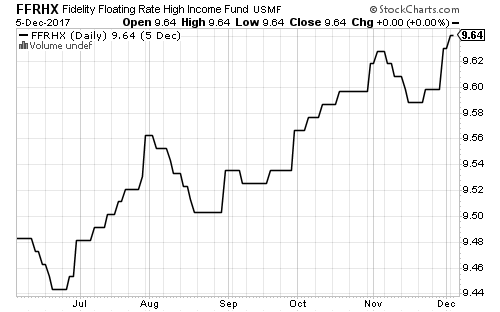

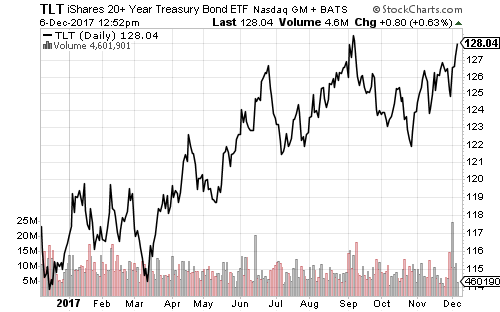

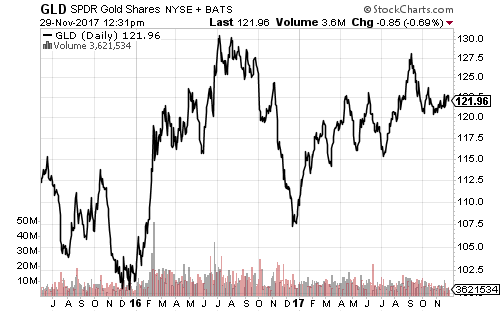

While short-term rates are rising, long-term rates are holding steady. The 10-year Treasury is in a very mild uptrend, but has remained effectively unchanged since October and trading at the low end of its range. As a result, intermediate- and long-term bond funds have performed well. Low-duration bond funds such as Thompson Bond (THOPX) and floating rate funds are also doing well.

iShares 20+ Year Treasury (TLT) is approaching its high for 2017 as corporations accelerate pension investments.