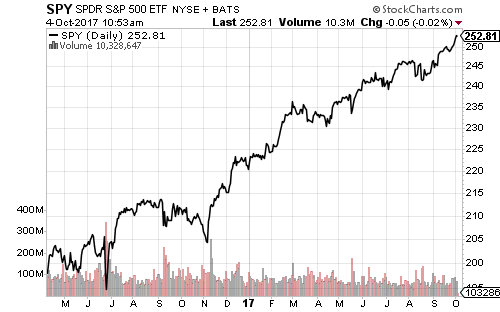

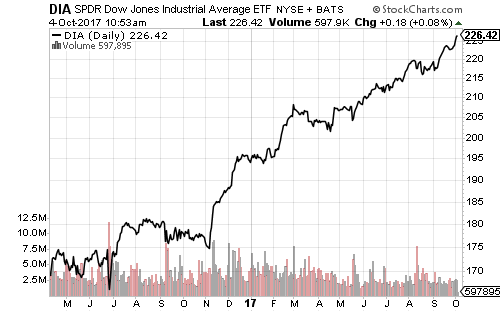

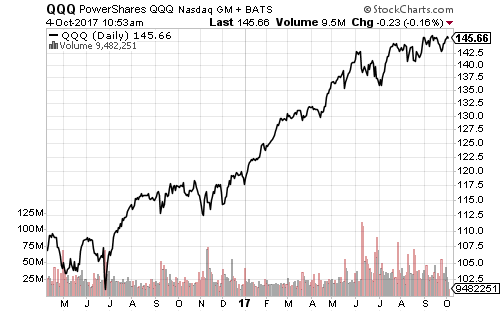

Equities touched new all-time highs in early Monday trading before easing. Technology, utilities and energy were the best performers on the day.

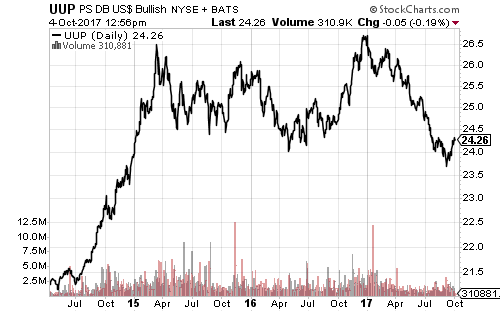

The minutes from the Federal Reserve meeting will be released this week. The Fed opened the door to a December rate hike with that meeting. Interest rates have been rising steadily since mid-September. The odds of a December hike are near 90 percent in the futures market.

The Job Openings and Labor Turnover Survey (JOLTS) will be out on Wednesday. Economists forecast 6.2 million job openings in August. September inflation data will be released on Thursday and Friday. Economists see 0.4 percent producer price inflation and 0.7 percent consumer price inflation, due primarily to higher oil prices. The core CPI is only forecast to rise 0.2 percent. September retail sales are expected to have grown 2.0 percent and 0.8 percent ex-autos. Auto sales have far exceeded initial estimates as consumers in Texas and Florida replaced storm-damaged cars. The University of Michigan’s initial consumer sentiment survey for October is expected to be 95.0, down slightly from September’s 95.1 reading.

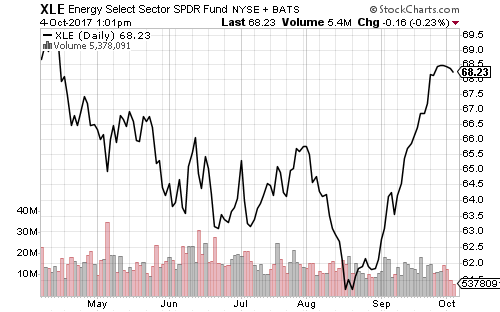

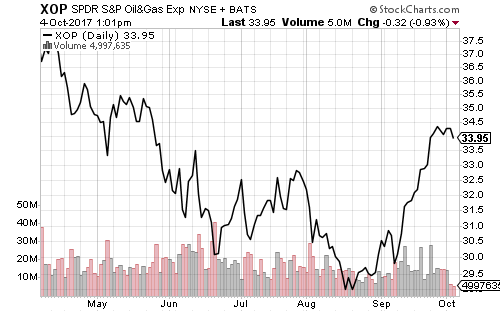

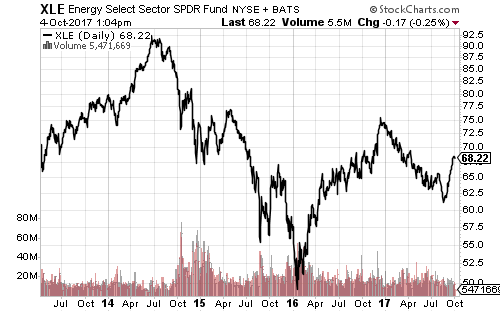

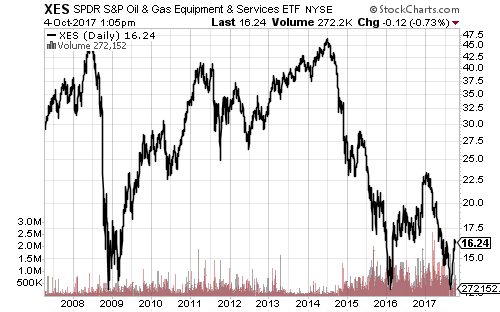

West Texas Intermediate crude fell from near $53 last week to $49 and change. Energy-related equities dipped late last week, easing overbought conditions. A further pullback is likely this week.

The U.S. Dollar Index fell on Monday, but the dollar rose against emerging market currencies. Turkey’s diplomatic confrontation with the United States resulted in a suspension of non-immigration visas. The Turkish lira fell as much as 4 percent on the day. iShares MSCI Turkey (TUR) declined 4.66 percent. iShares MSCI Spain (EWP) climbed 0.46 percent on the day after Catalonia tabled its decision to declare independence.

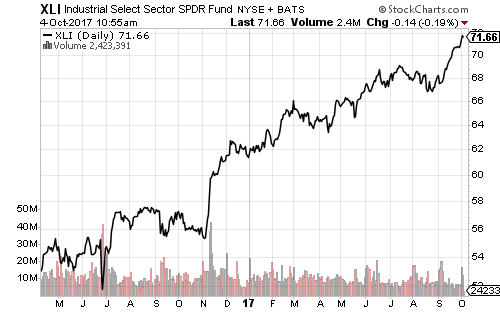

General Electric (GE) fell nearly 4 percent on Monday. GE has lost 23.9 percent this year and XLI has gained 16.9 percent. A leadership shake-up was blamed for the move. Chairman Jeff Immelt retired three months early from his position as chairman along with two vice chairs last week. CFO Jeffrey Bornstein announced his departure as well. Wall Street analysts interpreted the departures as bad news for the company, possibly signaling a poor earnings report is coming.

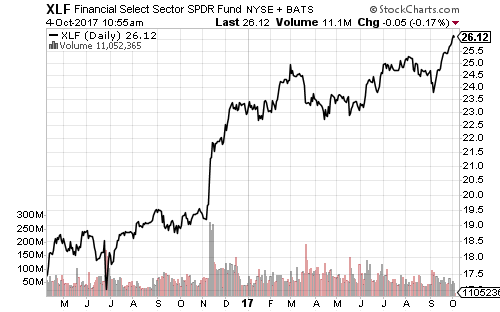

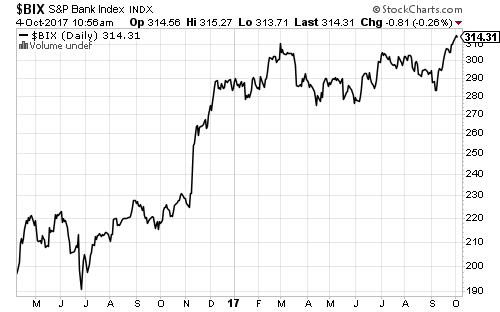

Earnings season kicks off this week. On Wednesday, BlackRock (BLK), Delta Air Lines (DAL) and Fastenal (FAST) will report. They’re expected to report earnings of $5.58, $1.54 and $0.50 per share, respectively. On Thursday, Citigroup (C) and J.P. Morgan (JPM) will release earnings. Analysts forecast $1.30 per share from Citi and $1.67 from J.P. Morgan. Domino’s (DPZ) will deliver the same day, with expectations of $1.22 per share, well above year-ago earnings of $0.96. Friday will bring more mega bank earnings from Bank of America (BAC) and Wells Fargo (WFC). Consensus forecasts call for $0.45 per share at BofA and $1.03 at Wells. Regional banks PNC Financial Services (PNC) and First Horizon (FHN) will also report. Analysts expect double-digit earnings growth from both.